Kubera

Product Name: Kubera

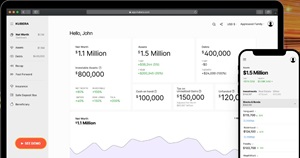

Product Description: Kubera is a personal finance dashboard tool that helps you track your net worth and integrates with all the major banks. You can track everything from hard assets like your house, to stocks and bonds, to even crypto (DeFi, NFTs). They also offer wealth planning tools to help you project your growth into the future so you can make planning decisions. Kubera costs $150 per year for individuals, $225 for families.

About Kubera

Kubera was founded in 2019 by a trio of startup founders (Webyog, Newton – both acquired in 2018) to solve their needs in managing their personal finances. In Hinduism, Kubera is the god of wealth.

Overall

Pros

Tracks stocks, crypto, physical assets and more

Syncs to most financial accounts

Can manually input information

Cloud document storage

Shareable portfolios

Cons

No financial planning tools

Paid subscription (after 14-day free trial)

No mobile app

Online net worth trackers like Kubera make it easy to calculate your current wealth and plan your financial goals.

Kubera can track your various investments, including stocks, cryptocurrency, and physical assets. It also makes it easier for your beneficiaries and trusted contacts to manage your estate when that time arrives.

This Kubera review will help you decide if this is the right service for tracking your net worth and managing your finances.

Table of Contents

- How Kubera Works

- Kubera Pricing

- Best Kubera Features

- Net Worth Tracker

- Notes and Documents

- Investment Tracker

- Taxable Asset Recap Report

- Cryptocurrency Tracking

- International Bank Tracking

- Physical Assets

- Insurance

- “Safe Deposit Box”

- Beneficiary Management

- Share Portfolios

- Who Should Use Kubera?

- Kubera Alternatives

- FAQs

- Summary

🔃 Updated February 2023 with new details about the Documents feature and the new Kubera Family plan. We’ve also taken a look at their new Taxable Assets Recap Report.

How Kubera Works

With Kubera, you can take advantage of the following features:

- Track investments and debts (including crypto!)

- Calculate your liquid net worth

- Upload of important personal documents

- Name an account beneficiary

- Shareable portfolios

Other net worth trackers only provide insights into your investment accounts and physical assets. Being able to manually input account details, digitally store documents, and name a trusted contact set Kubera apart from similar services.

One new feature (as of February 2023) is the addition of a Kubera Family, which is a way to share access to your information with other people. This can be other members of your family but also advisors and accountants. They get their own access with their own username and password.

The platform, however, does lack some additional features like budgeting tools, savings goal calculators, and financial advisors that other sites may provide.

Navigating Kubera

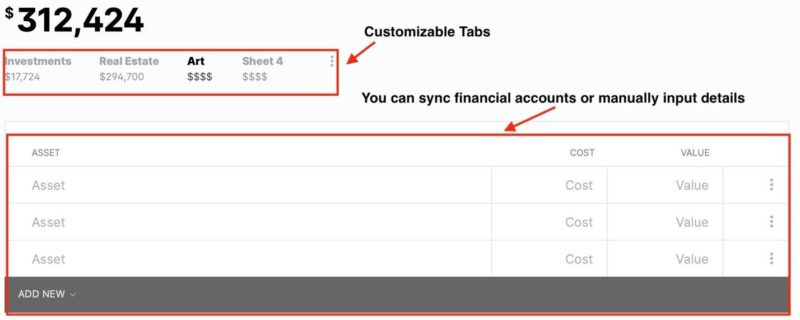

Kubera is very easy to navigate thanks to its minimalistic design. The layout is similar to Microsoft Excel or Google Sheets. Thankfully, you don’t have to be a spreadsheet expert to use the service.

You can categorize your assets and debts into sheet tabs. In addition, the service lets you add or remove sheets and rename them.

You can manually input data such as names, the current balance, and your initial investment amount for the cells, and you can view your account online or download it to Microsoft Excel.

The company also lets you share a read-only link that you might share with a family member or a financial advisor if you’re making a financial plan or getting a portfolio review.

Kubera Pricing

Kubera is not free.

After a 14-day trial that costs $1, Kubera costs $150 a year.

If you opt for the Kubera Family plan, it is $225 per year.

Unfortunately, there isn’t a free subscription plan, but the good news is that you won’t see ads or get phone calls and invitations for additional services—like a managed investment account.

Best Kubera Features

These are some of the core services that Kubera offers.

Net Worth Tracker

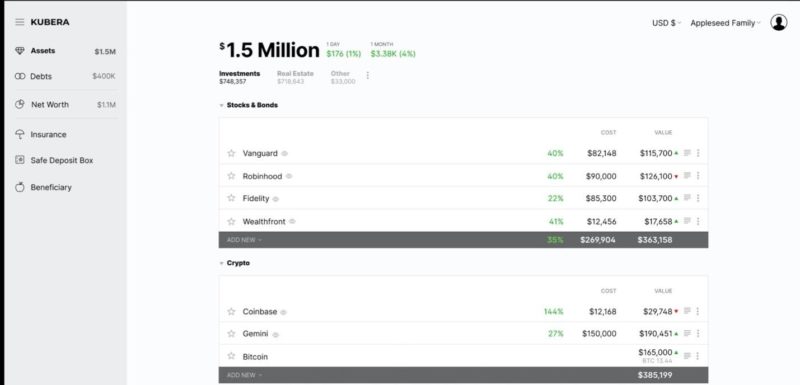

For most, net worth tracking will be the number one reason to use Kubera.

Some of the trackable accounts and investment assets include:

- Brokerage accounts

- Cryptocurrency accounts

- Bank accounts

- Credit cards

- Personal loans

The platform can sync to your various financial accounts can connect using third-party services like Plaid and Yodlee. Most stock brokerages, crypto exchanges, and banks can sync and automatically update.

Note: I tried syncing several brokerage and bank accounts for this Kubera review. The one account that couldn’t connect was Coinbase due to a programming error. I have had more negative syncing experiences with other financial apps.

You can also manually input your positions for accounts that don’t sync or if you want to track the value of physical assets like real estate and precious metals.

The service also lets you manually track life insurance benefits and debt. Entering your asset details is simple and similar to using a Microsoft Excel spreadsheet to name your account and its current market value.

As you input your assets and debts, Kubera calculates your total net worth.

Related: 5 Net Worth Benchmarks You Should Know

Notes and Documents

In addition to seeing your current net worth, Kubera lets you upload account-specific documents and add personal notes.

This organizational tool can make it easier to keep these documents in one place:

- Contracts

- Ownership documents

- Title deeds

- Tax receipts

These documents cannot contain your account number or password.

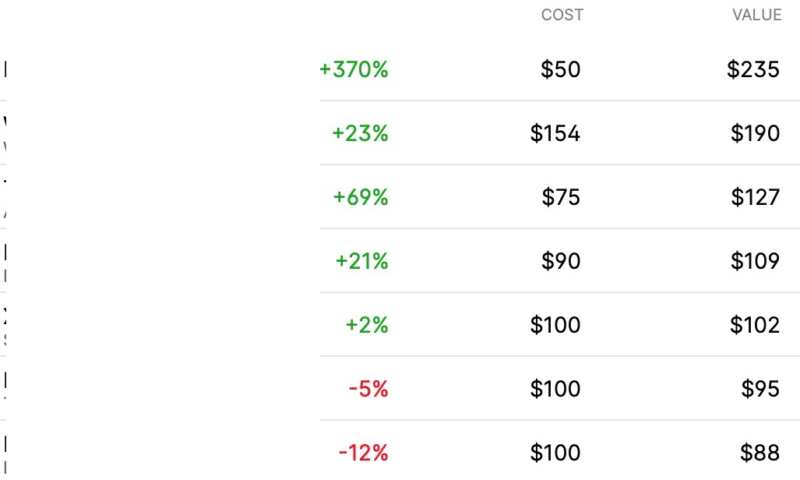

Investment Tracker

Kubera provides an excellent high-level stock tracker to see your unrealized gains by position and automatically populates the information when you link your stock and crypto accounts.

If your account doesn’t connect, you can manually add holdings by looking up the stock or crypto ticker.

This tool is valuable if you use several platforms to invest. For example, you have your 401k on a different platform than your Roth IRA or taxable accounts.

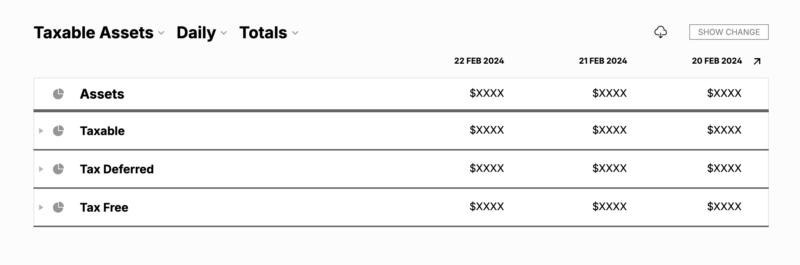

Taxable Asset Recap Report

In February 2024, Kubera added a new report called the Taxable Asset Recap Report. It’s a simple report that breaks down your portfolio based on its tax status – taxable, tax-deferred, and tax-free. By default, all of your assets are set to Taxable but you can go in and change this to the report is more accurate (go to the Assorted tab for each asset’s details page).

Once you designate a tax status for each asset, you can start creating reports and update different dashboards to show that information. It can be valuable for tax planning, especially as you near retirement.

Cryptocurrency Tracking

Many investors adopt Bitcoin, Ethereum, Dogecoin, and numerous other altcoins to diversify their investment portfolio.

Kubera is currently one of the very few net worth apps that can connect to your crypto exchange.

International Bank Tracking

Kubera is an excellent choice for international citizens and individuals that hold multiple currencies because the platform connects to many international banks. For example, you can link to BNP Paribas accounts in the United States and several foreign countries.

Your US-based accounts may also hold several different currencies.

Physical Assets

You can also track the value of alternative assets such as:

- Real estate

- Precious metals

- Vehicles

- Domains

- Art

It’s possible to track your current real estate investments (or primary residence) using Zillow data. You can enter your property’s street address to auto-fill the estimated market value. For vehicles, you can include the VIN.

Kubera uses the current spot price to track the value of your precious metals, such as gold bullion. Therefore, you will need to manually enter the value of any numismatic coins you may have that are worth more than the current metal value.

Insurance

You can manually enter your life insurance, income protection, disability insurance policies. One of the fields allows you to enter your policy number. This detail can make it easier for your survivors to receive your insurance benefits. By the way, if your life insurance coverage isn’t up to date, check out our review of the best online life insurance companies.

“Safe Deposit Box”

The Safe Deposit Box feature (it’s now just called Documents) lets you upload digital copies of your essential personal documents. This feature ensures you have a backup copy separate from everything else.

It can also make it easier for your trusted contacts to access your documents instead of combing through your file cabinets or trying to crack the safe code.

Some of the documents you might upload include:

- Last will and testament

- Power of attorney

- Insurance policies

- Tax returns

- Contracts, Property Records and Insurance Documents

- Ownership Records for Digital Assets

- Passport copies

- Treasure maps

- Secret codes 😂

You can upload a variety of file formats including, PDF, ZIP, MP3, and MOV.

The service asks that you don’t upload containing account usernames and passwords. You also cannot store personal information for minors. There doesn’t appear to be any verification of this though (I’m not sure how this would even be possible so this is not a negative mark), so it’s on the honors system.

This feature can be one of the best reasons to join Kubera instead of another net worth tracking tool to view your entire financial portfolio in one place.

Beneficiary Management

You can add an account beneficiary who can get a copy of your portfolio if you do not respond to the “Life Check” feature.

Enrolling a beneficiary is easy and free.

You only need to provide these details:

- Beneficiary name

- Email address

- Phone number

Note – this is separate from what a “beneficiary” means on your accounts. Typically, a beneficiary is someone who gets the assets in the portfolio in the event of your death. This simply refers to who will get access to your information. Your assets are not transferred, just the information contained in Kubera.

Share Portfolios

Another neat feature is the ability to share your portfolio with a shareable “read only” link.

Your trusted family, friends, and financial advisors have read-only access to the details you choose to share.

It’s possible to share these account types:

- Assets

- Debts

- Insurance

- Notes and documents

- Safe Deposit Box

At a minimum, your shareable portfolio includes the assets and debts. You get to decide about the insurance policies and document uploads.

As a safeguard, you can schedule the link to expire on a specific date and require a passcode.

Your beneficiaries don’t need an account to view your shared link.

Who Should Use Kubera?

Kubera is an excellent option to track the current value and position details of multiple investment accounts, insurance, policies, and debts.

The document storage and portfolio sharing features can also make estate planning more manageable.

This service isn’t the best option if you want add-on features like investment management, financial advisor access, budgets, or financial calculators.

Kubera Alternatives

You might prefer these net worth tracking apps as they may offer different features that can be better for you. Some of these apps are also included in our list of free investment portfolio management software programs.

Empower Personal Dashboard

Empower Personal Dashboard (formerly Personal Capital) offers a free net worth tracker. It automatically links to most financial accounts and you can manually enter information too.

There are several free investment analysis tools too:

- Retirement planner

- Mutual fund and ETF fee analyzer

- Financial goal planner

These tools are relatively basic but can help you decide if you’re saving enough for retirement and provide a basic portfolio checkup.

You can upgrade to a paid plan when you have at least $100,000 in investable assets. Some of the benefits include financial advisor access and a robo-advisor brokerage account.

One downside of this platform is receiving periodic calls to schedule a financial advisor meeting.

Read our Empower Personal Dashboard to learn more.

👉 Visit Empower Personal Dashboard

NewRetirement

NewRetirement can be your best option if you want an online retirement planner that can also track your net worth. NewRetirement’s focus is more on the planning aspect of retirement, rather than tracking your current performance, and so it should be thought of more as a planner than a tracker.

There is a free and paid version of the platform. The paid version lets you enter risk assumptions and automatically connect accounts to run more accurate simulations. If you want to look at different complex retirement scenarios, this is the tool to use.

Read our NewRetirement review to learn more.

YNAB

If budgeting is what you want, YNAB (You Need a Budget) is one of the best premium budgeting apps. Use this app if you want to use the same platform to make your monthly budget and see net worth reports.

Read our YNAB review to learn more.

FAQs

No, Kubera costs $15 per month after a 14-day free trial. However, you can save a few bucks by purchasing an annual subscription for $150

Yes, Kubera uses bank-level security to protect your portfolio details and uploaded documents. Like any app, you may decide not to upload certain documents or add accounts you don’t want potential thieves or trusted contacts to see.

The app uses several safeguards to protect your accounts. For example, you cannot upload documents containing your account login details or information about minors.

No, Kubera currently doesn’t have a mobile app for Android or iOS devices. However, you can go to app.kubera.com and follow the directions to pin the service to your phone’s home screen.

The website is mobile-friendly and easy to navigate from a phone or computer.

Kubera is very easy to navigate, add accounts, and update details. The service automatically connects to many financial accounts. It’s also easy to manually enter accounts if you cannot link your account for a specific asset or debt.

Summary

The Kubera tracking tools make it easy to see what’s in your investment portfolio and your current net worth. Uploading brokerage, insurance, and personal estate documents are also beneficial to evaluate your entire financial picture.

Other platforms are better if you want a free tracking tool or one that offers hands-on budgeting and investing tools.

FreshLifeAdvice says

Great review Josh! I appreciate you weighing the pros and cons. Very in depth post. Keep up the great work!