Do you find yourself with a few spare minutes each day with not much to do?

What if I told you that in just a few minutes each day, you can significantly improve your finances? There are a lot of tasks you can do if you have 15 minutes to spare. These aren’t hour-long tasks that you won’t be able to finish in a day – these are fairly quickly, often forgotten, and super easy to do.

Today, I’m going to share seven things you can do in just 15 minutes each that will have a marked impact on your finances.

These small tasks are easy but important and they can have a big impact on your money situation.

Table of Contents

1. Look for Your Missing Cash

There are millions of dollars sitting in state unclaimed property accounts. If you’ve ever moved, you may have left a deposit check behind. A bill may have been refunded. A tax return unclaimed.

Find out if you’re owed some money by visiting MissingMoney.com – endorsed by the National Association of Unclaimed Property Administrators.

You, or someone you care about, might be very happy you did!h

2. Answer Some Surveys

Want a few extra bucks in your pocket? Rewards sites, especially those with paid surveys, offer the opportunity to earn a little cash in your downtime.

Swagbucks and MyPoints are the two stalwarts of the industry (and both owned by Prodege, with a A+ rating by the BBB). Both offer a $5 bonus for new signups.

Another good survey site is Survey Junkie. They are a reputable market research company that only does surveys – no signing up to offers, watching videos, or other things. Only surveys.

Here’s our list of all the legit paid survey sites available.

3. Shop Through Cashback Sites

If you joined Swagbucks to do surveys, you can always use their shopping portal to earn points on the dollars you spend.

Otherwise, another popular site that you’ve probably heard of already is Rakuten (here’s our full Rakuten review). New users can get $10 when they join through our link and make $25 in qualifying purchases within 90 days. You’ll also get the cashback from making those purchases, effectively double-dipping with the bonus.

These and other cashback rebate sites are a great way to save money on your purchases.

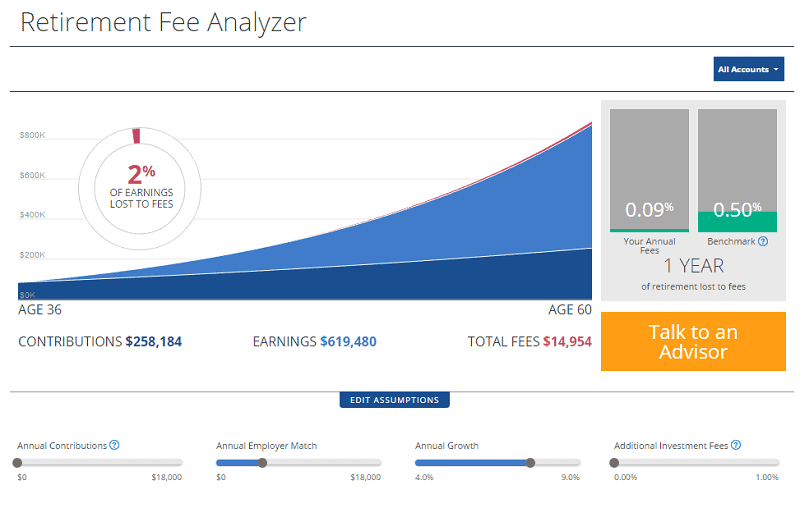

4. Slash Your Investment Fees

You can’t predict what the stock market will do in the future (hopefully keep going up!) but you can check how much you’re paying. High fees are the secret investment killer because they invisibly erode your investments. Sometimes they’re unavoidable… sometimes you’re simply overpaying.

Personal Capital is the tool I use to track my net worth but they have a free retirement fee analyzer that will tell you if you’re overpaying.

5. Get Paid Hundreds to Open a Bank Account

The days of free toasters and t-shirts are long gone. Banks are now willing to pay hundreds of dollars for new accounts and you can find a full list here.

6. Cancel Your Useless Subscriptions

A few years ago, I collected all the subscriptions I was paying for and realized I was wasting a ton of money on things I no longer cared about. $10 here, $15 there, it added up.

It’s not always fun to do the work to cancel but think of all the money you’re saving!

7. Check Your Credit Reports

One of the most important numbers in your adult life is your credit score. That’s all based on your credit reports, which are held at three credit bureaus (Experian, Equifax, and TransUnion).

By law, they must give you a copy each year. You can use my Waterfall Method or just request all three at once through AnnualCreditReport.com.

Then, sign up for Credit Sesame (free) so that you can monitor your credit for free.

While you’re checking on things, be sure to check things like your net worth, investments, and debt balances.

Fix any error you find immediately, no matter how trivial, because the fix can take a few weeks.

Don’t wait until you need a loan to do this!

Matt Warnert says

Good tips Jim. Unfortunately I’ve already got these covered. Now back to my 25% off pizza.

CentSai says

Definitely, can relate to #6! It is so easy to forget all the silly subscriptions you have subscribed to over the years, whether it is magazines, entertainment services, etc. Not to mention that all those $10 subscriptions can add up each month, and cost you big time!

Teri says

I know it’s not a popular idea and the only thing that saved me was a budget. It showed me where I was spending and where I wanted spending to go. It helped me make better choices. Identifying, and eliminating those $5 & $10 purchases that I did not value has made all the difference in my finances.

Alison Gilbert says

My primary bank account that has a debit card, a CR credit card and a TR credit card. The bank offers a great tool of a chart that illustrates my monthly expenses by category. I can keep easy track of my finances.

Unfortunately, it only works with their own products. It does not have a feature for including other CR or TR credit cards. The magic I made juggling 4 TR cards to get to visit family out of state was thwarted by this missing feature. What a nuisance.

sagar nandwani says

I like that you said that we need to consider our past experiences. Whenever I buy anything I make sure it is something that I will use after the first use.