Ratings are everywhere but when it comes investments, none have the “star power” and history of Morningstar ratings.

Go to any mutual fund and chances are, if they have a good rating, they will tell you what their Morningstar rating is!

For example, Thrivent lists Morningstar ratings of their funds on the Fund Details page for one of their four-star funds, the Thrivent Mid Cap Stock Fund (TMSIX). Many mutual fund companies will have a page devoted to listing their Morningstar Ratings, such as this one by Dupree Mutual funds.

But what do these ratings mean?

Are they handed out like Yelp ratings or is there more involved?

Let’s find out.

Table of Contents

How do Morningstar Ratings Work?

Morningstar will give a rating to an investment based on its historic returns. These can include individual stocks, but they are most often used when referring to a mutual fund or exchange traded fund.

For stocks, you’re usually deciding whether or not you’re investing in a specific company. There are a lot of company-specific factors to consider. The Morningstar rating is not going to play a big role in your decision. Still, it’s another research tool from a trustworthy research firm.

If you’re picking a type of mutual fund, there are several similar funds from other mutual fund companies. For example, it’s hard to differentiate between the various index funds that track the S&P 500 index. Your differentiator is going to be the expense ratio and any tracking error. Here’s where a Morningstar Rating can do some of the work for you.

There are two Morningstar ratings:

- Star rating – The star rating is used to compare an investment against its peers. Updated monthly.

- Analyst rating – The analyst rating is a “forward-looking assessment of a fund’s ability to outperform its peer group or a relative benchmark on a risk-adjusted basis over a full market cycle.” (source) Updated at least every 14 months.

Morningstar states that its rating system covers more than 600,000 investments globally. So, individual and professional investors across the world utilize this unique investment research.

The star rating is the most popular one because you do not need a Morningstar Investor membership to see these ratings.

What does the Morningstar Star Rating mean?

The rating shows how the fund compares to its peers. It’s on a scale of 1 through 5, and if the fund beats its peers, it’ll get 4 or 5 stars. If it lags its peers, it’ll get 1 or 2 stars. 3 is average. It is updated once a month.

To get this star rating, Morningstar looks at all the funds in the same Morningstar Category and rates the fund based on their “enhanced Morningstar Risk-Adjusted Return measure.” The rating assesses the fund’s track record compared to its peers and will only rate a fund if it has a track record of at least three years.

This backward-looking indicator requires 36 months of performance history before assigning a rating. Its inception date is 2002 and it’s a highly recommended investment analysis measurement.

How does the Analyst Rating Work?

While the star rating tells you about the past, the analyst rating is Morningstar’s attempt to be predictive of future returns. This is a forward-looking indicator focusing on qualitative traits.

Each fund is broken down into five pillars:

- People

- Parent

- Process

- Performance

- Price

An analyst will use interviews with the management team as well as proprietary data to establish a rating. The rating is based on the expectation of alpha. Alpha is how much an investment beats its benchmark. A negative alpha would mean it lags the benchmark, while a positive alpha means it outperforms its benchmark.

The Morningstar analyst rating has five levels with the top three having medals, here’s what they mean:

- Negative (worst) – Expected negative alpha, net of fees

- Neutral – Expected zero or negative alpha, net of fees

- Bronze – The bottom 50% of investments with positive alpha, net of fees

- Silver – The top 35% – 50% of investments with positive alpha, net of fees

- Gold (best) – The top 15% of investments with positive alpha, net of fees

It is updated at least once every 14 months.

There are also two additional ratings that Morningstar will establish for funds:

- Morningstar Quantitative Rating – When no analyst is covering a fund, Morningstar may still rate a fund using their forward-looking Morningstar Quantitative Rating system. They use a “machine-learning statistical model” to establish a gold, silver, or bronze rating. The Quantitative Ratings are calculated monthly.

- Morningstar Sustainability Rating – This “is a measure of how well the holdings in a portfolio are managing their environmental, social, and governance, or ESG, risks and opportunities relative to their Morningstar Category peers.” The backward-looking rating is a series of globes, 1 (low) to 5 (high), and is updated monthly

Example of Morningstar Star Rating

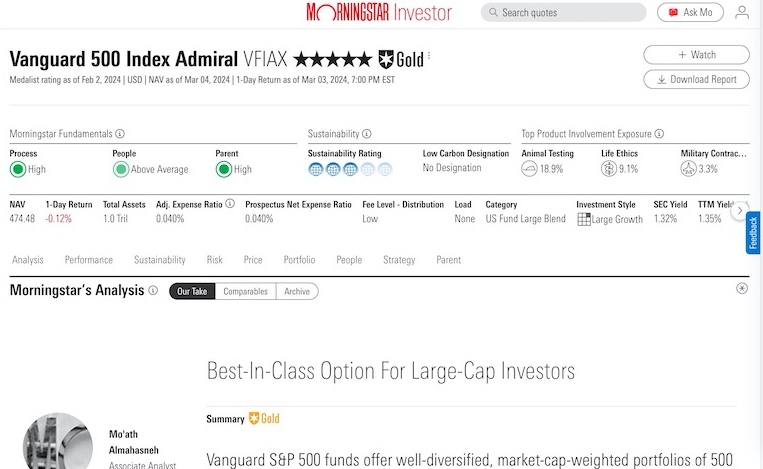

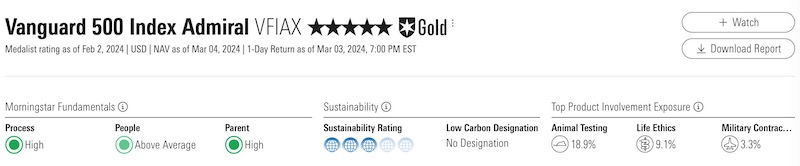

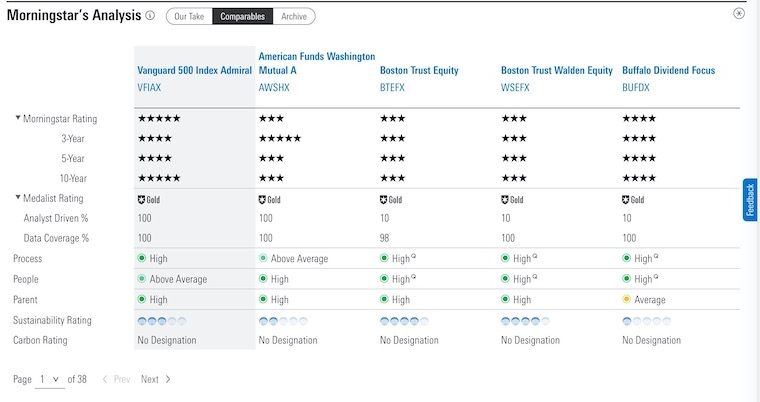

I took a look at the report for the Vanguard 500 Index Admiral Shares (VFIAX), which got 5 stars and a Gold rating as of March 4th, 2024. Remember, one of the rating criteria is Price and this report is based on the March 4th, 2024 price.

(Morningstar offers this sample report – it’s about DODGX)

Here’s the snapshot at the top:

Each fund summary includes Morningstar analysis of the five pillars:

You will see the current ratings for the process, people, and parent ratings for index and active mutual funds. There is also a sustainability rating. You will need to scroll down to read the detailed analysis and see the fundamental ratings date. The summary shows how long a mutual fund or ETF has had its current Morningstar Medalist rating.

I wish Morningstar Investor would post the fundamental rating publication date and include the performance and price pillar ratings in the summary bar like they used to just a few years ago. These additional details would make researching Morningstar ratings easier, although the current layout remains easy to navigate.

The real meat is the analyst report. This one’s analyst is Mo’ath Almahasneh, an associate analyst for Morningstar, and the report is quite detailed. If you read this report, you will be more informed than your peers about what you’re investing in. Some of it is just a “plain English” prose write-up of what you’d find in a prospectus, while others will give you context as to where it fits in versus its peers.

The second paragraph of the summary is a good example of this:

“The funds track the flagship S&P 500, which selects 500 of the largest U.S. stocks — roughly 80% of the U.S. equity market — and weights them by market cap. An index committee has discretion over selecting companies that meet certain liquidity and profitability standards. While a committee-based approach may lack clarity, it adds flexibility to reduce unnecessary changes during reconstitution, taming transaction costs compared with more-rigid rules-based indexes.”

The bolded area is useful – now you know it invests in companies that comprise most of the U.S. stock market.

A few paragraphs down highlights some of the potential risks of this investment strategy and also why the asset allocation stands as it is:

“However, when few richly valued companies or sectors power most of the market gains, market-cap weighting may expose the strategy to stock- or sector-level concentration risk, as is the case at year-end 2023. As of November 2023, the top 10 holdings made up the largest portion of the index (31%) in several decades and the 30% allocation to technology stocks was the highest since the dot-com bubble. But this is not a fault in design: The S&P 500 simply reflects the market composition. In the long run, its broad diversification, low turnover, and a low fee outweigh these risks.”

The bolded section is useful because you may not know the strategy by looking at the list of top holdings of the fund (as of January 31, 2024):

- Microsoft Corp.

- Apple Inc.

- Nvidia Corp.

- Amazon.com Inc.

- Meta Platforms Inc. Class A

- Alphabet Inc. Class A

- Alphabet Inc. Class C

- Berkshire Hathaway Inc Class B

- Tesla Inc.

- Broadcom Inc.

Their analysis of the People pillar is useful because it gives you detailed information about the fund managers without you having to dig through the prospectus. It’s not a make or break piece of information, it’s usually the names of two people I’ve never heard of, but once you see a lot of these you’ll recognize a pattern for various funds. Many of the fund managers have been there for years.

For VFIAX:

“Michelle Louie, Aaron Choi, and Nicholas Birkett share responsibility for the U.S. funds, except for Vanguard Institutional Index, which Choi does not manage. Louie has been with the firm since 2010 and has managed portfolios since 2014. Choi and Birkett have worked in investment management at Vanguard since 2015 and 2016, respectively.”

Over a decade (or nearly a decade for two co-managers) of fund management experience is impressive.

Also useful to know:

“Vanguard’s portfolio managers are compensated with a bonus that factors in the gross, pretax performance of the fund relative to its objectives. This includes the manager’s record of tracking a benchmark index over the prior 12 months. These characteristics align the interests of the managers and investors.”

Again, not investment-changing information but it’s nice to be able to read it all on a single page and leave feeling informed.

Morningstar Ratings for Stocks

A stock is more likely to receive a five-star rating when it’s trading at a discount to what Morningstar believes is its fair market value.

- 5 stars when trading meaningfully below fair market value

- 4 stars when trading below market value fair market value

- 3 stars when trading at or near fair market value

- 2 stars when trading above fair market value

- 1 star when trading meaningfully above fair market value

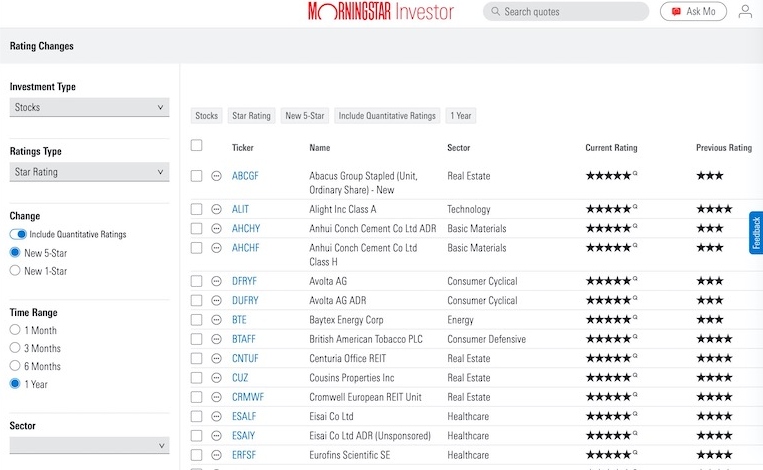

The screener lets you easily track ratings changes as one filter shows the latest stocks to receive a five-star or a one-star rating. This search shows the ticker’s previous rating to see how great of a leap it took to reach its current rating.

You may notice that some ratings have a “Q” designation next to the star rating. This notates that the rating is quantitative-based instead of qualitative-based. A Morningstar analyst doesn’t cover equities with quant ratings.

Fair Value Uncertainty

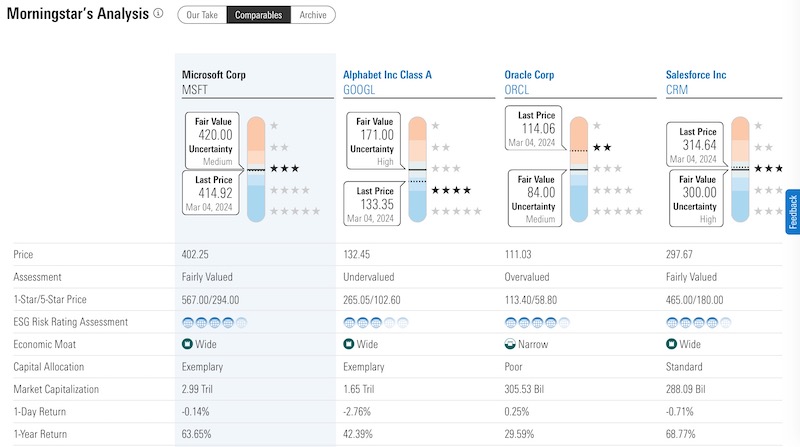

Morningstar also calculates a Fair Value Uncertainty rating that discounts what it takes to receive a five-star rating when the uncertainty score increases. It implies a recommended margin of safety and is one of five ratings (low, medium, high, very high, and extreme).

For example, a stock with a low uncertainty rating might receive a five-star Morningstar rating if its market price dips to 95% of its fair market value. However, an extreme rating can require a trading price of 50% below fair market value. So, this safeguard makes it more rigorous for volatile stock to be highly rated.

You can view the uncertainty rating for individual stocks and comparable investment options as the screenshot below indicates. The research screen also suggests what the stock price would be with a five-star or one-star rating.

Stock-picking services utilize several metrics to rate individual stocks. One of the ratings may include Morningstar along with third-party analyst ratings and other brokerage-specific metrics.

Morningstar Ratings for Funds

The iconic Star Rating rates mutual funds for adheres to the same five-star model as for stocks and ETFs. A 5-star rating implies a fund’s recent past performance is one of the best-performing for its benchmark. Morningstar states it’s a purely quantitative metric.

Morningstar will also assign a forward-looking Analyst Rating (qualitative-based) or a Quantitative Rating (quantitative-based) assessment of people, process, parents, and fees.

Combining these metrics can help calculate the potential trajectory with more precision.

You can use the fund screener or tap the “comparables” tab to find Morningstar and medalist ratings mutual funds and ETFs.

As a gentle reminder, past performance doesn’t indicate future results. However, the research firm assessed the accuracy of its ratings in 2022. To summarize briefly, the ratings system isn’t perfect (nothing is), but it is mostly reliable over a multi-year evaluation period when assets are more likely to encounter bullish and bearish markets.

Shortcut by Using Morningstar Rating Lists

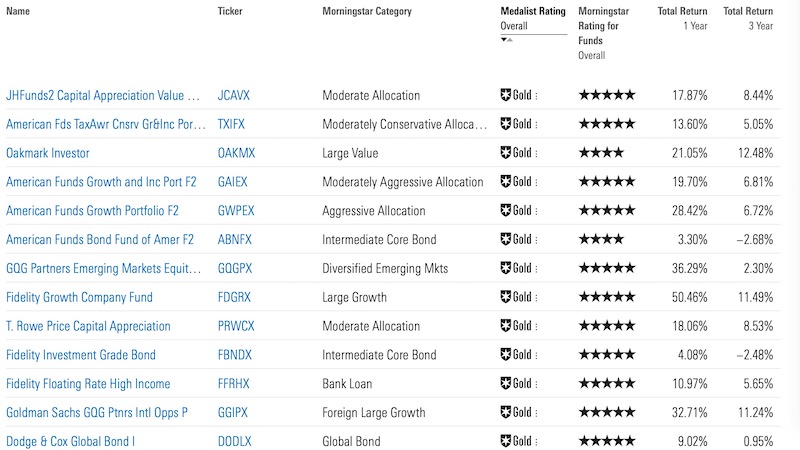

Now that you understand how the ratings work, here is how they become useful when you are an investor. You can start your search by filtering out funds that don’t meet a certain Morningstar rating or Morningstar Analyst rating.For example, their list of Medalist Funds are those who have earned a medal – bronze, silver, or gold:

Unfortunately, since the Morningstar Analyst Ratings require a Premium membership, you cannot see this list without a premium membership.

Unfortunately, since the Morningstar Analyst Ratings require a premium Investor membership, you cannot see this list without a premium membership.

Paid members can sift through the list by the following category columns:

- Fund name (alphabetically)

- Ticker

- Morningstar category

- Medalist rating

- Morningstar rating for funds

- Total return (one-year and three-year)

How to Find Morningstar Ratings

The most direct way to find Morningstar Ratings is by visiting the Morningstar.com. You can retrieve a Star Rating for free, but need a Morningstar Investor membership to see the advanced ratings, such as the Medalist Rating. A paid subscription is also necessary for stock and ETF ratings.

The Morningstar platform also publishes numerous free and premium articles which highlight the highest-rated stocks and funds.

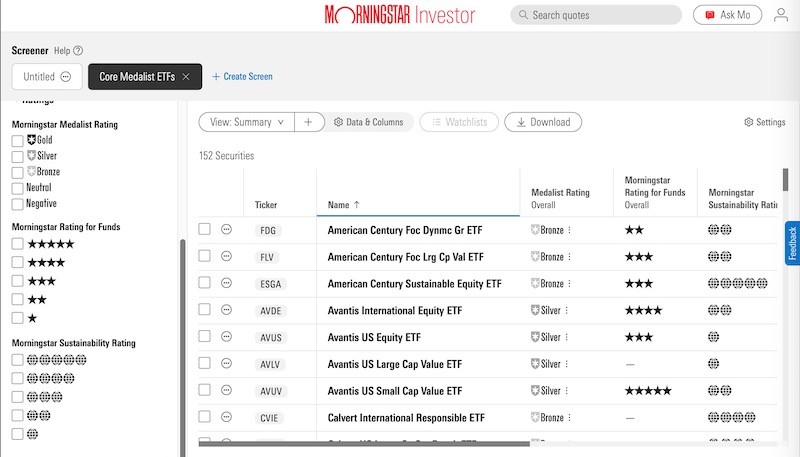

Morningstar Investor members can also access the utilitarian screener to find stock, ETF, and mutual fund ratings. The ratings filters include the Morningstar Medalist ratings, star ratings, and sustainability ratings.

Final Verdict

The star ratings are good for quickly assessing past performance, and the analyst ratings will get you up to speed on the investment if you don’t know anything about it yet, so these ratings do have value.

Do they result in better performance? The future is never certain, but because of the five different factors in an analyst rating, it can give you a greater degree of confidence when you invest. Remember that the best investors are those who can buy and hold for the long term. If you have greater confidence, you’re less likely to sell an asset that underperforms because of external reasons.

If you think a fund is well run, low cost, and doesn’t generate unnecessary taxable events; you’re more likely to stick with it. So, confidence does matter and these ratings do give you a bit of that confidence.

Finally, Morningstar has been rating investments for a very long time and is very respected in the investing world. A rating doesn’t guarantee better performance, but if you want a rating, they are the ones to turn to.