I enjoy reading the news but it can be stressful to see the stock market go up and down. Well, only when it goes down. The up days are nice. 🙂

It’s even more stressful when all the news lately is how we’re minutes away from a recession.

Logically, I know that I should not be messing around with my investments.

But it’s hard. Very hard.

So I use excuses psychological games to keep me invested. 🙂

Want to hear some of them?

Table of Contents

Look at the Gains

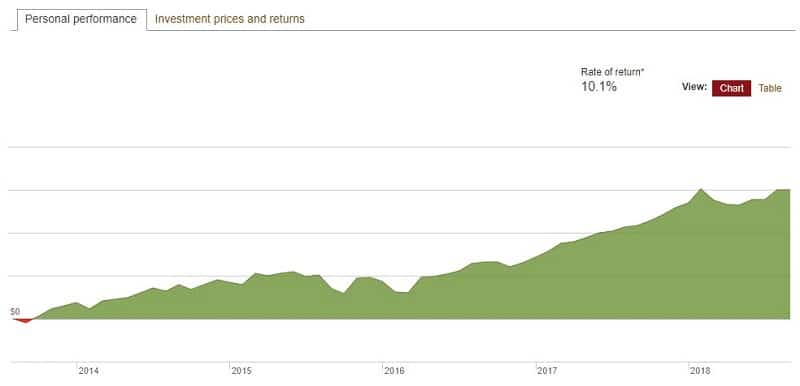

I’m up on my investments. I’ve also been invested for close to twenty years now. So I should be up on my investments. 🙂

There were some rough patches in there (dot com, housing bubble, financial crisis) but time heals all.

If you’ve been invested for any reasonable amount of time, you’re probably up too.

If and when the market goes down, I have a moat for losses and still remain positive.

Logically, I know this argument is garbage. My investments need to appreciate to maintain their purchasing power.

Inflation is the hidden enemy of every person who has money.

$10,000 in March 2007 has the same buying power as $11,872.35 in March of 2017 (see the BLS’s CPI calculator).

If you maintained inflation, you may think you’re doing well because your balances have increased but in reality, you’re the same. In nominal terms, you’re up. In real terms, you’re treading water and choppy water at that!

But psychologically, those gains give you room to “lose” if the market goes down and still be “up.”

Look at the Taxes

Speaking of gains… if I want to bank them, I’d have to pay taxes on anything not in a tax-advantaged account. My IRAs are tax-free (Roth) or tax-deferred (Rollover), but anything in a taxable brokerage account is subject to short term and long term capital gains.

And I don’t mind paying taxes. It means I’ve made money.

Ackshully…. that’s a lie. I don’t like paying taxes. No one likes to pay taxes.

I pay taxes just like I do a lot of things that are good for me but are not fun. Like running.

And so to avoid paying taxes, I’ll avoid selling those holdings unless there is a compelling reason to do so. (like tax loss harvesting)

Being afraid that the market will go down is not a compelling reason.

This is Part of the Plan

When you started investing, what was your plan’s expected rate of return? 7%? 9%?

Up or down, the historical return of the market is a well-known entity and should be part of your plan.

If you’re up and ahead of schedule, just look at the gains and realize that you’re just on the plus side of the lumpiness of investing. The stock market is volatile. These gains outweigh the inevitable losses and average out to the historic average return.

Leverage FOMO

Fear of missing out. We all have it.

Leverage it.

The CAPE is a measure of how expensive the S&P 500 is – it’s short for the Cyclically Adjusted Price/Earnings Ratio. The historical average is around 16-17.

It’s been above that average for quite some time and above 20 since 2010.

The S&P 500 has had an annual gain of over 10% since January 2010 (to June 2018).

If you sold everything in 2010 because you thought the CAPE meant it was expensive, you’d be kicking yourself. Hard.

You don’t want to miss out… do you? 🙂

Marketing Timing Won’t Work

Marketing timing works. It just doesn’t work for you because you don’t have a real edge.

If you have an edge, the law of large numbers says you will win. Casinos work off this very principle and they do quite well as long as people keep going.

If you want to time the market, what’s your edge? It needs to be a legitimate edge.

Not a rumor or some hot stock tip – those are bogus and you know it.

We’re talking about that edge you get when your orders are nanoseconds faster than your competition because you installed your servers closer to the market (Flash Boys is a great read on this and that whole world of legit edges).

The folks who win the lottery, they have an edge. My friend Colin was on a blackjack team that made a boatload of money because they had an edge (and not teaches it at Blackjack Apprenticeship). A mathematical edge based on analysis, large numbers, and games that did not know they weren’t perfect.

Market timing does work … but not the way you think it does.

These guys are operating at the nanosecond level and feasting on folks who think they have an edge.

OK, You Can Rebalance

If you have an itch, it’ll be there until you scratch it.

So scratch it. But scratch it responsibly.

With the recent gains, your asset allocation is probably out of its initial allocations. Experts recommend you rebalance your gains at least once a year but there’s nothing to say you can’t do it more often.

The idea behind rebalancing is that your assets will move at different rates and sometimes in different directions. If you want an 80/20 stock/bond mix, the gains in the market may now have you at 85/15. Your goal is to keep your asset allocation in roughly the same percentages so you’ll want to move that 5% from stocks to bonds.

Remember, you aren’t selling stocks because you think they’re overpriced and holding cash is not the goal. You’re simply shifting them to bonds because that’s your plan.

Rebalance your allocations and you’re doing the right thing and the responsible thing.

The Goal Isn’t More

Finally, the point of investing isn’t to get “more” money with no end. You don’t need more.

You certainly don’t need more at the risk of losing out.

There is a poll by the Marist Institute for Public Opinion that found an annual salary of $50,000 was the happiness turning point for many families. Those who made over that amount were more satisfied with almost every facet of their lives. Those who made less experienced more stress and less happiness.

When you couple it with a Princeton University study that discovered happiness increases with salary boosts up to $75,000. Above that, an increase in income did not appear to impact overall satisfaction.

For many of us, money is like air. It’s bad if you don’t have enough. It doesn’t matter if you have too much.

When you jump in and out of the market, what you’re doing is introducing tangible stress into your life to try to get potentially more money. You want to avoid losses or try to take advantage of gains when the money won’t even make you happier.

Ask yourself this – would work for an hour and let the salary be determined by a coin flip? You can calculate your calculate how much an hour of your time is worth and then I’ll flip a coin.

Heads I pay you $0, tails I pay you double.

Or you work and I pay you a fair wage without games. I know which one I’d prefer.

Now leave your investments alone… or rebalance if you really want to scratch that itch. 🙂

Leave a Comment: