I graduated from college with ~$35,000 in student loans.

I was lucky because they were subsidized Stafford loans. My servicer was the oddly named ACS Education Services… ACS stood for Affiliated Computer Services. I got interest rate breaks for direct debit and electronic statements, both of which are common even today, and didn’t have too many problems with them.

They were not being serviced by Fedloan – which has developed quite a reputation.

Unfortunately, if you want to take advantage of the Public Service Loan Forgiveness Program (PSLF), FedLoan is the only game in town. The PSLF, in sort, is when you enter full-time public service employment for a qualified employer and make 120 qualifying monthly payments (10 years). After that time, your direct Federal loans are forgiven (loans made under the Direct Loan Program). It was created under the College Cost Reduction and Access Act of 2007.

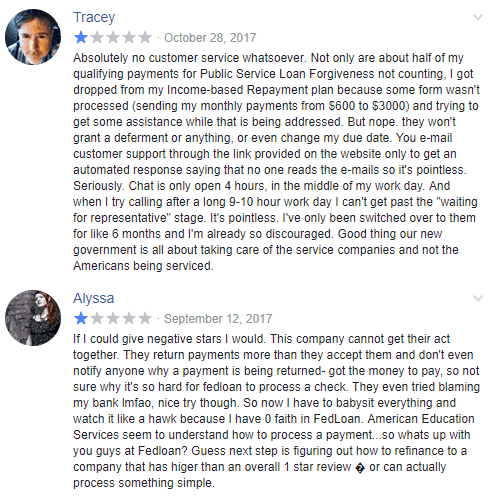

When I emailed readers about their experiences with student loans, one name and the word “nightmare” kept coming up. Fedloan.

My friend Travis is a Student Loan Planner and he’s created over a thousand custom student loan plans that will have you out of debt faster than you can imagine. He knows all the different programs, how they work together, and what you need to do to take advantage of them.

His average client saves a projected $59,000 over the life of their loans. If you want to find out more and see if a plan might help you, check out his service.

Table of Contents

Who is FedLoan Servicing?

A little background… Fedloan is a student loan servicer. A student loan servicer is a company that collects loan payments and, if necessary, help borrowers sign up for repayment plans set up by the Department of Education. This includes income-based repayment plans (IBR plans), income-contingent repayment plans, the PSLF Program, as well as others.

The Pennsylvania Higher Education Assistance Agency (PHEAA) is FedLoan Servicing’s parent company. Another name you might also see is Amerian Education Services, which is also owned by PHEAA and they manage private loans as well as those under the Federal Family Education Loan Program. These two companies service the most federal student loans in the United States.

FedLoan wasn’t always the only game in town for federal student loans. The Department of Education decided in early 2017 that they would move from nine different servicers to just one. Yep, you gussed it – FedLoan. The DOE estimated that it would save $130 million over five years, though it’s inclear how much borrowers will see in savings given the increase in volume of student loans, payments, and administrative burden.

Common FedLoan Servicing Problems

When I asked readers, they all had similar stories – “If you’re just making the regular payments and never miss any, never want to pay more, and don’t want to talk to someone… FedLoan is great!” If you want to do more than that, like making an extra payment to principal, good luck.”

In other words, if you have to actually deal with any student loan servicing issues… you will be dealing with servicing issues.

So, here are some of the common FedLoan servicing problems and how to avoid them:

Forced Switch for Public Service Loan Forgiveness

If you apply for the Public Service Loan Forgiveness program, you are forced over to FedLoan Servicing from whatever servicer you were previously using. One of our readers was a little surprised by this because they didn’t realize that only FedLoan handled the PSLF (this is a more recent development, as you expect, Fedloan news isn’t on anyone’s list of high priority items!).

The trouble with this is that with no other student loan servicer for PSLF, you’re stuck with FedLoan. If you want to enter the PSLF, FedLoan is the only game in town.

If you aren’t doing PSLF, make sure you compare rates and check out the latest student loan refi cashback offers from the top refinance banks.

Direct Debit Takes Two Billing Cycles

If you set up a direct debit, expect it to take two billing cycles before it goes into effect. For those two billing cycles, you need to manually make payments and stay on top of the payments to Fedloan to avoid any type of credit issues.

This is a common complaint and one that makes a little bit of sense, direct debit isn’t instantaneous but FedLoan doesn’t seem to make it easier to confirm these issues. Also, whenever the amount changes (such as for IDR), you need to redo the entire process again.

One reader told me – “When your taxable income changes (as mine did after we had a child) I had to start over again with direct debit. Even though I had just done it a year earlier. Add on that my wife also is in the same programs, also direct debit, and twice a year I am potentially sending in new forms just to pay them and get the .25% reduction of interest rate.”

Recertifying Income Takes A Long Time

Another reader is on the Income-Driven Repayment Plan and each year he needs to recertify his income. “What I like about FedLoan is that they have a dedicated paperwork upload system where I can upload my paperwork online so no need to fax or physically mail any documents. They process the information I send to them usually within a couple days and send an email about the status of my uploaded paperwork. Emails for all my questions have usually been answered or at least responded to within a few days. The paperwork for the PSLF takes a little longer, maybe a couple months but once it is processed, they send a hardcopy letter and an email stating all the information about my current status within the PSLF program.”

While the process has improved, Fedloan has an abysmal response time. One reader told me they sent the forms in April and only heard back in late August. It’s been like that for years.

It’s gotten so bad, the Massachusetts Attorney General Maura Healey sued FedLoan Servicing (technically, they sued the Pennsylvania Higher Education Assistance Agency)!

They allege:

- “PHEAA’s [Fedloan’s parent company] servicing failures have harmed Massachusetts student borrowers, depriving them of months that should have counted toward their loan forgiveness, causing them to lose financial grants and further saddling them with debt”

- <“In addition, PHEAA has made it more difficult for student borrowers to manage their debt by overcharging them and misprocessing their applications for Income Driven Repayment (“IDR”) plans that make borrowers’ monthly payments more affordable.”/li>

So keep that in mind!

Clarify Extra Payments

If you make extra payments but do not specify which loans your payments are meant for, they will spread it across all of your loans. If you make a payment on one loan and do not specify, it will be applied to the next payment. If you paid more than your regular payment, the next regular payment will not be debited.

If you are on an Income-Driven Plan, you can’t make payments ahead of your IDR anniversary or recertification date. Any payment overage at that date is applied to the loan itself, not a future bill. These are key distinctions to remember because you may want your payment applied to your student loan different.

Contact Customer Service

Don’t use email – the best way to get an answer is to hop on the phone:

- US Toll-free number: 1-800-699-2908

- International number: 717-720-1985

They’re open Monday through Friday from 8 AM to 9 PM Eastern.

If you want to email, you will need to log in to use their secure email system. I recommend calling and talking to someone on the phone though.

Do Not Trust Their Advice

I think it’s safe to say that the customer service representatives you talk to at any company, Fedloan or otherwise, are rarely going to be the folks you want to take financial advice from. It’s not their job to know the intricacies of student loans, student loan options, and all the vagaries of debt and forgiveness. I’d expect them to be experts in their own systems, being able to apply payments properly and navigating the menus of their own computer systems.

A few of the stories I’ve heard involved folks being put on plans they shouldn’t have been on. It’s hard to give financial guidance and even harder when you don’t have a complete picture. Do not trust the FedLoan customer service reps if they give you advice or steer you in a certain direction – they’re not necessarily qualified to give that advice. They’re not being purposely deceptive and they’re not trying to trick you, they can’t possibly know the full picture.

Your Turn

Did you have an experience with Fedloan that you wanted to share? Are they like this laundry list of nightmares and student loan problems? I’d love to hear it and others would too!

pggenia says

I am (and was) basically ignorant about student loans, but back in 2010 when I was 60 years old, I decided to complete my AA degree (don’t ask). I got 3 Stafford loans to do so. I completed the first semester with flying colors, but then I had a big interruption in my life when a friend with two foster children had to move in with my husband and me. I decided I couldn’t handle the school work with all the uproar in our home. I was 2 days late in deciding to drop the courses. I asked for forgiveness and was turned down. Nobody want to hear my problem. It’s now the end of 2017, and I owe almost $4,000. I was not able to make substantial payments, so it just keeps piling up. Is there ANYTHING I can do at 67 years old to get this forgiven?

luis gutierres says

i have been with fedloan for about 6 months and i have no complain about the services received, very nice customer service.

Savvy says

Just found this piece after searching ‘Fedloan never came out’ since I just got an email from them saying I’d missed my payment that was due January 12th. I logged in and made that payment on January 5th! Each month in my planner, by my note reminding me when it’s due, I check it off and write down the date I pay it. Usually when I get confirmation pages after making online payments anywhere, I don’t bother to print them, but I sure wish I had this time!

It makes me feel better to know that I’m not just losing my mind and it’s not just me, but geez, what a disappointment! Everyone using Fedloan, make sure to check that your payments really did apply; I’ll make sure to print those stupid confirmation pdfs moving forward. I feel lucky since my payment is small, I didn’t even notice it hadn’t come out of my checking account, but knowing that kind of thing can affect credit, I won’t be so trusting next time. Sure hope the government shutdown doesn’t make Fedloan even worse!

Thanks for this article!

Wow, so when did they apply the payment? After the 12th even though you made it on the 5th? The 5th is a Friday, they can’t even claim it was a weekend.

Travis says

I qualify for the PSLF program and was able to enter it with relative ease. The payment plan I was put on was one listed for the PSLF program. A few years went by and I started getting a random email every few months saying that the plan I had been paying on wasn’t one that worked with the PSLF program. I would log on and very plainly it would say at the top of the screen, it was an eligible plan. Not being sure if I was receiving a phishing email, as it didn’t line up with what their site was telling me, I reached out with an email. Six months went by with no response. I got another email telling me my plan wasn’t an eligible plan for forgiveness, so I again sent another email asking for clarification. This time only three months or so passed and I got a response this time! It was all of two lines of text telling me that my plan was not eligible for forgiveness and all my years of payments never counted. I was completely deflated. I later called and spoke with someone who tried to put me on an eligible plan with a ten year pay-off. I explained over and over that my having my loans paid back over ten years was of no benefit towards forgiveness of the remainder after ten years of paying. I might as well had been talking to a brick wall. It’s now been seven years and I’m no closer to any type of loan forgiveness that when I first started paying my loans back. With almost fifteen years of service, not one month has counted and any advice I’ve sought has been met with more confusion.

Irene says

I entered the PSLF with ICR with FedLoan a couple of years ago. I’m less than 2 years away from meeting the forgiveness possibility. I received in the mail a letter stating that I needed to recertify or my payment would remain the same. It also stated that I HAVE to recertify once a year, so I did so. What a huge mistake! Now my payment has more than doubled! I’ve called them a couple of times. First time was advised to do the paperwork again and use a pay stub for proof of income, which I did. It was declined. Called a second time and basically was told that I should have NOT recertifyed. Now I’m stuck with a more than $400 a month payment, which most likely will pay off the loan before the PSLF kicks in. My income fluctuates and I was trying to explain this over and over. The service rep I was speaking to was very patient, but I felt like I needed to take this to a higher level (those who make these decisions, rather than a phone rep). Do I have any recourse? Previous payment was $168. This really hurts my budget at the moment.

Wait so they mailed you a letter about recertifying and then told you that you shouldn’t have? That makes no sense whatsoever. Did you try to escalate it and what happened?

Kim says

Apparently, they don’t process payments on weekends on holidays. So even though our direct deposit went through the day before my husband’s bill was due, since it was on a weekend, his loan was listed as being in “Default” on the website the following week.

That was last month. I checked back today, and now his loans are apparently in “Forbearance” for no reason I can ascertain. I’ve never had this many issues with other student loan companies (and, sadly, I’ve dealt with several).

Breanne says

I switched to this company after wanting to access the PSLF program. After spending nearly an entire year trying to get certified and my payment plan changed, I actually decided the hassle wasn’t worth it an accessed a state bank to consolidate my student loan debt. Now I have one remaining loan with them because the interest rate was so low. I am now in a position to pay that off earlier than anticipated. I made a $430 extra payment to my loan and when I looked at it, they applied $3.73 to a loan that has been classified as “Paid in Full” for three years. The phone rep told me that there has been a small remaining balance left on the loan. So it’s too small to report to me, but large enough to take a portion of my payment for? Just a very seedy business practice. I will be relieved to be done with them.

Peter says

6 years with Mohela on properly consolidated loans, under qualifying employers, and in qualifying payment plans – but no running count of the number of PSLF payments made. So I submitted a PSLF form and was auto-switched to FedLoan in July 2017. FedLoan started processing my payments 2 months later, but has yet to give me a count of qualifying payments towards PSLF and it is April 2018! They have certified that my employers qualify but keep telling me that nothing “pre-conversion” counts. So 7 years in, each bill I receive notifying me of an auto-payment to FedLoan says that I have made zero qualifying payments towards PSLF. What a scam. Any advice?

Devin Gray says

I attended undergrad from 2009-2013, taking advantage of both unsub and subsidized Stafford loans, totaling approx. $25,000 borrowed over my 4 years of study. I had made payments on the accrued interest while I was in school (based on the quarterly statements I received) and in September of 2012, I made a payment of approximately $7500 (that I had saved while working 2 jobs during school) to reduce the astronomical interest that accrues. In December of 2012, I received a statement from Myfedloan that was quite perplexing- it showed that I had a balance of $25,000 and no record of any payments. Not. One. Single. Payment. Obviously shocked because I not only had the confirmation from Myfedloan that they received the payments, my bank statement showed that the funds had cleared my account. I called (the first of what would turn into dozens and dozens of frustrating calls) to find that the representative had no record of payments either, and advised that I fax a copy of my bank statement showing the payments that were made.

The submission of my bank statement was the first of a 9 month ordeal where I would submit documentation of the payments as instructed by the rep, await the 7-10 business day processing time only to be told that they either did not receive the paperwork, or that it was not sufficient to prove the payment was made. Collectively, I spent hours at my bank trying to explain what a “tracer number” was that they had requested, (the processing time to obtain this was 6 weeks) only to be told by MyFedLoan that that was not sufficient and not even helpful in showing proof of payment.

This went on for 9 full months, all the while I am concerned that the incorrect amount of debt against my assets would make it more difficult to qualify for the apartment I needed to secure for myself upon graduation, and the overall feeling of frustration and hopelessness that the money I had worked so hard for had essentially disappeared, and there seemed to be no way to correct the situation. My mother has been a loan officer for 25+ years and I consider myself to be quite diligent with my finances, so given the fact that I had (in theory) all the resources available to me to handle this the right way and get it corrected speaks to the unimaginable delinquency of this company.

The situation finally resolved itself when my father, who happened to be in Harrisburg for work and took an afternoon to golf, wound up with the same tee time as one of our congressional representatives. Earlier that day he had received yet another upset call from me about the situation and brought it up with the congressman, who’s office reached out to MyFedLoan to inquire about the situation. Within days, the payment was reflected on my account and I received a call from MyFedLoan- adding insult to injury, they called to inform me that the situation had been corrected, and that they encourage me to contact them directly in the future if I have any questions or concerns about my account. Needless to say, they do not track their engagement with customers.

Since then, I have made all of my payments manually and pay as much as I can afford so I can first and foremost eliminate my relationship with this awful company (which is more stressful than the burden of student loan debt, ironically enough).

Brigette says

I have been with Fed Loans for the PSLF since 2013. I have worked full-time except for 6 months. It is now 2018, so 5 years since I have started these qualifying payments. I got off of the phone yesterday and they told me that I only have 27 qualifying payments. I asked how that can be in 5 years and they kept saying oh well these two months they were in forbarence and looking into renewing your income contingent plan. They had BS reasons why most of my payments were not qualifying and I kept recertifying my employment! This is a crock.

AMY ELIZABETH McKEE says

Once FedLoan took over my account from Navient my 42 applicable PSLF payments simply are not showing up as counting toward the program. To make matters worse, the payments I have make direct to FedLoan (totaling 11 so far) have not been applied toward the program either. They said they were “behind” in applying those payments. In January 2018 I opened a case to have this situation addressed. They told me six weeks. I called in February, they told me to check back in May. I called yesterday (April 30) and said it would be June. I have now filed a complaint with CFPB. I suggest you do as well. If there was a class action lawsuit against this outfit I would join it. Heck, I may even file one myself!

D says

This exact same thing is happening to me right now. They WILL NOT help me. I have worked full time for 5 years and have 22 qualifying payments.

ed says

Same boat as Amy above: I was transferred to FedLoan from Navient after submitting my first PSLF certification form. Whoops. When it was transferred, they listed me as having made 0 payments toward PSLF, despite making 3 years worth at Navient.

In November, 2017, I asked them to review my payments at Navient to count them, and they said they would do so, and that I could expect a response within 60 business days. Here we are at the end of May, 2018, and I have no resolution. Instead, I’m told that it “takes time” because there are lots of payments to go through.

Employment certification is another problem – one of my employers refused to certify my employment, and despite a checkbox on the form that indicates this, and that assures the borrower that they will receive help to certify, my certification form was denied several times – they wanted paystubs, something I have no access to a year-and-a-half later. It took my W-2s to finally get that year of work certified.

My payments come out on time, which, you know, is cool. That’s about the only positive so far, except for the friendly call center worker I get now and again.

Amanda says

I was asked to recertify my PAYE plan documents by 4/27/18. I did so in time. I then received a letter stating that it was denied because it wasn’t time to recertify. !!? I called and she said it was a mistake. I sent the documents again and it was approved but they have now changed my payment to the standard plan and say that my lowered PAYE payments don’t start again until next month. So after their mistake, I owe $1400. Now I can’t get through to anyone that can help me and have been calling for two days. NOT happy.

Jamie says

I submitted employer certification for PSLF in October, 2017. I’ve been on the Income Based Repayment plan since the summer of 2009. As of June, 2018, they still only have about half of my qualifying payments counting towards PSLF. Every time I call, they tell me that the rest of them haven’t been assessed yet. 8 months seems like plenty of time since their original letter just said it would take at least 90 days. I hate this company.

Kristen says

I paid my loans through Navient 5 days before my loans were transferred to FedLoan in December 2017. If I had know applying for the forgiveness program would move my loan to FedLoan, I WOULD HAVE WAITED. FedLoan STILL has not acknowledged the payment I made to Navient in December. I was told in January to just pay as usual even though it says I’m behind on payments due to that “missing” December payment. It’s now JUNE and the December payment is STILL MISSING. I can’t get anyone to help me. They don’t respond to emails and trying to get through on the phone is an effort in futility. When I finally connected to a customer service rep in April, they said the payment from December was being applied and that everything was all sorted out, to just give it a week or two to update. It never did. This article is spot on. Like I said, had I known my loans would be transferred by applying for the forgiveness program, I would have just waited until I was closer to the 10 years to submit the application and certification information. UGH.

Angel says

…..Okay so now, even though I should qualify for PSLF, I am terrified to apply d/t the reviews of this company. I am with Great Lakes right now and their customer service is great. I haven’t had any issues with them. I wonder who paid and/or lobbied to get this company this contract. It’s ridiculous.

Krista says

Angel, I’m in the same boat! I’ve made only 3 qualifying payments so far with my current lender, and I know I’m supposed to complete the employment certification form and get switched to FedLoan in order to eventually qualify for forgiveness under PSLF, but I am TERRIFIED to switch to FedLoan as a servicer and go through all of this craziness, especially at this time in our country, when consumer protections are being systematically dismantled and the PSLF is being targeted for elimination, anyway!

Casey says

I have had the same issue as several commenters above! I switched to FedLoan in July 2017 from Nelnet after applying for the PSLF program. In July 2017, I had made nearly two and a half years’ worth of qualifying payments (although through Nelnet). In early September, I get a letter from FedLoan about my PSLF, and it says I have only made 5 qualifying payments, with no further information about why the other payments did not qualify. So I called to get some answers. I talked to a woman who explained she couldn’t see *why* the payments didn’t qualify, but she would start the process to have it reviewed, and she said it would take about 90 days, but to call after Thanksgiving if I hadn’t heard anything.

So I called late November/early December. I explained that I was calling to check on my review process. The woman I spoke to this time was so rude. She told me that just because it usually takes 90 days doesn’t mean it *only* takes 90 days, and that the first person I spoke with should not have told me to call to check on it. She essentially told me not to call again and check on it, that they would let me know when it was done. And I said, “So if I haven’t heard anything by Easter, you’re telling me just to keep going and assume its working itself out?” She rudely said yes. I told her that was just too bad because I would be calling to check.

In April 2018, I called to check. Remember, in SEPTEMBER 2017 this review process was supposed to have been initiated. Nope. In April, the woman I spoke with (who was very nice and, I think, helpful) realized that though the September helper was supposed to start my review in September, nothing had actually been done. She could see that the woman took notes about the review and tried to get it started, but it hadn’t actually been started. So this time, the helpful woman did start it. She told me she went through each month and checked off each individual payment to indicate that they each needed to be checked. She again mentioned that it usually takes only 90 days, but that every case is different. I thanked her and made a note to call at a later time.

I called last week and there are no updates. No new information. Nothing. The guy could only say that he could actually see that a review had been initiated, but that was it. I understand that I have a lot of payments to process. But I don’t really understand how this process is so difficult? Either my payments meet certain criteria, or they don’t. Is there not a computer algorithm that can handle this? And if not, is it *that* difficult to get some actual information or updates from the people who are (allegedly) checking over this information?

At this point, I have begun to doubt whether or not I will ever see the loan forgiveness at all.

Rhonda says

I’ve been in an IDR (originally ICR, now IBR) repayment program since 2005 and have had my employment certified/recertified for PSLF every year since 2014. I received a letter date 6/5/2018 verifying 72 qualifying payments with 10 instead of 12 payments the year my loans were transferred to Fedloan. After checking my bank statements and verifying that in the year my loans were transferred, 5 payments went to my original servicer and 6 went to Fedloan. I emailed them and asked for an accounting and received an email stating I would received this in 60 days. OK. Two months (and 2 payments later) I logged into my account and the payments total is now only 71. I called and spoke to an agent who could see the payment dates and said to ignore what’s on the website and go by the letter. Not a chance. He, also, said I was eligible for an override since there was nowhere to send a payment during the transferring of my loans. This means I should have 74 qualifying payments. So I contacted them again using the “contact us” email asking how my qualifying payments had decreased. I received an email today saying it would take 10 months, that’s right, 10 months to get this information for me.

This is very worrisome because when it’s time to request forgiveness, I will be ready to retire (not early, but at 65). Given that I will need to be employed full-time throughout the process, I could be working an additional year or more. I’m so frustrated. My loan balances are so high that I could never pay them off or I would quit now.

Katherine says

I recently moved my loans to FedLoan for PSLF. Right now I’m extremely confused. Half of the loans that transferred have 0 qualifying payments, while the remainder have 18 (which is correct).

Most of the loans were pulled from Nelnet, but my payment to Nelnet has actually INCREASED (~$20 for everything to ~$27 for one) and FedLoan is telling me I need to pay ~$160/mo for loans previously bundled into the ~$20.

Has this happened to anyone else? I feel like I’m in the Twilight Zone.

Anissa says

Everyone seems to have the same complaints against FedLoan Servicing. I have so many issue with the servicer that I would not know where to begin in describing my nightmare. My question is, why can we not start a class action lawsuit? There is obviously criminal activity, coercion, and theft going on, yet we all continue to just complain and bend over. Who would take this on? Where does one start? UGH!!!!!

Mel says

Has anyone actually had qualifying payments from their original loan company applied to their PSLF with FedLoan? Does that ever happen??? I have 35 payments made to Great Lakes that are not counted in FedLoan records. Asked them to look into the discrepancy a year ago and many phone calls and emails later have nothing to show for it.

Amber says

Not sure if anyone is still looking at these comments but Mel (previous comment) I requested that my payments be calculated on their site over 14 months ago and it still hasn’t happened. I’ve e-mailed and also talked to people in that department. When I called, the person in the PSLF department said they would talk to their supervisor to see if they could escalate my request because it had been over a year. I don’t know if they are understaffed or if it is a game they are playing so people end up paying longer so they get paid but its absolutely ridiculous. In the past I have never had an issue but the past 6 months has been awful. Not only am I waiting on my payment calculation but I also got kicked off IBR and needed to re-enroll in another IDR plan. Changing that was a pain and they told me that I automatically go into deferment while they figure it out. I just don’t get it.

Rhonda says

I’m in the same situation as a combination of the one(s) above. I’m missing at least one payment from my loans that were transferred from Nelnet (from 2013) and I requested a review last year 6/5/2018 but they took away a payment prior to performing any kind of review. It’s been a year and I have followed-up many times only to be told that manual reviews for those applying for forgiveness come first. That’s great, but I have multiple emails telling me it would be complete in 60 days, 90 days, 10 months (what a random number that is!) and nothing has happened. I just sent in my annual certification so we will see how that goes. When I call, they’re apologetic but have no answers.

Mike says

My principal balance increased by almost $200 in less than a week. No capitalized interest, no fees, no explanation for such an increase. The interested accrued looks about correct but no rational reason for a significant increase on the principal. Perhaps the payment was pushed to future payment and the principal was added back on? No notification and unfortunately funds have not been carried over to future payments as I owe for next month. They essential stole this money or mishandled it. Incompetence or theft. Possibly both. I joined the Army to pay off my loans. I overpay every month and check my account every single day. This isn’t right.

Cece says

This happened to me too, increased by over $4500…no explanation. Not interest cap, not a new loan. How can they do this!

Tanner says

Fedloans advice in a few words: DONT DO IT. Their customer service representatives lied straight to my face about refinancing my parent plus loans. And not just one rep, 3 did. On 3 separate occasions I called to confirm that if my mom and I refinanced my parent plus loan so that we could enter IDR and subsequently PSLF that I could still put it into deferment if I (THE STUDENT) were to go back to school. They all said yes because the loan originated as a parent plus loan that me going back to school – as the student that borrowed – would put it into deferment. Well guess who started graduate school this week. And guess who’s loan is “ineligible for deferment” due to it having been refinanced. MINE. Absolute savages that care nothing about their constituents. Now I’ll be having to take out a loan to pay a loan. I’ll be a slave to them for the rest of my life.

Susan T says

My first year with Fedloan was a dream. I was told I owed nothing on my student loan due to my income. I recertified for my second year, which is a requirement with them. They responded saying I know owe $340 a month! Nothing with my income has changed! What’s with that! My loan payment prior to them was about $150/ month at a low interest rate. I plan to address this issue with them. Has anyone else had this experience?!

annoyed says

lost 4k in payment becuase I was being told my payments were up to date. Literally told every month fo ra year that owed 0.00$ only to be told at the end of the year that a loan had capitalized and boom, 4 more in debt.