If it feels like the rich play by a different set of rules, it’s because they do.

I recently learned about the concept of “Buy, Borrow, Die” and it’s fascinating. I’m not an expert on estate planning or taxes or am I rich enough to do this (yet!), but it highlights how different parts of tax law can come together to something (likely) unintended.

As far as I can tell, the origin of this framework (or at least the fun name) comes from Professor Edward McCaffery of the University of Southern California Gould School of Law. It’s outlined on his site People’s Tax Page on Tax Planning 101: Buy, Borrow, Die.

This strategy has three parts – buy, borrow, and die.

If you need to create an estate plan, consider Trust & Will. They can help you set up an estate plan that’s a fraction of the cost of hiring a lawyer to help you draw up a will. It’s certainly worth a look if you haven’t set this up already.

There are also several free online will makers you can use instead.

Table of Contents

1. Buy

First, you buy something.

You have a big slug of money and you want to invest it in appreciating assets so you can retire forever. It’s also important that those appreciating assets do so tax-free (or more accurately, tax-deferred).

You’ll want to put this money into the stock market, real estate, or another asset class that appreciates. Buying a car would be a bad idea for this because the value of a car goes down over time. It’s also better if you pick an asset class that enjoys the tailwind of inflation pushing up its nominal value.

Real estate is almost perfect for this because:

- its value tends to go up,

- it is not volatile

- you can depreciate it, which reduces your income tax

- it’s easily accepted as collateral.

And the collateral is important for the second step. You want to pick an asset that can be used as collateral for a loan. Investing in your friend’s business is bad for this. Investing in your own business would be better, but not as good as real estate.

A bank may not want to use your business as collateral but they’ll all take real estate.

2. Borrow

Next, you borrow against your asset.

Typically, if you are asset rich and cash poor, you might sell some of your assets for cash to live. When you do, it triggers capital gains.

To avoid this, you don’t sell your assets to get cash. Instead, get a loan from the bank with your assets as collateral. By keeping the assets as they are, where they keep growing value, you don’t trigger a taxable event. You still get cash, it’s just a loan.

The best part about this is that when you get a loan, it’s not considered income. Since you’re borrowing against an asset, you’ve received cash in hand but you are also holding a loan that you must repay.

Use some of the proceeds of the loan to make the loan payments.

This is NOT a 401(k) Loan

If this sounds a little like taking a loan from your 401(k), it’s not the same. When you take a loan from your 401(k), you’re reducing the value of the account by the amount of the loan. You pay interest to yourself, which is kind of nice, but you miss out on any gains (or losses) that occur when the money is out of your 401(k).

We avoid any capital gains taxes because of the 401(k)’s tax-deferred status.

With the Buy Borrow Die strategy, your assets are used as collateral and never touched. It can continue to appreciate.

You get your cake and eat it too! (though you have to carve off a little slice to the bank as interest – so there’s no free lunch)

3. Die

Every good plan requires a good exit strategy and this one relies on the ultimate exit strategy – death.

You die.

When you die, your estate goes to your heirs. The loans are paid off with the assets and then the assets get a step-up in (cost) basis when they pass to your heirs. When your beneficiaries get those assets, their current cost basis in that asset is the current market price (at the time of your death). That step-up can save your heirs a ton in taxes.

For example, if I bought shares of Apple for $15 in 2011 and I died today (with it priced at ~$172), my beneficiaries get the step-up in cost basis. If they sell those shares today at $172 each, they will pay no capital gains tax because they had no gains. (They may have to pay estate taxes as a result of getting those shares.)

The strategy works because of the step up in cost basis of the asset. I paid $15 per share and if I sold it, I’d owe taxes on the gains. Because they got the shares after I died, they “paid” the higher price and if they sold it that day, they owe $0 because they had no gains.

What about the loan? You pay it off with the proceeds of the sale. Easy peasy.

Is There A Catch?

No catch.

Well, the catch is that your assets have to keep appreciating. And you have to die.

But we all do that so you might as well take advantage of it! (also, that part is in the name so if that comes as a surprise then good luck)

The advantage of this strategy is that when you borrow money from the bank instead of selling an asset for the cash, you pay the bank some interest and the government doesn’t get its capital gains tax. You have to go through a few more hoops because of the loan but it’s not hard to borrow against your stock portfolio. Selling an asset and reporting the sale on your tax return is easy and requires no application – but you pay taxes.

The other consideration is that it might not be the most efficient way of acquiring an asset in the first place. You can typically own real estate by paying a fraction of the cost of buying it. You can get a piece of property for a 20% down payment (sometimes less).

While there is no catch, there are two realities that make this strategy effective:

Low Interest Rates

Since you are borrowing against your assets, you need interest rates on that loan to be relatively low or you’re just paying interest instead of taxes. If you’re reading this in 2022, we’ve experienced some of the lowest interest rates we’ve ever seen in the last decade or so.

If they creep up, it makes this strategy less and less effective. The loans are almost always variable rate loans so if that rate goes up, your costs go up and this is not as appealing as it once was.

Stepped Up Basis

This strategy works so well because of the stepped-up in basis “loophole.” If that didn’t exist, this plan isn’t as effective (but is still helpful from a tax planning perspective). The step-up in basis removes a potentially huge chunk of gains from taxes.

If the step-up in basis were removed, you still benefit a little bit because you still get cash while retaining the asset so it can appreciate. You just have to keep paying the loan’s interest rate in the meantime so you need the asset to appreciate more than the interest rate on the loan. It’s really no different than borrowing money to invest, which is not unheard of, but you’re doing it in a way that avoids capital gains.

💵 U.S. Bank – up to $700

Earn up to $700 when you open a new U.S. Bank Smartly® Checking account and a Standard Savings account and complete qualifying activities. Subject to certain terms and limitations. Offer valid through June 27, 2024. Member FDIC.

Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm.

This Isn’t That Crazy of an Idea

If the strategy sounds like a really crazy idea, it isn’t – we actually do this already with our homes.

You buy a home, which is generally an appreciating asset, and you can get a loan against the value of the home (home equity loan). When you go to sell, you can ignore $250,000 of gains as long as it was your primary residence (similar to step-up in basis). If the loan is still outstanding when you sell, you can pay back the home equity loan with the proceeds and it doesn’t impact the cost basis on your home.

Ever refinance the loan on your home after it’s appreciated? Cash out refi? It’s basically this same strategy.

The only thing missing is that you can’t depreciate the value of your home and use it to offset your income. 🙂

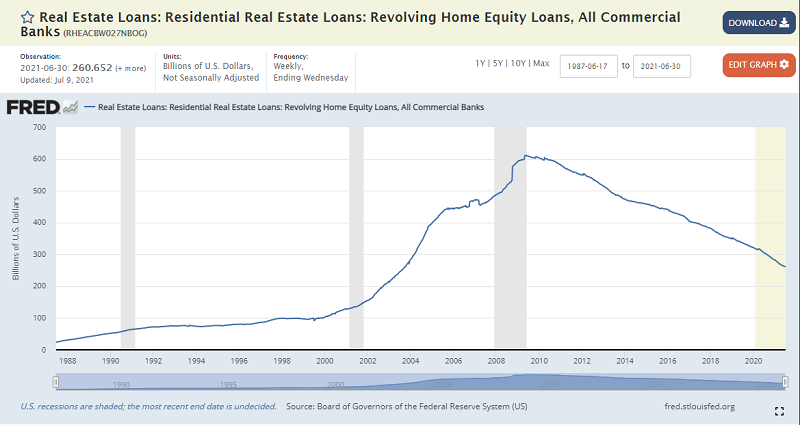

There are over $263 billion revolving home equity loans according to The Federal Reserve (data is from July 9th, 2021):

Home equity loans are simply loans taken out against the equity in your home. Buy Borrow Die is just a riff off this very popular idea.

The only wrinkle is that most people don’t take home equity loans for everyday spending money – they typically do it for major purchases but money is fungible. It doesn’t matter what you use it for.

Want to do this with your stock portfolio? Some, but not all, brokerages offer this. For example, Schwab calls it a Pledged Asset Line.

Now you know the Buy Borrow Die Strategy!

Go impress your friends at the country club. 🙂

Physician on FIRE says

I like parts one and two!

Not so excited about part three, but if the step-up in cost basis remains, it’s an important part of the estate planning strategy.

After being debt-free for more than 5 years, I’m contemplating taking out a mortgage. Tough to say No with rates on a 15-year fixed close to 2%.

Cheers!

-PoF

So true… rates are so crazy low right now.

Antonio Nataro says

Thank you for sharing this tidbit, quite fascinating how the rich can skirt taxes. Quick question: are estate taxes calculated on the current value of the asset or what what paid for the asset? In your example with Apple stock is it calculated on the $15 or the $120 for estate taxes?

It’s calculated based on the stepped-up basis. In this way there’s no “free” lunch, so to speak. You get the step-up but you pay estate taxes if you’re above the exclusion.

Adobojackson says

Will this concept work in California? Due to proposition 19 that passed recently, inherited residential properties are reassessed to current market rate values. Before proposition 19, assessment of residential property tax in the event of a transfer to an heir (parents to children or grandparent to grandchildren) was based on the original purchase price of the home. For example, a married couple buys a home in San Francisco in 1975 for $100,000 at 1%.property tax rate. In 2025, that same couple passes on and their children inherit the home. The children are now responsible for the property tax at 1% of $2,000,,000. Although they are not responsible for capital gains, they will be responsible for the newly assessed property tax. The only exclusion is if those inheriting the home will use it as their primary residence, therefore being responsible for the property tax at time of original purchase. What are your thoughts?

I am not familiar with California tax law so I’d consult a tax attorney to know for certain… but it sounds like Proposition 19 steps up the basis of the home for property tax reasons? That’s bad only because, I guess, in California the step up wouldn’t happen and the heirs would get super-low property taxes based on the (smaller) basis?

Libra says

I live in the state of Texas and like the TX tax Free bonds. I graduated from California University of Pennsylvania which is part of the Pennsylvania Higher Education. Cal. U is jokingly called Harvard on the Mon(Monongehela River). I tend to have a great distrust for some of these hungry financial agents who want to make you rich. Ken Fisher sued one of his clients long story but now he claims to be a Fiduciary –Yeah sure. I once got a blog of mine published in Forbes Magazine and I got a letter from Ken’s attorney threatening a suit. I wrote and told him to go ahead as he had lost most of my Roth IRA They also use JAMs as a private arbitration which costs over 15 K if you wish to pursue your problem with having your funds lost.

Libra says

I like the Warren Buffet method–If I do Not understand it–I do not invest in it… It saved me from losing big time with the CMO rackets.. I asked the defintion of a TRANCH–They could not tell me what was a tranch.. So I said as I left with my checkbook intact Warren Buffet saved me.

Libra says

It was the CA real estate market that ruined the Real estate market in Oregon.. The Californians had purchased a home years ago for 25K,, worked for the state and retired with a very nice pension–sold the 25K home in CA for 250 K then move to OR and begin the bidding wars for a much larger newer cheaper home. They ended up driving all real estate prices much higher in the state of OR. People never dreamed real estate could devalue but as a small child in Iowa during the Great Depression–land and farms were devalued to the point that Homesteaders lost the farms they had struggled all of their adult lives to build and spent their last days in the poor house. They really existed the poor houses. The large Insurance companies became ever wealthier as they had purchased the mortgage notes on these farms from the U.S. Farm Bureaucracy that had written them on that particular farm.

My Money Wizard says

Really interesting. I just learned about this myself while researching the rumored increases in capital gains tax rates. A lot of people speculate that if the capital gains tax rates increase, this practice will become even more common than it already is.

Like you said, it’s always crazy to see the unintended consequences when so many different laws come together!

Especially when interest rates are so low!

Richard says

Or maybe these “unintended” consequences are really “intended”?

Maybe 🙂

Libra says

I appreciated your article. There are always drawbacks to borrowing. Since I began my working career in Pittsburgh, PA– it was in the late 50’s and it was felt that married women needed. to have no benefits as they were married. My Husband was a combat veteran of the Korean Conflict and he was not well when he returned after serving 2 years in the Army. It seems he had pneumonia several times and was treated and returned to the front lines. It was 40 degrees below zero and they were surviving in below ground bunkers along with the rats and mice who I found later were carrying the HANTA VIRUS. He had a massive coronary at age 42 and survived until age 55 –long enough to see his children grow up and hold his first grandchild.. I found later at a medical seminar that 1200 of our G.Is had died in Korea from the anta virus and that the Government had kept this a secret. I knew that I had to build myself a pension as Don was not able to work again after surviving that massive coronary. I purchased my first tax free municipal bond. IRA’s were not yet available. I kept collecting them when I had the funds to do so. When I retired at age 60–I thought I was bullet proof. Not so– Interest rates began to drop and they began calling in my bonds. No one ever dreamed that interest rates would continue to remain low for so long. I am now age 86 and have stopped buying muni bonds. The interest rates are now at 1.52% on a long bond out to 2050 or longer. I am now thinking that I shall buy some high quality ETFs. Imagine a return on a million dollars of only $30,000.00 I will not invest in under 3% int. on a bond. It is very helpful to have tax free income and I stress to my daughter that to just collect the interest and wait for a call or maturity which ever comes the earliest. Whether she will–I will never know. I do have common stocks which I still re-invest–The power of compounding interest is not to be sneered at. I did make a big error.. Ken Fisher bought a list of names from Schwab and after 2 interviews–I finally fell for his sales folks pitches. and he ruined me. He sold off all of my blue chips and bought many foreign stocks for my Roth and conventional IRAs. I was pretty old when I was finally able to get those IRAS. There is a heavy dividend tax on foreign stocks–some as much as 30%. When I did my taxes with pencil and paper, I was able to file an1116 form and take those div. taxes as a tax credit–but now I have been using Turbo tax and I just cannot get a tax credit on my IRS form. Will do amended forms. Turbo tax wants you to take a business deduction which is just wrong to advise people tp lose their hard earned money. You were speaking of gimmicks that people are advised to use including borrowing on a home. I have seen some of those schemes explode and I have huge sympathy for the victims. I am only staying in the stocks so that my daughter will get the stepped up value at my death but should I need income over and above I can always stop the re investing on the stocks and increase my income. I had planned for 2 streams of income for retirement. I pay very little in income taxes yet my total income is at least 4 times higher than my last year of full time employment. My B.S. is in Business administration–Accounting and economics from Cal. U. of PA. . When my husband knew that he could never work again–he wanted me to return to school and I earned my degree at night after working days as a Registered Radiologic Technologist in Oakland where I saw manty College students from U.of Pitt. C/M U & Pt ParK U. I do enjoy your articles

Lalani says

You brightened my day Ms.Libra! What a life/financial story! So sorry about your husband and his health issues that you had to witness. But your strength, intelligence and forward and clear thinking through it all is simply amazing. I applaud your strategic planning and you as a person. WOW! I would love to hear your financial story and all the details of each little golden nugget you inserted through out your reply 🙂 What’s truly remarkable is you did all that and gained all that knowledge when everything was manual(no internet or google!)

Richard says

Theres a danger of these so called tax avoidance schemes or even perceived unfairness to the masses. They go to the voting booth with the intent of “burning the house down” with all of us in it! Now THAT’S unintended consequences!

Msshaay says

For real estate asset borrowing, does one need a steady income in order for banks to lend? This strategy may not work for people already in retirement if they do not have income even though the property is there as collateral.

Typically no because your loan is secured by the real estate.

Ss says

If you have a lot of appreciated assets you borrow against to finance your lifestyle, how are you going to be paying off the loan? Don’t you have to sell some of you are appreciated assets in order to be current on your loan, triggering capital gains taxes?

You don’t spend all of the money at once – so you pay the loan with the loan itself. Let’s say you borrow $25,000 at 5%, that’s a monthly payment of about ~$135.

Ss says

Got it, thank you. So you just keep on refinancing those outstanding loans based on increased value of assets to maintain this game?

Exactly – that’s why your assets must appreciate otherwise you have to get a job! (or sell the asset)

Pedro says

To be clear, Professor McCaffery was not advocating for this framework and it did not originate from him. Rich people have been doing it for years. The point of Professor McCaffery’s book is that we need a consumption tax because the current tax system does not account for the framework.

I didn’t dig deeper into the origins, or Professor McCaffery’s broader point, but I didn’t mean to imply that Professor McCaffery was an advocate.

Micheal Kidd says

Actually does work ..in 2017 I refinanced my hotel from 4 m loan to 7.5 m based only ltv of 60 percent ..I pulled out 2.5 m tax free bought 3 nzd house in New Zealand and bout 800 k house ocean in Cook Islands …and retired

Loan 4.65% .. now three yrs later owe 6.8 m on loan .. property now appraises at 13-14 m

I hoping refinance at 3.5-4 percent save 8 k month monthly payment .

But most importantly with higher appraisal expect pull out another 1-1.5 m tax free .

The savings on monthly payment increases my pension by 100 k year .

I don’t need 1.5 m cash but I will invest in 5 percent tax free muni bonds gets another 50-75 k pension .

Hotel still net positive 400-500 k year after debt

plus I get above additional 150 k yr pension tax free

Depreciation on hotel shelters a lot hotel 450k yr profit .. still have pay taxes on it , but Ibecause this plan I live in two paid off houses in countries most dream about and have great pension …

I fixed up hotels and resold them for years but the tax was crazy with both California with both and fed capital gains .. I would been okay but not comfortable am now .

I stumbled on to it wish I knew earlier … I sold out my company to my partner he still working I’ve been retired comfortably since 2017 . And keeps coming .

Amazing! Thanks for sharing your personal experiences Michael!

Bob Smith says

So you borrowed say 300,000 of gains in 2021. And you spent it. Now it is 2022 and you have to pay principal and interest on it. Where does that money come from?

Then in 2022 you borrow another 300k . And you spend it. Now you are paying principal in an interest on 600K.

Seems like you are soon going to be having all money to debt service.

I believe the idea is that you don’t spend it all – you borrow $300,000 but you spend it over time and not all at once. The $300,000 can pay for the debt service while you are using it. Plus during all this time, your assets (hopefully) appreciate and you can “double dip” (spend some while the balance still grows).

Rahul says

May not be as simple as it sounds. For example, the interest on the loan that you borrow is paid “each” year. So let’s say that even if you borrow $100k at 3% instead of paying 15% capital gains, and you keep rolling over the loan, soon (within 5 years) you will have paid 15% on your original amount. In this situation, you would have been better off paying 15% capital gains in the first place.

Paying 3% a year for five years is better than paying 15% in year one – also because your investments are still invested in the market for those extra five years.

robert quintal says

I am curious about your thoughts on a reverse mortgage. A LOC version of a jumbo seems to fit your strategy nicely.

I think a reverse mortgage seems like it offers too many bells and whistles (and costs and requirements), which make it a slightly less appealing option. For example, if you were to use a home equity conversion mortgage (HECM), there are requirements that you are over 62 years old, have it be your principal residence, mostly paid off (or completely), etc. In return, you get a line of credit that you don’t have to make regular payments on but you also have to pay an upfront insurance premium (usually 2% of your house’s value) and origination fees, etc.

Richard Schlosberg says

Hey Jim, I have this nagging question about this strategy, I haven’t found an answer yet…. If I take a 300k loan out against 300k in invested assets to avoid taking any taxable cash out, how do I repay the loan without selling assets (or earning a salary) that will be taxed? Am I missing something here? you can just borrow 300k and then sell 325k in assets to pay the loan back…. you’d have to pay taxes on the 325k you liquidated right?

You pay it back with the money you received from the loan. In your case, you pay taxes on the gains on the assets.

Let’s say you have $300,000 in assets and you borrow $100,000 against those assets. You keep paying interest on the $100,000 loan but you can use the loan proceeds, the $100,000, to pay that interest.

At some point, you may want to sell your $300,000 in assets. When you do, you owe taxes only on the gains. If you purchased those assets for $300,000 then your gain is zero. You owe nothing in taxes.

If you bought them for $250,000 then you owe $50,000 in gains which are taxed based on your holding period and your tax bracket.

The loan has nothing to do with the taxes you pay on the sale of the assets.

Frank Z says

With all the recent discussions of billionaires tax, I still do not understand this concept fully. Say Elon Mask borrowed 500 millions for his mansions and yachts against his billions in TSLA stock. He eventually has to pay back the loans. He has to sell his stock to get the cash. Then he pays his 20% capital gain tax. So it’s not he avoids tax, it’s just he delays paying tax to the current administration. Even if he dies tomorrow and his heirs get a stepped up basis, the heirs pays no capital gain tax but still has to pay HUGE estate tax over the threshold (assuming current law of keeping the step up basis and the threshold of 22 millions for he and his wife). So the tax is just deferred but not avoided. All the talks is really politicians want your money and want it NOW. Am I correct in understanding this but borrow and die?

The piece you’re missing your explanation is that he doesn’t have to pay back the loans all at once. He pays back bit by bit, like other loans, and can always continue to borrow because he’s not borrowing shares, he’s borrowing dollars using his shares as collateral. So he is avoiding the capital gains tax because he’s getting cash and never selling shares.

The stepped up basis will reduce the burden on his heirs further but eventually estate taxes will take a chunk.

As for politicians, they care about votes and public opinion and it looks bad when ordinary Americans were struggling in 2020, couldn’t pay rent, needed stimulus checks, etc – while billionaires made billions. They want to appears to be doing something about this unfairness though I suspect there’s little chance this type of thing goes through.

Bruce says

Thanks for this advice, Jim. I have been mulling how it will work in my situation. I don’t earn much in annual income, but I have a fair amount in retirement and home equity. I have about $250K in equity, in a neighborhood that appreciates steadily (the house is currently valued at $700K). I plan to be in this house at least 5 more years. I will inherit another house in 10-15 years, and that will end up being my primary residence. I’m wondering if should apply this strategy now in some way, using my current equity as collateral. Or if I should just wait to cash out the equity I build up in the next decade, before moving into the inherited house.

You’re in a situation where this strategy doesn’t necessarily have a huge benefit to you because you can’t borrow against retirement assets and you already get tax benefits if you were to sell your home, though it sounds like you don’t want to do that for 10-15 years.

If you wanted to use this strategy, you could get a home equity loan against your home and use that as your spending money and the cost would be interest on that loan. When you sell your current home, you’ll get the tax benefits of selling a primary residence (no capital gains on the first $250,000 in gains, or $500k if you are married) and can use the proceeds to pay off the loan.

You are essentially cashing out the equity using this strategy, so it’s really the same thing. 🙂

Frank Z says

How do you comment on Elon Musk’s recent selling of near 10% of his stocks with billions in tax? One thing you did not mention in the strategy of borrowing and die is if the underlying business lost its value (AOL or Yahoo comes to mind), then it’s better for its founder to cash out while it was worth a lot?

I don’t understand what comment needs to be made about Elon Musk selling stock? He sold it, owes tax, end of story?

If the underlying asset loses value then the bank might need you to provide more collateral. Or pay down the loan so the ratio is within their ranges.

It’s not an “always win” scenario, just one that is useful if you have a large capital gain and you don’t want to realize it yet.

michael obossa says

Jim, since you’ve been so good about answering people’s questions here, please help me out with a relatively simple one, at least i hope so.

all of my googling like, “best banks for SBLOC” doesn’t lead me to anywhere with any sort of list or comparison of lenders, but instead, sites and articles like this one, which just talk about what it is and a little bit about the how, but no recommendations or lists of banks on where to get started.

i saw one youtube video where the woman said there are ONLY 4 banks which do these types of loans, is that true?

anyway, it would be very helpful to me and any other future readers here if you know which banks those are, or any recommendations.

thanks,

mike

Hi Mike – I’m not sure if there are only 4 backs that offer this but it’s not something that’s extremely common. What you’ll want is to use a broker that offers this, since they will be holding the assets, and they usually refer to them as Pledged Asset Lines (PAL) rather than SBLOC (this was the first time I heard that acronym). It sounds like they’re similar products though. Charles Schwab and Interactive Brokers are the two bigger brokers that offers this, I’d start there in your research.

db says

I think many of the comments are missing the point here. Buy, Borrow, Die.

With a “large” stock portfolio, rather than selling and paying taxes and losing future appreciation, you borrow.

Small detail – interest rate for borrowing against a “large” stock portfolio is much lower than a mortgage. Some say less than 2%, others say less than 1%. It depends on who you are and who your banking relationship is with. The larger the portfolio the less the rate.

The lower rate is a big benefit of this strategy. Is the interest on the loan tax deductible?

My main question is about the Die portion. The 30,000 foot view is that the step up basis happens and then the appreciated shares are sold at the stepped up basis, without cap gains taxes, to pay back the loan.

Is this actually true? The estate has to be settled before shares are passed to heirs (no?) and (it appears) the step up happens after the estate is settled. This is the key to the strategy working. When does the step up happen and when is the load paid back? If the loan is paid within the estate process and the shares aren’t yet stepped up, there’s a cap gain payment due.