Radius Bank

Strengths

- Rewards Checking pays both high interest and cash back

- Very large fee-free ATM network

- Low minimum initial deposits

- Business banking services

Weaknesses

- Requires minimum $2,500 to earn interest and cash back

- Interest rates aren't near the upper range of the industry

- Not a direct lender for most loan products

Radius Bank was recently acquired by and rebranded to LendingClub Bank.

Radius Bank is an online bank that offers competitive interest rates as well as the kinds of bank services you will find at a local brick-and-mortar bank.

So, while they don’t have the absolute highest interest rates (they do come close) they provide a lot more services than most online banks. If you are looking for a well rounded online bank, Radius might be what you’ve been searching for.

For example, their checking account has both generous interest and cashback rewards. That’s a tough combination to beat anywhere, and it’s worth looking into Radius Bank for that account alone.

Table of Contents

About Radius Bank

Radius Bank (FDIC #32551) is an online bank based in Boston, Massachusetts – which is where they have their only physical location.

They provide a wide variety of accounts including both personal and business banking. While the bank specializes in attractive deposit products, (including an interest-earning, cash back checking account) they also provide credit cards and access to both personal loans and student loans.

Opening an account is easy and quick and there are no fees on their savings or checking accounts.

You can open deposit accounts with as little as $100 which then have no minimum monthly balance requirement. CDs are available in minimum denominations of $500 or $1,000.

Radius Bank Deposit Products

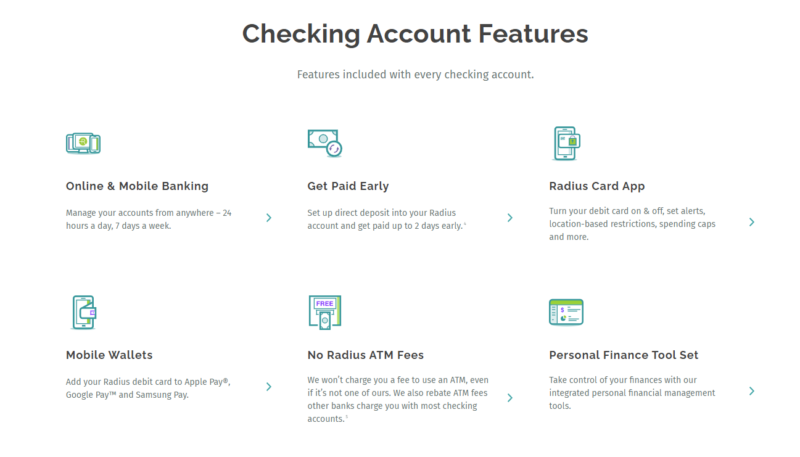

Radius Bank offers checking and savings accounts, as well as certificates of deposit.

Rewards Checking

This is one of the most innovative checking accounts in the banking industry. Not only does it pay interest, but you also earn cash back on purchases!

You can open a Rewards Checking account with just $100, and there are no monthly maintenance fees. The account comes with a debit card and unlimited ATM rebates for non-network ATM usage. (Radius Bank is part of the NYCE ATM Networks, providing more than 500,000 fee-free ATMs nationwide.)

Interest is paid based on the following schedule:

- Balances under $2,500, no interest paid

- Balances between $2,500 and $99,999.99, 0.75% APY

- $100,000 or more, 1.00% APY

Cash back rewards: You can earn unlimited 1% cash back on online and in-store signature-based (“credit”) purchases. But to earn those rewards, you need to meet the following qualifications:

- Have your Rewards Checking account open for at least 30 days, and

- Receive a minimum of $2,500 in direct deposits into your account from an employer or another source of income, OR

- Have an average balance of $2,500 or more in your account.

The checking account also comes with budgeting tools and a networth tracker – and you can link external accounts to the app so you’ll get a full picture of your finances.

High-Yield Savings Account

Interest rates paid on Radius Bank’s High-Yield Savings are comparable to some of the highest paying online banks. The interest rate tiers are as follows:

- Balances under $2,500, no interest.

- Balances between $2,500 and $24,999.99, 0.75% APY

- $25,000 or more, 1.15% APY

You’ll need a minimum of $100 to open an account, but there’s no minimum balance requirement thereafter. The account features no monthly maintenance fees, a free debit card, and no Radius Bank ATM fees for use of other banks’ ATM machines.

Certificates of Deposit

Radius Bank offers certificates of deposit ranging from three months to five years. The minimum balance to open a CD is $1,000 for certificates under one year and $500 for those with terms of one year or longer.

A sampling of current CD interest rates are:

- 1-year CD: 1.55% APY

- 5-year CD: 2.20% APY

Credit Cards & Loans

Radius Bank offers credit cards, personal loans, student loans, and yacht loans. In most cases, these loans are available through partnerships with other lending institutions. (Note: Radius Bank does not make mortgages or auto loans.)

Credit cards: Radius Bank offers six different credit cards:

- Visa Signature Real Rewards Card pays a $25 reward bonus after your first purchase, then 1.5 points for every $1 you spend on the card (equal to 1.5% cash back).

- Premier Rewards American Express Card earns $100 cash back after spending $1,000 in the first three months, then 4X points on restaurants, 3X points on airlines, 2X points on gas stations, and 1X points on all other purchases.

- Cash Rewards American Express Card earns $25 on your first purchase, then 3% cash back at gas stations, 2% at supermarkets, and 1% on all other purchases.

- Visa Platinum Card comes with a 0% APR on balance transfers for the first 18 months.

- Secured Visa Card is a secured credit card for those with no credit or poor credit, with a credit limit of up to $5,000.

- Visa Signature College Real Rewards Card is designed for someone wanting to build credit. Earn $25 on your first purchase, then 1.5 points for every $1 spent, equal to 1.5% cash back.

Personal Loans: Radius Bank doesn’t make direct personal loans but acts as a marketplace for Credible and Prosper.

Student Loans: Radius Bank has partnered with Credible to offer student loans and student loan refinances.

Yacht Loans: Radius Bank does make direct yacht loans. They offer fixed rate, adjustable rate, and interest-only financing, on vessels with a maximum age of 20 years. Loans are also available for foreign vessel registration.

Business Banking

Though we’re not going to cover the business banking features in any detail, this is an important service offered by Radius Bank. There are many online banks offering the highest interest rates in the industry, but only personal banking. Radius Bank also offers business banking, which makes it a perfect choice if you’re a small business owner.

Some of the business banking services they offer include:

- Their Tailored Checking account

- SBA loans

- Escrow services

- Cash management

- Business credit cards

- Commercial financing, like commercial real estate and equipment financing

- IOLTA/IOLA NOW accounts

Radius Bank Fees & Penalties

As noted in the deposit account descriptions above, Radius Bank has no monthly fees, and either no ATM fees, or unlimited ATM fee reimbursement.

However, like most banks, Radius Bank does charge fees for special services. The fee schedule includes the following:

- Daily overdraft fee, $5

- Deposited item reversed, $8

- Money order, $3

- Returned item charge, $25

- Stop payment, $25

- Treasurer’s check, $8

- Domestic wires: $10 in, $20 out

- International wires: $10 in, $40 out

Early withdrawal penalties on certificates of deposit are as follows:

- Terms 3-6 months, 3 months simple interest

- 9-month CDs, 180 days simple interest

- CD terms of one year or longer, 365 days simple interest

Customer Service

Radius Bank offers both online and mobile banking. Phone and live chat are available Monday through Friday, from 8:30 am to 1:00 am; and weekends, from 8:00 am to 8:00 pm, all times Eastern.

Pros and Cons

Pros

- Full service online bank

- Free checking account that pays interest and cash back on purchases

- Low minimum initial deposits

- Participates in the largest fee-free ATM network

- Offers business banking services

Cons

- Requires a $2,500 balance to start earning interest

- Lower interest rates than you could get elsewhere

- Offers loans but they are not the direct lender for most

Conclusion

Radius Bank is well worth considering if you’re looking for higher interest rates on your deposits than what you’re getting at your local bank. You’ll also get the benefit of no-fee banking, as well as the potential for cash back on your checking account. If you’re looking for business banking, Radius Bank is an obvious choice.

If you’d like more information, or you’d like to open an account, visit the Radius Bank website.

Leave a Comment: