Ellevest

.25%Strengths

- Designed for the unique investment needs of women

- Low account minimums and fees

- Specialized career and financial coaching for Premium members

- Gender-lens investing choices

Weaknesses

- No tax-loss harvesting strategies

- No 529 investing options

- Premium account fees are higher than some other robo-advisors

The world is full of robo-advisors created to help people invest responsibly and affordably. The premise behind the robo-advisor is to provide automated, algorithm-based investing to help investors get investing assistance.

The benefit is that robo-advisors typically charge a fraction of what a human investment advisor charges.

Ellevest is a robo-advisory service, and it comes with a twist. This review will share what Ellevest has to offer so you can decide whether the Ellevest investment platform is right for you.

Table of Contents

What is Ellevest?

Ellevest is a robo-advisor with a feature we haven’t seen before: it’s geared toward (but not exclusive to) women.

Ellevest was started in 2014 by one-time Merrill Lynch Wealth Management CEO and Wall Street veteran Sallie Krawcheck and her business partner Charlie Kroll. When Sallie realized that traditional “gender-neutral” investing platforms weren’t serving women, she created Ellevest.

The goal? Create an investment platform that would better assist women in achieving their financial and career goals. They also recently pivoted to a money membership model adding in banking*, coaching, and learning.

The team spent over 200 hours interviewing women to determine their financial and life goals to create an investment company that met the different needs of women working to grow their net worth.

How is Ellevest Different?

Ellevest takes into account the differences that occur in women’s careers and lifestyles when the company creates its investment plans.

For instance, it’s well-known that there is a pay gap between men’s wages and women’s wages. This pay gap needs to be accounted for when setting financial goals.

In addition, women often experience career breaks due to raising children. A woman’s investment choices and goals need to consider those potential career breaks.

If they don’t, those career breaks could leave a woman’s net worth far behind her male counterparts who don’t take career breaks.

Lastly, women have a longer average lifespan than men. This means there’s a good chance they’ll need their savings and retirement investments to last longer than what their male counterparts will need.

All of these facts add up to the need for women to plan and invest differently than men do. Ellevest’s goal is to get more money into the hands of women – and one way they do that is through their membership by helping women create an investment plan that takes the above-mentioned factors into account.

How Does Ellevest Work?

Here are some details about how Ellevest accomplishes the goal of helping women accomplish their investment needs and goals.

Ellevest has three membership plans to choose from: Ellevest Essential ($1/month), Ellevest Plus ($5/month), Ellevest Executive ($9/month). They also offer Private Wealth Management outside of the membership.

Ellevest Essential

Ellevest Essential is the company’s most basic membership and investing offering. You pay just $1/month to have access to investing, banking*, and learning. You can also purchase coaching sessions with a CFP or Executive Coach for 20% off.

Ellevest Plus ($5/month) gives you access to retirement, including help rolling over any old 401(k)’s you may have. It also gives you 30% off coaching.

Ellevest Essential gives you unlimited access to their online investing tools.

Ellevest Executive

Ellevest Executive ($9/month) is the highest access to membership. It gives you access to all the other features in addition to goals-based investing like buying a home or saving to start a business. It also gives you 50% off coaching.

Private Wealth

The Private Wealth program is for investors who want personal, one-on-one investment management. You’ll have a dedicated financial advisor and client services team with this program.

The annual membership fee is $1-$9/month and you will not pay any additional management fees regardless of the assets you have with Ellevest.

Other Fees

Note that there are fees you’ll accrue with Ellevest based on the ETFs you invest in as well. These fund fees can range anywhere from 0.05 percent to 0.19 percent per year as of this writing.

Gender-Aware Investing Strategies

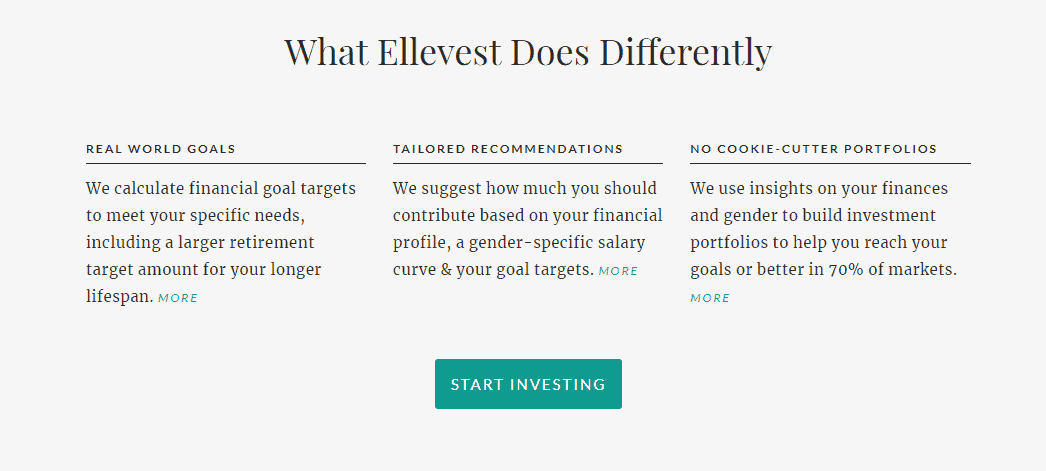

Ellevest uses what they call a “gender aware” investing strategy. Their algorithms are set up to calculate and design financial goals and goal targets to meet the differences talked about above.

In other words, the Ellevest algorithms take into account a woman’s potentially longer lifespan.

The Ellevest robo-advisor uses that information to design goal-related investment strategies for clients. After the company has calculated your target investment portfolio balance goal, they suggest how much you should contribute to reach that goal. Depending on your membership plan, you will have access to different goals.

For retirement, they use your personalized financial profile, a gender-specific salary curve, and your target horizon to do that. This isn’t the case with all goals, however.

Ellevest’s Investment Roadmap

With Ellevest Essential you will be able to open an account to build wealth, with Ellevest Plus you will also have access to a retirement account, and finally, with Ellevest Executive you will be able to set additional goals like saving for a home or having kids. Unlike many investment advisors, Ellevest won’t ask you what your risk tolerance level is.

Instead, they’ll focus on sharing what you need to do to reach your goals. They’ll recommend a personalized investment portfolio (primarily comprised of ETFs) that gives you the best chance of reaching your goals in the majority of markets.

Another unique feature of Ellevest is the company’s option to invest in Ellevest Impact Portfolios. These portfolios are designed under the scope of what Ellevest calls “gender-lens investing”.

What this means is that they aim to design portfolios that have a positive social and environmental impact on the world. For instance, the Impact Portfolio choices contain stocks in companies that include a minimal amount of gun manufacturers (typically less than 0.02 percent).

But at the same time, the portfolios combine that positive impact to maximize returns in a way that will help you reach your investment goals.

In other words, they allow you to invest in a positive-impact portfolio that still offers sound investment choices. This strategy goes one step further than many gender-lens investing companies, which stop at simply choosing companies that have a higher representation of women on boards and in senior management roles.

If this type of positive-social impact combined with goals-oriented investing sounds new and different, it’s because it is. Ellevest’s gender-lens investing strategy works to take the whole picture of social impact into consideration.

Monte Carlo Simulations

Ellevest uses Monte Carlo simulations to help you design your investing roadmap. Here’s how Investopedia describes the Monte Carlo simulation:

“Monte Carlo simulations are used to model the probability of different outcomes in a process that cannot easily be predicted due to the intervention of random variables.”

In other words, using Monte Carlo simulations helps Ellevest forecast your potential investment results based on several different investing strategies and other factors.

What this means for you is you’ll get a more well-thought-out investment strategy that is designed to consider many different economic and personal possibilities.

Ellevest Concierge Team

Ellevest has a concierge team available for support. The concierge team can help you navigate your investment goals and can help you with rolling over your 401k if you’re in Ellevest Plus or Executive.

Is Ellevest Secure?

It’s important when investing to ask whether a company has appropriate security measures in place.

Ellevest is SIPC-insured for up to $250,000 per member**. In addition, the company uses the highest level of encryption available. They use 2048-bit encryption for certificates and are rated A+ by Qualys, an information security and compliance firm.

In other words, they take the necessary steps to ensure your information and privacy are well-protected.

How Does Ellevest Compare To Other Robo-Advisors?

As we talked about earlier, there are many other robo-advisors out there. Some of the most popular robo-advisors are Betterment, Wealthfront, and Personal Capital. What does Ellevest have to offer that some of these other companies don’t?

Gender-Lens Investing

Likely the most intriguing feature of Ellevest when comparing it to other similar robo-advisors is its gender-lens investing focus – this means they factor in unique things that affect women such as a longer lifespan.

In addition, as talked about above, they work to create funds that offer “impact investing” options that focus on making a difference in the world too.

They know that women care not only about advancing in their careers but about being socially ethical as well–even when it comes to investing.

Executive Coaching

Another interesting Ellevest feature is the company’s Ellevest Coaching Sessions. These sessions are available at a discount for members to purchase with a CFP or Executive coach. They can help coach members through important career decisions, salary negotiations, etc.

Coaches will work to help you sharpen your negotiation skills and strategize your career moves to line up with your life goals.

Ellevest Pros and Cons

Here are some pros and cons to consider when thinking about investing with Ellevest.

Pros

- Designed for the unique investment needs of women

- Low account minimums and fees

- Specialized career and financial coaching for Premium members at a discount

- Gender-lens investing choices

Cons

- No tax-loss harvesting strategies to help investors minimize capital gains taxes

- No 529 investing options

A Solid Investing Option

All in all, Ellevest has a lot to offer. It’s fairly competitive with other robo-advisors as far as programs and fees go. The option to invest for impact in both socially and environmentally responsible investments is attractive, both for men and for women.

And the way Ellevest helps women with their goals by taking into account career breaks and pay gaps in certain goals is a refreshing take on investing.

Finally, the coaching services available for purchase are a nice feature for both men and women. Getting advice on how to better negotiate salaries and job offers is a benefit anyone can use. Non-members can also purchase coaching sessions.

Ellevest is a solid investment option for a wide sector of investors.

Disclosures

*Banking products and services are provided by Coastal Community Bank, Member FDIC, pursuant to license by Mastercard International.

**The Ellevest Spend and Save accounts are FDIC-insured up to $250,000 per depositor through Coastal Community Bank, Member FDIC.