My son is in elementary school and there’s a classic question they like to ask kids who are young. Would you rather have $1,000,000 or would you rather have a penny that doubles every day for thirty days?

Depending on the age of the kid, they may see “one million dollars” and opt for that. A million bucks is a lot of bucks!

But if you do the math, you’d know that you want that penny.

A penny doubled every day for 30 days is worth $5,368,709.12.

So, in fact, you’d rather have the penny than $5 million!

Even as an adult, and one that knows that exponential growth is very fast growth, might have been tempted by the $5 million rather than the penny that doubles every thirty days. 🙂

Table of Contents

Growth of a Penny That Doubles Every Day for 30 Days

If you are curious how the penny grows in value over the course of thirty days, here it is:

| Day | Value |

|---|---|

| 1 | $0.01 |

| 2 | $0.02 |

| 3 | $0.04 |

| 4 | $0.08 |

| 5 | $0.16 |

| 6 | $0.32 |

| 7 | $0.64 |

| 8 | $1.28 |

| 9 | $2.56 |

| 10 | $5.12 |

| 11 | $10.24 |

| 12 | $20.48 |

| 13 | $40.96 |

| 14 | $81.92 |

| 15 | $163.84 |

| 16 | $327.68 |

| 17 | $655.36 |

| 18 | $1310.72 |

| 19 | $2,621.44 |

| 20 | $5,242.88 |

| 21 | $10,485.76 |

| 22 | $20,971.52 |

| 23 | $41,943.04 |

| 24 | $83,886.08 |

| 25 | $167,772.16 |

| 26 | $335,544.32 |

| 27 | $671,088.64 |

| 28 | $1,342,177.28 |

| 29 | $2,684,354.56 |

| 30 | $5,368,709.12 |

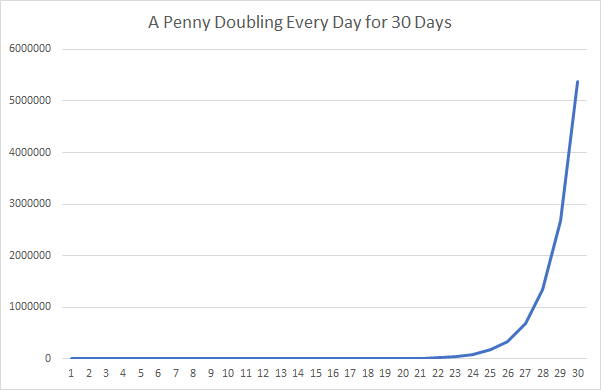

Here’s the surprising thing about exponential growth, it’s slow at first and then goes up real fast.

You don’t break $1 million until the 28th day. Go to bed and it’s now closer to $3 million than $2 million. One more day and you’re over $5 million.

You know what they say – the first million is the hardest!

So if your teacher asks you if you’d take a million bucks or a penny that doubled every day for 27 days, you take the million. 🙂

For all you visual learners out there, here’s what it looks like on a chart:

Penny Doubling Every Day for 31 Days

By the way, need to know what happens if it doubles for 31 days?

A penny doubling every day for 31 days is worth $10,737,418.24.

So you’d rather take that penny over $10 million – assuming you could wait 31 days.

Why We Don’t “Understand” Compound Growth

A penny doubling every day is a very simple example of compound growth. As an adult, we can override our intuition that tells us that a penny doubling can’t be that much. That’s because we logically know that compounding is very powerful.

Intuitively, we find it difficult to accept because it doesn’t happen often in our daily lives.

Most things experience linear growth (also known as arithmetic growth). That’s when something grows at a relatively constant amount per unit of time measured.

When you think about saving money, you’re thinking about its arithmetic growth. If you are able to save $50 each month, then after one year you’ll have $600. After 13 months, you’ll have $650. The growth is arithmetic as it increases by $50 each month.

The compound growth happens when you invest that money in the stock market. If you get 10% annually (compounded monthly), then after the first year you’ll have $628.28 in savings. If you continue saving, you’ll have $1,322.35 on just $1,200 in actual cash saved. (we used this calculator)

That’s the power of compounding. Our money finds friends to help it find more friends.

The other challenge about intuitively understanding compound growth is that while we “get it,” we know that it rarely compounds forever. Even if a genie offered us a penny that doubled every day for 30 days, it’s hard for us to believe it would actually double for that long. We think something might happen because it feels like too much of a good thing.

It’s why roulette wheels have that screen of historical numbers. We see a string of red numbers on that monitor and we assume a red is coming. We know they are independent events but our brains still want to believe they aren’t.

Our brain knows this magical doubling penny is magical but we still try to assign our real world experiences to it – that a magical doubling penny can’t possible keep doubling up to $5+ million!

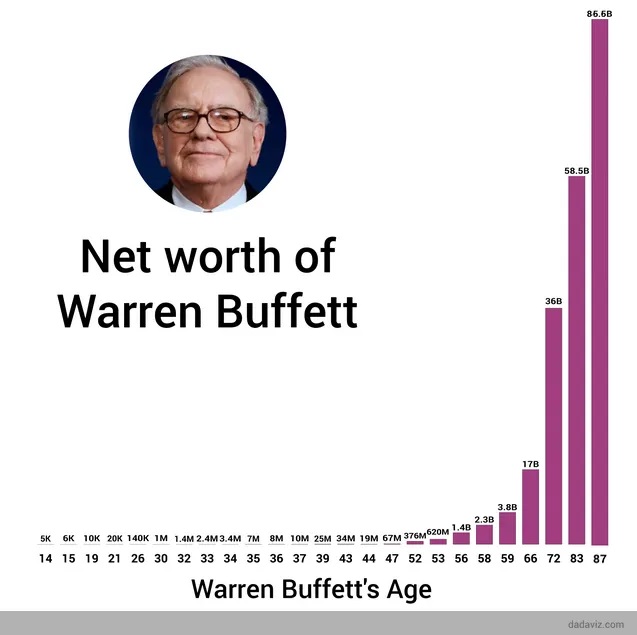

Warren Buffet’s Net Worth

One of the crazy ways we can see this play out is whenever you look at the net worth of some of the world’s most successful investors.

Warren Buffet’s net worth looks like a penny double every day:

A $5,000 net worth at 14 years old is pretty good.

$1,000,000 at 30 is also very impressive.

But when you consider he was worth $67 million at age 47, it’s not as crazy as knowing he’d have $2.3 billion just 11 years later at the age of 58. And $86.6 billion at age 87.

The hocky stick growth is compounding at such massive scales. It’s a penny doubling every day… except it’s millions and billions of dollars compounding every year.

Key Takeaways

I want this post to be more than a math lesson (or a quick answer to a “trick” question) because there are important lessons you can learn from this.

Notable, these two:

- Compounding is real and a very important part of your financial life.

- Suspend your initial disbelief (if you have any) and lean into what compounding can do for you.

If you save your money and invest it in the stock market over a long period of time, you will come out ahead. The thing that trips people up about the stock market is all the “financial entertainment” masked as “news” and the volatility.

On any given day, the market can go up or down. Sometimes massively. The news makes those gains and losses seem even bigger – with fantastical headlines about the market “soaring” or “crashing.”

But over a long enough time period, the stock market is always up. There are bull and bear periods but if you have decades, you’re guaranteed to be up.

Let the power of compounding work for you as early as you can and reap the rewards when you’re older.

Bob Tierney says

Jim,

Late last week you mentioned that Citi bank was coming out with new Bonus offers that you would list on Monday, (7/18/22), did I misconstrue that?

JIM, PLEASE ANSWER THE ABOVE QUESTION

Your chart for doubling a penny every day reminds me of what I saw a long time ago.

However in that case, the king owed his servant a big favor and would award his servant anything he wanted.

But instead of picking just one valuable thing in the Kingdom for his reward, he ask that the king actually give him just one grain of wheat on day one.

And then add to that each day with the doubling effect each day for a total of 30 days.

At the end of 30 days the king owed the servant more wheat than the total amount that the king had in the kingdom.

Pretty much as you have shown in your chart, except that in the king/servant example:

I believe the servant first asked the king to actually give or credit him with the 1 grain of wheat on that first day.

And then add to that each day with the same doubling effect for 29 more days.

It was the SUM total of all 30 days being doubled every day that came out with a larger end result than you have listed.

If that would be the case in your example, then the total would be 10,737,418.23, one shy of just doubling the 30 day amount alone, where your example shows $5,368,709.12

In any case, the doubling effect is un questionable which ever example one chooses to use.

I think we’ll all agree, that locking in each days reward before doubling is almost double the end result, OR, take and lock in as you go before the king realizes long before the 30 days he can’t fulfill his original promise, AGREE?

Have a good day Jim, and a better day tomorrow.

Sincerely,

Bob

Hey Bob!

It’s live – https://wallethacks.com/citibank-new-account-promotions/

That rice parable is the same basic idea, told in a different way, and I love it too. I think it does depend on how you start off the story, but ultimately the lesson is (as you pointed out) the same.

Brian @ KidWealth.com says

My kids acted out the play/book, One Grain of Rice, which is the concept with rice instead of pennies. I wrote a little about it here: https://kidwealth.com/compound-interest-one-grain-of-rice/.

I highly recommend adding it to your kids’ summer reading list if they haven’t covered it. Of course, I just asked my son if he’d rather have a million dollars or the magic penny and he choose the million dollars. 🙄

Hahahah, I’ll have to check it out!