Self Credit Builder

Strengths

- Application will not be denied for low or no credit score

- Payments will be reported to the three major credit bureaus

- Upon completion of the program, you’ll have money in a CD

- Receive a free monthly credit score

- There is no minimum income requirement.

Weaknesses

- You can have only one active Credit Builder Account at any one time.

- The Self Visa® Credit Card credit line is tied to the balance in your Credit Builder Account.

- There is a small early withdrawal penalty if you pull out of the program early.

If you have found yourself with bad credit, or no credit then you know how hard it can be to increase your credit score. But luckily, there’s a financial service that will help you to either build or rebuild your credit.

The Self Credit Builder Account is a loan that you can use to build your credit and your savings. Let’s say you take a loan for $500 each payment you make is set aside in a CD that becomes available to you when the loan is paid off.

At the end of the agreement, you have on-time payments reported to the credit bureaus and a CD with $500 plus minus interest and fees.

Table of Contents

- What is the Self Credit Builder Account?

- How a Self Credit Builder Account Works

- Self Credit Builder Account Loan Options

- How to Open a Self Credit Builder Account

- Self Visa® Credit Card

- Why Not Just Apply for a Credit Card or a Personal Loan?

- Self Credit Builder Account Features

- Self Credit Builder Account Pricing & Fees

- Self Credit Builder Account Pricing & Fees

- Alternatives to Self Credit Builder

- Self Credit Builder Pros & Cons

- Will Self Credit Builder Work for You?

What is the Self Credit Builder Account?

Based in Austin, Texas, and founded in 2014, the official name of the company is Self Financial, Inc., however, it commonly is known simply as Self. The company is dedicated to giving its customers the ability to either better their credit or to build it from the ground up. The company reports more than 500,000 consumers have used the service.

Self is a technology company offering their Credit Builder Account to those who either have no credit or don’t have access to traditional financial products. The account is an installment loan that enables customers to build a positive payment history, while also saving money.

Self Financial has a Better Business Bureau rating of “B”, on a scale of A+ to F. It also has a rating of 4.8 stars out of five by nearly 16,000 users on Google Play, and 4.9 out of five stars among more than 39,000 users on The App Store.

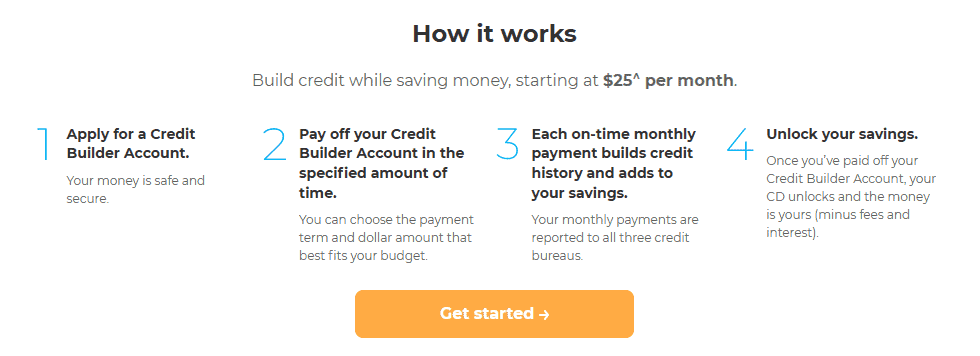

How a Self Credit Builder Account Works

As described above, Self offers their Credit Builder Account, which is a loan that runs for a term of 24 months. You can choose the repayment plan that fits your budget. And each time you make a monthly payment, it will be reported all three major credit bureaus – Experian, Equifax, and TransUnion. Whether you have no credit or poor credit, making your payments on time each month will help you to either build or better your credit history.

There’s an added bonus to the arrangement, and it’s huge. Each time you make a monthly payment, you’ll be adding funds to a certificate of deposit (CD) in your name, which acts as security for the loan.

You’ll start the process by applying for a loan that will be held with one of Self’s bank partners. Bank partners include Sunrise Bank, SouthState Bank, Lead Bank, and First Century Bank. The same bank will also accumulate the monthly contribution to the CD portion of your payments.

Self Credit Builder Account Loan Options

Self offers four different account options, based on your budget. The details of each are as follows:

| Monthly Payment | Loan Term | APR | CD Balance at End of Term |

|---|---|---|---|

| $25 | 24 months | 15.92% | $520 |

| $35 | 24 months | 15.97% | $724 |

Under each loan term, you’ll be able to pay off or close your account early, however, you will be charged a small early withdrawal fee on the CD. Self does warn its customers that paying off the Credit Builder Account early can decrease your credit betterment efforts.

Also, be aware that you will not have access to the accumulated CD balance until the term loan is paid in full. CD funds will be released within 10 to 14 business days of loan payoff and be delivered either by check or ACH transfer into your bank account.

How to Open a Self Credit Builder Account

To be eligible to open an account you will need to be at least 18 years old, and either a US citizen or valid permanent US resident with a physical address in the US.

You’ll also need to have the following available:

- A bank account, debit card or prepaid card (credit cards are not accepted).

- A valid email address and phone number.

- Your Social Security number.

The information is necessary to verify your identity as well as to make payments on your account.

Credit: Self will run a “soft credit pull”, which will not affect your current credit score. However, no one is denied a Self Credit Builder Account based on their credit score. They do warn it is possible to be denied for other purposes, including lack of sufficient verification of your ID, being under age 18, not having a Social Security number, or not being either a US citizen or permanent resident.

Self also discloses that each of their bank partners will run your name through ChexSystems. This is of a repository used by banks that tracks consumer performance in managing their bank accounts. For example, if you ever closed a bank account that had an open balance, it will appear in the ChexSystems database. This is another possible reason you may be denied for a Credit Builder Account. (not all banks will use ChexSystems though)

Income: Self does not have a minimum income requirement. They only require that the monthly payment you choose is one that you can well afford in your budget.

Once your account has been approved, you’ll pay a one-time, non-refundable administrative fee for the service – details will be provided under Self Credit Builder Account Pricing & Fees below.

One of the three bank partners will provide you with a small loan, with the loan funds held in a certificate of deposit that’s fully FDIC insured. The following month, you’ll begin repayment on your account. The loan will be for a fixed term of 24 months.

As you make your payments on time each month, your payment history will be reported to the three major credit bureaus, giving you an opportunity to build or rebuild your credit history. Once the loan has been fully paid, the CD will mature, and the funds will be available to you. This is the strategy used by Self to both better your credit and enable you to accumulate savings in the same program.

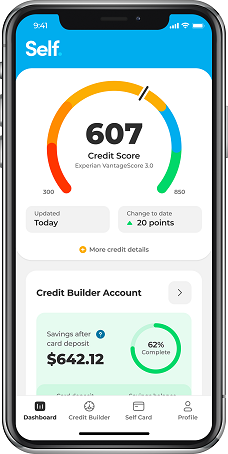

As an added bonus, you can get your monthly credit score through Self free of charge.

Self Visa® Credit Card

Self also offers a Visa credit card. However, to be eligible for the card, you’ll need to first open a Credit Builder Account, and meet the following eligibility requirements:

- You must have made at least three monthly payments on time.

- Have at least $100 in savings progress in your Credit Builder Account.

- Your account must be in good standing.

Just as is the case with the Credit Builder Account, your credit history- or the lack of it – will not be a factor in determining your eligibility for the card. In fact, there is no hard credit check.

If you become eligible for the Self Visa® Credit Card, you can choose what portion of your savings progress will be used to secure your card and set your credit limit. That limit must be a minimum of $100. The credit limit can be increased in increments of $25 at a time, based on the increase in your portion of the balance in your Credit Builder Account CD.

The Self Visa® Credit Card does not offer rewards, allow balance transfers or cash advances. It is also not possible to add an authorized user. However, just as is the case with the Credit Builder Account, your payment history on the Self Visa®Credit Card will also be reported all three major credit bureaus, giving you another good credit reference.

Your Self Secured Visa® Credit Card credit line is tied to the funds on deposit in your Credit Builder Account. The only way to have those funds released at the end of the loan term is to cancel your Visa® card. Unfortunately, the portion of your Credit Builder Account CD that secures your Visa® credit card does not earn interest.

Why Not Just Apply for a Credit Card or a Personal Loan?

In theory, you could apply for either a credit card or a personal loan to help you build or rebuild your credit. But there are a couple of problems with that strategy.

First, if you don’t have a credit score, it’s almost impossible to get a credit card or personal loan. Second, if you have bad credit, you won’t be eligible for traditional credit cards or personal loans.

In either case, you’ll be forced to take a credit card or personal loan that will either charge exorbitant interest rates and/or very high annual or monthly fees. And just as important, credit cards and personal loans for consumers with no credit or bad credit are notorious for very low loan limits. Plus, in the case of credit cards, you may be required to provide a security deposit out-of-pocket.

And unlike the Self Credit Builder Account, neither a credit card nor a personal loan will leave you with money in savings after you’re done with the arrangements. That’s because Self provides a dual advantage: credit building while also building savings (minus interest and fees, of course).

Self Credit Builder Account Features

Availability: All 50 US states. Self is not available outside the US.

Savings security: All funds accumulated through your monthly payments will be held in a CD at a partner bank and will be fully FDIC insured.

Referral bonus: The Self Financial dashboard will give you access to a unique referral URL. You can provide that to friends and family members and earn $10 for each person who signs up for a Credit Builder Account. The referral bonus will be paid after the friend or family member has been approved for an account and has made his or her first account payment.

Mobile App: Available at The App Store for iOS devices, 10.0 and later, and is compatible with iPhone, iPad, and iPod touch. Also available on Google Play for Android devices, 5.0 and up.

Customer support: Available by email and live chat, Monday through Friday, from 9:00 AM to 5:00 PM, Central time.

Self Credit Builder Account Pricing & Fees

Whichever loan term you choose, there’ll be a $9 non-refundable administrative fee.

Each loan will also come with a specific interest rate and APR. Those APRs are shown under the “Four Different Self Credit Builder Account Loan Options” section above.

If you close your account before the end of the term there is an early withdrawal fee of up to $5 depending on the account size.

Late fee: If a loan payment is more than 15 days past due, you’ll be charged a late fee equal to 5% of the scheduled monthly payment. If the payment is more than 30 days past due, it will be reported as a late payment to the three credit bureaus.

Self Credit Builder Account Pricing & Fees

Whichever loan term you choose, there’ll be a $9 non-refundable administrative fee.

Each loan will also come with a specific interest rate and APR. Those APRs are shown under the “Four Different Self Credit Builder Account Loan Options” section above.

If you close your account before the end of the term there is an early withdrawal fee of up to $5 depending on the account size.

Late fee: If a loan payment is more than 15 days past due, you’ll be charged a late fee equal to 5% of the scheduled monthly payment. If the payment is more than 30 days past due, it will be reported as a late payment to the three credit bureaus.

Alternatives to Self Credit Builder

Self Credit Builder isn’t the only credit builder loan available. There are now several companies that offer credit builder loans, here’s how they compare:

Kikoff

When you sign up for Kikoff, you can get a $500 credit line (Kikoff Credit Account) with no credit check – but there is a $5 monthly membership fee (annual commitment). They furnish data to all three bureaus but they report monthly payments on the credit line to Equifax and Experian.

Additionally, you can also get a credit builder loan that is reported to TransUnion and Experian. You are asked to put away $10 a month, each month, for 12 months. Then, at the end of the year, you get back all of the $120 you put in. (if you want to learn more, check out our Kikoff review)

Chime

Chime has a Chime Credit Builder Secured Visa Credit Card and isn’t technically a “credit builder loan” but offers similar benefits in that it’s a revolving line of credit that reports to bureaus. The benefit of this secured card is that Chime also offers a Savings Account, which acts as the secured part – you don’t have to put in a security deposit.

Now you can expand on this by getting a Credit Builder (you need to get a Chime Spending account with $200 qualifying direct deposits), but the benefit is that it’s free. Chime also reports to all three bureaus – Experian, Equifax, and Transunion.

Our full review of Chime has more information on this.

Learn more about Chime Credit Builder

Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. The Chime Visa® Debit Card is issued by The Bancorp Bank or Stride Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted. Please see back of your Card for its issuing bank.

Self Credit Builder Pros & Cons

Pros:

- Your application will not be denied for either a poor credit score or a lack of credit history. Both are the whole purpose for a Self account in the first place.

- Your credit history will be reported to all three major credit bureaus.

- By the time you complete the loan term, you’ll have a CD in your name waiting for you.

- Self will provide you with your free monthly credit score to help you track your credit progress.

- There is no minimum income requirement.

- Once you have established a Credit Builder Account, you will be eligible to add the Self Secured Visa® Credit Card. That will not only give you a credit card, but also provide an additional credit reference.

- Self offers a $10 referral bonus for family and friends you refer.

Cons:

- You can have only one active Credit Builder Account at any one time.

- The Self Secured Visa® Credit Card credit line is tied to the balance in your Credit Builder Account. If you have the CD funds dispersed to you, the credit card will be closed out.

- There is a small early withdrawal penalty if you pull out of the program early.

Will Self Credit Builder Work for You?

If you’re not happy with your credit report and credit score, or you have no credit profile at all, the Self Credit Builder Account is a good option. What’s more, it will also give you an opportunity to begin building savings. That’s important because those with bad credit often have a lack of savings, which is part of the reason for the bad credit itself.

In that way, the Self Credit Builder Account will help you achieve two very important financial milestones in the same program – building or improving your credit and getting on track to save money. You can participate in the program with a monthly payment of as little as $25, and both fees and interest rates are very reasonable.

Think about it – you can build your credit over 24 months, and by the time you complete the program, there’ll be a funded CD waiting for you. Self has put together a best-in-class service to help consumers both better their credit. If you’re looking to do either or both, this is the program for you.

*All Credit Builder Accounts made by Lead Bank, Member FDIC, Equal Housing Lender, Sunrise Banks, N.A. Member FDIC, Equal Housing Lender or Atlantic Capital Bank, N.A. Member FDIC, Equal Housing Lender. Subject to ID Verification. Individual borrowers must be a U.S. Citizen or permanent resident and at least 18 years old. Valid bank account and Social Security Number are required. All loans are subject to consumer report review and approval. All Certificates of Deposit (CD) are deposited in Lead Bank, Member FDIC, Sunrise Banks, N.A., Member FDIC or Atlantic Capital Bank, N.A., Member FDIC.

**Self Visa® Credit Card issued by Lead Bank, First Century Bank, N.A., or SouthState Bank, N.A., each Member FDIC. See Self.inc for details.

***Sample loans: $25/mo, 24 mos, $9 admin fee, 15.92% APR; $35/mo, 24 mos, $9 admin fee, 15.97% APR; $48/mo, 24 mos, $9 admin fee, 15.72% APR; $150/mo, 24 mos, $9 admin fee, 15.88% APR. See self.inc/pricing

****Card eligibility: Active Credit Builder Account in good standing, 3 on-time payments, $100 or more in savings progress, and satisfy income requirements. Requirements are subject to change.

*****Credit Builder Accounts & Certificates of Deposit made/held by Lead Bank, Sunrise Banks, N.A., SouthState Bank, N.A., First Century Bank, N.A., each Member FDIC. Subject to credit approval.

Leave a Comment: