Thinking about opening a bank account with Citi® and want to know what their best promotional offers are?

You are in the right place!

As banks compete with one another for your business, a lot of them are turning towards cash bonuses. Considering how complicated our finances are, changing banks is not easy. You have to change so many things and if you make a mistake, late fees can be quite expensive. That’s why you should be paid for your time to change and this post will help you understand the bonuses that Citi offers for new accounts. (also, review our guide on bank account bonuses to know what to watch out for)

Citi is one of the oldest and largest banks in the world. They have a fully-featured app that lets you link non-Citi accounts, deposit checks, and 24/7 fraud protection. The bonus is just the cherry on top of what is a very large and established bank with a large geographic footprint.

They currently have two types of offers:

- A $300 offer if you have a direct deposit

- An up to $2,500 if you don’t but have a large balance to transfer

Read on to learn about the different cash bonuses available when creating a new account with Citi.

Table of Contents

- Citi Checking with Enhanced Direct Deposit — $300

- Citi Checking Account — up to $2,500

- Citigold® Checking Account — up to $2,500

- Citi Savings Account — up to $3,500 [EXPIRED]

- Citi Self Invest – up to $500

- Citi Personal Wealth Management – up to $5,000

- Citibank Routing Numbers by State

- How Do These Bonuses Compare?

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Citi Checking with Enhanced Direct Deposit — $300

Citi Checking with Enhanced Direct Deposit $300 Bonus Summary

- What you get: $300 cash bonus

- Who qualifies: Nationwide

- Where to open: Online

- How to get it:

- Open a Citi Checking with Enhanced Direct Deposit account,

- Next, have two (2) Enhanced Direct Deposits directly into your new checking account within 90 calendar days from account opening. Your total combined Enhanced Direct Deposits must equal $1,500 or more

- Transfers from Zelle and Venmo count as Enhanced Direct Deposits!

- Collect $300 after you complete the required activities.

- When does it expire: 7/8/24

Citi Checking with Enhanced Direct Deposit is a limited time offer where you can get a $300 bonus when you open an eligible checking account by 7/8/24 with qualifying Enhanced Direct Deposits and completing required activities.

What are the required activities? I’m glad you asked!

You qualify for the bonus when you have two (2) Enhanced Direct Deposits directly into your new checking account within 90 calendar days from account opening. Your total combined Enhanced Direct Deposits must equal $1,500 or more.

What is an Enhanced Direct Deposit? “An Enhanced Direct Deposit is an electronic deposit through the Automated Clearing House (“ACH”) Network of payroll, pension, social security, government benefits and other payments to your checking or savings account. An Enhanced Direct Deposit also includes all deposits via Zelle® and other P2P payments when made via ACH using providers such as Venmo or PayPal. Teller deposits, cash deposits, check deposits, wire transfers, transfers between Citibank accounts, ATM transfers and deposits, mobile check deposits, and P2P payments using a debit card do not qualify as an Enhanced Direct Deposit.”

To be eligible, you must have have owned a Citi checking account in the last 365 days, meet Tax Requirements, and are at least 18 years old. There is a monthly fee that is waived if you have $250 or more in Enhanced Direct Deposits each month (there are other ways to get it waived too).

Your bonus will be deposited into your account within 30 days of completing the required activities.

Reader Experiences with the Citi Checking with Enhanced Direct Deposit offer

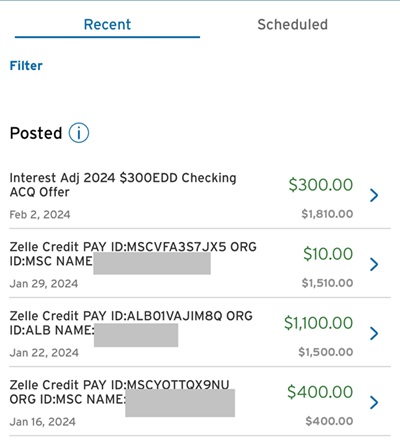

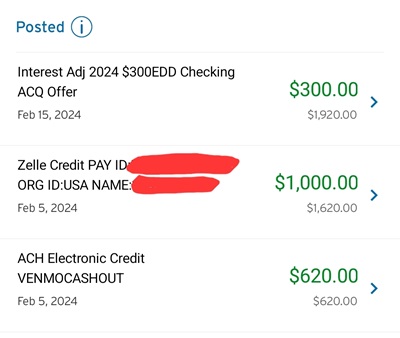

We’ve had several readers email us with how easy it was to qualify for the Citi Checking with Enhanced Direct Deposit offer shown above.

Since you can use Zelle and Venmo to trigger the direct deposits (Citi explicitly states it accepts them, they are “enhanced”), and because Citi is so quick with paying out the bonus, we’ve had people open an account, make two transfers, and get the bonus all in just a short period of time.

We’ve had some readers make both transfers on the same day and get the bonus a couple days later, like this one:

It might be good to wait a day or two if you’re concerned but it doesn’t seem like you need to be.

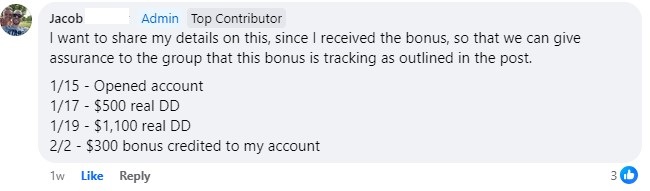

The above Facebook message says:

I want to share my details on this, since I received the bonus, so that we can give assurance to the group that this bonus is tracking as outlined in the post.

1/15 – Opened account

1/17 – $500 real DD

1/19 – $1,100 real DD

2/2 – $300 bonus credited to my account

Citi Checking Account — up to $2,500

The Citi Priority Account has a juicier bonus but a higher minimum balance requirement. To get up to $2,500 from Citi, you’ll have to open a new eligible checking account and:

- Within 20 days of opening, deposit the minimum amount of new-to-Citi funds.

- Maintain a minimum balance for 60 consecutive calendar days from the 21st day.

- If your balance falls to a lower tier at any point during the maintenance period, the bonus changes.

- Bonus will be paid within 30 days after you successfully complete all required activities.

The amount of the bonus, is based on the amount you deposit according to this schedule:

| Minimum Deposit And Minimum Balance | Cash Bonus |

|---|---|

| $30,000 – $199,999 | $500 |

| $200,000 – $299,999 | $1,500 |

| $300,000 and above | $2,500 |

For example, if you deposit $50,000 and maintain it for 60 days, you get $500.

Member FDIC.

Citigold® Checking Account — up to $2,500

If you’ve been interested in a Citigold® Checking Account, you’ll want to hear about this welcome bonus.

Just open a Citigold® Checking Account and deposit $30,000 or more in New-to-Citi funds in eligible linked accounts within 20 days and then maintain that balance for 60 days following the 21st day. The bonus gets higher the more you deposit.

It’ll be deposited into your account within 30 days. We list this one last, despite being such a high bonus amount, because it requires a lot of cash for the highest bonus amount.

So long as you have not owned a Citi checking account in the last 180 days, are at least 18 years old, and furnish or have a valid Form W-9 or Form W-8BEN on file with Citi® and are not subject to backup withholding, you can participate in the Welcome Checking Cash Bonus Offer in select markets.

They expanded the bonus structure to:

| Minimum Balance | Cash Bonus |

|---|---|

| $30,000 – $199,999 | $500 |

| $200,000 – $299,999 | $1,500 |

| $300,000 or more | $2.500 |

Citi Savings Account — up to $3,500 [EXPIRED]

The Citi Savings ccount offer has returned, this time with a bonus that is truly eye-popping if you have a cool million sitting around the house.

This is available to existing Citi customers:

- Open a new eligible Citi Savings Account account by 10/3/2022.

- Fund your account with the required minimum deposit in New-to-Citi® Funds within 20 days of opening your account.

- Keep the required minimum balance for 60 consecutive calendar days after the 21st day.

- Get your bonus deposited to your account!

The bonus is based on how much you deposit into the account:

| Minimum Deposit & Minimum Balance | Cash Bonus |

|---|---|

| $10,000 – $29,999 | $40 |

| $30,000 – $49,999 | $100 |

| $50,000 – $99,999 | $200 |

| $100,000 – $249,999 | $400 |

| $250,000 – $499,999 | $800 |

| $500,000 – $999,999 | $1,750 |

| Over or Equal to $1,000,000 | $3,500 |

You must be a resident of NY, CT, MD, VA, DC, CA, NV, NJ, FL or IL.

Learn more about this offer

(Offer expires 10/3/2022)

Citi Self Invest – up to $500

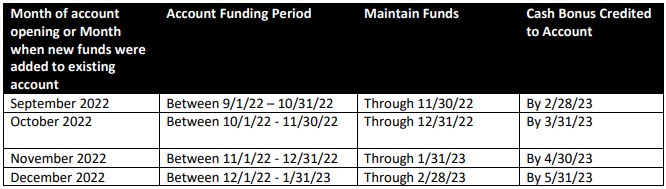

Citi Self Invest is an investment account that offers up a bonus based on how much you put into the account. You have to fund a new or existing Citi Self Invest Account by 1/31/2023 with at least $10,000 in new-to-Citi funds. Then maintain that amount through a deadline based on the schedule below:

The bonus is based on your funding amount:

| New-To-Citi Funding | Cash Bonus |

|---|---|

| $10,000 – $49,999 | $100 |

| $50,000 – $199,999 | $200 |

| $200,000 or more | $500 |

Citi Personal Wealth Management – up to $5,000

If you are looking to open a new or existing Citi Personal Wealth Management account, you can get up to $3,500 when you make a deposit of at least $50,000 in new-to-Citi funding.

Here are the four steps:

- Contact us to open and enroll in a new or existing eligible Citi Personal Wealth Management account by 9/30/2023.

- Fund the Citi Personal Wealth Management account with New-To-Citi Funds within 2 months of account opening or funding of your existing account.

- Enroll the new or existing Citi Personal Wealth Management Account into e-delivery of statements within 2 months of account opening or funding of your existing account.

- Maintain the new funding through the end of the following month (or 3 months after the month of account enrollment).

The bonus amount is based on the total amount you deposit:

| New-to-Citi Funding | Cash Bonus |

|---|---|

| $50,000 – $199,999 | $500 |

| $200,000 – $499,999 | $1,000 |

| $500,000 – $999,999 | $2,000 |

| $1,000,000 – $1,999,999 | $3,000 |

| $2,000,000+ | $5,000 |

Citibank Routing Numbers by State

Do you have a Citi account and just need your ABA routing number?

The easiest way is to find one of your checks and find the routing number on the bank (it’s the nine digit number at the bottom).

If you don’t have a check, here they are broken up by state:

| State / Region | ABA Routing Number |

|---|---|

| Northern California – incl. San Francisco & Central California | 321171184 |

| Southern California – incl. Los Angeles & San Diego | 322271724 |

| Connecticut | 221172610 |

| Florida | 266086554 |

| Illinois | 271070801 |

| Maryland | 052002166 |

| Nevada | 322271724 322271779 321070007 |

| New Jersey | 021272655 |

| New York | 021000089 |

| Pennsylvania | 021272655 |

| Texas | 113193532 |

| Virginia | 254070116 |

| Washington D.C. | 254070116 |

How Do These Bonuses Compare?

If you’re talking strictly bonuses, it’s comparable to current Chase checking offers. Chase Bank will give you a bonus of $200 if you open a Total Checking Account. The new cash requirements are a little trickier to compare but for Chase, you need to bring $10,000 to the savings for 90 days. No such requirement for checking. With checking, you need to set up a direct deposit.

The requirements to waive the monthly fee on those accounts are comparable – set up a direct deposit of $500 or more or keep a minimum daily balance of $1,500 in checking or keep an average daily balance of $5,000 in all your accounts. You also cannot close the account within 6 months of opening or you forfeit the bonus.

Barclays – $200

Barclays Bank will give you a $200 if you open a new savings account and deposit $25,000 or more within 30 days and maintain at least $25,000 for the next 120 days. The savings account also pays a competitive interest rate of 4.35% APY while you wait.

BMO Relationship Checking – $400

BMO Bank is offering a $400 bonus* when you open a BMO Relationship Checking and when you have at least $7,500 in qualifying direct deposits within the first 90 days. It is a very straightforward offer that is available nationwide.

*Conditions apply

Bank of America – $200 Bonus Offer

Bank of America offers a $200 Bonus Offer cash bonus if you open a new account and Set up and receive qualifying direct deposits totaling $2,000 or more into that account within 90 days of account opening. It has a monthly fee that is easy to have waived.

Chase Total Checking® – $300

Chase Bank will give you $300 when you open a Total Checking account and set up and receive direct deposits totaling $500 or more within 90 days. There is a $12 monthly fee that is waivable with a monthly direct deposit of just $500, so no gotchas on this deal!

HSBC Premier Checking – up to $4,000

HSBC has an offer where you can get up to $4,000 for eligible new customers who open an HSBC Premier checking account, make a sizable deposit, and make recurring monthly qualifying direct deposits of at least $5,000 for 3 consecutive months.

Buyer beware: We’ve been contacting customer care for months trying to get our Citi Priority bonus. They’ve told us that we qualify for it, but they’re unable to release the bonus because they haven’t received our W-2 form. They give us an address to send the W-2 (at our own expense), and we mail it to them. But the next time we call, they claim that they never received it, and we need to send it again (at our own expense again). I’m giving them one more chance. Our next step will be to file a complaint with the Federal… Read more »

File the complaint. They jerked me around once on a bonus, but of miles and not money. Once I filed the complaint they sang a different tune.

Ask for a fax number or take a picture of your W-2 form and send it to them through secure messaging on your online Citibank account. That channel is theirs, is secure, and there are time stamps for when you send it. They should see it within however long it takes their customer service or imaging dept to see it, which for large financial firms is usually like 2-3 business days (my estimate). Sen it thru there, then call them and ask them to look for it there. They should be able to find it. But the point is, it… Read more »

it’s actually 150 days on the citi. I just opened one and am STILL trying to get a straight answer. I DO THINK it’s like this:

1. open the accounts and put 50K in.

2. Maintain that balance or greater for 60 days.

3. After 60 days you STILL HAVE to leave it open but it can go below the 50K threshold.

4. At the end of 150 days you will receive your 700 bonus.

@ Kenneth F. LaVoie III, you are correct. I opened a Citibank Account Checking and Savings package. I funded it with $15,000 b/w both accounts right away to get the clock started: 60 days to keep the $15k in there and then another 90 days to receive the $400 bonus. On 6/3/20, I funded the accounts with $15k ($14975 in Savings to get more interest, and $25 in Checking b/c that was the minimum required to open the Checking account). Then on 8/4/20, I called Citi and verified with a rep that about 63 calendar days had passed, and I… Read more »

Can you close your account and then do this again in a year?

There are typically restrictions on how many bonuses you can receive in a period of time. The terms for Citibank are usually that you can’t be a signer on a Citibank checking account within the past 180 days.

It’s under “Eligible Customers” in the terms and conditions at the bottom of the page – double check that before you sign up because that may have changed since I wrote this comment.

I did the Capital One offer. LOVED IT! My $400 bonus hit right on time with no hiccups at all!!

I’m almost certain I will keep the account. I love the online banking platform – I love the electric external transfer functions – and I love how i can seamlessly pay my CapOne cc payments!

CapOne is the way to go!

I have never had any trouble with Citi Bank. I have a promo with them now. I get it every year.

My wife and I opened separate accounts at Citibank at the 50K level each. There were no hiccups and the $700 bonuses were paid to each of us when they were due. No problems.