Since 2014, we've had Southwest's Companion Pass.

And I know I'll have it until the end of the year, 2024, because we re-qualified again last year.

I'm not a “travel hacker” or some guru. I'm a regular person like you.

I have little interest in getting a dozen credit cards, joining half a dozen rewards and loyalty programs, and figure out the most efficient way to convert hotel points into airline points into whatever. I don't want to do a spreadsheet to track it all. I don't want to download any calculators.

To the folks who love that stuff, I salute you. I'm a huge nerd myself and love a good spreadsheet, everyone knows that, but travel hacking isn't one of those things.

That said, I see why it's appealing. Going on nearly free trips, staying at swanky hotels for nearly nothing, and getting the most out of a credit card is fantastic.

Here's step by step how I did it.

Before I got the Southwest Companion Pass, I was looking into the whole travel hacking phenomenon. I learned it wasn't for me, except with one exception — Southwest Companion Pass. We live near BWI airport (Baltimore/Washington International, Thurgood Marshall Airport), which is a big Southwest hub, so this was a perfect fit. From BWI, we could fly to many destinations including international airports like Aruba.

The Best Way to Get Companion Pass in 2024

Very rarely, Chase and Southwest offered Companion Pass and points as a new sign-on bonus.

That offer has since expired and now we are back to the more standard offerings (though this latest offer has a nice little bonus we'll get into below), though the minimum spend is much lower than previously.

Do you run a business? If so, the new Southwest Rapid Rewards Performance Business credit card will give you 80,000 points after you spend $5,000 on purchases in the first 3 months. There's a $199 annual fee but you also get 9,000 bonus points after your Cardmember anniversary.

Here are the best offers on those cards (currently the bonus is all the same):

- Southwest Rapid Rewards Plus Credit Card – Get 50,000 points after you spend $1,000 on purchases in the first 3 months of account opening.

- Southwest Rapid Rewards Premier Credit Card – Get 50,000 points after you spend $1,000 on purchases in the first 3 months of account opening.

- Southwest Rapid Rewards Priority Credit Card – Get 50,000 points after you spend $1,000 on purchases in the first 3 months of account opening.

How I Got My Southwest Companion Pass (2014 – 2024)

📢 The following advice, which explains how to earn Companion Pass through points, is no longer necessary since the current promotion is that you get 50,000 points after you spend $1,000 on purchases in the first 3 months of account opening.

On the personal and business cards, they will frequently run 50,000 Rapid Reward point promotions. I waited for one of those times.

For years, the standard promotion is closer to 30,000 miles for spending $1,000 in the first 3 months. That's not very good. I had to wait until they increased it.

Nowadays, you want to wait for a 60,000 point offer. They come around more often now that CP takes 135k.

Also, anyone with an existing Southwest credit card can refer you to this offer, plus they get 10,000 points too (and those points count towards Companion Pass!).

How to get the Companion Pass for Southwest Airlines (updated with more “traditional” promotional numbers):

- Get the personal consumer credit card, like the Southwest Rapid Rewards Premier Credit Card and you spend the $3,000 for the bonus — that's 63,000 points.

- Stack on a Southwest Rapid Rewards Premier Business Credit Card too, it runs smilar promotions, which right now is 60,000 points after you spend $3,000 on purchases in the first 3 months your account is open. That also has a $99 annual fee. Don't have a business, read our applying for a Business Card section below because you can have a business.

- Otherwise just spend another $72,000 and you're in. I know it's a lot, but creativity can help here.

- With 135,000 points, you'll get SW Companion Pass for rest of the current year AND the next year!

Remember the Chase 5/24 rule! Chase has a rule that if you've been approved for 5 cards in the last 24 months, you will be declined for new cards. You probably can remember when you applied for a card but if you've forgotten, the best way to check is to check your credit reports.

If you don't see the 50,000 or better promotion, be patient and wait. The standard 25,000 point version just isn't as good and the 50,000 comes back all the time. Southwest also offers a Southwest Rapid Rewards Plus card (instead of Premier) which has a lower annual fee ($69) and a few other smaller bonuses (3,000-anniversary points instead of 6,000 for example). There are often 40,000 Rapid Rewards point bonuses too – you can take those if you want but 50k is ideal.

In total, this will cost you the annual fees of the cards you get, which don't count towards the required bonus spending on either card.

Want other ways to earn RR points without the credit card OR flying? My list of Southwest Airlines money-saving hacks explains how their various point-earning programs work, from the Dining program to electricity supplier reward programs.

Common Questions about Companion Pass

If you have questions about Southwest Airline's Companion Pass or the strategy, you're not alone.

Here are the most common ones I've been asked, hopefully, it answers your questions!

What Is Southwest Companion Pass?

Companion Pass lets you name one person who can fly with you for free (you only pay the September 11th fee) anywhere you fly on Southwest. No blackout dates. You fly, they fly free (you still pay fees like the September 11th security fee)

It's an amazing perk and we've saved thousands each year because of it. It's probably one of the best frequent flyer perks out there, and you don't even need to be a frequent flyer. 🙂

To earn a Southwest Companion Pass, you need to earn 135,000 Rapid Reward points in a single calendar year. When you do, you get the Southwest Companion Pass for the rest of the year in which you earned it plus the following year.

If you get it January 1st 2024, you'll have Companion Pass until December 31st, 2025. Nearly two years.

If you get it December 31st, 2023 then you'll only have it until December 31st, 2024. A year and a day.

There's a huge difference. When earning your miles, you want to get it as early in the year as possible to maximize your free flights.

The fastest way to earn miles is by getting the bonuses on their credit card. They often run promotions where you can get 50,000 miles for spending $2,000 in the first three months. More on that shortly.

Best Time to Earn Southwest Companion Pass

You want to get your SW Companion Pass as early in the year as possible since you'll get it for the remainder of the year… plus the next year.

The best time to apply for the cards is near the end of the calendar year. That way you get the cards at the start of the year, hit your spending goals, and earn Companion Pass. If you apply roughly in mid-November, get the cards shortly thereafter, you have three months (December to February) to spend the $2,000 on each card to get the bonus 100,000 miles.

You know your spending habits. Adjust your application date to when you will be able to reach the tiers.

Personally, I applied in December, got the cards in January, and reached the spending limits sometime in February. My Companion Pass congratulations email arrived on March 6th, once all the points posted.

Can I Spend My Points Before I Get Companion Pass?

Yes. You don't need 135,000 Southwest Rapid Reward points in your account, you only need to earn 135,000 Rapid Reward points in a calendar year.

So if you earned 5,000 points in January, that's 5,000 towards that year's Companion Pass eligibility.

You can spend those points on flights, your meter will still have the 5,000 points that you earned.

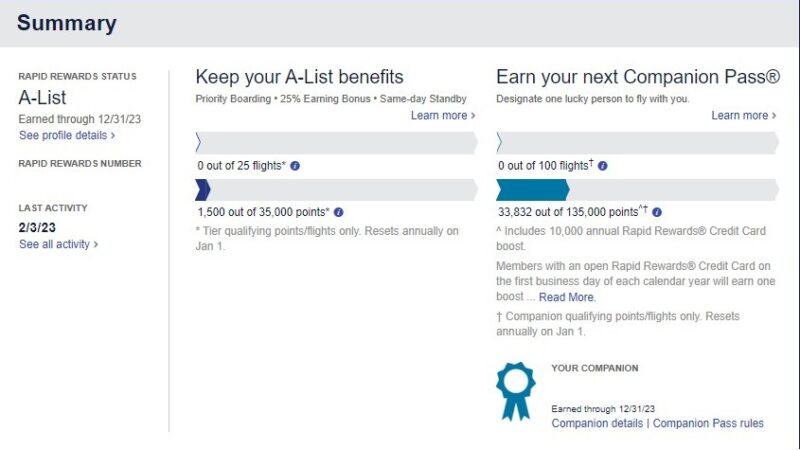

If you log into your account and at the top, it'll show your progress towards A-List and Companion Pass:

We're early in 2023 so my bar is relatively low (we did fly several times which is how it's almost a fourth of the way!).

As you accumulate points, it'll fill up to the 135,000 points you need. (A-List is always a tease though!)

Can I get points for both the Southwest Plus and Premier Cards?

No!

Why can't I get both the Plus and Premier cards? On April 5th, 2018, Chase added new language to the terms of the landing page of the promotions:

This product is not available to either (i) current Cardmembers of this credit card, or (ii) previous Cardmembers of this credit card who received a new Cardmember bonus for this credit card within the last 24 months. To qualify for your bonus points, you must make Purchases totaling $1,000 or more during the first 3 months from account opening. Please allow up to 8 weeks for bonus points to post to your Rapid Rewards® account. (“Purchases” do not include balance transfers, cash advances, travelers checks, foreign currency, money orders, wire transfers or similar cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable.) To be eligible for this bonus offer, account must be open and not in default at the time of fulfillment.

Booo. 🙁

Can an Authorized User Get the Bonus Later?

When we got our first Southwest credit card, I was worried about putting my wife on as an authorized user because I wanted her to be able to apply for the card and get the bonus in the future. It turns out my concerns were not warranted!

I asked Southwest and Chase on Twitter and they told me that…

If the authorized user hasn't gotten bonus points then they are eligible to get it as the primary cardholder!

What if I cancel my card and re-apply, can I get the bonus?

The basic rule governing this is that you cannot get the same bonus on the same card in any 24 month period. If you opened a Chase Southwest card last year, earned the bonus last year, then you won't be eligible until 24 months after you earned that bonus. If the bonus was awarded in January 2017, you have to wait until at least January 2019 before you are eligible to get that same sign up bonus.

Let's say you're beyond the 24 month period but you're still using the card. Can you cancel today and get the card and bonus again?

Yes… but you have to wait 60 days before you apply for the card. It takes that long for their systems to be updated. If you apply earlier than 60 days, you risk being denied because their systems think you still have an activated account.

Other Things to Remember

Before we go into the business card section, some last few thoughts:

- You only need to spend purchase requirements in the first three months to get the bonus point promotions on each card. That's the only time limit. The remaining amount you can spread out over the rest of the year, but it's better to spend it earlier so you'll have Companion Pass for longer.

- The goal is to earn 135,000 Southwest Rapid Reward points in a year, so all the other ways of earning them (like flying, renting cars, hotels, etc.) are all in play. We focused on the credit cards and putting the points in terms of spending because it was easiest to explain. You don't have to spend $6,000 to get the other 6,000 points, you can earn them in more traditional ways.

- You can change your flight Companion up to three times in the validity period.

- Check out these other Southwest Airline hacks to earn miles easily, like Rapid Rewards Dining and joining Rocketmiles if you stay in a lot of hotels.

- The best part is the Southwest credit cards are also Visa Signature cards so you get all the promotions and protections associated with Visa Signature.

Big Change to Southwest Companion Pass qualification RR Points

There was a big change on January 1st, 2017 – the only way to earn Southwest Companion Pass eligible Rapid Reward points:

- paid revenue flights on Southwest Airlines,

- points earned through spending on a Southwest Airlines Rapid Rewards credit card (including the bonuses),

- points earned through transaction with Southwest Rapid Rewards partners.

That means e-Rewards, e-Miles, converted points from hotel and car loyalty partners, Valued Opinions and Diners Club will no longer count towards qualification for Companion Pass. You still get the points, they just don't count towards the 125k you need each year.

Years ago, a popular strategy was to convert Chase Ultimate Rewards points and this change closed that method.

🙁

“Spending” without Spending?

Where do you live?

If it has four walls and a roof, chances are you're paying rent or a mortgage. Most landlords and all banks will not let you pay rent or a mortgage with a credit card. Credit cards charge the merchant fees and landlords aren't a fan of those. 🙂

But if you are getting close to a bonus, or Companion Pass, and just need a little more to get there… using a service to pay your mortgage with a credit card is an option.

They charge fees, because they pay the merchant fee to the credit card, but if you need a few hundred or a few thousand points to get to the bonus and time is running out, it might be worth it.

Applying for the Business Credit Card

If you have a business, awesome! (if you don't, your best option is the Personal Plus card)

Use all the information you have from that.

What if you don't have a business? You're in luck, you might have a business and not even know it. In the United States, if you earn income outside of a job reporting your income on a W-2, then you are operating a sole proprietorship. You don't need to be incorporated, you don't need to have any employees, and you don't even need to make that much money.

In fact, if you've made a profit three out of the last five years, the IRS considers that a business and not a hobby.

Get an Employer Identification Number. It's free, nearly instant, and you never need to use it.

Getting an EIN won't guarantee you'll be approved but it's a step up from using your Social Security Number on the application.

If you want to really improve things, get yourself a website.

Otherwise, fill in the application truthfully.

Here are some more tips on getting a business credit card.

Pending Review???

Once you apply, your application will be approved or “pending review.” Pending review is not always bad but it means they couldn't verify your business or need more information.

Wait a day or two, then call the reconsideration line and ask them that you'd like to check on the status of your application. Be prepared to answer these types of questions about your business:

- What is your business and what do you do?

- How long have you been in business and what were your annual revenues and profits?

- How much do you expect to make this year, revenue and profit?

Whether they approve you will be up to the representative but here are a few tips for a reconsideration call.

When I got the card, I had to call the reconsideration line even though I've had a revenue-generating business for years. They can't verify anything on the application through a third party so the approval process is effectively the same as for the personal card. And remember, when I applied, I told them I was a blogger.

How much have we used it?

ALL THE TIME. (before the pandemic, that is)

I can't even remember the last time we flew an airline other than Southwest. We've since gotten a few flights to New York to visit my parents, Boston to visit my sister and her family, plus vacations to San Juan, PR and soon a flight to Aruba.

The most expensive flight we've gotten for “free” (you pay taxes and fees) will be the one to Aruba. That baby cost me $727.50 and will cost my lovely wife just $70.60. That comes out to be just under $400 per person.

$400 for a direct flight to Aruba? I'll take it.

The 135,000 points we get via promotions are valuable too. They're worth about 1.66 cents on the best Wanna Get Away fares ($108 o/w from BWI to ISP), so that's worth about $2,200+ in and of itself.

All in all, this experience has been a very positive one.

Great breakdown Jim! Both my wife and I got the CP during the first quarter of this year and have loved it. It was relatively simple to earn, especially since it coincided with us adding a deck to our house – thus allowing us to charge a relatively large expense. Given that SW added those Caribbean routes I think it brings even more value to the program. We’re going to Cancun for our 15th next year and will likely take at least 1, if not 2, similar trips with our kiddos over the next year. We both just redeemed free… Read more »

We’ve taken advantage of those international routes too – we went to Puerto Rico (ok ok, technically not international) earlier in the year with it and in a week we’ll be in Aruba. Huge savings so far!

Jim,

Is this program still good as of 6-14-16? Someone told me they thought the ability to use the signature visa miles towards the companion pass was not allowed? Since it appears the pass is good for the year in which you apply and the following year, I was confused by the comment above that suggested one wait until November to apply. Thank you very much for the information.

Hi Glen – the program of Companion Pass? The suggestion to wait until November to apply is driven by this strategy: Apply in November, get the card in late November or December, wait to spend the $2,000 until January. In January, you get 50k points (or 100k if you get two cards), then you get Companion Pass for that year and the following year. If the 110k points hit in Jan or February of 2017, you get Companion Pass for 2017 AND 2018. If you apply now (June) and get the 110k points in August, you get companion pass for… Read more »

Jim,

Awesome article! I only wish that I had seen it before registering and receiving my Southwest card. Womp!

Would it be possible to sign up for the business card now and still receive the 50k points? I read this in the terms…

“Bonus Points

This product is not available to either (i) current cardmembers of this credit card, or (ii) previous cardmembers of this credit card who received a new cardmember bonus for this credit card within the last 24 months.”

Any thoughts?

If you have a business, yes you can still apply. It’s a completely separate card. Good luck!

So what happens if you get the 100,000 pts in January (2017) from applying for the cards but then transfer some Hyatt points earned in 2016 to SW in January (2017) to get to the 110,000? Would those points not count because they were earned in 2016 or would they count since they were transferred in 2017?

Earned = when they hit the account, so if you got the 100k points in January then it counts for 2017. Same with the transfers, even if the original points were earned in 2016 in the other program (they have no idea when the original points were earned).

Jim, Once you got your card and your business’s card, did you have to do something to combine them?

They’re still separate cards but they are linked to the same (my) Rapid rewards account number.

Looks like those bonus points no longer count toward companion status. According to Southwest: Points purchased for personal use or as a gift, transferred points, points earned from program enrollment, Tier bonus points, flight bonus points, and Partner bonus points (with the exception of the Rapid Rewards Credit Cards from Chase) do not qualify as Companion Pass Qualifying Points.

Which bonus points? The points from the credit card? According to what you pasted, it still applies.

Can anyone verify if the 50,000 points from enrolling in the RRCC from Chase counts toward companion status still?

I can confirm it, it still counts. You can always ask @SouthwestAir on Twitter too, they answer pretty quickly.

I am 22,000 miles short of my companion pass with 1 month to go. I just secured a chase marmot rewards card with a 80000 mile signing bonus with intent to transfer them to SW. Although the SW terms say transfer points will not be applied to the companion pass… so I hope like you mentioned they do? Is there any other good ways to make up a shortfall before new years? I’m afraid Im not going to get the 80,000 Marriot points posted and transferred to SW in time. I love my Companion Pass!!!! I’m addicted !

Hi Jim,

I just applied for SW Premier card and got approved and waiting for approval for business card. If I got both cards, I am still short of 20K Points to get companion card. I called SW credit card department, they said that points from Hotel will not count toward to companion pass (I have 50K points from Chase Sapphire Preferred and plan to transfer to Hyatt and transfer to SW Rapid). Will you please give me some suggestions what to do to get companion pass?

Did you tell them specifically that you were transferring those points to Hyatt and then from Hyatt to RR?

Hi Jim,

No, I just asked whether Hyatt points can be transferred toward SW Companion Pass and response is ‘No, only points that use for airline bookings can be counted toward Companion Pass’.

Hey Jim, My wife has a business and she is going to apply for a card in her name. Is there an issue if we use my SWA mileage account with her card?

It won’t work, Southwest says the names on the account have to match. That said, you can always say you’re an employee of the company and get the card anyway.

Can you use any of your points while you are accumulating them?

Yes

Hey Jim, great article and interesting take on travel hacking not being for you. As an avid travel hacker, many people would assume that I’d think not travel hacking would be insane, but I can actually see your point of view. Sometimes, the rewards aren’t worth all the effort (even if you are a nerd about spreadsheets!) I feel this same way with things like taxes – yes, I know there are some things I could nerd out about that would save me money, but I just don’t care enough. And as long as you pick off the low hanging… Read more »

Trav – thanks for stopping by! I’m a fan of your blog and love the name too. I think the rewards are worth the effort, it just happens that the effort can be really high if you want to take full advantage. At it’s core, it’s not really any more complicated than researching and booking a trip, you just add a layer of credit card applications, spending, and coordination. But as you said, we all get excited about different things and I think my energy & attention is better directed towards other things. The benefits of travel hacking are certainly… Read more »

This is one of the best values in credit card rewards. Period. I got mine in March of this year, and was able to visit family and take a last-minute trip to Nashville, just because. I was also able to use points to fly my parents a few places as well. Still have about 70k miles left (WOOHOO Wanna Get Away fares!), and will most likely use it for my trip to San Diego next fall. We’ve saved thousands in travel, and this companion pass is a HUGE reason why 🙂 Maybe you can take a trip to the World… Read more »

Ha so we were in the NY this past weekend visiting my parents on Long Island, I was tempted to go to a game but they’re at 8pm… it would’ve been fun to go to a World Series game but I’d get back home around 2-3am, which wouldn’t have been fun. Plus, I could watch the game with family and my son – no way he would make it to a game now. 🙂

Gotta groom the young ones while you can. Wouldn’t have been as fun to go to a game without him too. There’s always next year.

Hey, maybe the Mariners will live up to LAST YEAR’s hype and get there…..

^ (I almost typed that without laughing out loud….almost…LOL)

We don’t get much news about the Mariners here, being that they’re the AL West, but hype makes sports fun. 🙂

Hi there, we got the 50K points for a new cc earlier this year and since then I’ve accumulated quite a bit for business and personal travel. Would you recommend we still do this late as it’s late in the year? Will we get the companion pass for next year or just this year 2015?

The pass is based on earning 110,000 RR points in a single calendar year, not total points in your account.

If you got the 50K points already, you’ll need to hit 110k before 2015 ends in order to get credit for the 50K you earned earlier this year. On Jan 1, your points earned reset back to zero. You still have the points, but the meter on getting the pass gets reset.

If you hit the 110K, you’ll get the pass for 2015 (this year) and 2016 (the following year).

We got found a deal on Kayak and paid $422 from Boston to Aruba on American… no companion pass necessary. I’m definitely going to be looking into this though.

When we looked, we could get individual flights on other airlines for slightly more than our Companion Pass subsidized rate, but they all had layovers in Atlanta or Miami or JFK. These were like multi-hour layovers too, tacking on 2-3 hours to the travel time, which is not something I enjoy. 🙂

That’s a good point. My wife made the reservations this year and I just remember the price.

Last year, we went with Southwest and got a Super-Saver (or whatever their biggest discount is) for under $400 I think. The free baggage with Southwest is great. It’s definitely one of our preferred airlines.

Southwest has a lot of stuff going for them and if you get over the whole A/B/C boarding process, which seems to be the only complaint I hear frequently, it’s a great process. I fly it whenever I can.

Jim,

In 2011 we cut up all the credit cards and haven’t used them since. We live on a monthly budget and literally account for every dollar that comes into our lives. With that said, I know we could get this Southwest Card and funnel $6k through it in 3 months tim. However, now I feel like I’m the alcoholic that says “its only 1 drink, I’ll be fine…” . What do you think Jim? We travel SW all the time too. Hmmmm…

Well if you feel your use of credit cards is akin to an alcoholic with one drink… No. Don’t do it. 🙂

If it’s more of an exaggeration, I’d say it’s a good chance to see if you can use credit in a way that gives you overwhelming benefits. It’s a clear cut benefit with a goal and a good reason, so it’s a relatively controlled situation.

Plus, you seem like a well disciplined guy so with such clear parameters it shouldn’t be a problem.

Very helpful article, Jim!

Say I spend up to $1999/card this year and these purchases post in December 2015. Do you know if these amounts count towards the 110,000 points needed for the pass? Or do I instead need to spend the $4k in 2016 in order for it to count for 4,000 points? I hope to have the 2×50,000 bonus points post early 2016.

Thanks!

The $1999 spend will not count towards the 110,000 points needed if it posts in 2015. You need to spend or have the statement with the spending post in 2016 for that spending to count.

Hi Jim,

I have a small ebay side business. I’m planning to sign up for an EIN and then apply for the business card. But since the EIN will have no history, I’m afraid I will get denied. Would I be better off simply using my social to apply for the business card?

An EIN is better than your social because it’s a sign that at least you have an EIN. 🙂

I don’t know if they consider the age of an EIN. My EIN was many years old (registered in 2006, I applied in 2015) and I still had to call the reconsideration line.

Do I need to keep the cards around after I get the companion pass?

Nope, I have no idea where mine are. 🙂

Can the cards be cancelled after receiving the CP and still have the points? I don’t want to pay the annual fees again.

If I don’t get the business card, how much do I need to spend this year to qualify?

You would need another 60,000 points to reach 110,000 after the 50,000 bonus points. So $60,000 or less if some of that is spent on Southwest flights (or you go on flights associated with that account).