I used Mint for a long time before switching over to Personal Capital. Mint’s budgeting tools are some of the best on the market but as my finances progressed I found I needed less budgeting help and more investment tracking. So I took a look at Personal Capital.

Both services are free and will track your budget and investments but that doesn’t make them equal. Mint is a stronger budgeting app and Personal Capital is a better investment tracker.

Which you will like best will be determined by where you are in your financial journey. If you are more interested in tracking your spending and building your savings then Mint is likely the app for you. If your budget is second nature and you are focused on investing and building your wealth then Personal Capital probably has more of what you are looking for.

Table of Contents

- What is Personal Capital?

- Net Worth Monitoring

- Budgeting

- Retirement Planner

- Education Planner

- Fee Analyzer

- Wealth Management

- Investment Services, Wealth Management, and Private Client

- What Is Mint?

- How are Personal Capital and Mint Similar?

- How are Personal Capital and Mint Different?

- Personal Capital

- When is Personal Capital Better than Mint?

- When Is Mint Better than Personal Capital?

- Summary

What is Personal Capital?

Personal Capital is a service that acts as your financial dashboard. Like Mint, it allows you to set a budget and track your expenses, but it also helps you track your investments. The software has integration with a litany of brokerages.

Personal Capital’s financial dashboard tool is totally free to use. Here’s a rundown of the features it has to offer.

Net Worth Monitoring

When you sign up for a free Personal Capital account, you’ll have the option to use the software’s net worth monitoring feature. You start by entering in all of your financial information. You can enter your checking and savings account information, debt information, savings information, and investment information.

Entering this information into your (bank-level secured) account allows you to have quick access to your net worth. This feature helps you keep an eye on your net worth, allowing you to ensure the number is growing.

If you’re already tracking all your financial accounts on the platform, you’ll be able to keep a running total of your net worth. Both assets and liabilities will adjust automatically, keeping your net worth tally current on a daily basis.

You can also use the net worth calculator to determine the number manually. You can enter the value of your real estate, investment portfolio, retirement plan(s), checking and savings, and other assets, as well as the relevant dollars figures for each.

You can then enter any liabilities you have, like credit cards, student loans, mortgages, personal loans, auto loans, or other liabilities, along with the amount you owe on each. You’ll be able to calculate your net worth in a matter of seconds.

Budgeting

Personal Capital also has a budgeting tool. You can organize your expenses, set spending targets for specific categories, and more. Just as you can keep a running total of your assets and liabilities to calculate your net worth, you can do the same with your income and expenses.

Personal Capital does more than keep summary totals. If you want, you can take a closer look at the components of both income and expenses. For example, it keeps tabs on the specific deposits and deposit dates that make up your income.

On the expense side, you can track specific expenses. That’s important when it comes to budgeting, because it will enable you to identify possible excess spending in certain categories. That will give you an opportunity to drill down into the offending expense, to isolate unnecessary expenditures.

Another aspect of the budgeting tool is the Cash Flow monitoring tool. This feature helps you live within your means. It shows you what has come in for income and compares it to your expenses.

Retirement Planner

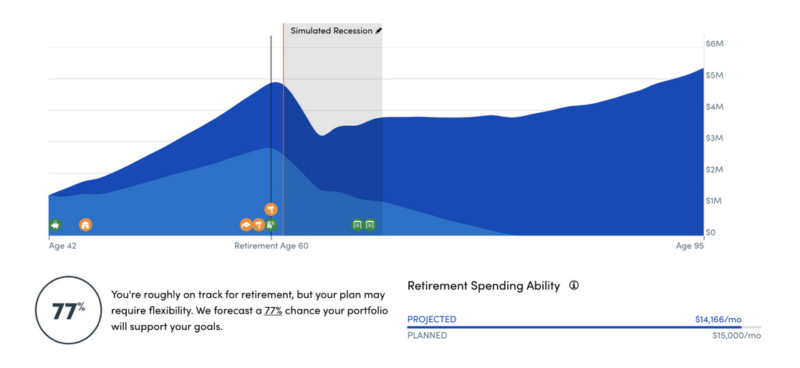

The free version of Personal Capital also has a retirement planning feature which helps you calculate and determine your projected monthly income in retirement.

In some ways, this might be the most important tool available on the platform. There are plenty of tools and calculators on the web to help you reach your retirement savings goal. But it’s rare to find one that helps you to look at the all-important other side of retirement, which is how much you’ll need to live on.

You’ll enter your retirement goals, as well as your expected retirement date. From there, Personal Capital helps you design a plan to reach those goals. Then it allows you to see if you are on track for the retirement you dream of.

Unlike many retirement planners, it starts with the basic premise of how much money you’ll need when you retire, rather than focusing mostly on an arbitrary savings target.

Based on your current retirement savings amount, as well as the information taken from your linked financial accounts, Personal Capital will indicate the likelihood you’ll reach your goal, shown as a percentage. If that percentage is low, you’ll have an opportunity now to make the kinds of adjustments that will help you arrive at retirement in style.

Education Planner

Personal Capital’s Education Planner helps you create a plan to save for education costs down the road. This is a great feature if you’ve got kids or grandkids. Or if you plan on going to college yourself in the future.

You can access the Education Planner from the Retirement Planner. Once in, you’ll create a new education goal, adding your child’s name, birth year, and the type of education you hope to provide for him or her.

Next, you’ll enter the amount of savings currently dedicated to that goal. Since you can link accounts to the education goal, you can designate some or all of the connected accounts toward that goal. That includes a dedicated education account, like a 529 plan, or a portion of a taxable investment account.

The planner will even calculate average college education costs, including tuition, room and board, and books. This will ensure you’re working with actual numbers.

From there, you’ll be shown how much you’ll need to save to meet the education goal. The planner will even show you the tax savings from a 529 plan.

Fee Analyzer

This is one of the most popular tools on the Personal Capital platform. The Fee Analyzer helps you see the impact fees are having on your investment accounts. It helps you see how investment fees are reducing your investments over the long run.

Why are investment fees important? Most investors today hold their money in funds, whether it’s mutual funds or exchange traded funds. Though it’s not always apparent on the surface, each fund has their own internal expenses, referred to as expense ratios. These include sales charges, commissions for the securities traded in the fund, administration fees and other expenses.

Collectively, they can add up to as much as 1% of the fund value, which is charged each and every year. You should know exactly how much those fees are because they’ll reduce your net return on investment.

The analyzer will show you exactly what you’re paying on each fund, as well as any costs associated with your retirement plans.

The analyzer works especially well with 401(k) plans, since they often include investments in mutual funds. You’ll link your plan to Personal Capital, then see a list of the fees you’re paying for each fund. But it doesn’t stop there. You’ll also be able to research alternative, low-cost funds that you can substitute for the funds already in your plan.

Wealth Management

Another feature Personal Capital offers is wealth management. This feature isn’t a part of the free Personal Capital version. However, the cost for Personal Capital’s Wealth Management is attractive. You must have at least $100,000 to invest and then the fees are based on the amount of money you have invested with them.

Though Wealth Management is often confused with robo-advisors, it’s actually something very different. Even though automated investments methods and tools are used with the service, human guided management also comes into play.

In this way, Wealth Management is a mix of both 21st Century robo-advisors and traditional, human-guided investment management. But it provides that service at far less than the cost of traditional investment advisories.

For clients with $1 million and under – 0.89% per year

For clients who invest $1 million or more:

- First $3 million – 0.79% per year

- Next $2 million – 0.69% per year

- Next $5 million – 0.59% per year

- Over $10 million – 0.49% per year

A portfolio will be designed for you, comprised of US and international stocks and bonds, as well as alternative investments, like real estate investment trusts, precious metals and energy.

Though most investments are held in exchange traded funds, the US equities allocation will be divided among at least 70 individual stocks. This enables more precise income tax reduction strategies than are available with fund investing alone.

Investment Services, Wealth Management, and Private Client

Depending on how much cash you have invested with them, you’ll choose from their Investment Services, Wealth Management, or Private Client programs.

For investment accounts under $200,000, you can rely on their suite of free tools that analyze your investments and offer automated advice. You also get access to Personal Capital’s advisory team.

If you have an account over $200,000, you’ll get two dedicated financial advisors to help you manage your account. They’ll customize a portfolio for you based on your growth and risk tolerance preferences. This program is what Personal Capital calls the Wealth Management program.

If you choose to invest over $1 million with Personal Capital, you’ll be eligible for their Private client program. That program includes priority access to investment specialists, in-depth support, and more.

Here’s our full review of Personal Capital if you’d like to read even more.

Get Started with Personal Capital

What Is Mint?

Like Personal Capital, Mint helps you to see your total financial picture in one place. You can enter bank accounts, debt accounts, and investment account information on Mint’s secure site.

From there, you can use a number of Mint features.

Financial Picture Dashboard

Mint has a financial picture dashboard feature that gives you a quick glance at your total financial picture. This is a quick and easy way to see where your money is.

Budgeting

This is the service Mint is best known for, and what they do best. Since you’ll be aggregating all your financial accounts – assets, liabilities, income, and expenses – on the platform, you’ll get a more accurate picture of where your money is coming from and where it’s going.

Mint will help you create a budget, track your spending, and categorize expenditures. It will track your income and help you see if you’re spending more than you’d planned.

Many people are surprised to see how much money they’re spending in different expense categories, which helps to know where reductions can be made. Those expense reductions are often what makes it possible to pay down and pay off debt, as well as to increase savings and investment contributions.

If the main thing you are looking for is a budgeting tool, you may also want to consider YNAB. Here is our YNAB vs Mint comparison.

Bill Tracker

Mint’s Bill Tracker feature lets you input all information about upcoming bills. This feature can be a great way to ensure you never miss a payment due date.

Credit Monitoring

This is a feature provided by Mint that isn’t offered by Personal Capital. You’ll have 24/7 access to your credit score, free of charge.

The credit score provided is your VantageScore, which isn’t your FICO score as used by lenders. VantageScore is what’s often referred to as an educational score, meaning it approximates your FICO score. It does that using similar criteria applied to the same credit report information.

Even though it isn’t your official credit score, it will give you a close approximation of what your FICO score is. And just as important, significant changes in your credit score can indicate the need to investigate further.

For example, a 30-point drop in your credit score could indicate one of your creditors is reporting a late payment. If you know you haven’t made any late payments, that should tip you off that something needs to be investigated.

The best time to remedy any credit problem is immediately after it happens. With free credit monitoring from Mint, you’ll have that opportunity.

Investment Tracking

Once you know what the fees are, you’ll be better armed to make alternative investment choices. Just by shifting to lower-cost funds and accounts, you’ll be able to improve your long-term investment performance. That step alone can add many thousands of dollars to your portfolio over several years.

Here’s our full review of Mint if you’d like to learn more.

How are Personal Capital and Mint Similar?

The key similarity between Mint and Personal Capital is how they automate your financial life. They both offer the ability to link up your accounts to a financial dashboard, which can save you a ton of time and simplify your life.

How many financial accounts do you have? I have a handful of credit cards (I mainly use three), a few bank accounts, and two brokerage accounts. If I had to manually go into them to review my expenses, check my balances, and go over my investments – it would be a lot of time. I’d be less likely to do it.

But since both tools offer a dashboard, I can get a snapshot in seconds. You can also get email notifications for all kinds of things, like your spending.

How are Personal Capital and Mint Different?

Personal Capital provides many of the same services as Mint. That includes aggregating all your financial accounts on the financial dashboard and providing budgeting capabilities. However, those budgeting capabilities are more limited than they are with Mint.

Personal Capital

Personal Capital’s strength is in its investment tools. Whether you’re using the free dashboard or Wealth Management, Personal Capital is first and foremost an investing platform.

But the free dashboard provides the following tools and resources:

- Free investment tools

- On-site investment monitoring/management (for a fee)

- Retirement planning help

- Education planning help

And of course, if your primary interest is in investment management, and you have the minimum $100,000 needed, you can take advantage of Personal Capital’s Wealth Management service. They provide a professional investment management program, with both a lower minimum investment requirement and fees that are less than half that is charged by traditional investment advisors.

Mint

Mint is primarily a budgeting service and a much more advanced one than Personal Capital. Its investment features are much more limited, though they are useful for smaller investors.

Services they provide, include:

- Investment portfolio snapshot

- Bill tracker tool/payment reminder

- Credit monitoring

Credit monitoring is one feature Mint has that Personal Capital doesn’t. If you’re looking to include credit monitoring with your budgeting and other financial activities, Mint offers the service free of charge.

When is Personal Capital Better than Mint?

Personal Capital’s total money management dashboard is heads and tails above Mint. With Mint, you only budget. You see what you spend, you try to spend less, and you stop there. If you want to track investments, Mint’s not great.

With Personal Capital, all of my banks, brokerages, and investments are tracked in one place. My income and expenses are tracked too.

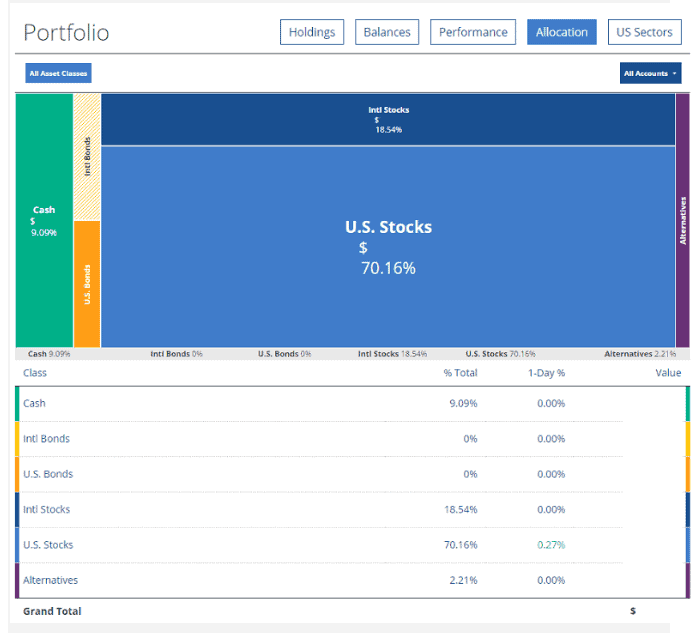

Here’s a look at some of the investment screens – none of my money is with Personal Capital, this is data they pulled from my other accounts:

This screen is interactive as well, you can click on those boxes and it zooms in and out on each.

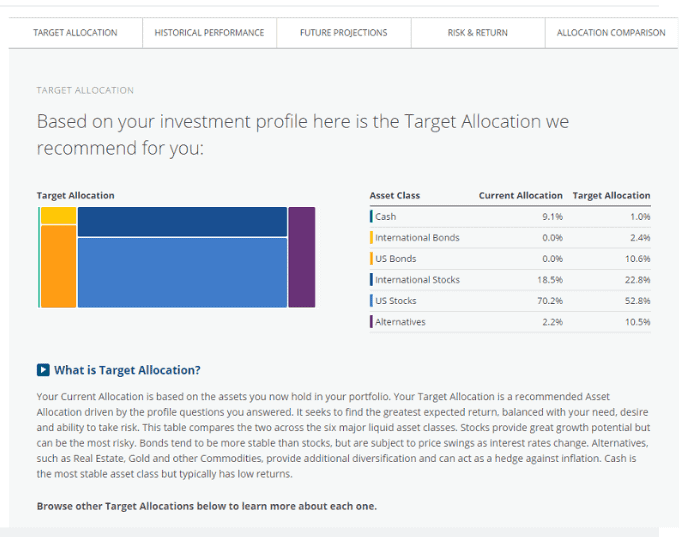

And with their tools, you can get advice on what your investment should be (according to what you tell them your risk tolerance and age is):

If you have investments and want a tool that does that and tracks expenses, give Personal Capital a try.

I asked readers of the blog about their favorite personal finance app and this one comment resonated with me – “Mint I use to see where my money has gone and Personal Capital I use to see where my money should go.” Very well put.

Personal Capital planning tools can help you do everything from analyze the fees you’re paying in your 401(k) to see if you are saving enough for retirement. You can set how much you expect to spend, your saving rates, and it’ll help figure out if you will end up with enough.

If you have multiple brokerage accounts, link them up and now you can see how your asset allocation is distributed across those accounts. That’s much harder to do manually. These are all tools available for free too so if that interests you, definitely check them out.

Get Started with Personal Capital

When Is Mint Better than Personal Capital?

When it comes to simply budgeting, Mint is better. They’ve had a longer period to develop their tools and so those tools are more robust. The reports are easier to understand, the categorization is more intuitive, and the notifications are better designed.

Personal Capital can create a budget, but I found Mint’s budgeting capabilities more thorough.

Mint will also, which is part of their business model, recommend ways for you to save money. This includes promoting different products, like credit cards and insurance, but that’s how they pay for the budgeting tools – since they are free to the user.

There’s a good reason why Intuit acquired Mint and then sold off Quicken! Mint is one of the best budgeting tools available, but where they suffer is in the area of investments. If you don’t need any kind of portfolio management tools, then you’ll be very happy with Mint.

In fact, you’ll probably prefer Mint if you’re a huge budgeting junkie.

However, if you’re looking for something more comprehensive that includes investment help and management, you’ll probably prefer Personal Capital.

Summary

If you want both a killer budgeting tool and a strong investment tracker you can use both together. They’re both free so you’re not double paying (or even single paying!) for a service. In addition, they’re both automated so you’re not doing double work.

However, if you’re just looking for budgeting help, you’ll likely prefer Mint. And if you’re looking for basic budgeting help plus investment help, you’ll probably prefer Personal Capital.

Personal Capital can be your all-in-one money management service. Just remember that the budgeting tools aren’t as extensive as they are with Mint. But they’re not bad, either.

All in all, both are good services that can help you manage your money better.

Steveark says

I’m a private client of Personal Capital’s and they will do things like recommending a ROTH conversion strategy, I know because they are doing that for me. They also provided business tax advice to me in the past. They do have higher fees but I like having at least some of my money in something besides Vanguard index funds and they do invest differently. Their free tools are great, especially for someone who doesn’t budget, like me. I can actually track the transactions at every one of my 18 accounts back for years, in a way that is much more convenient than the individual institutions’ applications which often limit me to standard monthly or quarterly PDF’s. If you want to check how big a check you got from the IRS five years ago or what you paid to get your car’s transmission fixed three years ago you can do that with Personal Capital looking at your checking account records. Its a pretty neat hack I use all the time. Trying to do that with my banks awful app is a nightmare. Personal Capital is easy.