Cleo

Strengths

- user-friendly question/answer format that speaks to you in casual language

- Built-in credit builder capability

- Cleo Visa card provides up to 7% cash back on selected merchandise

- Recommendations for building additional income sources and cutting expenses

- A free version is available

Weaknesses

- The Cleo Wallet is not interest-bearing, nor is the balance guaranteed

- The Game may be fun to play, but the promised prize money doesn’t always arrive

- Cleo currently cannot accommodate joint spending accounts

Cleo is one of many budgeting apps that does more than just budget. It’s a budget app, first and foremost, but it’s also designed to help you build savings (providing strategies to help you get there), benefit from cash advances, and even build or improve your credit.

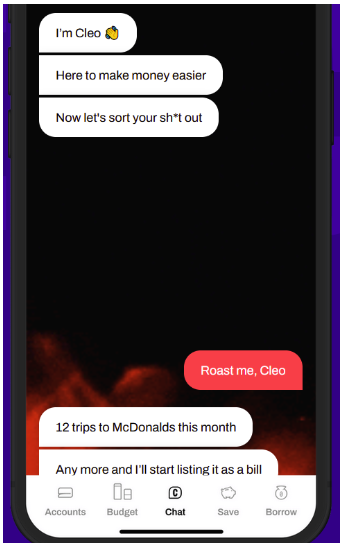

What’s immediately apparent is that Cleo makes it personal and even fun! The app will “speak” to you in ordinary language, sometimes bordering on crude. It may even seem like Cleo is “taking you to the woodshed” for bad behavior. But that’s pretty much how this app works.

If you’re interested in a different kind of budgeting app that goes beyond budgeting and does it in a way that’s…different…Cleo may be of interest. But how does it compare to top budgeting and savings apps like YNAB or Acorns? Find out in this Cleo review.

Table of Contents

- What is Cleo?

- How Does Cleo Work?

- Is Cleo Safe?

- Cleo Features

- Cleo Budget

- Cleo Save

- Cleo Borrow (Cash Advance/Salary Advance)

- Cleo Build Credit

- The (Cleo) Game

- Cleo Side Hustles

- Cleo Money Hacks

- How Much Does Cleo Cost?

- How Does Cleo Make Money?

- How to Sign Up for Cleo

- Cleo Pros & Cons

- Cleo Alternatives

- The Bottom Line on Cleo

What is Cleo?

Cleo describes itself as a “Budget/Building Credit/Money App that doesn’t suck.” That’s a broad statement, but the multi-tier focus is exactly what Cleo is aiming for. Instead of helping you with one specific area of your financial life, like budgeting, Cleo takes a more holistic approach to address multiple challenges.

Cleo uses artificial intelligence (AI) to help you better manage your money. But it uses a humorous touch to make it feel more real. You’ll have to decide if they’ve succeeded.

The following screenshot shows the app in “Roast Mode.” Notice the use of plain street language? When identifying weak spots in your finances and making recommendations, Cleo speaks to users as you might speak with a friend who can withstand a little ribbing.

The company was founded in 2016, is headquartered in New York City, and is available in the US and the UK.

The app is well-regarded by users. It has a Trustpilot score of 4.4 out of five stars, with over 3,000 reviews. A full 81% of those reviews gave Cleo an excellent rating, and another 7% rated it as good.

Meanwhile, Cleo has a rating of 4.7 out of five stars among 2,500+ iOS users on The App Store and 4.0/5 stars among more than 42,000 Android users on Google Play.

How Does Cleo Work?

Like many budgeting apps, Cleo is a financial account aggregator that requires you to connect your various accounts to the service. It readily links up with most major banks, but you can request support if yours is not one of them.

Cleo starts by backtracking three months of spending transactions in your accounts. From there, it creates a custom budget based on that activity.

But it would be inaccurate to say Cleo is purely a budgeting app.

As you’ll see in the next section, it also allows you to save, borrow, build credit, and even develop side hustles for extra income.

Cleo is interactive and uses a question/answer format. For example, you can enter a question in the app, like “can I afford to go out for dinner?” and Cleo will give you suggestions. It also provides proactive notifications, quizzes, updates, insights, and challenges designed to make you look at money differently.

You can also use the app to set goals, and Cleo will provide you with a roadmap to reach them. And to keep it personal, Cleo will even tell you when you’re screwing up!

Is Cleo Safe?

As a financial account aggregator, Cleo displays your information in read-only mode. That means while you can see all your account information on the app, Cleo doesn’t have access to your money. You can also rest assured that they don’t store your bank login details and that they’re protected with 256-bit encryption.

Cleo covers you with a $250,000 pledge if that’s not enough. That means they’ll match your bank in security (i.e., the $250,000 FDIC insurance limit).

Cleo Features

Cleo Budget

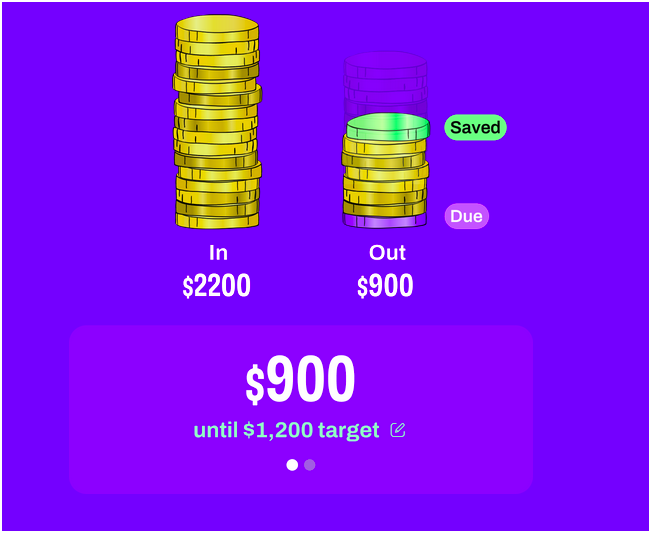

Cleo uses an AI assistant to help you better manage your budget. They will establish monthly targets based on your spending history and file them by category. You’ll need to enter your bills and monthly income to make the budget work.

Cleo automatically tracks income and spending transactions from your linked accounts. For obvious reasons, they don’t include cash or check transactions or transactions to and from unconnected bank accounts. Not a problem, Cleo enables you to add these transactions manually.

You can set up different categories within your budget, like groceries, auto expenses, insurance, and dining. Use the “watch category” feature if it’s a category you want to track closely Cleo will notify you anytime money is spent in that category. Cleo lets you change watch categories at any time.

You can set up your budget monthly or by paycheck (biweekly). The paycheck method is ideal for anyone with multiple incomes or who is paid irregularly (self-employed, gig worker, commissions, etc.).

Cleo recommends the 50/30/20 rule – 50% of your money goes to needs, 30% to wants, and 20% to savings. This formula does not bind you, so you can adjust the percentages based on your own personal circumstances.

Cleo Save

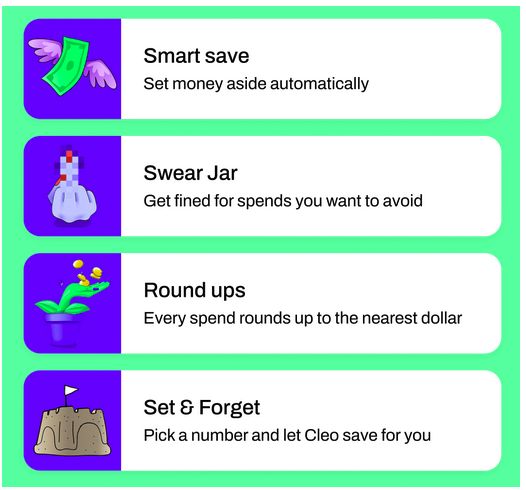

Cleo offers multiple ways for you to save money. It works on the principle of “hiding money from yourself.” That means putting money where you can’t easily get to it for spending.

Like many financial apps, they offer “roundups.” This feature rounds up your purchases to the nearest dollar, moving the change from each purchase into savings. It gives you the ability to accumulate money for savings while you’re spending for everyday purchases.

And like any good budgeting software, they also offer their Smart Save feature, allowing you to put money away automatically. The Set & Forget feature allows you to pick a specific amount to save so Cleo can make the transfers automatically.

But the most interesting – and amusing – is the Swear Jar, a feature perhaps no other budgeting app has. Cleo “fines you” for spending money where you shouldn’t. The fines go into savings.

Cleo also provides a cashback capability on everyday purchases (more on that below under Cleo Build Credit). Meanwhile, your account will come with a Cleo Wallet. That’s where you can hide money from yourself, either by moving cash rewards or regular withdrawals from your checking account into the wallet.

They even provide coaching to help you become a better, more disciplined saver.

Cleo Borrow (Cash Advance/Salary Advance)

Cleo provides their cash advance, at least partially, to avoid relying on high-interest cash advance apps or payday loans. Not only do they not charge interest on their cash advance, but they don’t perform a credit check for eligibility. It’s also worth noting that Cleo does not require proof of employment or income to qualify.

As a first-timer, you’ll qualify for a cash advance of between $20 and $70. Once you pay back your first advance, you’ll be able to access up to $100. Repayment can be between three and 14 days. However, you can request a 14-day extension to repay.

That may not be much of an advance; after all, some other apps advance as much as $200. But it’s not a bad deal when you consider it’s interest-free and doesn’t require pulling your credit for eligibility.

The advance is available with Cleo Plus and Cleo Builder, each requiring a monthly subscription fee. If you need an express transfer, there is a $4 fee for each transfer. But you can avoid that by using the ACH option instead.

While most applicants are immediately approved for the cash advance, not everyone will be. It’s mostly a matter of having money in your account and demonstrating your ability to stay within your budget.

Cleo Build Credit

Cleo offers their Credit Builder Card to help you build or improve your credit score. What makes it such an advantage for so many is that Cleo does not run a credit check. That will allow you to rebuild your credit, even if you have a poor credit score.

The Cleo Build Credit is a Visa card that doesn’t charge interest. But you will need a Cleo Builder subscription that entitles you to cash advances, cashback rewards, and priority support. You can even use the card to pay bills and subscriptions.

The card can also provide you with an advance of up to $120 per advance. If you use the advance, there will be a fee of $2.50 per transaction. If you take advantage of the advance, you’ll be limited to $300 per day, $400 per week, and $600 per month. However, you cannot access more than 90% of your credit limit for the advance.

You may also be eligible for up to 7% cash back (with a Cleo Plus premium subscription). Cleo will provide offers, street rewards, and cash when you shop with your regular merchants.

Be aware that it is a secured credit card, and you will never be able to spend more than your deposit amount. But it will help you build credit because Cleo reports your payment history to all three major credit bureaus each month. That will help you gradually build or improve your credit score, which is the card’s primary purpose.

And along that line, Cleo enables you to keep track of your credit score within the app.

The (Cleo) Game

Cleo is dedicated to making financial management easy and fun. Part of the way they make this happen is with The Game.

Each week, Cleo gives you a quiz about your money, mostly how you spend it. You’re given a series of multiple-choice answers. The quiz takes place only on Saturdays and is designed to help raise awareness about your spending.

But you can also win money, which could be as much as $10 or even $20. You may not receive any cash even if you get all the questions right. Cleo portions out the prize money, which means not everyone participating in the quiz gets the cash.

Cleo Side Hustles

As part of their blog, Cleo has a section dedicated to side hustles. These are accounts, usually personal stories, of people making extra money and how they’ve made it happen. You may find an idea that works for you or at least inspiration to get your own side hustle going.

Cleo Money Hacks

Much like Cleo Side Hustles, Cleo also offers a blog dedicated to ways to save money. After all, budgeting will be more effective if you add cost-cutting to better money allocations.

Clear provides multiple blog posts on a variety of topics on saving money.

How Much Does Cleo Cost?

Cleo is free to download and use. But they do have a premium version, Cleo Plus. It comes with a monthly subscription of $5.99, which will automatically be withdrawn from your checking account each month.

With the premium version, you’ll be able to take advantage of Cleo cash advance to avoid overdrafts, payday loans, or other expensive short-term financing.

It will also give you access to up to 7% cash-back rewards. As you earn cash back, Cleo deposits it to your Cleo Wallet. In addition to cash back rewards, you can also move regular amounts into the wallet from your checking account.

The Cleo Credit Builder program is also subscription-based. The fee is $14.99 monthly and entitles you to cash advances and cash back rewards.

How Does Cleo Make Money?

This is a common question consumers have with any free service and a good one to ask. After all, if the service is free to use, it may not be around for very long.

But Cleo makes its revenue from the Cleo Plus and Cleo Builder subscription fees, as well as from venture capital funding. Like other fintech startups, Cleo uses makes use of venture capital.

How to Sign Up for Cleo

Signing up for Cleo is easy. You can download the iOS version from The App Store or the Android version from Google Play.

To sign up, you must be at least 18 years old, have a valid Social Security number, and provide your birthdate and address. You don’t need to be a US citizen to apply for the app.

There is no charge to download the app, but a monthly $5.99 fee will apply if you sign up for the premium service, Cleo Plus, or $14.99 for Cleo Plus.

Cleo Pros & Cons

Pros:

- user-friendly question/answer format that speaks to you in casual language

- Built-in credit builder capability

- Cleo Visa card provides up to 7% cash back on selected merchandise

- Recommendations for building additional income sources and cutting expenses

- A free version is available

Cons:

- The Cleo Wallet is not interest-bearing, nor is the balance guaranteed

- The Game may be fun to play, but the promised prize money doesn’t always arrive

- Cleo currently cannot accommodate joint spending accounts

Cleo Alternatives

Though there are no financial apps that do exactly what Cleo does, there are several that come close or provide different service levels.

You Need a Budget (YNAB) is a true budgeting service and perhaps the best standalone budgeting app. They use four “rules” designed to help you get ahead of your finances, putting you in a better position to save money and pay off debt.

YNAB is a premium service, one likely to save you several times more than the annual fee they charge. And despite the fee, YNAB is regarded as one of the best straight-up budgeting apps. For more information, check out our full YNAB review.

Personal Capital isn’t particularly strong on budgeting, but they offer a free financial account aggregator service that works much the same. You’ll be able to see and manage all your accounts directly from the Personal Capital platform.

Where they’re really strong is investing. The free service also offers retirement assistance and investment fee analysis. And if you have at least $100,000 to invest, Personal Capital provides one-on-one investment management at a lower fee than traditional professional investment managers. Read our Personal Capital review for more details.

Acorns doesn’t provide budgeting capabilities, but it does enable you to invest money – after helping you to save up the funds needed to do it. That’s the basic job a budgeting service does or should do. Like Cleo, they use spending round-ups and transfer the money into your savings, where you can invest it.

But you can also make regular, direct contributions to your account. The funds will be invested in a diversified, fully managed investment portfolio. It’s the perfect service for anyone who cannot save and invest in the past and wants to start immediately. Find out more in our Acorns review.

The Bottom Line on Cleo

If you’re serious about taking control of your finances, but that control has escaped you up to this point, it’s time to get serious about finding the right budgeting app. So, how does Cleo stack up?

YNAB has superior budgeting capabilities, and I would recommend it over Cleo if budgeting is your primary goal. At $14.99 per month ($98,99/year), YNAB is expensive, so you might also consider Mint, one of the best free budgeting tools you’ll find, with many features.

On the other hand, if you’re searching for a tool that can help you in several areas: budgeting, saving and building credit, and you prefer an app that’s interactive and fun to use, then Cleo is worth a look.