A few years ago, Capital One launched a new online savings account called 360 Performance Savings?

When they announced it, I was puzzled.

They already had a savings account. Why did they make a new one? That’s when things got a little tricky.

I had a few accounts with Capital One but they all were legacy ING Direct accounts. Capital One acquired ING Direct in 2012 and when the accounts migrated, I kept them. I was tempted to close them when I went through a big personal finance simplification phase, but I continued to use one as a bank account firewall with PayPal. It served a purpose, paid a competitive interest rate, so I left it alone.

But then a few years later, Capital One introduced the 360 Performance Savings, and now it’s time to pay attention.

🚩 If you had an existing Capital One 360 Savings account, they did not automatically move you over to the new account. You are earning a very low interest rate until you change accounts.

Table of Contents

- What is Capital One 360 Performance Savings?

- How to Convert Your Account from 360 Savings to Performance Savings

- Capital One 360 Performance Savings — up to up to $1,500

- How to Close Your Account Online

- Alternatives to the Capital One 360 Performance Savings

- Discover Bank Online Savings Account

- CIT Bank Savings Connect & Savings Builder

- Apple High-Yield Savings Account

- Should You Open This Account?

What is Capital One 360 Performance Savings?

It’s Capital One’s name for their high-yield, no-fee online savings account.

You get an interest rate of 4.25% APY with no minimums. Your funds are FDIC insured up to $250,000, there’s a mobile app, and you can open it online in just a few minutes. It’s a pretty run of the mill online savings account.

When Capital One started offering this “new” type of account, they took away their 360 Savings Accounts and 360 Money Market Accounts. It’s now Performance Savings only.

If you’re an existing Capital One 360 Savings customer, it’s pretty much the same as before except you get a higher interest rate with the new account type.

Money market accounts have been falling out of favor in the last decade or so. In the past, they were useful because you could earn a higher interest rate and still have more than six transactions/transfers per month. Nowadays, with online banking and credit cards, there really isn’t a useful place for your traditional money market account. It’s no surprise that Capital One did away with it.

How to Convert Your Account from 360 Savings to Performance Savings

There doesn’t appear to be a single button you press to convert an existing 360 Savings Account into a Performance Savings account.

You will have open a new Performance Savings account, transfer all of your funds from the 360 Savings to the Performance Savings, and then close your 360 Savings account.

Fortunately, opening a new account is simple, takes about five minutes. Capital One prepopulates most of your information, and you just have to enter your employment title and salary and check off a few disclosure statements. You can even do it on a weekend (I did it on a Sunday).

Presto – nearly double the APY. It won’t be a ton of money, but it’s like picking up a quarter on the sidewalk.

Sadly, the Capital One 360 Performance Savings new account promotion has ended. We keep the information below so you know what it used to be, just in case it comes back.

There is, however, a bonus for a 360 Money Market Account – details after the Performance Savings offer information.

Capital One 360 Performance Savings — up to up to $1,500

Capital One 360 up to $1,500 Performance Savings Account Summary

- What you get: up to $1,500 cash bonus

- Who qualifies: If you have or had an open 360 Performance Savings, 360 Savings, 360 Money Market, Savings Now or Confidence Savings account as a primary or secondary account holder with Capital One on or after January 1, 2021, you will be ineligible for the bonus. If your account is in default, closed or suspended, or otherwise not in good standing, you will not receive the bonus.

- Where to open: Online

- Promotion code: BONUS1500

- How to get it:

- Open a Capital One 360 Performance Savings Account,

- Next, deposit at least $20,000 in new funds into the account during the 15-day initial funding period and keep it there for an additional 90 days

- When does it expire: not listed

The bonus is based on the deposit amount:

- Earn a $300 bonus when you deposit $20,000 – $49,999,

- Earn a $750 bonus when you deposit $50,000 – $99,999,

- Earn a $1,500 bonus when you deposit $100,000 or more.

If you have or had an open 360 Performance Savings, 360 Savings, 360 Money Market, Savings Now or Confidence Savings account as a primary or secondary account holder with Capital One on or after January 1, 2021, you will be ineligible for the bonus. If your account is in default, closed or suspended, or otherwise not in good standing, you will not receive the bonus..

Learn more about the offer

(Offer expires not listed)

How to Close Your Account Online

Unfortunately, this no longer works. You have to call in.

First, log into your account as normal… then visit this link to access the old interface:

https://secure.capitalone360.com/myaccount/banking/account_summary.vm

(copy and paste it in the browser after you log in)

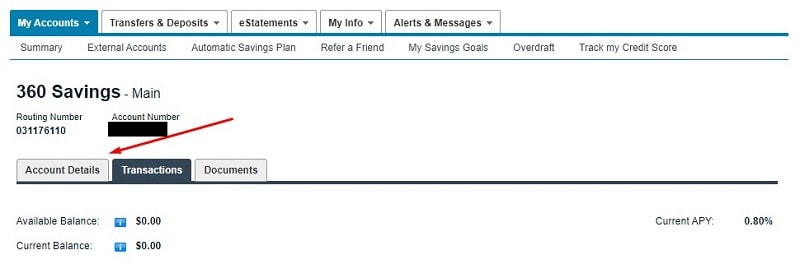

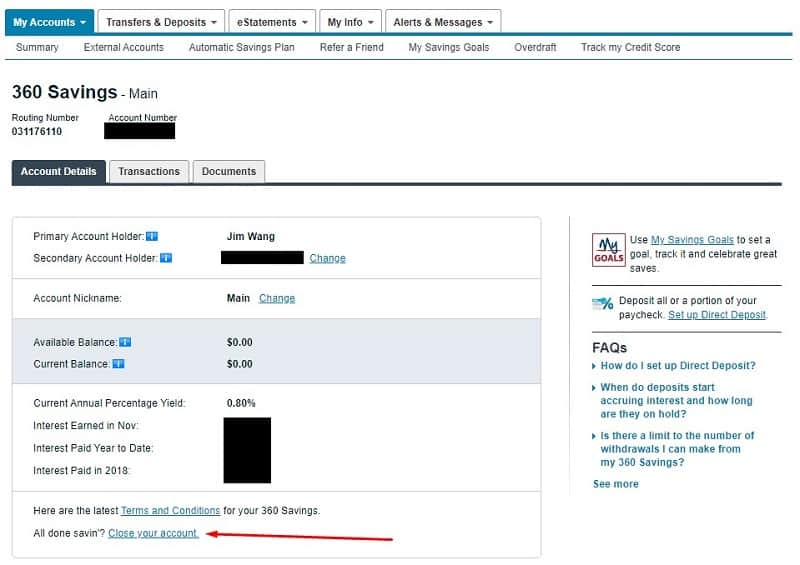

Then click on your account name in the list, followed by “Account Details” tab underneath your Routing Number and Account number. The site defaults to your list of transactions.

Then click on “Close your account” at the bottom:

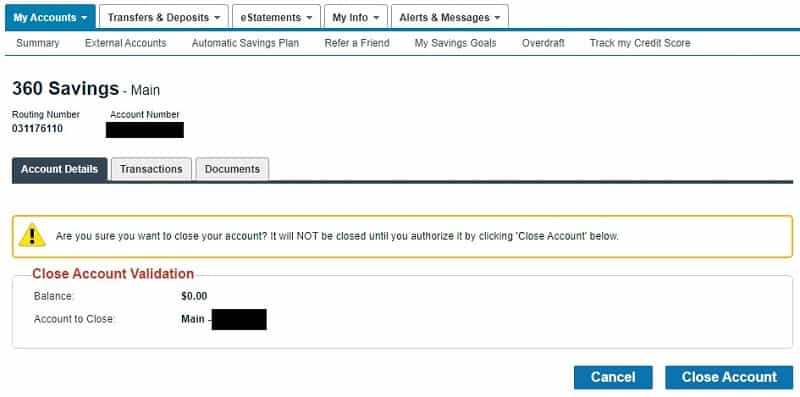

There’s a confirmation screen but then you’re done:

Alternatively, you can call customer service to close your account. In the past, I’ve had success using the online chat to close an account too.

Alternatives to the Capital One 360 Performance Savings

There’s plenty of competition out there for the best savings accounts, with online banks like CIT offering high APYs and even other tech companies like Apple entering the finance space. Here’s how Capital One’s 360 Performance Savings compares to some of the most popular products out there.

Discover Bank Online Savings Account

Discover’s Online Savings Account also comes with no monthly fees, no minimum opening deposit, and the same APY as Capital One (4.25% APY, as of publishing). It’s also easy to open an account with Discover online — no in-person bank visit necessary.

For all these reasons, Discover’s product is equal to Capital One, and choosing between the two comes down to personal preference or whether either is offering any kind of sign-up promotion.

Read our full review of Discover.

CIT Bank Savings Connect & Savings Builder

CIT Bank offers two separate savings account options, the Savings Connect and the Savings Builder. The Connect product is far superior and even beats Capital One and Discover, with a 4.65% APY as of publishing. While there is an account minimum of $100, there are no monthly maintenance fees.

The Savings Builder is decidedly less impressive, with a tiered rate of 1.00% APY if your account is below $25,000. And once you deposit more than that, the rate drops to an abysmal 0.40% APY.

If you’re looking for the highest interest rate, CIT may be a better option for you than Capital One — just remember you’ll need to keep a minimum of $100 in there and you want to be sure to open the Savings Connect, rather than the Savings Builder.

Read our full review of CIT Bank.

Apple High-Yield Savings Account

Apple (yes, the computer company) launched its own savings product in April 2023. Like Capital One, it has no fees and no minimum balance requirements. Also, like Capital One and other banks, Apple’s High-Yield Savings Account is FDIC-insured, meaning your money is protected up to $250,000, just as it would be with any traditional bank account.

However, Apple’s interest rate is lower than the competition, currently at only 4.15% APY as of publishing. Another caveat is that you must have an Apple credit card to access the savings account. That said, if you do have an Apple Card, you benefit from being able to automatically add the 3% cash back from purchases directly to your High-Yield Savings Account.

Read our full review of the Apple High-Yield Savings Account.

Learn more Apple High-Yield Savings Account

Should You Open This Account?

If you don’t have an existing Capital One 360 Savings account, does it make sense to open a 360 Performance Savings?

Its interest rate is competitive, especially when compared to other popular savings products, like Discover’s Online Savings, CIT’s Savings Connect, and even Apple’s High-Yield Savings.

However, I don’t feel like there’s a ton of added value with this account. For example, if you open an Ally Bank account, you get a 4.25% APY interest rate plus the ability to link up an Ally Invest account. Ally Invest is a brokerage account that gives you free trades on all U.S. stocks, ETFs, and options. (they also run cash bonuses for new brokerage accounts)

SoFi Money is a cash management account that pays 4.60% APY (unlocked with direct deposit or by depositing $5,000+ every 30 days, otherwise 1.20% APY) but also has SoFi Invest, another no commission stock brokerage. They’ll also give you up to $300 when you receive qualifying direct deposits totaling at least $5,000, no maintenance fee – our full list of SoFi promotions is here.

I’ve always been a fan of how convenient it is to open accounts and manage savings goals with Capital One but I’m not sure it’s a good option if you’re opening a new account.

How will interest be calculated if I move my two savings accounts over from the old Capital One savings account to this Performance Savings account today? I’m thinking it’s probably safer to move the money over on Friday, Nov 1st, so that I’m not giving up 28 days of interest.

You wouldn’t give up interest, it would still be credited to the other (older) account. Any interest after the fact would still make it to you.

Is there any chance of ´losing ´money in the process of going through the hassle of closing old 360 savings accounts and opening the 360 performance savings? I mean I have several 360 savings and hate the hassle, I only want to open one performance savings and do not know if I am required to close all the others?

Joanne

You don’t have to close anything but if you close them you are still paid the interest you were due. There are no minimum balance requirements so you can keep them open and close them after the interest is paid.

Thank you for the information on Capital one 360 savings account I will definitely take advantage of that opportunity.

Regina Channelle

Can’t add a joint holder to the Performance Savings, have to call on the phone, wait, and then it is still a PITA. Not sure why can’t do online like other places. CapitalOne had turned a good ING product into crap. Plus very incompetent customer service. I’m looking for a new bank after 15 years there starting with ING.

Thanks for the heads up on this. I had 3 CapitalOne 360 savings accounts that weren’t converted to Performance Savings. Just opened the Performance Savings after reading your post, transferred all the funds over and then closed the 3 old ING/Capital One accounts. To close the accounts I found an old workaround via YouTube where you can login to your account in the previous 360 interface, go to account details and click “close account” to close your old accounts. Piece of cake. 5-10 minutes total to open the new account, transfer funds and close the old ones. Gave me a… Read more »

How do you access the previous 360 interface?

You just login to your CapitalOne360 account, then go to the old URL:

https://secure.capitalone360.com/myaccount/banking/account_summary.vm

Once you’re in the old interface just click on the account you want to close, click on “account details” tab, and then click the “close your account” link at the bottom of the page.

YOU JUST BLEW MY MIND!

Thank you so much for this information. The ability to access the old interface and close accounts was awesome. I’m another of those who loved ING and just deal with capital one. This has been so helpful for my yearly financial tidy.

You’re welcome, thank Pete because he saved us all a lot of time!

I wouldn’t close old accounts until a month goes by, to make sure you get your last monthly interest posted?

You could do that to be absolutely sure but on the 360 Performance Savings Disclosure, there is a section governing what happens if you close your account:

Effect of Closing an Account – You will receive the accrued interest if you close your account before interest is credited.

It’s unclear how they will credit you though, but I suspect if you had an open account with them then they’d use that. Otherwise, they send it to your state’s abandoned property division.

You wrote: “Capital One prepopulates most of your information and you just have to enter in employment title, salary, and check off a few disclosure statements.” I have an existing Capital One MM account and was thinking of transferring my funds over to the new Performance account. This is a savings account, what business is it of Capital One what my employment status is and what my income is? I am not asking for credit or a loan here, I’m the one giving them funds. What if a person is disabled, retired, or unemployed? Is that really any business of… Read more »

I don’t know why they need it, it could be regulations require them to ask but I doubt an answer would change the outcome.

Is the 1.8% fixed or variable (where it will/could change every few months)? I have a 360 Money Market, opened 6 months ago, $100K. I repeatedly asked when opening the account of the 2% was variable. I was told that 2% was the rate that would be paid on this account, by the woman opening the account for me. In the last month the rate went to 1.8% and is now 1.7%. Probably my fault for not reading the fine print before establishing the account and relying on the bank employee, the fine details say the rate is variable and… Read more »

It’s variable, all savings accounts are variable. To get fixed, you need to put it in a CD.

They have nice incentive to open a 360 Performance Savings Account. $200 plus a better than average 1.8% rate is really nice. Closing my Discover Savings and moving the money over to Capital One.

Where is that $200 incentive to open a 360 Performance Savings account?

Use the code SAVE1000 to earn the $200 bonus.

Restrictions on $200 bonus. Existing customers do not qualify. To earn a bonus, open a 360 Performance Savings account between 12:00 a.m. ET on October, 15, 2019, and 11:59 p.m. ET on December 31, 2019. If you have, or had, an opened savings account with Capital One on or after January 1, 2016, then you’re ineligible for the bonus. Your account must be funded with at least $10,000 in new money for the $200 bonus or $150,000 or more in new money for the $1,000 bonus from an external bank within the first 10 days of account opening (Initial Funding… Read more »

We just noticed this today when checking our account with them. Called and spoke to a rep who said they allegedly tried to notify existing customers of these changes. Their email never made it to us as well as many others that have not made it the last year or so. Promptly transferred the funds to our local bank who, after reading their latest offerings, has almost as good a rate and NONE of the hassle. And, we get their emails every week! Goodbye Capital One

As of 1/16/2020 the money market rate is down to 1.50%, the performance savings rate is 1.70%. Is there any reason to keep the money market open with with a smaller amount while transferring the bulk to to performance savings? Would there be any reason to think that in the future the money market rate would be greater than the performance savings rate?

I think this type of “optimization” may not be the best use of one’s time – we’re talking fractions of pennies on the dollar. I’d take the highest interest rate available now and focus on other areas.

What happens to legacy CO 360 checking accounts and their CO 360 debit cards if you transfer everything from your INGDirect account to the new CO 360 Performance Savings account and then close the legacy INGDirect\CO 30 Savings account?

Do you also have to close the CO 360 checking account and debit card and open a new checking account and get a new debit card?

Thanks!

If you close the old accounts, they’re likely to be disabled and unusable since the account will be closed.