CIT Bank is a bank that I discovered a few years ago after learning how expensive wire transfers were. Very few banks offer it for free and some charge as much as $50 to send and receive wire transfers.

CIT Bank is one that charges no incoming wire transfer fee and $10 for outgoing wire transfers if your balance is less than $25,000. If your balance is more than $25,000, the wires are free. $10 is already a relatively cheap fee but free is free!

Anyway, you’re not here for that – you’re here to learn whether CIT Bank has a bonus and the details of that bonus. I’m happy to report they have an active promotion going on right now and it’s pretty good.

Table of Contents

Who is CIT Bank?

CIT Bank is now a division of First Citizens Bank after the two completed their merger in early 2022. They’re a nationwide bank and so there are no geographic restrictions as to who can open an account with CIT Bank. They are FDIC insured, like every other bank listed on this side.

We have a review of CIT Bank if you want to learn more.

From time to time, CIT Bank offers a variety of promotions for their accounts. I’ve found them to be pretty generous and so I jumped on a promotion for their Savings Builder account a while back.

Today, we have a promotion for their Money Market account and it appears to be available for new and existing customers.

Editor’s Note: As of December 24th, 2022, CIT Bank is no longer offering this new account bonus. For other bank bonuses, check out our post on the best bank bonuses and promotions or click here to sign up for our email newsletter and get notified of new bank promotions. We will update this post with the new details when they are made available.

How to Get Free Amazon Prime Membership ($139) from CIT Bank [EXPIRED]

The promotion is pretty easy:

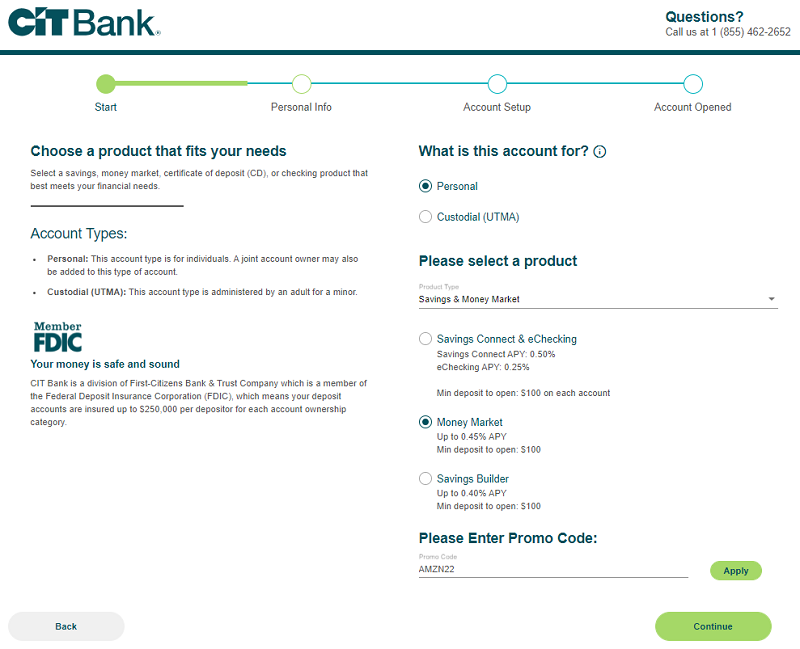

- Open a new CIT Money Market account using the promo code AMZN22;

- Fund your account with at least $15,000 within 15 days and keep a minimum balance of at least $15,000 for 60 days following the 15-day funding period.

- Within 30 days following the end of the funding period, if you’ve fulfilled the requirements, we’ll send you an email with your Prime membership code.

This promotion will work for new and existing Amazon Prime customers. If you have an existing membership, the code can be used to renew your membership for an extra year.

It appears that existing CIT Bank customers can do this promotion – you just have to open a new Money market account and fund it with new-to-CIT Bank funds. Fortunately you can have multiple accounts.

The only restriction is that there is a limit of one Money Market promotional offer per account and per customer – which seems fair to me. Oh, and you must redeem it no later than 3/23/2024.

Don’t forget the promotion code!

(Offer expires 12/23/2022)

I‘m an existing CIT Bank customer with a Savings Builder account and I will be trying this out. When I opened my account, I was able to enter the promo code and it didn’t tell me I wasn’t eligible. While that doesn’t mean it worked, it is a promising sign.

How Does This Bonus Compare?

The bonus is for a membership worth $139 on a deposit of $15,000 for 60 days. We use Amazon Prime so we get the full value of the membership and I’m already a CIT Bank customer so it doesn’t add much to any of our financial processes.

I’m a fan of CIT Bank because the offer free outgoing wires when you have a balance of at least $25,000 and so this is just another sweetener on the account. The money market account also offers a decent interest rate (it’s not zero!) so it’s an all around good offer.

If you don’t have a CIT Bank account, the offer is OK.

You may find better ones here:

Barclays – $200

Barclays Bank will give you a $200 if you open a new savings account and deposit $25,000 or more within 30 days and maintain at least $25,000 for the next 120 days. The savings account also pays a competitive interest rate of 4.35% APY while you wait.

BMO Relationship Checking – $400

BMO Bank is offering a $400 bonus* when you open a BMO Relationship Checking and when you have at least $7,500 in qualifying direct deposits within the first 90 days. It is a very straightforward offer that is available nationwide.

*Conditions apply

Bank of America – $200 Bonus Offer

Bank of America offers a $200 Bonus Offer cash bonus if you open a new account and Set up and receive qualifying direct deposits totaling $2,000 or more into that account within 90 days of account opening. It has a monthly fee that is easy to have waived.

Chase Total Checking® – $300

Chase Bank will give you $300 when you open a Total Checking account and set up and receive direct deposits totaling $500 or more within 90 days. There is a $12 monthly fee that is waivable with a monthly direct deposit of just $500, so no gotchas on this deal!

HSBC Premier Checking – up to $4,000

HSBC has an offer where you can get up to $4,000 for eligible new customers who open an HSBC Premier checking account, make a sizable deposit, and make recurring monthly qualifying direct deposits of at least $5,000 for 3 consecutive months.