Are you familiar with the game Blackjack? It's really simple. You get two cards, the dealer gets two cards, and then you say Hit if you want more cards. The point is to get closer than the dealer to 21 without going over.

To get an edge, you can “count cards” to keep track of how many high cards are left in the deck relative to low cards. The more high cards, the better because the dealer is likely to go over 21 and bust.

If you had the memory for it, you could just remember each card. In most six deck game configurations, this is impossible so counting cards is what people do instead.

I have a friend, Colin, who is/was a card counter. It's masterful stuff.

When you count cards, there are cards that add to the count (2-6) and cards that subtract from the count (10 – Ace). 7, 8 and 9 have no impact.

This running count is valuable because it represents the house edge. The more 10 – Ace cards left in the deck, the more likely you'll get Blackjack and the dealer will bust. Without knowing the exact history of cards, you have a good sense of what the rest of the deck is like and that's good enough.

(what the casinos didn't like about card counting teams, like the one my friend Colin ran, was that one person would play until the count was favorable and then signal to a compatriot who would start betting big – I can see how this is unfair… but I don't care!)

Counting cards is a simplified but very effective way of keeping track of six decks of cards as it progressed through a game of Blackjack.

While I'm not a big gambler, I've always loved this idea.

What if you approached your budget this way? Simplified but still effective.

Positive Days, Negative Days

I like to think of positive saving days and negative saving (spending) days.

You start your day with a number – whatever you daily income is. As you spend money, you subtract from that number. If you end the day with a positive number, even if it's just a penny, you get a check. If you end the day with a negative number, you don't get a check.

This will do a few things – it's a budgeting version of Jerry Seinfeld's Don't Break the Chain strategy. Seinfeld would try to write (jokes) every single day. On days that he wrote, he put a check mark on a calendar. Eventually, he's start a chain of multiple days in a row when he wrote. That would then motivate him to continue writing because he didn't want to break the chain.

As you have your positive and negative days, you'll want to keep the streak going too. Positive days, even if by just a penny, are wins. If you keep all your days positive, you win. Even if you keep most of your days positive, you win.

Now that you get the idea, how do we execute on this?

Calculate Your Starting Point

You need to calculate your starting point – how much you earn in a day.

For that, think about how much your time is worth.

Or you can do it manually…

1. To calculate your daily income: Take your salary, minus all your deductions (taxes, FICA, retirement savings, etc.), and divide it by 365. If you get paid monthly, just multiply your paycheck by 12 and divided by 365. If you're paid bi-weekly, multiple by 26 and divided by 365. This smooths out your earnings to include your weekends.

OK – now you have how much you earn in a month. You need to subtract your daily fixed expenses. These are bills you pay once a month or once a year, calculate the daily cost to you to adjust your number.

2. Subtract your daily fixed expenses: Calculate how much goes towards various rent/mortgage, insurances (auto, home, renters), cable/internet, and the like. Figure out the daily cost (which is a useful thing to know anyway!) and subtract it from your income.

Is your daily number still positive? If so, yay! If not, cut some expenses… you're going backwards!

After this brief little exercise, you have a starting point amount for each day.

Gamify Your Positive & Negative Days

You have your Don't Break the Chain gamification, marking positive days on a checkbox, but that might not work depending on your starting point. If you can't get enough positive days in a row to build a chain, it won't motivate you.

If that's the case, let's count cards days.

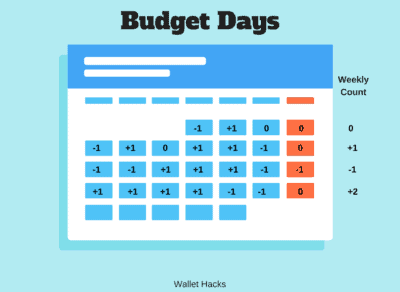

For each day, if you spend more than that then the day is a negative one (-1). If you spend less, it's a plus one (+1). You can, if you want, give yourself a little wiggle room on the negative end by saying anything between $0 and -$20 is a zero (0).

Keep a running count for the week, the month, and the year. Try to keep the weekly count positive, the month over 5, and the year over 60.

A positive weekly count means you have more positive days than negative days. A monthly count over 5 means you have more positive weeks than negative weeks. And a yearly count over 60 means you have more positive weeks and months than negative weeks and months.

What about big expenditures? If you buy a plane ticket, it'll probably make that day negative. That's fine… the key is keeping a running count and trying to keep the other days positive. You want to buy the ticket when it saves you the most money, don't shift spending just for this little game.

What if I have hugely negative days and tiny positive days? Then you will not be saving any money. The point of this is to leverage human psychology to help you save more. It does this with something very simple and uncomplicated. The best way to budget is to track it to the penny but that's also the reason so few do it.

This approach is an attempt to find something simple, fun, and reasonably effective. It's a lot like the 52-Week Savings Challenge – games make things fun.

There will always been boundary cases where this won't work.

Now go forth and count!

Susan Gaffney says

Love it. Simple, fun idea that even kids can use once they have their “own” money.

AdventureRich says

Excellent, I always find that by gamifying goals or tracking metrics, it becomes much easier to stick with it. Great idea!