If you've been reviewing your credit report, you may have discovered an acronym for a credit line or inquiry that you didn't recognize. Or perhaps you were using a credit monitoring service, like Credit Karma, and they sent you a notification.

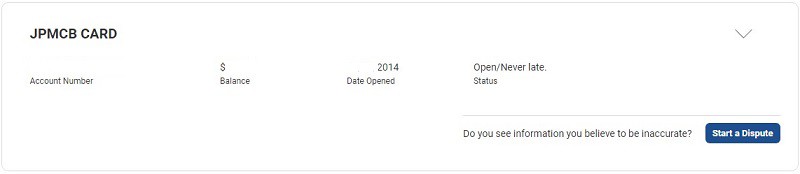

I have one on my credit report:

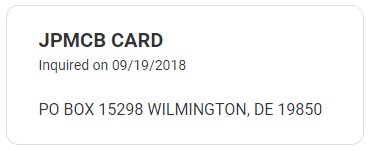

I also have a few soft inquiries:

The part that's a little disconcerting is that the soft inquiries look different. The first one has the full address with phone number, the second has just the address, and the last one has just the date of the inquiry.

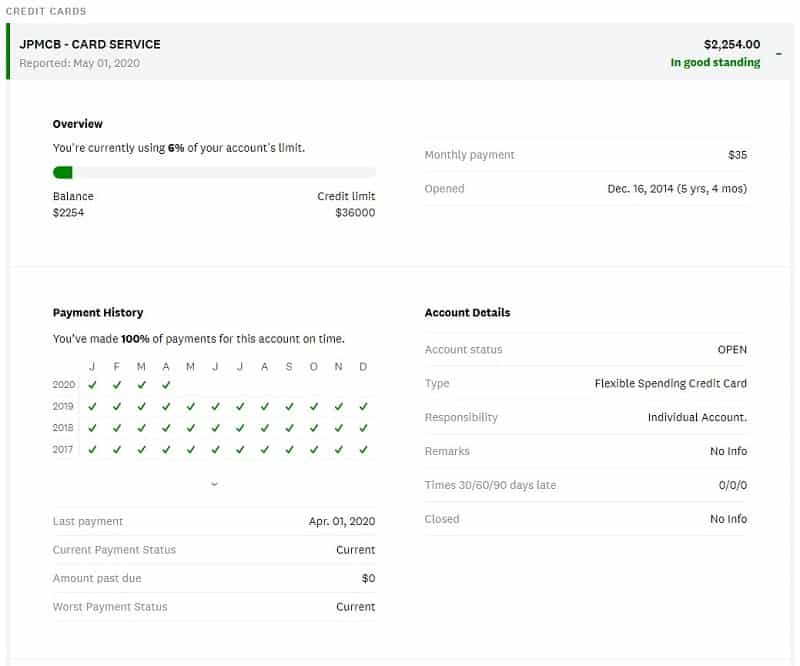

Here's what it looks like on my Credit Karma report:

Uhhh, I don't have a credit card with a weird acronym… so what's up?

What Does JPMCB Stand For?

JPMCB stands for J.P. Morgan Chase Bank and, at least in my case, it's a legitimate credit card card. I don't open many credit cards so I immediately recognized that as my Chase Ink Business card. (it's a business card but they always make an inquiry on your personal credit)

This means that if there's any activity on your credit report associated with J.P. Morgan Chase, it'll show up as the cryptic JPMCB.

This includes if:

- You have a soft inquiry,

- you have a hard inquiry,

- are added as an authorized user,

- are given a line of credit, such as a credit card

- and many more

If it involves J.P. Morgan Chase Bank, it'll show up as JPMCB. This is because of a recent name change in the last few years by Chase from Chase Bank to JPMCB for credit reporting purposes. The credit bureaus are shortening the name to the acronym so from here on out, all Chase Bank related credit reporting will show up as JPMCB Card Services.

How to Remove JPMCB Inquiries?

If it a soft inquiry, there's no reason to get it removed. Soft inquiries don't affect your credit score so there's nothing to worry about.

If it a hard inquiry and you didn't apply for a credit card, you can get the hard inquiry removed. This typically means you go through the normal dispute channels with that credit bureau. You should also look for a line of credit with the same account number as it's possible a thief applied for and was approved for a credit card in your name.

I would also review the other bureaus to see if they have similar information. You always want to dispute inaccurate information, even if you think it'll help your score because you never know what can happen.

What's a good JPMCB Card?

If you're looking for a new Chase card, the Chase Freedom Unlimited card is one that gives you unlimited 1.5% cash back on all purchases. It also offers a $200 bonus after you spend $500 on purchases in the first three months of having the card – all with no annual fee.

Learn more about the Chase Freedom Unlimited card

Build a DIY Credit Monitoring System

One of the ways to catch something like this early – so you can monitor and are more likely to remember it – is to have some kind of DIY identity theft protection system in place. You can use a suite of free tools to keep an eye on changes to your credit report in almost real-time. It can be incredibly effective and not a ton of work.

The only benefit a paid service offers is “insurance,” but it's arguable whether that's even worth it.

Bottom Line

False alarm from the identity theft front but it's good you were paying attention. It's better to research sketchy things than assume everything is OK and discover you were the victim of identity theft.