When I was a kid, one of my favorite games was The Game of Life.

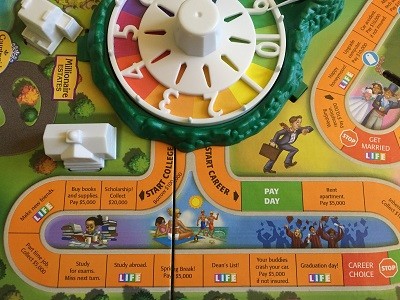

If you were a kid in the 80s, you probably played it too. You gave the spinner a whirl, drove your little plastic car around, and “lived” life – picking career or college, getting married, having kids, buying insurance, upgrading your house, etc.

It was fun because it let you pretend to be an adult while you were a kid. (what we really need is The Game of Being a Kid – I'll trade being told to eat my vegetables if I don't have to write TPS reports)

Here's something I realized much much later – the Game of Life kind of messed me up for actual life.

(or more to the point, it would have messed me up if I believed life had to be lived that way)

We go through life with invisible scripts and limiting beliefs. Invisible scripts, a term I learned from Ramit Sethi, are those beliefs that are “pre-written by our societal values.” Limiting beliefs, which seem to go hand in hand with invisible scripts, are those beliefs that constrain us in some way.

The Game of Life is one massive invisible script for how you should Real Life.

That's why I won't let my kids play The Game of Life.

(OK I let them play it but you get my point, but no thanks to Monopoly)

There are more than two paths

If you go to college, you are saddled with $100,000 of debt but you could get a career with a higher salary. There are 9 careers and only 2 careers (Doctor, Accountant) require a college degree. Let's ignore the other mechanics of the game (how paydays are determined, other benefits like the Computer Consultant gets paid $50,000 anytime the spinner stops between numbers or comes off the track) but the basic premise is that to get a higher payday you need to go to college.

Jobs are a matter of supply and demand. If you have skills that in demand, you can command a higher salary. If you have skills that are in abundance, you can't.

It also ignores how often someone can change careers at any time. What you decide at the beginning of the game does not set your path for life. You can always add to your skillset. What you decide in your twenties is not your lot in life.

(By the way, there's a space where you pay $5,000 for spring break if you go to college — that alone should disqualify this game from Real Life!)

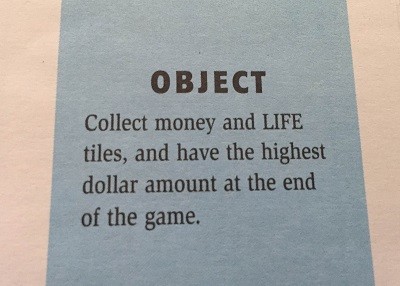

The goal isn't money

As if Real Life were so simple!

Money is important but is it the objective of life? If you were to ask someone ambitious, hungry, and 20 — money seems all-important.

Ask someone who is 40. 50. 80. Has two kids. Found a partner. Lost a partner.

Money takes on a different meaning.

When I was deciding what to study in college, the number one factor was the career prospects of that field. I chose Computer Science at Carnegie Mellon University because your chances were pretty good. No disrespect to other majors but in 1998, computer science at a premier university was your meal ticket. It helped that I enjoyed the problem solving and tinkering but the #1 overriding factor was money.

Graduate and I could get paid that sweet sweet startup money!

As I write this today, at 35 with two kids and barely into what I consider my “real adulthood,” money is a means to an end. I want enough to support our lives but so many things are ahead of money in importance. My post about Why Do You Work? is one of the most popular on the site because it's a question we all want to understand about ourselves.

Life is more than just work. It's family, it's friends, it's holidays, it's free time, and so many other hours not captured in the 40+ of work.

The Game of Life's objective might be to have the most money, but in my Real life the objective is something very different. When you think back to the happiest moment from last year, what do you think about it? It's probably not seeing a direct deposit line item in your bank account. 🙂

Investing isn't gambling

I realize The Game of Life has to do something to try to capture this idea and the idea of index funds and 8% gains every turn is decided un-sexy, but straight up gambling? And you can buy only one stock? You can't sell the stock and get paid tax-free dividends?

I want my kids to learn that investing looks like it's a lot of craziness, especially if you turn on CNBC and catch an animated Jim Cramer, but it's quite boring. Invest your retirement and/or savings (you don't need for 5+ years) in the stock market through a low-cost index fund, watch it grow over time (or more like don't watch it spike and drop), and sell when the time comes. Zzzzzzz.

But Zzzzzz is smart and it's better to be smart than entertained. 🙂

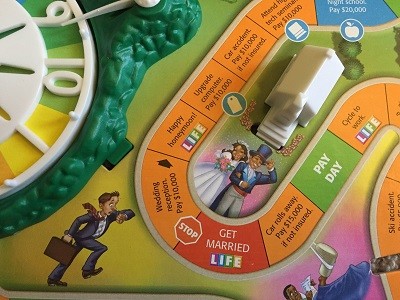

Getting married & buying a house

- Career Choice

- Get Married

- Buy a House

- Sell 1st House, Buy a 2nd

Some are required spots, like Career Choice and Get Married, but they all play into invisible scripts. We should all make a single career choice and then potentially change it in a mid-life crisis (the game has a mid-life crisis space!!!!). We should all get married. We should all buy a house and then trade up to a more expensive house.

The Game of Life isn't cruel, it's merely mirroring the invisible scripts of our society. If you are in your mid-30s and unmarried, society views it a certain way. If you are in your mid-30s and without kids, society views it a certain way. Ask anyone in those position and they get pressure from their parents.

Is it right? No. Everyone should be free to live their own lives however they want because it's their life!

But society says you need to get a job, get married, buy a house, and then trade up that house. If you don't, you're weird. Or there's something wrong with you… says society.

I say forget that – live your life.

Retirement is at the end

Do you need to own a house? No, but it makes sense depending on your situation.

Do you need to get married? No, but it makes sense depending on your situation.

Here's one invisible script that I think needs to get busted up big time – you work for 40+ years and then retire. In the Game of Life, you live your life until you retire. That's the end.

Many people defer their lives until retirement. That's why you have so many mid-life crises – people are living an unhappy or unfulfilled life and have a crisis where they overcorrect.

Some folks find so much of their identity in their work that there may be a link between mortality and retirement.

I want our kids to find fulfillment and happiness in their work but I also want them to live a balanced life. I don't want them to defer their happiness because of work. I don't want them to have mid-life crises. And I don't want them to think things have to be done a certain way and checkboxes need to be marked.

The first step is to identify these invisible scripts and limiting beliefs in life and ensure we don't pass them on.

Physician on FIRE says

You & Milton Bradley need to collaborate on the Jim Wang Game of LIFE, with many more forks in the road, an entrepreneurial path, and of course a road leading to early retirement!

Cheers!

-PoF

I know! I’m not sure a lot of people would buy it though… 🙂

Norman says

Nonsense, I think the game of your life would be much more interesting than the original game of Life! You would have many more options, such as early retirement, start a business, start a blog, invest in index fund, etc. Perhaps this could be your next business idea?

Holly says

I haven’t played that game forever, but yeah, I agree it offers a very narrow script! I hadn’t really thought about it that way.

Scripts are all around us!

Norman says

I didn’t play this game as a child, but I appreciate all your insights regarding this game. Perhaps the people who made this game had too many “invisible scripts” going on, and those scripts and limiting beliefs are reflected in the game even if they don’t realize it.

How do you feel about the game Monopoly?

In terms of teaching kids the wrong things? I think it’s fine, not nearly the same scripts as Life, but it doesn’t teach too many lessons other than you want to find Free Parking and avoid income taxes. 🙂

As a game, Monopoly is kind of boring. There is a limited amount of strategy (buy or don’t buy, build or don’t build, etc.). Board games of the last 10-15 years are far better, more strategy, more interaction with players, etc. Settlers of Catan is popular for that reason. It’s still competitive but there’s far more strategy involved.

Kalie @ Pretend to Be Poor says

I loved the game of Life as a kid, too. Since then I’ve heard similar critiques, and I agree that there are some very questionable assumptions presented in it. I remember thinking as a kid that some of the monetary ratios seemed off. I also remember altering the game to allow for more choices. We wouldn’t draw our houses blindly–we’d just choose the one we wanted.

As to whether I’d let my kids play it, I’m not sure yet. It could be a good way to open up a conversation about these cultural assumptions and messages one day. I definitely won’t let them go unchallenged!

I think we used to pick our houses too – adds a little more flavor.

For now, it’s just a game and we don’t really play it as much as we play with the various pieces. The little people and the cars are fun. When they get older though… we’ll talk more about it. 🙂

Vic @ Dad Is Cheap says

Love that game! I played that game so many times growing up by myself. That’s a depressing thought. Glad my parents eventually bought me a Playstation. Haha.

I see the game of Life being played out as I see relatives graduating this year. The older family members are basically saying to these graduates the same thing The Game of Life says – go to college, get a degree (preferably in Law, Medicine, Computers), get married, and retire.

As a personal finance nerd I try to tell them that that’s not the only option. While I’m a huge advocate of college and getting a great job like a doctor, I try to tell the youngsters that life isn’t all about money. If you could find a good living doing something you love, that’s more important than making six or seven figures at a job that you hate.

I think that the “college, degree, married, retire” is the “safe” path. Safe as in it gives you the higher probability for a comfortable life. The problem is that it’s not 100% safe and if that’s all you know and have been prepared for, if it doesn’t work out then you don’t know what to do. You’re ill equipped for life.

It’s also, as you rightfully point out, not the only way. Parents just want the best for their kids, they’re not looking to lock you into a six or seven figure prison.

That said, recommending that path is safe too. You can never go wrong giving certain bits of advice and it’s safe to give it. For the longest time, “Go to college” was 100% safe. Nowadays, with soaring student loan debt, it’s not always the case for everyone. But recommending it is still safe from scrutiny.

Financial Slacker says

I’m surprised they haven’t come out with the Millennial version of life – graduate, go work for a start-up, cash out at 30. For those of us that worked in the late 90’s, that was the standard view of the world.

But you’re right, it’s still fun to play – along with Risk and Monopoly.

A game for the 0.00000001%? 🙂

Denise says

Another very good post, Jim.

I know you talk money, but The Game of Life goes way beyond that. It has cultural, social, nationalist and political undertones. If you live life a certain way, you deserve certain things and if you don’t, you don’t. I get all kinds of sneers, bordering on hostility, for giving up my cushy corporate job to go freelance.

Not to mention that this game was created for the majority population who thought things would never change, or at least wish they did not.

I agree 100% – there are a lot of undertones which fall into the idea of invisible scripts. For example, why does everyone need to get married? You MUST get married in the game.

In life, a lot of people get married but it’s not required. In fact, plenty of people are perfectly happy never marrying. Plenty of people marry for the wrong reasons and then separate. There’s no divorce step in the game! That’s just one of the many parts of the game that take a very fluid situation and force you on a single track.

Kids are another. Some people think kids are great (me!), some people think life is better without them, so why does the game think everyone needs kids?

Debbie M says

The game “Careers” is better. You start out by writing out your own formula for success involving some combination of money, happiness, and fame. You can go to college any time you get an opportunity, and you can change careers every time you change jobs, though if you get a job in a career you’ve had before, you’ll probably do better.

I’d never heard of that game before and it was made in 1955! I’ll take a look, it’s certainly a more fluid way to think about work… wonder if “blogger” is a career on the list. 🙂

Debbie M says

Blogger is not on the version I had! But teacher is–that’s sort of close!

Close enough!

Stefanie says

Agreed – on so much. One thing I think about is how radically changed the job market is since I entered into it in 2008, I can’t begin to imagine what it will look like by the time your kids get there. I think the whole concept of a path will be totally obsolete.

The nature of work will certainly be different in 15-20 years, much like how it’s changed so much the last 15-20. And the 15-20 before that. Manufacturing gave way to office/managerial gave way to creative. Granted, there are still a lot of folks in all those industries but the percentage is lower these days…

Petra says

A friend of mine tried to program this game into his computer, and found that indeed there was only one moment where you could choose. Luckily, real life has so many more options and choices!

Ha, there are probably a few more but point taken!

Dr.J @ MedSchool Financial says

Enjoyed the post Jim, board games have the potential to instill a lot of good habits early on about strategy and future planing, but agree with you on defining those aspects that bring our the full potential of a life well lived because that will vary for all of us. Money is a tool, and the better you can learn to use that tool the better.

Thanks Doc! There are some good lessons but the insidious one of invisible scripts can have a long lasting impact on how people approach problems. Is it the right script? I’m not sure.

Josh says

We used to play this game a lot growing up. We played the modern version recently & I didn’t remember the 80’s version having as many opportunities to make loads of money & swap salaries. I’m sure it was there, but certain things aren’t important as a child who thinks it’s cool just to spin the spinner like on “Wheel of Fortune.”

Jack says

I remember playing that game at my friend’s house all the time as a kid. Fun but predictable.

I plan on playing Cashflow 101 with my boys so they learn more about the business and investing side of life.

I do want to try that Cashflow game out some day, not sure it’ll supplant some of the more “fun” games in our library though. 🙂

Dani says

Did you know that Dave Ramsey has a game called Act Your Wage!, Robert Kiyosaki has Cashflow 101, and of course The Donald has a game called TRUMP! I’d be curious to see how the games compare, although in one online review of Act Your Wage, the reviewer states that there’s no strategy or choices to be made–but it does get the player used to using the envelope budgeting system, etc.

Michelle says

I’ve never heard of this game. You make an excellent point. Those kind of messages can be really dangerous for kids.

Mr. Enchumbao says

I prefer Monopoly just for the pure joy of buying lots, building houses and collecting lots of rent money!

ZJ Thorne says

The forced marriage always rubbed me the wrong way. I did not realize I was a lesbian then, but I found the game so strange. Decisions are not made in a moment. Careers and lives happen over many moments. They build on themselves. They pivot you. They are magical.

That’s another great point… they don’t happen because you “land” on a square. 🙂

Heath says

People take things waaaay to seriously. It’s a game.

Annalisa says

Is there a follow-up post: 7 Games I Encourage my Kids to Play?

I agree that LIFE left me a little disillusioned about life. At age 25 with 3 degrees, no work prospects, and a broken engagement (with no desire to “start over” with relationships at that age), I moved to a third-world country where I help other kids get an education. I had completely lost at LIFE without giving life a chance.

So, now that I’m in my 30s, married, and expecting a child (still no house), what games DO I play with my children?

Ooooooh this is a good idea for a post!

Our kids are still a little too young for more complex games (funny enough, our son enjoys playing Life because of the pieces and driving around)… but we will introduce them to some gems.

AudreyA says

There is a real life script that people can follow for success in this country. 1) Graduate high school 2) work full time 3) then get married and have kids, in that order. There are a TON of other scripts influencing kids these days, from popular culture that celebrates single parenting to the now wide-spread belief that pot is safer than tobacco and nonsense like believing in yourself is the best way to be happy. (That horrible song, “Learning to love yourself is the greatest love of all”– can you spell narcissistic?) In fact, the script in the game of Life is no longer supported at all by the popular culture. I grew up in the age of family sitcoms (The Waltons, the Brady Bunch, The Cosbys) but now the shows are about singles and power players. The game of Life SHOULD be played by kids because the reality is…it is the formula for financial security and makes a happy life more likely.

debbie b says

When you play with 4 people each person “life” is different…there is the rich the poor the one in the middle, some with kids some with 2 some with 2 car fulls, the money amounts are fake and that is okay with me. It is the concept of what happens to people on the journey of living, some do get stopped by the police some are willing to pay to have someone do their spring cleaning, some rather take a hike in the forest while others rather buy the painting. the point of the game is spending family time together doing something that is not electronic and invites conversation..

Dennis says

There is only one overriding principle that this board game teaches us. I instinctively understood it after playing it many times, and then after that playing it lost all appeal to me.

It is that eventually Life Ends.

Bill says

I agree with you on most of what you said. The game does however, in simple terms, address the fact that there are tradeoffs for every decision. Also, even if you choose everything “wisely” by societies standards, you may still be dealt a bad hand that puts you behind others who choose “poorly “. Life is a crap shoot that way in reality but better choices put you ahead of the next person in the same situations that are out your control.

It comes down to personal values in real life as to if you win or lose, that can’t be quantified. So the game wouldn’t actually be able to score a winner or loser if it actually reflected life. You would need to start with each player setting parameters for their values… money, assets, health, longevity, retirement age, relationships with family and friends, faith are all factors to happiness. So decisions have tradeoffs that effect everything but we all view success differently. For me stress free independence, and early retirement is a win …regardless number.