You know how they say a car loses a third of its value the moment you drive it off the lot?

Whether it’s a third, a quarter, or a tenth – the point is a used car can offer you tremendous savings over a brand new car. If you know how much car you can afford, you can often get more for your money by going used.

The first few cars I owned were used. I actually bought them on eBay, a Toyota Celica from a retired police officer in Florida and an Acura Integra from a dealership somewhere in the midwest. There was a little headache in that I had to arrange to ship the car (you can find car shippers online) and I had to buy them sight unseen.

There was no way I was going to fly to the car’s location even though the deal was so good. With the Integra, I ended up getting into a car accident three years into owning the car and the other driver’s insurance company cut me a check for exactly what I paid for the vehicle.

The only thing I could do was review the photos and do a check of the car’s VIN, or vehicle identification number.

Back then, your best bet for checking a car’s VIN was to pay for the car’s Carfax. When you buy a vehicle from a dealer, they’ll often show you the Carfax report (or Autocheck) for free. Unless your seller has pulled up the report (which as a seller, is a good idea!), this means you will have to get it yourself if you’re buying it from a private seller.

What if you are looking at a bunch of cars and don’t want to pay for each lookup?

There are some free databases you can use to do a quick check:

Table of Contents

National Insurance Crime Bureau

The National Insurance Crime Bureau (NICB) has a simple VIN check search tool that will show you if the vehicle has been stolen (but not recovered) or been reported as a salvage vehicle by an NICB member insurance company. They limit you to 5 searches in a 24-hour period per IP.

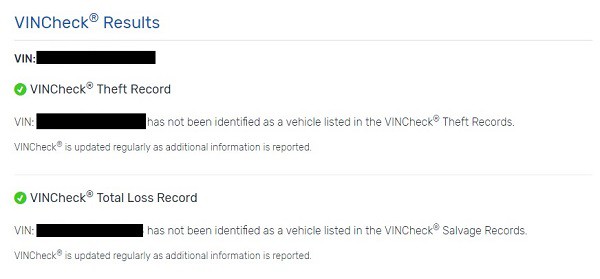

The report is very simple and when I put in my vehicle (which is neither stolen nor salvage), it reported:

Which I knew… since it was my car already!

But this can very quickly show you two huge red flags before you consider buying a car.

VehicleHistory.com

VehicleHistory.com is a free tool that pulls data from various sources to build a report similar to what Carfax and AutoCheck offers, except it’s for free.

They get data from:

You can view a report for any VIN without having to register or login. Here’s a report for a random 2018 MINI Countryman. It has a detailed vehicle history, list of NHTSA recalls, theft and junk salvage information, sales records, and even inspections.

Since the car is relatively new, it only has the original odometer reading from back in 2017 via the National Motor Vehicle Title Information System (NMVTIS).

What about vehicles not listed in a marketplace? It shows similar information, such as data on theft, junk salvage, inspection, and sales but that’s the extent of it.

iSeeCars iVIN

Lastly, if the VehicleHistory.com report isn’t comprehensive enough (or you want another report to corroborate the VehicleHistory.com report), you can turn to iSeeCars’ iVIN report. iSeeCars is a marketplace so they provide a report if one is available.

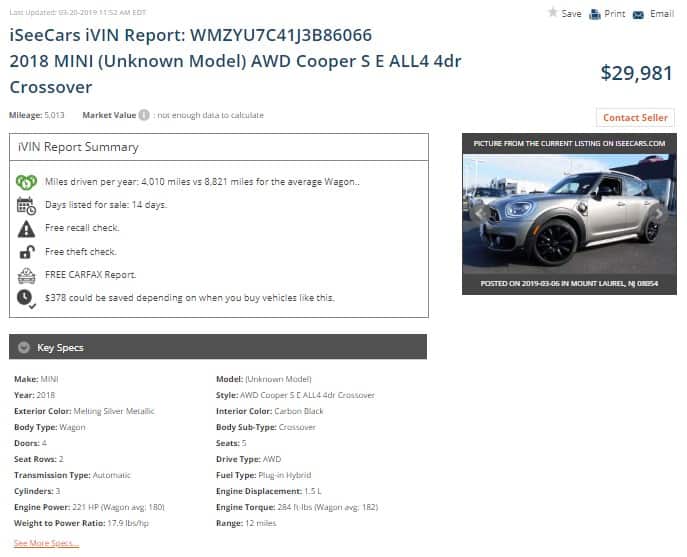

Here is the iSeeCars iVIN report for the same 2018 MINI AWD Cooper S E ALL4 4dr Crossover.

One of the best parts of this report is that since this is a vehicle listed on a used car site (and by a dealer), you can find the link to the Carfax report in this report too.

What about vehicles not listed in a marketplace? It doesn’t have nearly as much information, unfortunately.

Here’s the summary report:

iVIN Report Summary

- $14,411 market value. (Based on an estimated mileage of 83,022)

- This vehicle is estimated to have 83,022 miles on the odometer.

- Days listed for sale: Similar vehicles sell in 31 days. The average vehicle typically sells in 36 days.

- Free recall check.

- Free theft check.

- Projected depreciation: $2,336 in 5 years.

- $378 could be saved depending on when you buy vehicles like this.

It’s very limited in what it shares about the specific vehicle but it does offer some pricing information to help with negotiation.

NHTSA Recalls

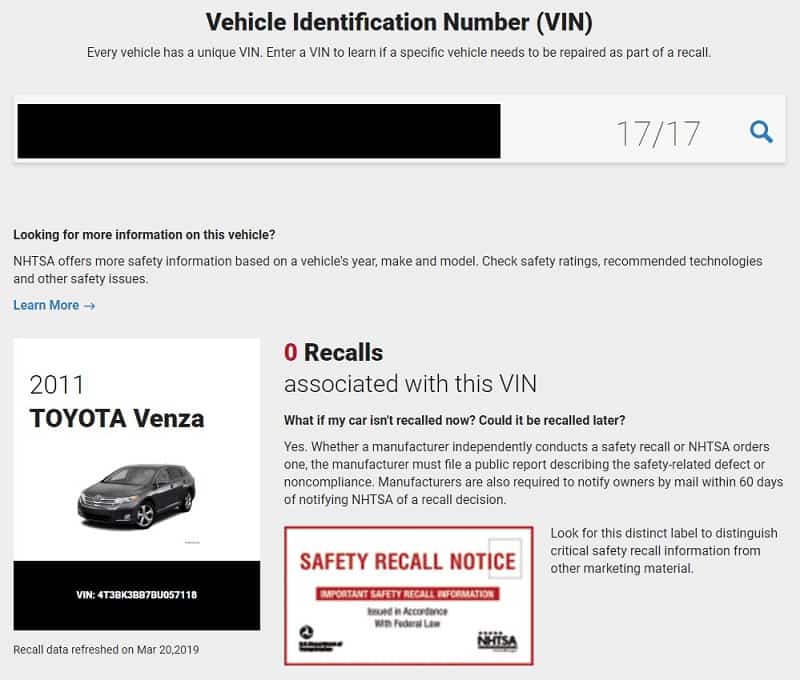

This is unrelated to getting a car report but if you are considering a vehicle, pop the VIN into the National Highway Traffic Safety Administration’s Recall tool to find out if that vehicle has had any recalls. Then confirm with the seller that they had these fixes performed.

If there are recalls and they didn’t get it fixed, you can use it to negotiate down the price (since it’ll be a minor headache to get it fixed). It also might give you an idea of how attentive the owner is to their vehicle!

How much do Carfax and AutoCheck cost?

Here’s how much the commercial lookups cost:

Each Carfax report costs $39.99. You can buy multiple lookup packages too, where you pay $79.99 for three reports or $99.99 for five reports.

Each AutoCheck report costs $24.99. You can also buy a package of 25 reports in 21 days for $49.99 or a 300 reports in 21 days package for $99.99.

Remember, if you are buying a car from a dealership then they will have these reports for free. Just ask to see one.

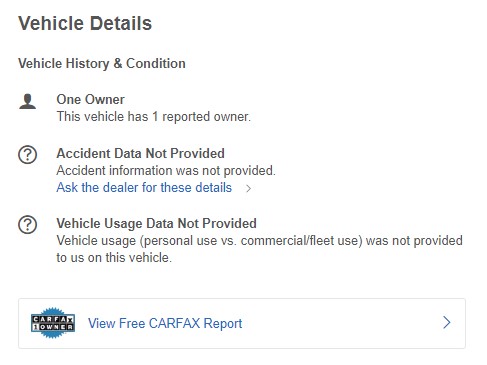

If you are using a search online, the car listing will usually show a free Carfax or Autocheck report you can read. For example, on edmunds.com, you scroll down on an individual car’s listing to Vehicle Details and you can see a button that leads you to the Carfax or Autocheck report (depends on the dealer):

What is the difference between Carfax and AutoCheck?

Carfax has been around longer and often seen as a “gold standard” for car history reporting, but both companies offer good reports.

Carfax started in the 1980s when you would actually get a fax copy of the report, hence the name Carfax. They no longer use faxes (as far as I know) and all the reporting is available online with the screeching. It’s also one of the more expensive services since it is “brand name” and often has the most detailed information. It’ll have the car’s owners, maintenance information like dates and service performed (as long as the repair center shares data), plus publicly available data all rolled into one.

AutoCheck is owned by Experian, one of the credit score reporting companies when you think of your FICO credit score, and they “score” vehicles on a range between 70 and 90. This score is based on the vehicle compared to other cars built that same year, which can help you very quickly pick out which cars are worth buying and which are worth skipping. Remember the score is 70-90, not 0-100. It also contains a lot of historical data, not as comprehensive as Carfax, and the innovation it offers is a score you can see quickly.

How to find the VIN

The vehicle identification number is listed in a bunch of different areas but the easiest one is going to be on the windshield.

Go to the driver’s side and look at the point where the glass meets the dash, it’s likely going to be shown there etched in the glass. It’ll be a 17 character string of letters and numbers.

If it’s not there, you’ll have to get access to the car. Open the driver’s door and look at where the door latches to the car frame – it’ll be shown there too.

Should you pay for a report?

If you can’t get a report for free, I’d run the VIN through the NICB VINCheck tool to see if there are any red flags.

Then, try the other services to see what data is available for free. If you are still comfortable with the car, and you’ve nailed down a good price and terms, then pay for a Carfax or AutoCheck report as the last step. Rather than run a dozen reports, you only have to pay for one. It’s worth it if you want to avoid serious headaches on a multi-thousand dollar purchase.

Good luck!