When I started investing in the last 90s/early 2000s there were no investment apps to take advantage of. I had a Vanguard account, paid gobs of money for trades, and basically kept all my money in various mutual funds. Back then, you didn’t have much of a choice. Trading commissions were expensive and Vanguard let me buy and sell mutual funds for free.

As the century progressed many different investment apps came to fruition. I hadn’t discovered E-Trade Financial yet, with their absurdly low trading commissions, but it didn’t matter. I didn’t trade that much.

When I graduated, I discovered Ally Invest and their low-cost trades (now they’re commission-free for U.S. stocks, ETFs, and options!) and I was in. There would be a few new entrants over the years, some offering free trades like Zecco, but they would all be acquired or shuttered once they discovered their model was not sustainable.

Today, the landscape is different. We’re in the heydey of financial technology (fintech as it were) and there is a lot of variety. I’ve put together this list of the best investment apps based on what makes the most sense for you. Each has a different use case.

Table of Contents

Robinhood — Best for Free Trades

Robinhood was the first investing app that offered free stock trades. It was so popular that it pushed the giant brokerages to follow suit. From there, they’ve become one of the more popular investing apps because they have no minimums, no fees, and a free stock referral program that has super charged their sign ups.

In the app, you can track stocks, and then either purchase them outright or place them on a watchlist to buy at a later date. There is no minimum balance to open or maintain your account. You can also set up automatic transfers between your Robinhood account in your bank account.

Robinhood Fees: There’s no fee to open an account, there’s no minimum investment amount, and there are no brokerage fees for the buying and selling of stock. When you buy and sell stock, you still pay the small Regulatory Transaction Fee and Trading Activity Fee to FINRA. The only fee you would pay to Robinhood is if you wanted to trade on margin, which requires a Robinhood Gold account ($75/year).

What We Like

- It offers free trades on stocks, ETFs, and options. It also offers free cryptocurrency trading if that’s what you’re into.

- Fantastic for very active traders, free trades is less of an incentive for buy-and-hold

- Mobile experience is very streamlined and desktop interface is similar.

- Robinhood will allow investing in Fractional Shares, with a $1 minimum, in real-time. (currently waitlist)

- Cash Management account for your cash balances, current yield is 1.50% APY (5.00% APY for Robinhood Gold Members) (as of May 2022)

What Can Improve

It also has limited customer support.

If you’d like to open an account check out the Robinhood website.

Click here to read our in-depth review of Robinhood including their free stock referral offer.

Sign up and get your free stock today!

(and if you want to check out another competitor, Webull is hot on Robinhood’s tails)

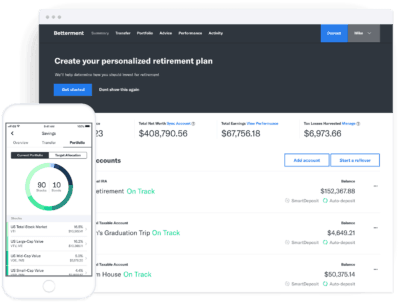

Betterment — Best Automated Robo-Investing

Betterment is the largest and perhaps best-known of the independent robo-advisors (another popular one that’s designed specifically for women is Ellevest). And for good reason. They’ve been one of the industry innovators, and have been a disruptive force in the investment universe. They brought professional investment management down to new and small investors, and at a very affordable rate.

You complete a short questionnaire that determines your risk tolerance, investment goals and time horizon. From that, a portfolio of exchange-traded funds (ETFs) is created to match your investment profile.

Your portfolio is comprised of 13 ETF’s, that represent the general market, large-, medium- and small-cap stocks, international stocks, emerging market stocks, and various bond funds. They even offer a value fund that invests in stocks of out-of-favor companies. This is one of the most time-honored ways of making money in stocks, and one used by Warren Buffett.

Creating Investment Goals Feature. Betterment enables you to create customizable subaccounts referred to as goals. You can establish them for retirement savings, emergency savings, or for a medium-term goal, like making a down payment on a house. Each goal-based portfolio has its own portfolio allocation. You can add new goals at any time.

Betterment Fees: Betterment charges a single management fee of 0.25% per year. It’s on the lower end of the range for management fees by robo-advisors.

What We Like

- With no minimum investment required, and a low fee of 0.25%, it’s the perfect investment platform for new and small investors. You can have a $2,000 account managed for just $5 per year.

- Betterment offers a cash management account for your cash balances, current yield is 5.50% APY

- Betterment’s investment mix includes value stocks, which holds the potential for your portfolio to outperform the market. Most robo-advisors try only to match the market.

- Betterment offers tax-loss harvesting on taxable investment accounts (it doesn’t apply to retirement accounts, since tax considerations don’t matter).

- RetireGuide. Betterment offers this tool to help you plan for retirement. It’s excellent for someone who is new to retirement investing.

- Betterment Advisor Network. If you like a personal touch with your robo-advisor, Betterment provides access to human investment advisor. The advisor is a vetted independent certified financial planner, who can develop a customized, comprehensive financial plan.

What Can Improve

About the only weakness in Betterment’s program is that they don’t offer investments in real estate or commodities. Some robo-advisors have added these sectors for greater diversification. Betterment has not followed suit – yet.

If you’d like to open an account check out the Betterment website.

(if you’re thinking about Wealthfront, you should read our comparison of Wealthfront vs. Betterment)

Click here to read our in-depth review of Betterment plus our updated list of Betterment free management promotions.

(Annual percentage yield (variable) is as of 2/20/2024. Cash Reserve is only available to clients of Betterment LLC, which is not a bank, and cash transfers to program banks are conducted through the clients’ brokerage accounts at Betterment Securities.)

Ally Invest — Best for Discount Broker

Ally Invest is the discount brokerage that is a subsidiary of Ally Financial, the parent company of Ally Bank. I got involved with Ally Invest because I used to have an account at TradeKing, which Ally acquired in 2016.

Ally Invest offers commission-free trades on stocks, bonds, ETFs, and options, much like many other discount brokers but pairs it with a sophisticated set of tools. They really shine if you’re into the options game, with great analysis tools and ordering platform that makes various strategies very simple to execute. The app offers all the features you’d expect from their website experience though I personally prefer to do research on a computer where I can spread out my information to really take it all in.

What’s also nice is that if you’re looking to move money from another brokerage, they offer a rich new account bonus as well as ACAT reimbursement of up to $150 if you transfer more than $2,500. This is applicable to all types of accounts, including individual retirement accounts.

Ally Invest Fees: No fee to open an account, no account minimums, no maintenance fees, and no commissions on stocks, bonds, options, and ETFs.

What We Like

- No minimums, no account fees, and no commissions – it’s the cheapest broker you can find.

- If you want a Managed Portfolio similar to a robo-advisor, you can get that too.

- The options platform is one of the best I’ve seen, making it really easy to execute complex trades.

- A near-seamless interface and integration with Ally Bank – you can transfer funds between a self-directed account and the bank in minutes.

What Can Improve

The app experience is fine but nothing to write home about. You can read our full review of Ally Invest for more.

Acorns — Best for Automated Saving

Acorns is an investment app that works with a different spin. Instead of funding your account through bank transfers, you invest using spare change. It’s an excellent way for a person who is not a natural saver to begin investing money. You literally accumulate investment capital by your normal spending habits.

When Acorns first launched, you connected a bank account and your credit cards to your Acorns account. When you made a charge for $7.50, and 50 cents was held to be moved into your Acorns account. This process is referred to as Round-Ups. When you connect your mobile phone to your bank account and credit cards, the app automatically invests the change from your purchases. You can set roundups based on the next dollar, or the next $10. Once the total of your roundups reaches $5, it will be transferred to your Acorns account.

Now, when you sign up, you get Acorns Checking account – it’s an FDIC-insured checking account with a Visa debit card. Acorns is fully integrated into the account and Round-ups appear in real time. They’ve also negotiated special cashback offers from over 350 Acorns Found Money partners, including Nike, Chevron, and Air BnB, sometimes up to 10%, and you get that deposited into your Acorns account too.

They’ve also introduced Acorns Later, their name for a retirement account where they recommend the IRA that’s right for your needs. Acorns determines your investment profile based on a questionnaire. They then recommend up to five different portfolios, each comprised of a mix of six low-cost ETF’s. Portfolios range from conservative to aggressive. Your account is fully managed by Acorns.

Acorns Fees: You pay $1 per month for account balances less than $5,000, and 0.25% per year once your account reaches this threshold.

What We Like

- This is the perfect app for a person who has been unable to save and invest money in the past. The savings method is completely passive – you do what you always do, spend money, and the spare change ends up in your investment account. You also sometimes get bonus cash back from some retailers.

- There is no minimum account balance required, nor do you need to set up recurring deposits.

- Acorns makes the app available for free for full-time students.

- You do have the option to add recurring deposits if you want to fast-forward your investing.

What Can Improve

- You have to open a new banking account (Acorns Checking) which is another item to manage, but you get the benefit of seamless integration.

- The fee is high on small balance accounts.

- The use of just six ETF’s is a little on the light side. Most robo-advisors use only a limited number of ETF’s, but usually at least a dozen.

Click here to read our in-depth review of Acorns.

Stockpile — Best for Stock Gifts

Stockpile is a brokerage that lets you buy, sell, and gift fractional shares of over a thousand stocks and ETFs. The appeal is that you can buy small amounts and not wait until you have a full share’s amount of cash.

The gifting aspect is in the form of Stockpile gift cards. You can give those to people, such as young investors (nieces, nephews, grandchildren, etc.), much like people use to give savings bonds or single shares of stock. They simply log into their account (or sign up) and redeem it for fractional shares of an investable company.

It operates just like a regular brokerage and trades are 99 cents each.

Stockpile Fees: No maintenance fees, just 99 cents a trade. When sending gift cards, there are additional fees. Digital gift cards cost $3.99 for the first stock and 99 cents for each additional stock, plus a 3% fee for processing the credit or debit card. If you want a physical plastic card, it ranges from $4.95 to $7.95 depending on the value of the card.

What We Like

- Stockpile lets you buy fractional shares of 1000+ companies and ETFs, exactly as advertised.

- You can give a Stockpile gift card that can be redeemed for shares of stock. $1 minimum, $2,000 maximum.

What Can Improve

- You are limited to the 1,000+ stocks and ETFs they offer.

- Sending gift cards costs extra but no fees for the recipient.

Our review of Stockpile goes into greater detail on the service.

Closing Thought

Which investing app is best? It depends on what describes you as an investor!

If you are someone who wants to invest and isn’t entirely sure how, or you want someone to handle it for you, Betterment is best. Ally Invest might be your option If you’re looking for a discount broker with seamless integration with a great online savings account.

As you can see in each section, each one serves a slightly different purpose and so the best investment app is the best one for you at this moment in your life.

Troy Bombardia @ Bull Markets says

I don’t quite understand how Robinhood makes money. I mean, I don’t think a company can survive over the long run if it doesn’t make money. Robinhood doesn’t charge fees or anything.

josh says

Robinhood makes money on interest on the balance that you have in your account that is not being traded.

Joe says

Exactly what I was looking for. If all informative articles were written this well- the world would be a better place.

Thanks Jim!

Vanessa says

Thank you for this great analysis! I’m curios to know if you’ve heard of M1 Finance. I’d love to hear your thoughts on how it compares to Robinhood.

I have! We have a review of M1 Finance that you should check out. I think they’re for different investors but both are solid.

Jess says

Thank you sooooo much for taking the time to break these apps down. I’ve literally downloaded them all poured over the user reviews before I decided to hop on google and found your comparison. You sir, are a headache reliever for sure. 😁

Tarik says

I use all of these apps and each one serves its own purpose. Robinhood and Stash are my two favorite ones but Acorns is probably the best for long term results since you aren’t always buying and selling stocks. There’s also Webull and M1finance as well. These two apps aren’t as popular but they have some cool features. M1finance is a fractional share alternative to Stash Invesrt but you need at least $100 to get started. Webull is only 2 years old but they have a cool 2 free stock offer if you sign up.

I think each one has an appeal to each type of investor.