When I was growing up, I thought that everyone just found a job and went to work. You had to earn a living to support your family and your job was how you did it.

However, after a few years in the workforce, sitting at a desk for 40 hours a week, I started doing more research and learning how life really worked.

Have you heard that millionaires have, on average, seven streams of income?

Working a job is one way to earn money but it’s not the only way. But it’s just one stream of income.

That money you make from you job? Save and invest it in real estate with just $500 on Fundrise and it can produce another stream of income.

That spare time you have? You can spend your time building something someone will buy or a service someone will use. That’s yet another stream of income.

It’s not always (or only) about working for someone else all the time.

Experts have a name for this – it’s called passive income streams.

⭐ Top Passive

Real Estate Idea

If you want to get into real estate passively, Fundrise is my favorite option – it’s an eREIT (real estate investment trust) with just a $10 minimum investment.

It’s free to join and you do not have to be an accredited investor. No harm in looking!

Top Passive

Banking Idea

No Penalty Certificates of Deposit are a zero risk way to earn yield and you can withdraw at any time with no penalty.

SkyOne FCU is offering a 4.75% APY on a 12-Month CD!

FDIC insured, completely safe.

Top Passive

Investment Idea

Yieldstreet is an investment platform where you can select alternative investments such as art, real estate, and venture capital. These are asset backed short term investments.

They also offer $250 and $500 bonuses when you make your first deposit, depending on the amount.

Table of Contents

- What Is Passive Income?

- How to Find Passive Income Sources

- Best Passive Income Ideas

- 💰 No Penalty Certificates of Deposit

- 1. Invest in Dividend Growth Stocks

- 2. Invest in (crowdfunded) real estate

- 3. Earn credit card sign-up bonuses

- 4. Earn $200-$600 in new bank account promotions

- 5. Save with a High Yield Savings Account

- 6. Save with Certificates of Deposit (Brokered & Regular)

- 7. Invest in Stocks/Bonds/REITs/BDCs

- 8. Invest in a rental property (or two)

- 9. “Invest” in Private Credit

- 10. Rent out your space

- 11. Write an e-book

- 12. Create an online course

- 13. Get paid to do things you’re already doing

- 14. Promote products and earn affiliate income

- 15. Advertise on your blog

- 16. Rent out a room in your house

- 17. Rent out items you already have

- 18. Rent out your space

- 19. Become a private lender

- 20. Flip domain names

- 21. Become a social media influencer

- 22. Rent out ad space on your car

- 23. Invest in a local business

- 24. Start a Vending Machine Business

- 25. Invest in Royalty income

- 26. Sell stock photography

- 27. Build an app

- 28. Design products to sell on CafePress or Redbubble

- 29. Buy a laundromat/car wash

- 30. Purchase a Self-Storage Business

- 31. Robo-Adviser Investing

- 32. Buy Series I Bonds

- 33. Publish Your Songs

- 34. Invest in Art

- 35. Invest in Fine Wine

- 36. Take Paid Surveys Online

- 37. Get Paid to Lose Weight

- 38. Personal Shopper

- 39. ETF Investing

- 40. Cryptocurrency Investing

- 41. Email Marketing

- 42. Flip Homes

- 43. Buy Farmland

- 44. Podcasting

- 45. Start an Etsy Store

- 46. Sell Digital Downloads

- 47. Petsitting

- 48. Participate in a Sleep Study

- 49. Credit Card Rewards

- 50. Get Paid to Shop

- 51. Cut Expenses

- 52. Pay Off Debt

- 53. Buy an Existing Website

- 54. Rent Your Car

- Passive Income FAQs

- Ways to Earn Passive Income from Real Estate Investing

- How Is Passive Income Treated for Taxes?

- Final Thoughts on Earning Passive Income

What Is Passive Income?

Passive income requires less time or effort to earn money than say, a typical 9-5 job, which is considered active income. For example, if you write an ebook and sell it on Amazon, you make money anytime someone buys it.

That’s passive income.

You could be working at your job, you could be sleeping, or you could be on vacation.

As you write more books, they start selling each other. The first book in the series will sell the second book. Eventually, you’ve built up a series of books that can generate an income no matter what you do. (royalties are just one of the 7 income streams many wealthy Americans rely on)

Passive income isn’t “free” income or some kind of financial magic – it takes work. You may have to do a lot of research up front, you may have to go through a lot of bad investments before you find good ones, and it’s very easy to make mistakes.

One common myth about passive income is that it somehow doesn’t take work and that’s completely false. however, once you do the work, it can pay dividends for a long long time.

How to Find Passive Income Sources

The first step in finding passive income sources is to build up your savings. Many passive income sources are investments and all investments share one thing in common – you must have money to invest.

Whether it’s investing in real estate or investing in dividend stocks or investing in a business – it all requires you to save up money. While you are saving up and looking for passive income sources, you don’t want to put it in any risk whatsoever.

The best place to put money you’re looking to deploy is a high yield savings account. In fact, a high yield savings account is itself a passive income source, albeit a low yield one because it carries almost no risk.

If you need a savings account (earn interest while you find your next opportunity), one of our top picks is Barclays Bank because it offers an interest rate of 4.35% APY. It has no minimum balance to open, no maintenance fees, and has competitive rates for their CDs too.

💰 Yieldstreet – $500 Limited Time Bonus Offer 💰

Yieldstreet is an investment platform where you can invest in alternative investments that offer passive income. It’s similar to a brokerage but you don’t use it to buy stocks and bonds, it’s all about passive income investments.

They have a cash bonus offer where you get up to $500 based on your deposit.

Best Passive Income Ideas

Without any further ado, here is our list of 54 passive income ideas to earn $1000 per month or more. Some may require an investment of time or work upfront but can generate an income passively ad infinitum once the project is completed:

💰 No Penalty Certificates of Deposit

With the Federal Reserve increasing interest rates, currently sitting at 5.00% - 5.25% (set on 3/20/2024), No Penalty CD rates are really attractive right now if you want risk-free returns with very little hassle.

Through Raisin (formerly SaveBetter), you can get 5.36% APY on a 5 Month CD at Tech FCU. FDIC insured, completely safe, and a good place to park your cash while you decide where to deploy it.

At the time of this writing, it is the highest rate but you can always check our No Penalty CD page for the latest updates. With Raisin, you can move your cash around between banks easily too, a nice perk.

1. Invest in Dividend Growth Stocks

I am a huge fan of dividend growth investing – this is when you focus on stocks that not only pay a dividend but have a history of strong dividend growth. When I was first building my portfolio of individual stocks, I focused on buying companies with a history of dividends, a history of strong growth, and financials that supported a continuation of both.

I also used it as an opportunity to scratch that itch I had for picking individual stocks. Now, more than ten years later, many of these stocks sport double digits yields (on my cost basis) and the cash flow from those investments helps me manage the irregularity of income I experience as a business owner.

We have this list of Dividend Aristocrats organized by dividend payout date, useful if you want to build a monthly paycheck from dividends. Dividend Aristocrats are blue-chip companies with a long history of increasing (and paying!) dividends.

If you want to do this too, I recommend using M1 Finance because it offers a variety of tools you can use to build a portfolio.

2. Invest in (crowdfunded) real estate

If you are looking to add real estate exposure to your portfolio but don’t want to find, research, finance, buy, and manage properties directly (which is definitely not passive income), you could invest in a crowdfunded real estate project.

With crowdfunded real estate, you use a platform to find projects where you loan money to a corporation, landlord, or rehabber. They would buy the property and they would pay you interest to use your money. You would invest alongside others.

The advantage of this, besides simplicity, is that it makes it far easier to build a diversified portfolio. Many of these platforms have low minimums, so you can pick several projects. If you did this yourself, you’d be concentrated into one project.

The few I really like are (all are free to sign up so you can join, look around, and see which ones you like):

- Fundrise is an eREIT with a $10 minimum investment and no accredited investor requirement. It’s the simplest because you deposit funds, select a fund, and are diversified across multiple investments. In essence, you invest in a fund and they pick the investments. (here’s more on Fundrise)

- AcreTrader offers you the ability to invest in farmland. Farmland is attractive because you get a good yield, equity growth, and while it’s not without risk, it has traditionally been very difficult to invest in before AcreTrader. Sign up for a free account and see what they have available. FarmTogether is another platform in this space worth checking out for deals (here is our review of FarmTogether).

- Arrived lets you buy shares of rental homes and vacation rentals, which is an asset class that isn’t usually covered by other platforms. These are shares in individual properties, rather than apartment complexes or commercial buildings, and offers passive income in the form of rents.

- stREITwise is a REIT with a $5,000 minimum investment and no accredited investor requirement. The fees are very straightforward (only 2% AUM) and they’ve been paying 8-90% dividends since inception (though past performance is not indicative of future results, here is our full review of stREITwise).

- RealtyMogul is for accredited investors who have a few thousand dollars they want to invest into individual properties, whether it’s homes, commercial real estate, or mixed use buildings. (we go in deeper on this RealtyMogul review)

The appeal of these passive income sources is that you can diversify across many small investments, rather than in a handful of large ones. When you invest directly in real estate, you have to commit a lot of capital to individual projects.

Warning: Investing in property outside of your home state will increase your tax complexity because you’ll have to file a state tax return in each state. This is less likely with funds, since they will take care of this for you, but it will happen if you invest in individual properties.

When you invest in these crowdfunded investments, you can spread your money across many uncorrelated real estate ventures so individual investments don’t cause significant issues.

3. Earn credit card sign-up bonuses

Most credit card companies offer sign-up bonuses to entice you to open a credit account with them. As long as you don’t spend money just to hit the minimum balance and always pay your balance on time, this can have a minimal impact on your credit score while earning you hundreds – or even thousands – of dollars a year. Some of the best travel credit cards offer 100,000 points to new accounts when you meet reasonable spending requirements.

Also known as “travel hacking,” these rewards can be redeemed as cash (statement credit) or airline miles (for free airfare). It’s a great way to travel for cheap!

We maintain a list of the best credit card bonuses but some of those have an annual fee. This can cut into the welcome benefits so we also have a list of the best credit card bonuses for credit cards without an annual fee.

4. Earn $200-$600 in new bank account promotions

If you don’t want to mess with your credit score and chase credit card bonuses, you can apply the same ideas towards bank promotions and bonus offers without the credit impact. There are dozens of banks that will give you hundreds of dollars to open an account and most will do only a soft pull to confirm your identity if you apply online.

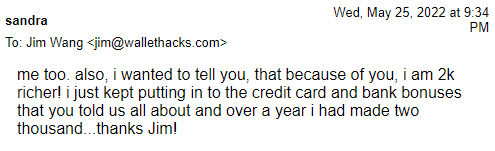

This is not entirely “passive” in the sense that you do it once and collect money for a long time but it’s zero risk and a great way to make a few extra dollars. There are folks who make thousands of dollars a year doing this.

The income will typically be reported on a Form 1099-INT so it’ll be taxed like interest income, which is passive income.

💵 U.S. Bank – up to $700

Earn up to $700 when you open a new U.S. Bank Smartly® Checking account and a Standard Savings account and complete qualifying activities. Subject to certain terms and limitations. Offer valid through June 27, 2024. Member FDIC.

Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm.

5. Save with a High Yield Savings Account

I wouldn’t think of a high yield savings account as a source of passive income but your savings should be getting something (less like Seinfeld syndication residuals and more like a commercial jingle residuals!). It won’t make you rich but it’s nice if your baseline, risk-free rate of return on cash is 1% or more. The best high yield savings accounts (or money market accounts) offer higher interest rate and there is absolutely no risk.

If you don’t mind locking your money up, you can get slightly more with a certificate of deposit, though rates there are not that attractive.

6. Save with Certificates of Deposit (Brokered & Regular)

NOTE: In early 2023, I wasn’t sure Certificates of Deposit were worth it anymore. As rates increased, I think they make more sense now – especially no penalty CDs where you can withdraw your cash without paying a penalty.

You’re probably familiar with certificates of deposit, where you save into an account that pays you a guaranteed rate of return for the duration. They are FDIC insured and completely safe.

If you want to get fancy with your certificates of deposit, you can save into a brokered CD. It’s similar in structure to a regular CD except they can be traded on the secondary market. If you want out of a bank CD, you have to redeem it and pay a small penalty on the interest.

These are most often used by people who wish to save their money for many years, brokered CDs can last as long as 30 years, or have more than the FDIC limit at a single bank and want to spread it around.

7. Invest in Stocks/Bonds/REITs/BDCs

A traditional choice for throwing off passive income, holding equities or fixed income in your investment accounts generates dividends/capital gains and or interest income, respectively.

REITs, or Real Estate Investment Trusts, invest in real estate and must pass at least 90% of income to shareholders to avoid being taxed as a partnership. Depending on the larger economic environment, REITs can potentially have higher yields than stocks and/or bonds.

BDCs, or Business Development Companies, are businesses that must pass at least 90% of their income to investors (similar to REITs) but they don’t invest in real estate. They typically invest in assets that are too large for regular investors but too small for private equity groups. Main Street Capital Corporation offers funding to privately-held businesses in equity and debt deals with investments as low as $5 million apiece.

My personal favorite stockbroker is Ally Invest because they have $0 commission trades (stocks, ETFs, options) and no maintenance fees. If you are looking to transfer your account, they offer a great stock broker bonus too.

8. Invest in a rental property (or two)

Though it can take a while to build up enough cash to put a 20% down payment on an investment property (the typical lender minimum), these investments can snowball fairly quickly. The key here is to correctly project income and expenses to accurately calculate cash flow (the free cash you can put in your pocket after all associated property expenses have been paid).

However, unless you want to manage the property yourself, be sure to include the cost of a property manager in your projections. Even with a property manager, you may be required to make large repair decisions every now and then – so while this is not a 100% passive activity, you are not directly trading your time for money like traditional employment.

Many buy and hold (ie rental property investors) take that excess cash flow and put it toward their next down payment. This is how they are able to slowly amass portfolios of dozens and sometimes hundreds of rental properties.

If you want access to rental properties but don’t have the funds for a downpayment, there are some crowdfunded real estate platforms that focus on single family homes. Arrived is an example of one company and they offer access starting at just $100. (check out our review of Arrived)

9. “Invest” in Private Credit

There is a market for private credit opportunities where you can take on notes and loans at higher yields. A platform that gives you access to this is Percent.

Percent isn’t a traditional brokerage account where you can trade securities like stocks and bonds but rather an alternative investment platform that focuses exclusively on private credit investment opportunities. As a result, this is for accredited investors only.

For their asset-backed deals, these are privately negotiated loans and debt financing made by non-bank lenders and you can invest in these notes as an alternative to traditional investments if you are an accredited investor.

A prime example of who these non-bank lenders lend to is a business that may need credit but doesn’t want to go the traditional bank loan route. They may sell their accounts receivables, like invoices, at a discount to a lender. They avoid the long drawn out nature of loans, you get a discount on their accounts receivables, and everyone is better off.

(see our review of Percent for more)

Percent also offers a bonus promotion based on the amount of your first investment:

| Investment Amount | Cash Bonus |

|---|---|

| $1,000 – $1,999.99 | $100 |

| $2,000 – $4,999.99 | $150 |

| $5,000 – $9,999.99 | $200 |

| $10,000 – $24,999.99 | $300 |

| $25,000 – $49,999.99 | $400 |

| $50,000+ | $500 |

These investments, like all investments, involve risk but getting a cash bonus is a nice way to reduce some of that risk.

10. Rent out your space

By now, everyone knows about Airbnb but what if you don’t want to deal with cleaning up after guests and endless laundry? Rent out your space for other people’s stuff.

Neighbor is a platform that lets you rent out space storage space. This can be a place for someone to park their car, truck, or R.V. It can be a garage or basement for them to store their stuff. You simply list the size of the available space, set a price, and then wait for someone to return it. Neighbor handles payment collection and you don’t have to deal with cash, checks, etc.

Our Neighbor review can explain more about this platform.

11. Write an e-book

Writing an e-book is very popular among bloggers, as many have noted that “it’s just a bunch of blog posts put together!” You will not only have to make an investment of time and energy to create the e-book but market it correctly. However, if marketed correctly (through blogging affiliates in your niche, for example), you could have residual sales that last a very long time.

Generally, e-books can sell very well because they are priced low. If your customer can afford to have a functioning laptop, tablet, or smartphone on which to read the e-book, they can afford to buy a cheap e-book without much financial difficulty. Cha-ching – residual income!

For example, if you run an online shop and are interested in building up your Pinterest presence to drive traffic to your shop, you have options as far as further education. However, online courses even typically cost upwards of $100, while e-books tend to be under $10.

12. Create an online course

If you have specialized knowledge in a certain topic, you can put together an online course to teach others. For example, if you have experience in real estate investing, you can create an online course “Real Estate Investing 101”. The benefit of an online course is that once you create the course material, you can sell it to as many people as you want.

Udemy and Teachable are two online platforms where you can create and start selling your online courses.

13. Get paid to do things you’re already doing

Surf the web? Answer polls and surveys? Watch funny videos? See what color best matches your personality?

There are a lot of things you’re doing on the web that you could, if you signed up for the right services, get paid to do.

See what things you’re doing already that you could be paid for.

14. Promote products and earn affiliate income

If you have a blog, you can make money by becoming an affiliate and promoting products to your readership. Basically, when they click through to the website using your unique link, you will receive a commission on their purchase. This is how many bloggers have grown their income month to month.

To learn more, Making Sense of Affiliate Marketing by Michelle Schroeder-Gardner of Making Sense of Cents is a highly recommended course.

If you need to start a blog, here’s my easy ten-minute guide to starting a blog.

15. Advertise on your blog

If you run a blog and get decent traffic, you can incorporate ads to your site. These will usually be on the sidebar, and perhaps at the bottom of your posts. Different ads will have different characteristics, but you can get paid per click or per view on each ad. If you have a lot of traffic, this can add up to a decent chunk of change.

If you need to start a blog, here’s my easy ten-minute guide to starting a blog.

16. Rent out a room in your house

If you have a spare bedroom, you can find a roommate or list the space on AirBnB for travelers. Having a roommate is the more passive of the two, as being an Airbnb host will require more work in the form of turning over the room between stays. This is a super painless way to earn $500 to $1,000 a month without much effort – you may even be able to cover your mortgage payment with this extra income!

17. Rent out items you already have

Given the growth in the sharing economy, your junk can start to pay for itself. For example, if you have some awesome vintage furniture inherited from your grandmother sitting in a storage unit, you can rent this out to photographers for their “styled shoots” which are becoming all the rage. If your furniture is more modern but you still can’t bear to get rid of it – perhaps a home stager will be interested. If you can bear to get rid of it, selling furniture has become a lot easier.

18. Rent out your space

If you have space, whether it’s an empty closet or a spot in your yard, you can use a site like Neighbor to rent it out to someone else to store their stuff. This can be anything from a vehicle, which tends to be the best rates for the least amount of hassle, to furniture and boxes (as a self-storage alternative).

It doesn’t need to look professional or even special, I’ve seen people list a spot on their driveway.

19. Become a private lender

As a private lender, you can lend to anyone in your social circle. For example, many home rehabbers need access to a source of capital they can tap into very quickly to fund the initial purchase of their properties. You can partner with a rehabber who uses your capital for a short-term in exchange for an interest rate that is mutually agreed upon.

20. Flip domain names

Domain names cannot be replicated. If one is taken, the only recourse would be to approach the owner to discuss a sale. While there are other variations you could choose, sometimes owning a certain domain (especially if it is attached to your business) can be worth the premium. Often, people will scout out domain names that are still available, buy them, and then sit on them to sell them down the road. Depending on who may want the domain down the road, you could sell it for a large markup.

You can search whether a domain is available using the site GoDaddy.

21. Become a social media influencer

This can be a little easier said than done, but if you have a large social media following, you can definitely earn money promoting a product or advertising for a company. You can even combine this with different marketing campaigns if you are an influencer and have your own blog (advertisement + affiliate income). This is how many bloggers make money! Again, it is not 100% passive but once set up correctly and then scaled, can be surprisingly lucrative.

22. Rent out ad space on your car

Some companies will pay up to a few hundred dollars a month for ad space on your car. Besides initially setting it up, after that you don’t have to do anything special to earn that income except drive your car around (which you probably do anyway).

This is just one of the five ways you can make money with your car.

23. Invest in a local business

Investing in a local business can be a risky proposition but one with good returns if you’re able to do it successfully. Becoming a silent partner is great because you don’t need to do any work – it can be less great if the business doesn’t do well.

Sometimes you can become a silent partner in a business because they need cash and are unable to get financing from the bank – this was common during the last recession. A perfectly good business with cash flow issues is the ideal target for this type of investment.

24. Start a Vending Machine Business

Vending machines are not completely passive but are similar to being a real estate investor with lower stakes. The key to making these successful is to get high-value locations and negotiate good deals with the people who own those locations.

You need to decide which machines you want to run, get the necessary licenses to operate them (you’re selling items so you need to get sales licenses and whatnot from your state), buy the machines and a truck for the items in the machines, find a supplier of the products, and then finally you can secure locations. Finally, you need to service them periodically or hire someone to service them.

25. Invest in Royalty income

For those who enjoy the music business or want to diversify their income stream, purchasing music royalties offers the artist upfront capital in exchange for an ongoing payment every time the piece of intellectual property (aka the song) is used.

For example, Royalty Exchange offers auctions where investors are able to bid on royalties.

26. Sell stock photography

Many online business owners don’t have the time or desire to take their own photos for their websites. Instead, they turn to stock photos, which are generic, professional photos. These are usually purchased in packages or for a monthly subscription to a stock photo website.

If you are a photographer looking to diversify your income stream, putting together styled stock photo packages can be lucrative. For example, a package of 15 wedding-themed stock photos for $10. You can then market this to any bloggers or businesses who are in the wedding business for their use (photos of different engagement rings styles are super popular). Through this method, it’s possible to make a continuous stream of income off of photos you’ve taken once (similar to a licensing deal).

27. Build an app

Know how to program? You can create an app, put it on the App Store or Google Play store, and then earn money for each download it receives. You will have to put some work into researching the apps that sell as well as marketing the app, but after it is built, the income can be relatively passive.

28. Design products to sell on CafePress or Redbubble

If you are creative and can tap into the latest trends to figure out what sorts of graphics would sell, you can post your design on CafePress Shop or Redbubble, where customers can buy all different kinds of merchandise printed with your design. They take care of back-end support while you earn a commission on the items sold.

29. Buy a laundromat/car wash

Laundromats and car washes are infamous for being cash flow machines, but before you buy one make sure you complete your due diligence. Verify the books and the income as well as expenses. Will you have to pay an attendant or any employees? Is the city planning on raising the cost of water anytime soon?

If you are lucky and find a seller who just needs money and wants to unload quickly, you could scoop up an even better deal.

30. Purchase a Self-Storage Business

Self-storage facilities are popping up across urban, suburban, and rural areas. You might be able to buy an existing complex. If you own vacant real estate, you can also build a complex. (less passive!)

This real estate investment idea can be less risky and maintenance-intensive than owning rental properties.

However, you may need to hire employees and the startup costs can be high but once you get going, self-storage is fairly hands off. There are many facilities that operate completely remotely (keyless entry) and one person manages several properties at once since they can be such low-touch businesses.

31. Robo-Adviser Investing

Investing in stocks and bonds can be one of the best long-term passive income ideas with minimal investment barriers (i.e., low investment minimum and no special skills are necessary).

For example, you only need a few dollars to invest and the investment platform manages your portfolio.

Most robo-advisors have a similar investment strategy by holding low-fee (and tax-efficient) index funds. The platform rebalances your portfolio to a more conservative risk tolerance as you near your planned withdrawal date.

Several automated investing platforms also offer additional features like cash management accounts or free checking accounts.

Some of the first platforms to consider include:

- Betterment lets you open an account with as little as $0 with a 0.25% annual management fee. Features include tax-loss harvesting, socially responsible investing, and free cash management accounts. See our full Betterment review here.

- Wealthfront lets you start investing with only $500. It’s possible to have your first $5,000 managed for free (then 0.25%). Cash management accounts are available. Learn more in our Wealthfront Review.

- M1 Finance lets you self-manage your portfolio but you can add premade portfolios to your investment pie. There are no account fees but the initial investment minimum is $100 for taxable accounts and $500 for retirement accounts. Learn more in our M1 Finance Review.

32. Buy Series I Bonds

Savings bonds have notoriously low yields that don’t make them an attractive investment for most income seekers. But as interest rates are expected to increase, one exception can be Series I Savings Bonds that yield 5.27% APY (on bonds sold from November 2023 - April 2023).

The bond yields adjust every six months based on the current inflation rate.

These bonds can earn more than most investment-grade bonds and the riskier “junk bonds” and you have the backing of the US Treasury.

33. Publish Your Songs

If you have musical talent, consider recording your music publishing it online. There are several different outlets to publish your tracks, including TuneCore.

This platform can help put your music on these streaming services:

- Spotify

- Apple Music

- TikTok

- Amazon Music

You may also be able to put your skills to use by writing music for others. You can connect with clients through Fiverr to create songs, background music, and voiceovers.

34. Invest in Art

Alternative assets are getting more exposure from individual investors seeking diversification. Investing in art is a popular stock market alternative.

For example, Masterworks lets you purchase fractional shares for modern and classic art. You can earn a profit after a multi-year investment period when the platform sells the piece for a profit.

Blue-chip physical art can outperform stocks and this service lets you invest with low investment minimums and off-site storage. Read our Masterworks review to learn more.

35. Invest in Fine Wine

Vinovest lets you invest as little as $1,000 to start collecting wine. Your bottles remain in climate-controlled cellars across the world. Plan on holding them for several years or decades as their value can increase as that vintage becomes rarer.

If you’re a serious wine enthusiast, you can also build a personalized portfolio with a higher portfolio balance.

You can also pay to have one of your bottles shipped to you when you want to enjoy a wine tasting. Read our Vinovest review to learn more about wine investing.

36. Take Paid Surveys Online

Paid survey sites can also be a quick way to earn a few extra dollars without any special skills. Admittedly, you must physically tap buttons to complete surveys but you can earn a signup bonus or install apps that share your mobile browsing habits.

It’s also possible to earn bonus points by referring friends with most platforms.

Swagbucks can be an exciting site to join as you can earn a $5 bonus by earning a minimum number of points in the promotion period. In addition to surveys, you can also shop online, play games, and watch videos. Learn more in our Swagbucks review.

37. Get Paid to Lose Weight

Losing weight and living a healthy lifestyle might be a staple of your daily routine. But, in addition to enjoying the health benefits of this activity, you can also make money losing weight and exercising.

For example, HealthyWage lets you wager money and enter challenges. If you achieve your goal, you win money. Otherwise, you lose your wager if you don’t lose enough. Find out more in our HealthyWage Review.

Another platform to consider is Sweatcoin. This platform is more passive as it tracks your steps and exercise activity. Then, you can redeem your points for physical and digital rewards.

38. Personal Shopper

Being a personal shopper and running errands can also help you earn more money. Of course, you will need to shop online or locally but you can use a rewards credit card and cash back apps to maximize your spending power.

If you enroll in an app like Taskrabbit, you may be able to charge a higher hourly rate that can earn more than other passive income ideas.

39. ETF Investing

Most investing apps let you invest in index and sector ETFs. Some of these funds focus on earning dividend income from blue-chip companies or investment-grade bonds.

While you may still have most of your portfolio in broad market index funds for additional diversification, dividend ETFs can provide stable, recurring income.

40. Cryptocurrency Investing

Cryptocurrency is one of the newest passive income ideas. While this investment sector is volatile, it can be profitable if you have a high-risk tolerance.

One way to make money is by selling your coins at a higher price than your original acquisition price. In addition, several cryptocurrency exchanges offer free Bitcoin when you create a trading account.

A second way is to earn interest by staking your position with no investment minimum.

41. Email Marketing

If you own a blog or a business, your email list can be a gold mine. You can promote products that you create, such as spreadsheets, ebooks, and online courses.

It’s also possible to promote affiliate links for products and services that you recommend within your niche. For example, you may recommend a specific pet food brand if you blog about pets.

42. Flip Homes

There are several different shades of real estate investing and owning long-term rentals or being an Airbnb host isn’t for everybody.

Consider flipping homes if you’re a short-term investor. This income idea can be passive when you can outsource the renovations to a trusted contractor. Consider using a platform like TaskRabbit to hire professionals to complete the necessary tasks.

If your local real estate market doesn’t have any fix-and-flip prospects at the moment, you can also invest in fixer-uppers through Groundfloor. The investment minimum is $10 per project and the typical investment period is between 6-12 months. Learn more in our in-depth Groundfloor Review.

43. Buy Farmland

Farmland investing can be another easy way to earn recurring income. You can lease your acreage to farmers that pay you annual rental income.

This is a possibility if you own farmland. For example, you may inherit the land that your family used to farm but you don’t want to sell.

Qualified accredited investors can also invest with fractional shares through AcreTrader. The investment minimum starts at $5,000 and has an average 11% annual dividend return. You can read our full AcreTrader review here.

44. Podcasting

Podcasting can be an exciting way to earn money from product sponsors as your audience grows. You might start a YouTube channel, but another option is joining Anchor to automatically distribute your podcast on Spotify and similar hosting services.

Anchor can also help you monetize your episodes by helping you connect with relevant sponsors.

45. Start an Etsy Store

Etsy lets you sell handmade and vintage items. Your income can be passive if you’re flipping items such as antique jewelry.

While most Etsy sellers offer physical items, you can also create printables that are truly passive once you make the item.

46. Sell Digital Downloads

One of the advantages of selling digital downloads is that you only have to create a product once and you can sell it indefinitely. Sure, you may need to make periodic updates but you don’t have to manually craft each sold item and ship it.

Gumroad is a leading platform to make one-time sales and offer membership subscriptions.

47. Petsitting

Petsitting can be an easy way to boost your income as pet owners drop their dogs and cats off for pet daycare or overnight boarding.

Rover is one of the best platforms to offer your services to local pet owners.

48. Participate in a Sleep Study

Sleep studies and medical studies can offer above-average pay if you live near a testing center. You can find opportunities at ClinicalTrials.gov or by checking with your local university.

Online focus groups may also provide additional ways to participate.

49. Credit Card Rewards

Rewards credit cards offer two different ways to effortlessly earn points:

- Signup bonuses: One-time offers for new members when you meet an initial spending challenge.

- Purchase rewards: Earn rewards points on any purchase. Some cards offer bonus points on select categories.

You may prefer cash back cards as you can redeem your earnings as a monthly statement credit and are less likely to pay an annual fee. Just be sure to pay your balance in full to avoid interest charges.

50. Get Paid to Shop

You can earn cash back through online and local purchases at most retailers. Rakuten is one of the best platforms as they partner with most online stores and several local retailers.

You can receive payment by PayPal, check, or gift card each quarter when your balance reaches $5.01. Find out how to earn cash back when you shop in our full review of Rakuten.

51. Cut Expenses

You’re probably familiar with the expression, “A penny saved is a penny earned.” Look for ways to cancel unwanted subscriptions and minimize your monthly expenses. These money-saving guides can help stretch your spending power so you can have more money to invest or put towards long-term goals.

52. Pay Off Debt

Paying off debt can also have the same effect as earning more passive income. After all, eliminating a monthly payment reduces the stress of having to make more money so you can pay the bills.

Using a debt snowball sheet can help you make a debt payoff plan to maximize your interest savings.

53. Buy an Existing Website

Blogging can be an exciting way to earn monthly income from ads, sponsors, and affiliate partners. However, starting a blog is hard work and it usually takes a few months before you earn your first dollar.

A better option can be purchasing an existing site with an established audience and already earning some income. For example, Flippa is a marketplace with apps and sites for sale.

54. Rent Your Car

You can rent your car on sites like Turo for single-day and multi-day rentals. This service can be an excellent way to earn money on the days you’re not using your vehicle.

Car sharing services are also becoming more popular as it can be difficult to find rental cars in some cities.

Passive Income FAQs

One of the easiest ways to start making passive income is by looking for ways to invest small amounts of money, such as investing apps that offer fractional shares of dividend stocks and ETFs for $1. You can also consider joining online brokers offering free stock to get free money.

Most passive income is taxable and you may receive an end-of-year tax form stating your taxable income. The tax treatment depends on the asset but is usually subject to ordinary income taxes like your day job salary. When possible, one way to minimize your tax liability is by using a tax-advantaged retirement account like a Roth IRA, traditional IRA, or a 401k.

There are two different types of income. Active income requires you to work for the money, such as a delivery app job or other side hustles. If you don’t work, you don’t make money.

Passive income may require some upfront effort and ongoing maintenance but you can recurring income from dividends or by selling digital items. Income-producing assets can be the best way to invest long-term and build wealth.

Stocks and bond index funds through robo-advisors can have some of the lowest investment minimums. Your investment is also highly liquid and you can quickly sell when you need to use the money for another purpose.

Crowdfunded real estate can also require less money and time than other activities as you commit funds and the experts manage the business and collect payments.

If you have the time and skills, you can also create digital content like podcasts, blog posts, and graphics that you can post and monetize. In most cases, the platform fees for creators are affordable and some free services exist.

Some passive income ideas are riskier than others. For example, cryptocurrency can be more volatile than an S&P 500 index fund. It’s a good idea to determine if you can earn additional income because of the higher risk. You should also diversify and focus on several income streams to earn something as some ideas may not always be profitable.

How much you make in passive income is based on how much you’re able to invest and the asset class you choose to invest in. If you choose an investment with a 5% yield, you’ll need to commit $240,000. If you choose an investment with a 1% yield, you’ll need $1.2 million.

The best passive income requires upfront capital but if you don’t have any, you’ll have to be creative and sell digital assets that can be bought and sold without you actively being there. This includes information products, ebooks, stock photos, and others. It’s harder to build a passive income without any money because it requires you to do the work upfront. The benefit is that the rewards can be immense, especially given the reach of the Internet, but not guaranteed.

Ways to Earn Passive Income from Real Estate Investing

There are several different ways to make money from real estate investments:

- Stocks and REITs: Publicly-traded real estate stocks, funds, and real estate investment trusts (REITs) can earn steady dividend income. Your shares can also increase in market value and you can sell them for a profit.

- Crowdfunded real estate: Private real estate deals can earn dividends. Equity-structured offerings can earn additional profit when the property manager sells the property. This investment idea doesn’t have the day-to-day share price volatility like real estate stocks and publicly-traded REITs.

- Rental property: You can purchase an investment property and earn rental income from short-term stays (i.e., Airbnb) and long-term tenants.

- House flipping: You can also purchase a fixer-upper, perform repairs that increase the market value, and potentially sell it for a profit.

Ways to Make Money By Renting Your Stuff

Yes, several apps let you make money from renting your various possessions and real estate.

Some of the platforms to consider:

- Airbnb: Rent your unused rooms or home to vacationers and business travelers for short-term stays.

- Neighbor: Use your empty rooms, closets, garage, or yard for month-to-month self-storage.

- Fat Llama: Rent electronics, power tools, and equipment so your community members won’t need to buy the item for short-term use.

- Turo: Lend your vehicle to others on the days you won’t need it.

How Is Passive Income Treated for Taxes?

There is a specific tax definition of passive income, known as “passive activity” to the Internal Revenue Service. Passive income is any income you make without actively working or are materially involved. The IRS defines it as any rental activity or any business in which the taxpayer does not “materially participate.” Nonpassive activities, or active activities, are businesses in which the taxpayer works on a regular, continuous, and substantial basis.

If you are paid a salary, whether annual or hourly, that’s active work. If you don’t go to work, you don’t get paid. That’s pretty straightforward.

We want to make sure that we stay away from anything requiring “material participation,” as defined by the IRS:

- Put in 500+ hours in the business in a year,

- If you’ve done “substantially all” of the work in a business in a year,

- You’ve put in up to 100 hours and that is at least as much as any other person involved.

There is a tax reason for this definition too. When you are actively involved, your income is taxed differently.

If it’s more like residual income, it’s taxed more efficiently.

Final Thoughts on Earning Passive Income

Building passive streams of income is the key to unlocking wealth. If you are constantly trading your time for money, you can’t really take advantage of leverage. Your money needs to make more of itself if you really want to succeed financially. It starts with saving and ends with investing in assets that generate the cash flow you can use to invest in even more valuable assets.

With this list, we’ve compiled over 50 passive income ideas. Which one are you going to try?

This is a helpful list for anyone trying to create income streams to replace a full-time job. Something in here for everyone. Peer lending and real estate crowdfunding are two of my favorites. Very passive, i.e. maximized for lazy investors like me.

-RBD

Love this. I have many things GS on this list that I am already doing including the blog and graphic design on t-shirt sites and ebooks.

I’ve been thinking of ideas for my own eBook or a course. I have so many ideas, and I think that’s what’s holding me back from creating a product.

Very extensive and useful list. I think the best strategy would be to pick a couple that really click with you and dive in and make it work! Almost all streams of income require lots of upfront work to get moving, but once the snowball gets rolling down the hill, it can be really fun!

There’s no free lunch, so many of these require work or money up front. It’s not “passive” in that it’s “easy,” it’s just not active work. 🙂

I wrote an ebook and yesterday … made my first sale!

(That took only, what, thirteen years?!)

I was happier with that $0.99 than with any bonus I’ve gotten at work.

Congratulations John! That’s awesome — time to make that second sale!

Great post! I’ve been thinking about writing an e-book for a while. I just need to decide on what the reader likes and what I want to write about. Hmm…

These passive income ideas are realistic and legit. Thanks for sharing!

Great List! Wanted your thoughts on REITs vs Rental Properties, I’m considering including REITs in my portfolio for passive income.

Great List,

I am moving to mexico. which of these sites is applicable for living in mexico? I am not sure if you know off hand but I figured doesn’t hurt to ask. Thanks in advance.

Great list! I think a lot of people expect passive income to just truly be money for nothing. I just feel like it’s missing some easy ones. What about apps that let you rent stuff out like airbnb, AirGarage, and ShareShed?

Those are a great way to monetize stuff you own that you aren’t using (at the time), but they’re not passive.

Im wanting to invest in some sort of real estate investment, to make a passive income and starting with 300 to 1k but im wanting to start making money, like at least 400 to 700 a month and i know there’s 100s of ways to make money, in real estate. But can you please suggest a real estate investment, for beginners and where i could starting earning at least 500 a month, as that’s got to be something and im not looking for yearly income?!