Everyone’s looking for the inside track for finding the best investments and investment strategies. And even successful investors are in a constant search to find ways to improve their performance. That usually involves turning to recognized investment sources, and even subscribing to premium investment services.

Two of the top sources in the field are The Motley Fool and Morningstar. Not only is each one of the most respected sources of information in the investment industry, but each also offers premium subscriptions giving you access to inside information.

But the comparison between the two – The Motley Fool vs. Morningstar – isn’t exactly an equal one. As you’ll see from our analysis of the two services, while one provides specific investment advice, the other is primarily a general source of information about nearly the entire investment universe.

Which service will work better for you will depend on your own investment experience level, as well as personal preferences.

Table of Contents

- About The Motley Fool

- About Morningstar

- How The Motley Fool Works

- How Morningstar Works

- The Motley Fool Advisor Programs

- The Motley Fool Stock Advisor

- Motley Fool Rule Breakers

- Motley Fool Rule Your Retirement

- Motley Fool Discovery: Cloud Disruptors 2020 (CD20)

- Morningstar Investor Program

- The Motley Fool Stock Advisor Pros and Cons

- Morningstar Pros & Cons

- Who is The Motley Fool Best For?

- Who is Morningstar Best For?

- The Motley Fool Stock Advisor vs. Morningstar – Which is the Best Stock Picking Service?

About The Motley Fool

The Motley Fool is one of the most widely followed investment news services in the industry and offers several stock-picking advisory plans. The company was founded in 1993 by two brothers, Tom and David Gardner. They claim to have more than 700,000 newsletter subscribers.

One of the advantages of The Motley Fool is that it’s designed for investors at all levels, especially new and intermediate investors who may not be as familiar with the technicalities of investing activities. That makes it a particularly user-friendly service. But they also offer several newsletter services to accommodate the different needs of their clientele. This can include a service for new investors, as well as for retirees, and those looking to invest in the cutting edge of technology.

If there’s a complaint about The Motley Fool it’s that once you sign up for a newsletter, the company does engage in up-selling efforts. But if you can put up with the repeated attempts to solicit you to trade up to yet another newsletter advisory, it can be one of the best stock-picking services available.

About Morningstar

Morningstar is easily one of the most respected names in the investment industry. Not only do they offer their Morningstar Investor plan to paying subscribers, but they are also a recognized source of information and security ratings throughout the industry. Many investment companies even integrate Morningstar services into their own investment programs to provide greater investor insight in choosing investments.

This interactive stock screener lets self-directed investors research stocks, ETFs, and mutual funds using exclusive Morningstar ratings, curated highest-rated lists, and analyst inputs. These tools can also analyze existing investor portfolios.

The company is based in Chicago and was launched in 1984 as an investment research firm. It’s best known for providing ratings of mutual funds, but it also has more than $220 billion in assets under management, making it one of the larger investment management firms as well.

How The Motley Fool Works

Though the focus of our analysis between The Motley Fool and Morningstar are the stock-picking services they offer, each company provides other services that are valuable to investors. For both providers, you can have access to those services and information free of charge on each company’s website.

The Motley Fool website provides extensive resources for investors at all levels. That includes articles on how to invest money, what to invest in, and how to invest specifically in stocks, index funds, and ETFs. They also provide detailed information on both the various stock market and the indexes attached to them, as well as lists of the best brokerage accounts and the best IRA accounts.

They also cover the various types of stocks – growth, value, dividend, and capitalization size – as well as specific industries, like technology, energy, healthcare, and others.

The Motley Fool also has an extensive archive of articles on retirement. This is hardly surprising since their retirement articles frequently appear on other major financial media sites.

Read our full review of The Motley Fool here.

How Morningstar Works

Morningstar is perhaps best known for rating investment securities, including mutual funds and stocks, generally on a five-point scale, with five points being the highest rating. However, they may also rate a fund as a Gold-Rated Fund, which means, based on their analysis, a particular fund is likely to outperform its peer group over the long term. If they rate funds by gold, silver, or bronze it’s expected to outperform the market over at least the next five years.

Unlike The Motley Fool, the platform doesn’t have a model portfolio or monthly stock recommendations. Still, it highlights many stock and fund investment ideas with articles, analyst-curated lists of the highest-rated securities, and a stock screener.

Typically, to get the most benefit from the research, you’ll need to sign up for their Premium service, appropriately named Morningstar Investor. Our analysis of Morningstar will focus on the Morningstar Investor service from this point forward.

Read our full review of Morningstar here.

The Motley Fool Advisor Programs

In total, The Motley Fool offers no fewer than 24 stock advisory services. They range in price from $199 per year to as high as $13,999 per year. However, fully 20 of those advisory services are currently closed to new members. In this section, we’re going to focus on the four plan levels that are currently available to new investors.

The Motley Fool Stock Advisor

This is the most basic plan offered by the Motley Fool, and also its flagship service. The Motley Fool Stock Advisor was launched in 2002 and is currently available for $199 per year. There is a special offer for the first year where you pay much less – only $99*.

*Billed annually. Introductory price for the first year for new members only. First year bills at $99 and renews at $199.

The service provides the following benefits:

- Two new stock picks each month.

- Best Buys Now – You’ll get 10 timely buys selected from more than 300 stocks.

- Starter Stocks – These are what The Motley Fool refers to as foundational stock recommendations for both new and experienced investors.

- Community and investing resources – You’ll have access to educational materials from “the world’s greatest community of investors” to help you improve your investment game.

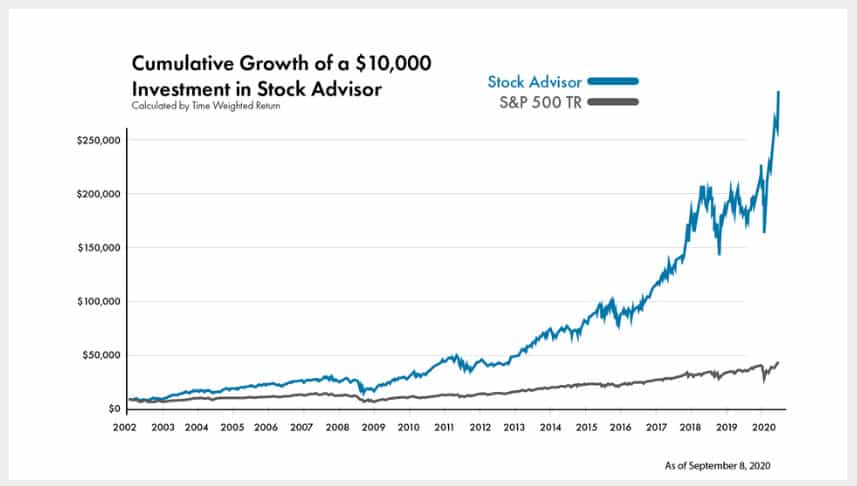

The company claims cumulative average returns on all stock picks by the Stock Advisor since the beginning of the service have returned 502%, compared to 101% on the S&P 500 over the same timeframe.

Motley Fool Rule Breakers

This advisory will provide recommendations of high-growth stocks selected by Motley Fool founder, David Gardner. The service began in 2004 and is currently available for $299 per year.

Rule Breakers provides the following services:

Two new stock picks each month

- Best Buys Now – You’ll get five stocks to buy now selected from more than 200 stocks.

- Starter Stocks – Same as with the Stock Advisor plan.

- Community and investing resources.

The cumulative growth of a $10,000 investment following the stock picks recommended in Rule Breakers is 262%, compared to 85% for the S&P 500 over the same timeframe.

Motley Fool Rule Your Retirement

Not much information is provided on this plan, such as when it began or what the cumulative returns have been compared to the S&P 500. But it’s the lowest cost plan available from The Motley Fool at $149 per year.

Rule Your Retirement provides the following services:

- Model portfolios – Three, in fact, to help you achieve the best investment mix using The Motley Fool’s allocation and rebalancing guidance.

- Mutual fund and exchange-traded fund (ETF) recommendations – Includes specific index funds and ETFs.

- Social Security tips, tricks, and strategies – Helps you to get the most benefits from Social Security.

- Coverage and analysis on critical retirement topics – Includes estate planning, insurance, and other information to help you prepare for a better retirement.

Get started with The Motley Fool

Motley Fool Discovery: Cloud Disruptors 2020 (CD20)

This is a premium plan priced at a lofty $1,999 per year. And similar to Rule Your Retirement, no information is available about when the service began or what the return on recommendations has been. But they promote the plan as “Invest in The Motley Fool’s No.1 Technology of the 2020s” – which likely means they won’t need to change the name of the plan in 2021 and beyond.

The program has an estimated 33 times growth potential for the decade of the 20s. The Motley Fool claims this is the only service focused exclusively on maximizing the estimated $3.2 trillion potential market stemming from cloud computing. They’re sinking $500,000 on cloud disruptors 2020 from now through 2022. That makes it sound like this plan may also be closed to new members in a couple of years.

Morningstar Investor Program

Morningstar Investor gives investors access to very specific investment information. This is where individuals can access analysis and ratings of stocks, bonds, exchange-traded funds, and mutual funds. As described earlier, the service highlights companies and funds that are likely to outperform their respective peer groups over at least the next five years.

They do offer their Morningstar Basic plan, which is free to use. However, it provides only limited access to Morningstar investment tools and no access to analyst reports and top investment picks – the two primary reasons to use the Morningstar service.

The free content can give you a feel for the content depth and analysis perspective. But you’d miss out on exclusive ratings and detailed insights that can help you make informed investment decisions.

Both analyst reports and top investment picks are available through Morningstar Investor. For $199 per year, you’ll have full access to security and fund analysis, as well as lists of the top-rated stocks and bonds. In addition to finding potential investments, you can enjoy ongoing portfolio analysis tools. The plan also comes with a 14-day free trial so you can test out the service before deciding if you want to keep it.

Morningstar Premium gives you full and unlimited access to the following services:

Analysts Reports. In these reports, Morningstar analysts provide an in-depth summary of their assessment of that investment’s future prospects.

Top Investment Picks. These are the all-important Morningstar investment ratings, as compiled by 220 independent analysts. It includes five-star stocks, ETFs, bonds, high-yield bonds or bond funds, foreign bond funds, US index funds, foreign index funds, bond index funds, “inflation fighters,” target-date funds, and starter funds. This is the service for which Morningstar is so well known.

Portfolio Manager. This is an online platform where you can track your investments, create watch lists, and modify your strategy going forward. In fact, you can access Morningstar reports through the table to see information quickly and easily.

Portfolio X-Ray. This tool evaluates your asset allocation, including your sector weights. It will alert you if you have concentrated positions in funds as well as individual stocks. That will keep you from loading up on stocks that may already be included in mutual funds.

Screeners. These are a series of tools that will enable you to search and filter stocks, ETFs, and mutual funds by category, rating, and performance. You can filter stocks and funds by over 200 factors, including analyst’s grade ratings and specific criteria like risk, sustainability, annual returns, trailing returns, load-adjusted returns, tax cost ratio, and other criteria.

✨ Related: Best Stock Screeners

For a limited time, Morningstar Investor is discounted by $50!

It comes with a 7-day free trial so you can lock in your savings, try the service, and cancel if you don’t think it’s for you.

The Motley Fool Stock Advisor Pros and Cons

Pros:

- Offers no less than four different investment advisory plans, each with a specialization.

- Provides recommendations of individual stocks and funds, and with the Rule Your Retirement plan, even portfolio allocations.

- At least two of their advisory plans claim their stock picks have easily outperformed the S&P 500, even by as much as five-to-one.

- Provides abundant – and free – investment information on their website.

Cons:

- The Motley Fool is known to upsell its clients. If you have one advisory service, they’ll work to convince you to add another.

- Some of the premium plans are clearly out of reach for small and even medium-sized investors.

- Doesn’t provide tools to manage your portfolio, nor offer recommendations on when to sell a recommended investment.

Morningstar Pros & Cons

Pros:

- Provides securities analysis and investment ratings on thousands of stocks, ETFs, and mutual funds allowing you to choose the investments you want to make.

- You can manage your portfolio from the Morningstar platform.

- Analysis and ratings are available through the program on an ongoing basis, including updates. This will enable you to better react to changes in investment status.

- Investor is a single program incorporating all the benefits and services Morningstar provides.

- The screeners will allow you to choose individual securities and funds within the plan using over 200 customizable filters.

Cons:

- Doesn’t make specific stock recommendations.

- Free research tools have limited capabilities.

- Potentially expensive for infrequent investors.

- Minimal technical research tools.

Who is The Motley Fool Best For?

Because it provides specific investment recommendations – or portfolio allocations in the case of the Rule Your Retirement plan – The Motley Fool is best suited to new investors, or experienced investors who would rather turn the job of investment selection over to a third party.

Get started with The Motley Fool

Who is Morningstar Best For?

Morningstar Investor is well suited to experienced, self-directed investors desiring fundamental analysis versus technical trading tools. It provides an extensive amount of security and fund analysis, as well as investment ratings and the online portfolio management platform.

You will benefit the most from this platform as a long-term investor who relies on analyst ratings, detail-rich research reports, and a stock screener. Its stock, ETF, and mutual fund research capabilities make it an excellent option for many.

Morningstar provides the analysis and a ranking system that will help you choose which investments are likely to outperform the market. You can then choose which specific investments you want to make based on your own investment preferences and experience.

The Motley Fool Stock Advisor vs. Morningstar – Which is the Best Stock Picking Service?

| Category | The Motley Fool | Morningstar |

|---|---|---|

| Free Investment Information | Yes | Yes |

| Number of Premium Plans | 4 | 1 |

| Premium Plan Cost | $199 – $1,999 | $199 |

| Security Recommendations | Yes | No |

| Security Analysis | Limited to securities recommended | Available for nearly all stocks and funds |

| Portfolio Management | Only with the Rule Your Retirement Plan | Yes, Online portfolio management platform |

| Live Support | No | No |

| Best For | Investors looking for investment guidance | Self-directed investors |

| Investment Performance History Published | Yes | No |

Even though both Morningstar and The Motley Fool provide a large amount of free information, as well as premium investment selection services, that’s really about all they have in common.

Between the two, Morningstar is more comprehensive. It’s perfect for the self-directed investor who isn’t looking for specific investment recommendations but rather wants to narrow down the field of potential candidates.

Morningstar not only provides more analysis of the entire investment spectrum, but it also offers an online portfolio where you can both manage your investments and access the information provided by Morningstar Premium.

On the other hand, The Motley Fool is much more targeted. You won’t need to sift through analysis and ratings of dozens or even hundreds of securities and funds. Instead, you’ll be provided with very specific investment recommendations. This makes it the perfect choice for someone who is looking to improve the performance of their investments but lacks either the time or the motivation to engage in investment selection.

If you’re interested in either service and don’t know which to choose, start by analyzing your own investor profile. If you’re oriented toward self-directed investing, and you just want investment assistance – as well as a platform where you can track your holdings – you’ll favor Morningstar. But if you’re looking for specific investment recommendations, one of the four advisory services offered by The Motley Fool will likely be the better choice.

The Millennial Money Woman says

Kevin,

This is a fantastic post comparing the 2 programs.

Personally, I use Morningstar although I like the Motley Fool as well. However, like you, I feel that Morningstar is a more comprehensive tool that provides more detail for some of the investment options any self-directed investor seeks out.

Thank you so much for your insight!

The Millennial Money Woman