How big is your emergency fund?

We keep twelve months of expenses as an emergency fund and I’ve often been asked – “what do you do with the money?”

The answer: nothing really.

It has to be 100% safe and 99.999% liquid in case of emergencies so I don’t do anything foolish like stick it in the stock market

When I say nothing, I don’t mean absolutely nothing. It’s currently in a high yield savings account but…

… when it makes sense, I put it in a certificate of deposit ladder, or CD ladder. This was far more effective when interest rates were higher but it’s something you can still do today if the numbers work out.

Table of Contents

What’s a CD Ladder?

It’s a series of certificates of deposit that mature on a monthly basis. They’re each “rungs” on a savings ladder.

When a CD matures, I roll it over into a new 12-month CD. In the event I need my emergency fund, I stop rolling them over and I use the money. Since my emergency fund is based on expenses, each month I have a month’s worth of expenses maturing and being accessible to me. If I am hit with an emergency that is greater than one month’s expenses, I can always close the CDs and take the small penalty. (unless I opted for no-penalty CDs, which offer very attractive rates)

One added benefit to rolling over my CDs is that my bank, Ally Bank, typically offers a bonus interest rate if you renew a CD!

How do I execute this?

In the beginning, it’s really easy. First, find a bank that offers you a high interest rate for certificate of deposits. Right now, the rates aren’t that great across the board so I can’t recommend any particular bank. Ally Bank, which is the one I use, offers 4.25% APY on a savings account but 4.50% APY on a 12-month CD.

With that kind of spread, it makes sense to get more yield by putting the money into a CD.

Another benefit of Ally Bank CDs is that the penalty for closing it early is only 60 days, it’s typically much bigger at any other bank.

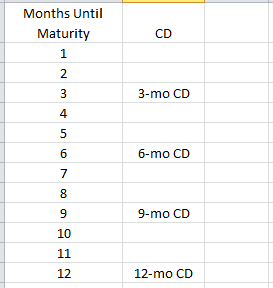

But for the sake of explaining the system, let’s say the rates are favorable and I wanted to get money in as quickly into CDs as possible. I’d put 1-month of expenses into a 3-mo, 6-mo, 9-mo, and 12-mo CD.

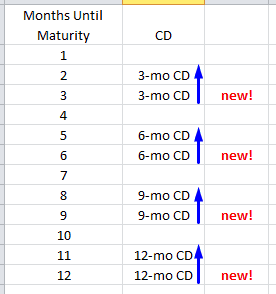

Simple enough right? The following month, I’d do it again. Now I would have CDs with a maturity (in months) of 2, 3, 5, 6, 8, 9, 11, and 12. (new CDs in bold) Last month’s 3/6/9/12 month CDs have all gotten one month older, they are now 2/5/8/11 month CDs.

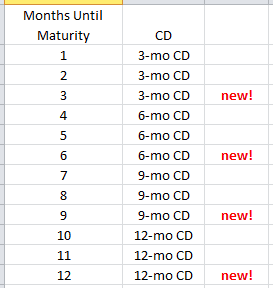

The following month, repeat. Now I have CDs with a maturity of 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12. Now it looks like this:

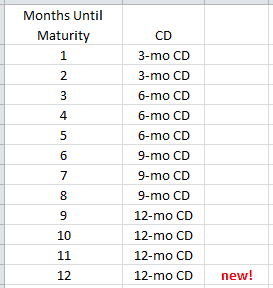

The following month, the first 3-month CD will mature and I put it in a new 12-mo CD.

Eventually, it’s all 12-month CDs (higher yield) but each month matures.

That’s a CD ladder!

You can also invest in brokered CDs if building a CD ladder at your local bank isn’t for you.

Hi Jim. This is very simple but genious. I used to have a few 1-month CDs spread out on different dates and have them automatically roll over monthly. If I need the money, I just find the nearest date and I didn’t get any penalty.

Greetings from Indonesia.

Exactly, it’s great… when rates are better. 🙂

I also use Ally and I can’t recommend them enough. I agree that the .05% doesn’t make sense but for one reason: keeping my grubby paws off of it. When it’s “locked” into a cd, even if the difference is pennies, I’m still less likely to use it for something random unlike my saving account. So I am working on the ladder by buying a single 12 year cd each month out of the emergency savings account. When I’m done I will have the emergency fund mainly in the cds, with a small amount (maybe $1000) left in the fund… Read more »

You make a great point, sometimes it’s not about the interest but more about the psychology of leaving it alone because you “feel” like it’s locked in.

Yep and with Ally it’s literally an online chat and a click to cash it in if something major happens (I cashed one in years ago and it was minutes after cashing it, the money was in my Ally account…I’m sure it would take longer to transfer to a non-Ally account). A final benefit I see to the ladder is that when the CD matures, you can let it roll over automatically, or even bump it a little. So a $500 CD rolls over and in a year its $510 or whatever with the interest…at that time it’s pretty painless… Read more »

Do you have an easy breakdown of how you can eventually turn this CD ladder into a 3 or 5 year ladder? I love the idea of having cash available each month, but would eventually like to extend it further past 1 year CDs.

You just want a ladder that extends into 3 to 5 years?

I want to be able to complete this ladder and then move it into a 3 or 5 and still have the ability to have money available each month.

I have several accounts already with Cap One. I’m interested in building a CD ladder with them BUT they only offer 6, 9, and 12 month CDs. Is there a way to tweak this formula without the 3 month or should I get a 3 month CD elsewhere ?

Thanks

Scot

You could get a 3 month CD elsewhere but with rates so low, it might be worth opening a new account solely for it.

Great information. Thank you for explaining and breaking it down. I had only seen yearly ladders and knew that would not work for an emergency fund. Your example is perfect.