Saving and investing for retirement without a specific retirement plan is like setting sail on a ship with no destination.

Let’s face it, the typical investor is probably unaware of the many intricacies involved in preparing for retirement. You’ll be attempting to prepare for an event that may be decades into the future and will feature plenty of variables along the way.

How can you possibly know everything you need to reach your destination safely?

Fortunately, there are retirement planning tools available. Some are simple calculators, that will primarily crunch the investment numbers. Others provide comprehensive retirement planning, often with the assistance of a dedicated certified financial planner. Some are free, and others will involve either a one-time or ongoing fee.

Whether you choose a free service or a premium one, using a retirement planner will increase the likelihood of a successful retirement. If nothing else, it will provide you with a series of target numbers that will help you to establish realistic retirement income goals.

While none of these can take the place of working with a fee-only financial advisor, they are a low cost alternative you can try to see if you do need to see a professional

Here are what we believe to be the five best retirement planning tools available. Choose the one that will work best for your situation, and get the help you’ll need to guide you on this all-important life journey.

Table of Contents

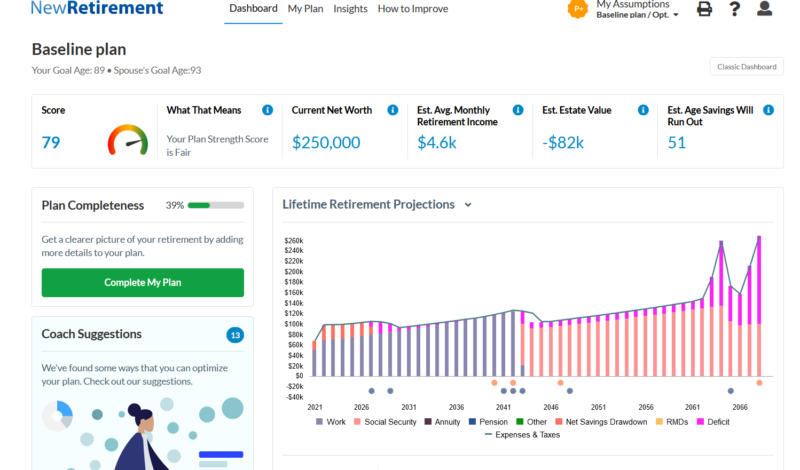

NewRetirement

NewRetirement is a retirement planning and calculator service used by more than 130,000 people each month. Though it offers a free version, there also three premium plans, ranging in price from $96 to as much as $999 per year.

The Free Planner helps you to organize and create a retirement plan. That includes helping you learn when you can retire, determining how much money you’ll need, and if your savings will last throughout your retirement.

It provides a detailed retirement plan, articles and resources, access to the community participating in the program, and the option to upgrade at any time.

The basic purpose of the Free Planner is to answer the question “do I have enough money to retire?” To answer that question, you can sign up for the free retirement calculator, complete with live coaching available for specific questions. It will help you learn if you’re on track to reach your retirement goals based on a calculation offered through their proprietary Retirement Score. From there, you get a personalized action plan to keep you moving in the right direction.

Retirement calculators offered on the platform include a Social Security calculator, lifetime annuity calculator, and even a reverse mortgage calculator.

Meanwhile, there’s a wealth of articles to help you deal with a multitude of retirement related issues. These include finding a part-time retirement job, finding a job after you’ve retired, volunteering, and even how to launch a post-retirement business.

But if you want to trade up to a premium version, you’ll get access to plan demos, virtual financial advisor suggestions, state specific tax projections, relocation models, Roth conversion modeling, Medicare estimations, the ability to link accounts to the program, online meetings with certified financial planners, retirement plan reviews, and personalized withdrawal strategies.

Check out our full review of NewRetirement.

Get started with NewRetirement

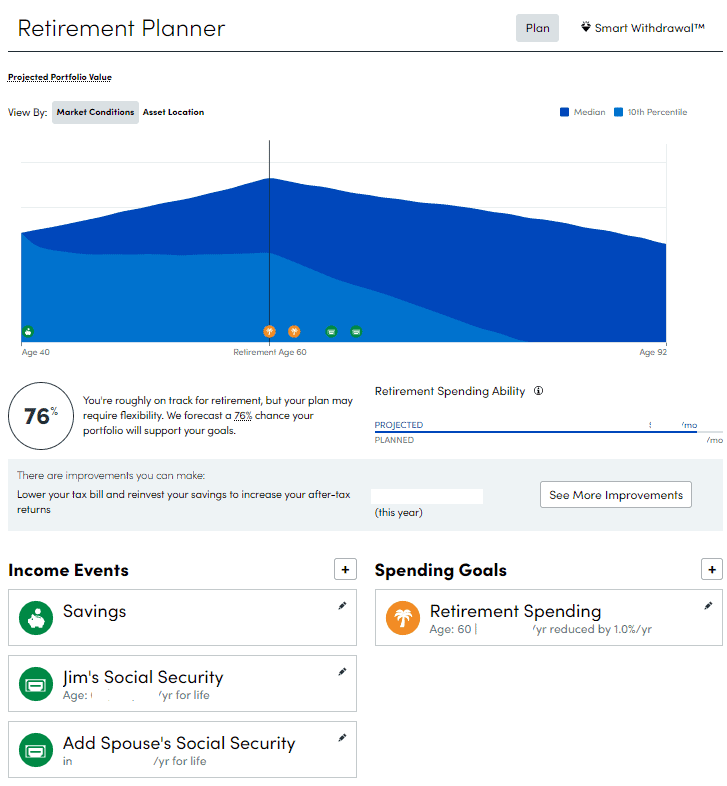

Empower Online Retirement Planner

Empower Personal Dashboard is a diverse financial platform offering everything from free personal financial tools to comprehensive wealth management.

If you choose – and if you have the portfolio – they can provide both investment management and financial advice for a single low annual fee. The service will naturally include formal retirement planning.

But even if you don’t have the minimum required initial investment, or if you don’t choose to participate in their wealth management program, you can still take advantage of the retirement planner. It’s a component of their free financial tools, and open to anyone.

You’ll start by linking your various financial accounts to the Empower Personal Dashboard. That includes savings, investments, retirement accounts, loans and credit cards. The purpose of including your financial accounts is to enable a holistic view of your entire financial life.

With all your financial accounts assembled in one place, the Empower Retirement Planner enables you to run different scenarios, such as evaluating various retirement dates or annual retirement savings contribution amounts.

It also helps you to build changes to your financial situation into your retirement plan. For example, you can factor in additional income sources, like Social Security and pensions. But you can also change the impact of major expenses on your retirement plan. Those include events like saving for your children’s college educations.

And while the focus of retirement savings is typically on the accumulation of funds, the Empower Retirement Planner helps you to develop a retirement spending plan.

After all, once you know how much you’ll need to live in retirement, the job of retirement planning becomes more precise.

They even offer a Recession Simulator to project how your retirement plan will weather a major event, like a recession or financial crisis between now and retirement.

Check out our full Empower Personal Dashboard Review.

Get started with Empower Personal Dashboard

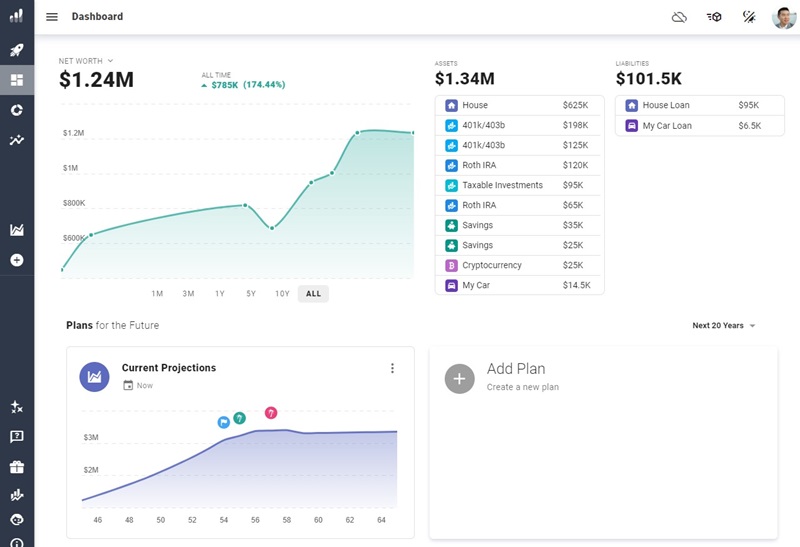

ProjectionLab

ProjectionLab is a personal finance dashboard that is one of the most beautifully designed tools I’ve ever seen. You start by establishing your “Current Finances” by adding in all of your accounts – this includes your bank account savings, brokerage accounts, investments, as well as your debts. This can include you and, if you have one, a partner or spouse.

Now comes the planning step – you can create multiple plans for the future. you start with a “Current Projections” – which is what your finances will be like on the current trajectory. As you build new plans, you can copy an existing plan (such as Current Projections) or start from scratch. If you start from scratch, you can start from “Today” or pick a start date in the future or the past.

From here, can plan different scenarios such as when you will retire, when your partner/spouse will retire, etc. These milestones can be tied to different factors such as a calendar year, your age, or when certain metrics hit their own milestones (like net worth exceeding a certain amount).

After that, you can set your assumptions (growth rate of investments, for example) followed by a whole slew of other factors like income, expenses, assets, taxation, etc. It’s very comprehensive and it walks you through each of these choices step by step.

After you’re done, you can see a chart of the next 20 years based on your assumptions. It’s really well done and you can adjust all of those factors to see how they impact your plan.

ProjectionLab is a paid tool with a free tier that lets you play with all of its features without having to enter in a credit card. You won’t be able to save your information though unless you upgrade to Premium ($9/month) or Pro ($45/month). Premium is what most regular people will use (Pro is for financial advisors or coaches).

Our ProjectionLab review includes a full walkthrough and explanation by the founder, Kyle Nolan.

Get started with ProjectionLab

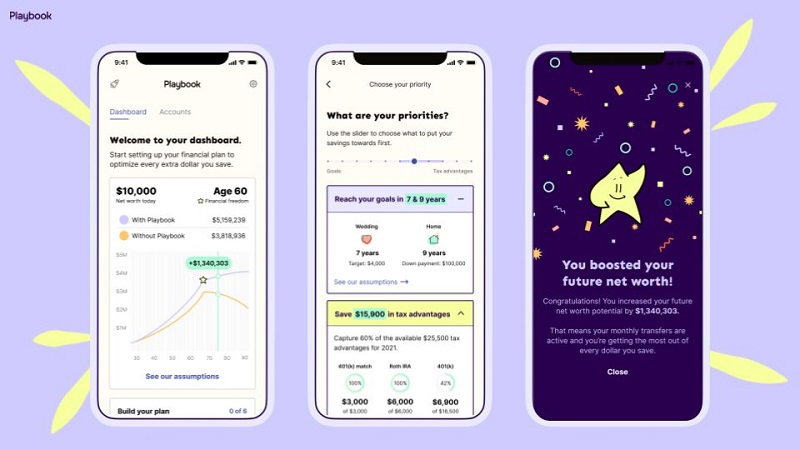

Playbook

Playbook is a company that will take a look at your finances (tax-advantaged accounts like 401k, IRA, 529, 403b, etc.) and give you a financial plan that will optimize your taxes. You connect your accounts and Playbook will analyze them to see if there are any opportunities to be more efficient.

Playbook is aimed at folks at the start of their retirement planning – where and how much to save into various tax advantaged accounts. By being efficient and taking advantage of tax breaks, you can save quite a bit over the course of your career. With a tool like Playbook, you can take much of the guesswork out of the process.

They will produce a financial plan, given your goals and risk profile, that you can use to adjust your investments.

Playbook costs $59 a month after their 30-day free trial.

Check out our full Playbook Review.

Vanguard Retirement Nest Egg Calculator

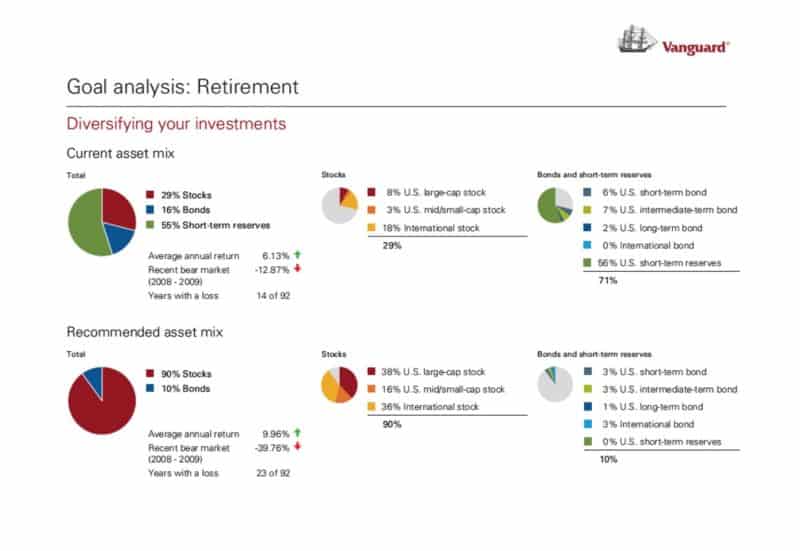

Vanguard is the financial world’s largest source of mutual funds, and it’s the second largest provider of exchange traded funds (ETFs). So, while they don’t have a retirement planning feature, it’s natural that they offer a multitude of retirement planning tools.

One is their “Maximizing your Social Security benefits” page. It will provide you with an overview of how Social Security works, as well as the ability to get your Social Security estimates directly from the Social Security Administration. They also provide advice on working while you collect Social Security, payment of your Medicare premiums, and the impact of government pensions on your benefits.

But a more hands-on tool is the Retirement Nest Egg Calculator. It will help you determine how long your retirement nest egg will last and how much your investments can grow based on different variables.

For example, it will take into consideration how many years your savings need the last, your current retirement savings level, and your annual spending. It will also consider your current investment allocation, then run simulations.

But if you want a more hands-on approach, you can take advantage of Vanguard Personal Advisor. It’s a personal advisory service designed specifically with pre-retirees and retirees in mind. However, it is an investment management service, and you’ll need a minimum of $50,000 to participate. But you’ll gain access to a team of financial advisors, and even have a dedicated financial advisor if you have $500,000 or more.

Check out our full review of Vanguard’s Personal Advisor.

Betterment Retirement Saving Calculator

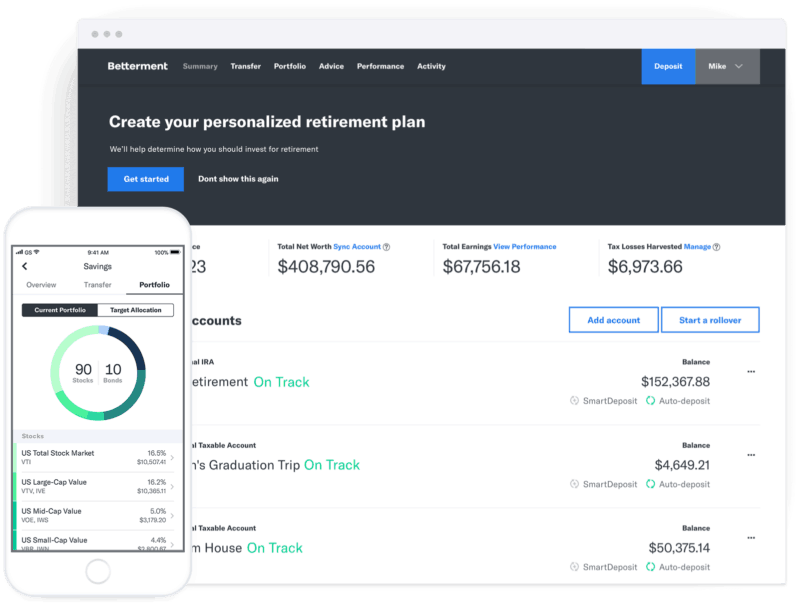

Betterment has a retirement savings calculator that works similar to the one offered by Empower.

You’ll provide basic information about your retirement plans, then sync your various financial accounts within the Betterment platform, providing access to your entire financial life in one place.

Betterment will project your retirement income, analyze your non-Betterment accounts, and provide a plan to help you reach your goal. You’ll then be able to track your progress to see how close you are to reaching your retirement goal.

And since Betterment is a robo-advisor, you’ll be able to have some (or all) of your retirement savings professionally managed by the service. With a low advisory fee of just 0.25% per year, you can have $100,000 fully managed for just $250. That will include portfolio creation – based on your long-term goals – security selection, periodic rebalancing, and dividend reinvesting.

All you need to do is fund your retirement account(s) and Betterment will take care of all the investment management for you.

Check out our full review of Betterment.

Bottom Line

If you’re not sure if you’re on track to reach your retirement goals you should definitely take advantage of a retirement planning tool. But even if you think you’re on track it’s never a bad idea to get a periodic “checkup” to make sure you’re on the right path.

Depending on your personal circumstances, any one of the above retirement planning tools should be able to get the job done for you.