A few years ago, Capital One launched a new online savings account called 360 Performance Savings?

When they announced it, I was puzzled.

They already had a savings account. Why did they make a new one? That’s when things got a little tricky.

I had a few accounts with Capital One but they all were legacy ING Direct accounts. Capital One acquired ING Direct in 2012 and when the accounts migrated, I kept them. I was tempted to close them when I went through a big personal finance simplification phase, but I continued to use one as a bank account firewall with PayPal. It served a purpose, paid a competitive interest rate, so I left it alone.

But then a few years later, Capital One introduced the 360 Performance Savings, and now it’s time to pay attention.

🚩 If you had an existing Capital One 360 Savings account, they did not automatically move you over to the new account. You are earning a very low interest rate until you change accounts.

Table of Contents

- What is Capital One 360 Performance Savings?

- How to Convert Your Account from 360 Savings to Performance Savings

- Capital One 360 Performance Savings — up to up to $1,500

- How to Close Your Account Online

- Alternatives to the Capital One 360 Performance Savings

- Discover Bank Online Savings Account

- CIT Bank Savings Connect & Savings Builder

- Apple High-Yield Savings Account

- Should You Open This Account?

What is Capital One 360 Performance Savings?

It’s Capital One’s name for their high-yield, no-fee online savings account.

You get an interest rate of 4.25% APY with no minimums. Your funds are FDIC insured up to $250,000, there’s a mobile app, and you can open it online in just a few minutes. It’s a pretty run of the mill online savings account.

When Capital One started offering this “new” type of account, they took away their 360 Savings Accounts and 360 Money Market Accounts. It’s now Performance Savings only.

If you’re an existing Capital One 360 Savings customer, it’s pretty much the same as before except you get a higher interest rate with the new account type.

Money market accounts have been falling out of favor in the last decade or so. In the past, they were useful because you could earn a higher interest rate and still have more than six transactions/transfers per month. Nowadays, with online banking and credit cards, there really isn’t a useful place for your traditional money market account. It’s no surprise that Capital One did away with it.

How to Convert Your Account from 360 Savings to Performance Savings

There doesn’t appear to be a single button you press to convert an existing 360 Savings Account into a Performance Savings account.

You will have open a new Performance Savings account, transfer all of your funds from the 360 Savings to the Performance Savings, and then close your 360 Savings account.

Fortunately, opening a new account is simple, takes about five minutes. Capital One prepopulates most of your information, and you just have to enter your employment title and salary and check off a few disclosure statements. You can even do it on a weekend (I did it on a Sunday).

Presto – nearly double the APY. It won’t be a ton of money, but it’s like picking up a quarter on the sidewalk.

Sadly, the Capital One 360 Performance Savings new account promotion has ended. We keep the information below so you know what it used to be, just in case it comes back.

There is, however, a bonus for a 360 Money Market Account – details after the Performance Savings offer information.

Capital One 360 Performance Savings — up to up to $1,500

Capital One 360 up to $1,500 Performance Savings Account Summary

- What you get: up to $1,500 cash bonus

- Who qualifies: If you have or had an open 360 Performance Savings, 360 Savings, 360 Money Market, Savings Now or Confidence Savings account as a primary or secondary account holder with Capital One on or after January 1, 2021, you will be ineligible for the bonus. If your account is in default, closed or suspended, or otherwise not in good standing, you will not receive the bonus.

- Where to open: Online

- Promotion code: BONUS1500

- How to get it:

- Open a Capital One 360 Performance Savings Account,

- Next, deposit at least $20,000 in new funds into the account during the 15-day initial funding period and keep it there for an additional 90 days

- When does it expire: not listed

There’s a bonus offer on this account – Capital One is offering up to when you open an account using the promo code REWARD250. The bonus amount is tied to how much you transfer into the account within the first ten days – but this has to be new money to Capital One. You can’t transfer from another account (sorry!). Then, maintain the required daily balance for 90 days and the bonus is deposited in 60 days.

The bonus is based on the deposit amount:

- Earn a $300 bonus when you deposit $20,000 – $49,999,

- Earn a $750 bonus when you deposit $50,000 – $99,999,

- Earn a $1,500 bonus when you deposit $100,000 or more.

If you have or had an open 360 Performance Savings, 360 Savings, 360 Money Market, Savings Now or Confidence Savings account as a primary or secondary account holder with Capital One on or after January 1, 2021, you will be ineligible for the bonus. If your account is in default, closed or suspended, or otherwise not in good standing, you will not receive the bonus..

Learn more about the offer

(Offer expires not listed)

How to Close Your Account Online

Unfortunately, this no longer works. You have to call in.

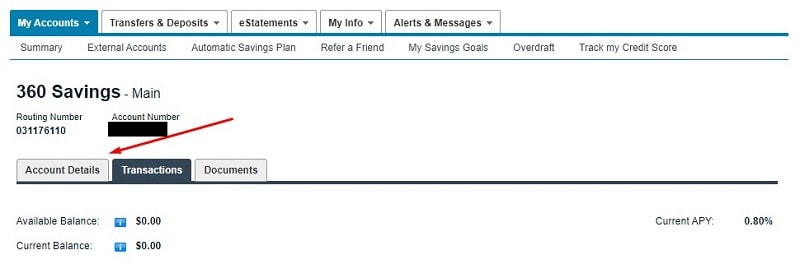

First, log into your account as normal… then visit this link to access the old interface:

https://secure.capitalone360.com/myaccount/banking/account_summary.vm

(copy and paste it in the browser after you log in)

Then click on your account name in the list, followed by “Account Details” tab underneath your Routing Number and Account number. The site defaults to your list of transactions.

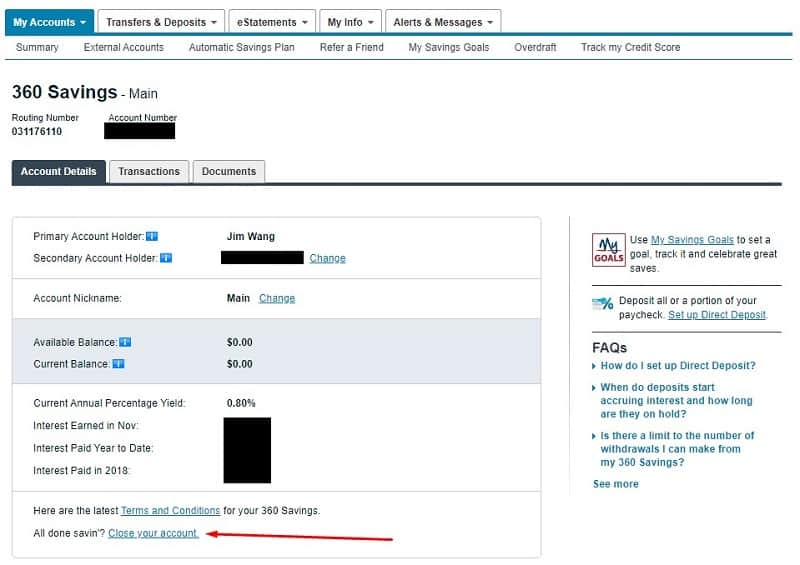

Then click on “Close your account” at the bottom:

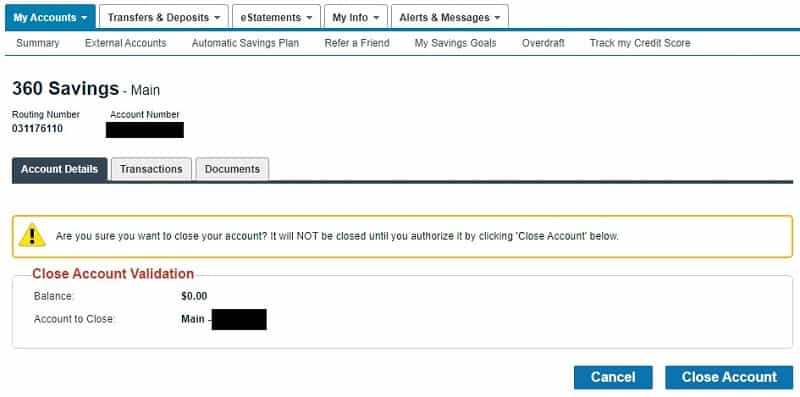

There’s a confirmation screen but then you’re done:

Alternatively, you can call customer service to close your account. In the past, I’ve had success using the online chat to close an account too.

Alternatives to the Capital One 360 Performance Savings

There’s plenty of competition out there for the best savings accounts, with online banks like CIT offering high APYs and even other tech companies like Apple entering the finance space. Here’s how Capital One’s 360 Performance Savings compares to some of the most popular products out there.

Discover Bank Online Savings Account

Discover’s Online Savings Account also comes with no monthly fees, no minimum opening deposit, and the same APY as Capital One (4.25% APY, as of publishing). It’s also easy to open an account with Discover online — no in-person bank visit necessary.

For all these reasons, Discover’s product is equal to Capital One, and choosing between the two comes down to personal preference or whether either is offering any kind of sign-up promotion.

Read our full review of Discover.

CIT Bank Savings Connect & Savings Builder

CIT Bank offers two separate savings account options, the Savings Connect and the Savings Builder. The Connect product is far superior and even beats Capital One and Discover, with a 4.65% APY as of publishing. While there is an account minimum of $100, there are no monthly maintenance fees.

The Savings Builder is decidedly less impressive, with a tiered rate of 1.00% APY if your account is below $25,000. And once you deposit more than that, the rate drops to an abysmal 0.40% APY.

If you’re looking for the highest interest rate, CIT may be a better option for you than Capital One — just remember you’ll need to keep a minimum of $100 in there and you want to be sure to open the Savings Connect, rather than the Savings Builder.

Read our full review of CIT Bank.

Apple High-Yield Savings Account

Apple (yes, the computer company) launched its own savings product in April 2023. Like Capital One, it has no fees and no minimum balance requirements. Also, like Capital One and other banks, Apple’s High-Yield Savings Account is FDIC-insured, meaning your money is protected up to $250,000, just as it would be with any traditional bank account.

However, Apple’s interest rate is lower than the competition, currently at only 4.15% APY as of publishing. Another caveat is that you must have an Apple credit card to access the savings account. That said, if you do have an Apple Card, you benefit from being able to automatically add the 3% cash back from purchases directly to your High-Yield Savings Account.

Read our full review of the Apple High-Yield Savings Account.

Learn more Apple High-Yield Savings Account

Should You Open This Account?

If you don’t have an existing Capital One 360 Savings account, does it make sense to open a 360 Performance Savings?

Its interest rate is competitive, especially when compared to other popular savings products, like Discover’s Online Savings, CIT’s Savings Connect, and even Apple’s High-Yield Savings.

However, I don’t feel like there’s a ton of added value with this account. For example, if you open an Ally Bank account, you get a 4.25% APY interest rate plus the ability to link up an Ally Invest account. Ally Invest is a brokerage account that gives you free trades on all U.S. stocks, ETFs, and options. (they also run cash bonuses for new brokerage accounts)

SoFi Money is a cash management account that pays 4.60% APY (unlocked with direct deposit or by depositing $5,000+ every 30 days, otherwise 1.20% APY) but also has SoFi Invest, another no commission stock brokerage. They’ll also give you up to $300 when you receive qualifying direct deposits totaling at least $5,000, no maintenance fee – our full list of SoFi promotions is here.

I’ve always been a fan of how convenient it is to open accounts and manage savings goals with Capital One but I’m not sure it’s a good option if you’re opening a new account.

Michael Clark says

How will interest be calculated if I move my two savings accounts over from the old Capital One savings account to this Performance Savings account today? I’m thinking it’s probably safer to move the money over on Friday, Nov 1st, so that I’m not giving up 28 days of interest.

You wouldn’t give up interest, it would still be credited to the other (older) account. Any interest after the fact would still make it to you.

joanne says

Is there any chance of ´losing ´money in the process of going through the hassle of closing old 360 savings accounts and opening the 360 performance savings? I mean I have several 360 savings and hate the hassle, I only want to open one performance savings and do not know if I am required to close all the others?

Joanne

You don’t have to close anything but if you close them you are still paid the interest you were due. There are no minimum balance requirements so you can keep them open and close them after the interest is paid.

Regina says

Thank you for the information on Capital one 360 savings account I will definitely take advantage of that opportunity.

Regina Channelle

bob says

Can’t add a joint holder to the Performance Savings, have to call on the phone, wait, and then it is still a PITA. Not sure why can’t do online like other places. CapitalOne had turned a good ING product into crap. Plus very incompetent customer service. I’m looking for a new bank after 15 years there starting with ING.

Peter says

Thanks for the heads up on this.

I had 3 CapitalOne 360 savings accounts that weren’t converted to Performance Savings. Just opened the Performance Savings after reading your post, transferred all the funds over and then closed the 3 old ING/Capital One accounts.

To close the accounts I found an old workaround via YouTube where you can login to your account in the previous 360 interface, go to account details and click “close account” to close your old accounts. Piece of cake. 5-10 minutes total to open the new account, transfer funds and close the old ones.

Gave me a little nostalgia for the good old days of ING back in the day. Thanks Jim!

How do you access the previous 360 interface?

Peter says

You just login to your CapitalOne360 account, then go to the old URL:

https://secure.capitalone360.com/myaccount/banking/account_summary.vm

Once you’re in the old interface just click on the account you want to close, click on “account details” tab, and then click the “close your account” link at the bottom of the page.

YOU JUST BLEW MY MIND!

Jill says

Thank you so much for this information. The ability to access the old interface and close accounts was awesome. I’m another of those who loved ING and just deal with capital one. This has been so helpful for my yearly financial tidy.

You’re welcome, thank Pete because he saved us all a lot of time!

Matt S says

I wouldn’t close old accounts until a month goes by, to make sure you get your last monthly interest posted?

You could do that to be absolutely sure but on the 360 Performance Savings Disclosure, there is a section governing what happens if you close your account:

Effect of Closing an Account – You will receive the accrued interest if you close your account before interest is credited.

It’s unclear how they will credit you though, but I suspect if you had an open account with them then they’d use that. Otherwise, they send it to your state’s abandoned property division.

jimm says

You wrote:

“Capital One prepopulates most of your information and you just have to enter in employment title, salary, and check off a few disclosure statements.”

I have an existing Capital One MM account and was thinking of transferring my funds over to the new Performance account.

This is a savings account, what business is it of Capital One what my employment status is and what my income is? I am not asking for credit or a loan here, I’m the one giving them funds.

What if a person is disabled, retired, or unemployed? Is that really any business of Capital One? We are talking about a savings account. Baffled.

Loved your piece. Very informative and to the point. Thanks.

Jimm

I don’t know why they need it, it could be regulations require them to ask but I doubt an answer would change the outcome.

cc says

Is the 1.8% fixed or variable (where it will/could change every few months)? I have a 360 Money Market, opened 6 months ago, $100K. I repeatedly asked when opening the account of the 2% was variable. I was told that 2% was the rate that would be paid on this account, by the woman opening the account for me. In the last month the rate went to 1.8% and is now 1.7%. Probably my fault for not reading the fine print before establishing the account and relying on the bank employee, the fine details say the rate is variable and it looks, to me, like the performance account is also variable. Thanks for your time and your article.

It’s variable, all savings accounts are variable. To get fixed, you need to put it in a CD.

RALPH SWINDLER says

They have nice incentive to open a 360 Performance Savings Account. $200 plus a better than average 1.8% rate is really nice. Closing my Discover Savings and moving the money over to Capital One.

Dude says

Where is that $200 incentive to open a 360 Performance Savings account?

Preston says

Use the code SAVE1000 to earn the $200 bonus.

bbd says

Restrictions on $200 bonus. Existing customers do not qualify.

To earn a bonus, open a 360 Performance Savings account between 12:00 a.m. ET on October, 15, 2019, and 11:59 p.m. ET on December 31, 2019. If you have, or had, an opened savings account with Capital One on or after January 1, 2016, then you’re ineligible for the bonus. Your account must be funded with at least $10,000 in new money for the $200 bonus or $150,000 or more in new money for the $1,000 bonus from an external bank within the first 10 days of account opening (Initial Funding Period).

Steve says

We just noticed this today when checking our account with them. Called and spoke to a rep who said they allegedly tried to notify existing customers of these changes. Their email never made it to us as well as many others that have not made it the last year or so. Promptly transferred the funds to our local bank who, after reading their latest offerings, has almost as good a rate and NONE of the hassle. And, we get their emails every week! Goodbye Capital One

Al Strauss says

As of 1/16/2020 the money market rate is down to 1.50%, the performance savings rate is 1.70%. Is there any reason to keep the money market open with with a smaller amount while transferring the bulk to to performance savings? Would there be any reason to think that in the future the money market rate would be greater than the performance savings rate?

I think this type of “optimization” may not be the best use of one’s time – we’re talking fractions of pennies on the dollar. I’d take the highest interest rate available now and focus on other areas.

Hoover says

What happens to legacy CO 360 checking accounts and their CO 360 debit cards if you transfer everything from your INGDirect account to the new CO 360 Performance Savings account and then close the legacy INGDirect\CO 30 Savings account?

Do you also have to close the CO 360 checking account and debit card and open a new checking account and get a new debit card?

Thanks!

If you close the old accounts, they’re likely to be disabled and unusable since the account will be closed.

Ralf Hoffmann says

Did the whole swap yesterday with 4 accounts. Unfortunately the close account option doesn’t show for me. Did they take it out or is there something I missed. I used the link on the page. Just the “close account” option is missing.

Ahhh looks like they took that away. Thanks Ralf!

DJ says

I am not sure if I am reading your article correctly. Are you suggesting we can open a new 360 performance savings account, move money from an existing 360 savings or money market account, and still get the bonus?

When filling out the information to open a 360 performance savings account, Capital One says: “If you have or had an open savings and/or money market account, excluding CDs, as a primary or secondary holder with Capital One on or after January 1, 2016, you’re ineligible for the bonus.”

Wouldn’t this make you ineligible for the bonus if you currently have or closed a money market account after January 1, 2016?

Thank you.

DJ – I tried asking Capital One and they said: “Bonuses and promos are a tad too customer-specific to dive into via social media, so best bet here’s to give us a buzz at 888-464-0727 for an assist.”

DV says

The above post from DJ is absolutely correct. Capital One would not pay a bonus if you already have or had a savings or Money market account with them on or after January 2016. I even transferred new funds to open the new Performance Savings account to get the bonus, but no luck. The representative was very specific about this condition for eligibility and told me I do not qualify.

Bdub says

This post is inaccurate according to the Capital One Performance Savings offer page. The first footnote on the page for the NEW500 promo code says “If you have or had an open savings and/or money market account, excluding CDs, as a primary or secondary holder with Capital One on or after January 1, 2016, you’re ineligible for the bonus.”

I’ve updated the post to include this exclusion.

Jason says

Thank you JIm

I happened to stumble across your article. As a long time ING and then Capital One active user I have spent the last 15 minutes opening and transfering 5 Savings accounts. It was painless. I did have to re-read your article because I just could not believe what I was reading! Thanks again

Glad it was helpful! It’s not a life-changing difference in interest (it never is!) but if it takes just a few moments, why not?

Colin says

Article is spot on. I had a old money market account and just opened this account and transfered the money over. Too bad they just don’t do this automatically.

aaron says

jim,

after a long time away, i found the site again. still doing great work!

i moved to the performance, because why not, but sadly after they stopped the easy close option on the old account. i will have to call it seems.

my question is are there still any referral bonuses for these accounts? for the life of me i can not seem to find them anywhere.

thanks again for all the work over the years

hey Aaron! Good to see you again – it stinks they removed the easy option, not sure why as it saves them dealing with it over a phone call.

I think they may have removed those but I haven’t had any referrals in years so I never look.

aaron says

same jim, same! i look forward to reading the site. agreed, i guess maybe they have “more accounts” to report as a metric or something. i hope the call is trouble free.

i think they must have, but i haven’t either, so who knows lol.

either way, thanks! take care.

Peter says

Thanks Jim for the helpful information. I am an existing Capital One saving account customer from ING Direct, and would like open a new performance saving account and transfer the fund of the existing saving account to the new one. I wonder if the linked external checking accounts of the existing saving account will be automatically linked to the new performance saving account?

Thanks.

It’s a completely new account so there won’t be any links yet, you have to add those back in.

Peter says

Thanks Jim! Will the new account link to the old one so I can transfer the fund from the existing saving account to the new performance saving by myself, or I have to call them?

Yep, they are linked by virtue of you being able to manage them within a single login.

Peter says

Great. Thanks a lot!

Kevin says

Just found this out now. Lost about 6 months of interest (2/3 less). They could have sent us a notice or made a note at log in.

Ice says

Great article Jim!

I’m still confused about the eligibility of the $500 for existing 360 Saving(ING) account holders.

Their web site says: “If you have or had an open savings and/or money market account (excluding CDs, IRA savings accounts and Kids Savings accounts) as a primary or secondary account holder with Capital One on or after January 1, 2016, you’re ineligible for the bonus. This account is subject to approval.”

Which tells me I don’t qualify (my ING account was opened in 2000’s and is still active).

However, I just got off the phone with a CO agent, who told me that I qualify.

It’s only people who opened an account after January 1, 2016 who don’t qualify.

Jim, you mentioned you had an ING account, so were you able to qualify for the $500 bonus?

Comments from some readers seem to also indicate that ING account holders don’t qualify.

Thanks everyone!

The one I list here is for new account holders only but they are also running a separate promotion they sent by email to existing customers. This is a link to that offer, it expires May 31st.

Scott Berg says

Jim,

Have never had any type of account with Capital One or banks they acquired and am considering opening a Capital One 360 Performance Savings account and get their bonus before May 31. Noticed that I must deposit money from an external BANK. I asked on the phone if they accept funds from a brokerage money market account (which is not a bank), to qualify for bonus, and they said “Yes”, but I’m not confident in that answer as it contradicts their written requirement that money must be from a bank. Do you know if money from a brokerage money market fund will qualify for the bonuses? Thanks. Appreciate your advice.

If you asked them and they said yes, why the concern?

Lan Hogue says

Hi Jim,

thanks for this article as I am trying to figure out whether to take advantage of an offer to earn $450 in 3 months if I add money to my existing 360 Money Market account. So, it seems they have not done away with it. Strange that they’d encourage me to add money to an account that on my app, tells me that it’s only earning .50% APY when the 360 Performance Savings account offer 1.0% APY. I’m not happy that they almost duped me into keeping an account that earns less than a new product they just launched. eye opener. here’s the link to what I connected to from the email I received from them.

Lan

https://www.capitalone.com/savesafe/?utm_source=DGBP&utm_source=sfmc&utm_medium=email&utm_medium=email&utm_campaign=05929_63514_360MMA_BalBld&utm_campaign=%2B95293_05929_63514_360MMA_Balance_Build_June2020_Drop1&utm_term=drop1&utm_term=&utm_content=learn_more&utm_content=77108&utm_id=0481470e-6955-4ab8-aee5-0e4e597ff265&sfmc_id=24433812&sfmc_activityid=098c0358-b6bd-45c7-9d4a-b0f17a44f0df

Hi Lan – I did more research and it appears the Money market account is no longer available to new customers but they did offer this to existing customers. I think they did this to keep people in the existing account, which seems weird because why not consolidate?

If you do the math, the bonus makes sense if you have $20k or $50k around.

For the $20k offer, half a percent is ~$100 for a year and they’re giving you $150 for three months.

For the $50k offer, half a percent is ~$250 a year. This is giving you $450 for three months, so you come out ahead by quite a bit just by keeping the MMA account for a little while longer.

(of course, it requires you to have that much cash on hand)

Beza says

Looks like the only way to open Performance 360 Savings is to link an account from an external bank (sneaky they don’t mention this when they say you should open account to get better interest). You can’t just transfer money from another Capital One account. Even if I wanted to link an external bank, external bank might charge transaction fees.

How to Open an Account: You must tell us to either electronically transfer money from your Linked Account or give us a personal check drawn on your Linked Account. Your 360 Performance Savings account won’t be considered “opened” until you complete our verification procedures.

Jackie says

Hi Jim, thank you for posting. I just happened to look at my September statement and looked up my APR and saw that it was reduced to 0.399% last month as you discuss here. Now I understand why! My question is, I see rates of 0.5% for this new type of account, not 0.8% as you say – did I miss the boat on that?

Their rates are constantly changing, especially since the Federal Research keeps rates low, so the rate you saw is what is active. You didn’t “miss” anything because it’s a savings account, everyone gets the same rate and it’s never locked in.

Tommy Little says

Last year I took advantage of one of these program so I thought and deposited 50K in capital one money market account and was to get $450 after 90 days. It did not happen. Despite the fact I communicated with capital one the entire time and made them aware the 50K was coming from one of my existing capital one account never was I told I did not qualify until the 90 days were up. I was very dissatisfied with capital one for not making this clear despite me asking a number of time. Will not participate again and has since move the majority of my assets.

Did they explain why you didn’t get the bonus? What happened after the 90 days?