Early retirement is a popular subject lately and with good reason – being able to tell your boss to “shove it!” is appealing (unless your boss is cool, then maybe it’s bittersweet… but still a little sweet).

There are a lot of fantastic early retirement blogs that can show you the path but the steps are still yours. It still comes down to math. You have to save enough money, invest it wisely so it grows, and then retire when you hit your magic number.

But what is that magic number? That’s the hard part.

Today, I’ll share with you some of the very best in retirement calculators so you can figure out that number for yourself.

Table of Contents

Empower Personal Dashboard Retirement Calculator

Empwoer Personal Dashboard is a powerful financial aggregator (one of my most useful personal finance apps) that will pull all your financial information into one place – banks, credit cards, brokerages, etc.

They have a really simple and straightforward retirement calculator (to use it, you’ll need to sign up) is your entry point into using the broader retirement planning tool.

The retirement planning tool takes your live data and helps you plan for your retirement.

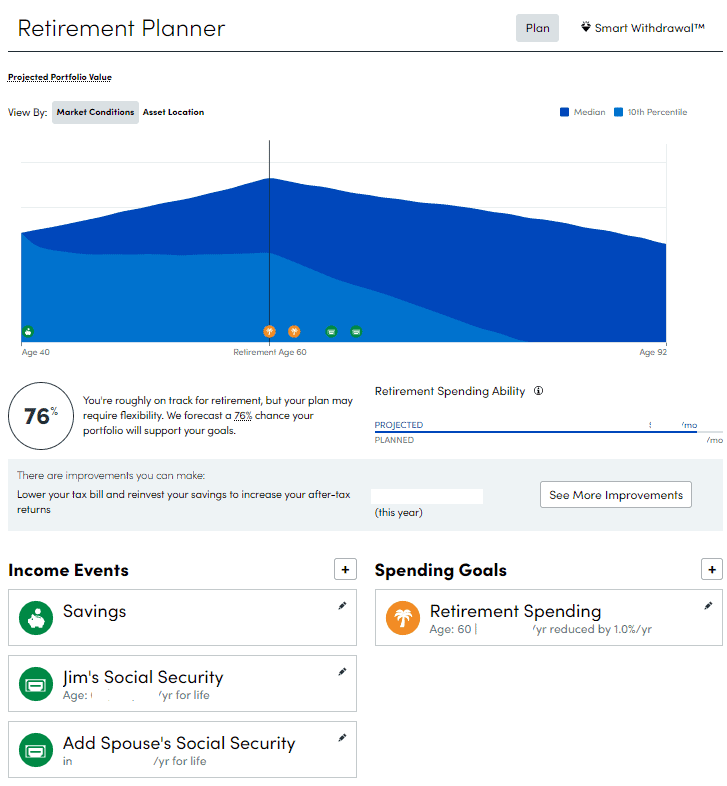

Here is what my retirement planner shows:

You can edit your Income Events and Spending Goals, adding to both, and the planner will adjust to show you whether you’ll make it.

The Savings entry will let you set how much you have saved up until now, how much you intend to save each year, plus how much you intend to increase your savings each year (percentage).

You can add all types of Income Events to your plan, including annuities, inheritance, pension, rental, property sale, working during retirement, and other income.

On the Spending Goals side, you set how much you want to spend per year and can add one-time spending events, like charity gifts, dependent support, education, health care, home purchase/renovation, vacations, wedding, and “other.”

Put all those in, set an investment growth rate, and the planner will tell you how you can expect your portfolio to perform.

I like how it uses your data, which saves you time, and what you put in the planner now will be saved into your account. Check out our in-depth review of Empower Personal Dashboard for more details.

Sign up for a free Empower Personal Dashboard account

Planswell Investment + Insurance Calculator

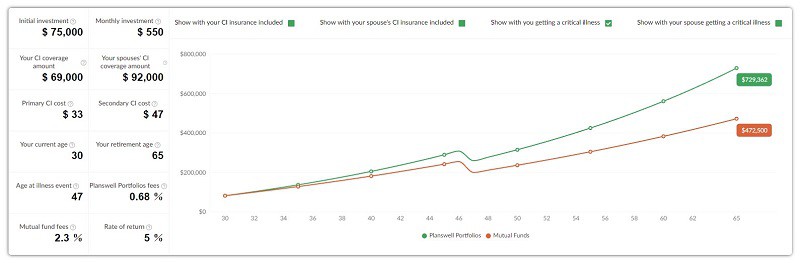

This is not a pure “early retirement” calculator like the others on this list but it is one that tackles an issue that is absolutely critical to retirees of all types.

What would happen to your nest egg in the event of a serious illness? We often worry about issues like the sequence of returns and cost of living issues, but what happens if you have a critical illness?

This quick calculator will help you calculate the impact of a serious illness event with and without critical illness insurance (for you and your spouse, if necessary).

It’s a calculator that can open your eyes.

Check out Planswell Investment + Insurance calculator

Minafi’s Choose-Your-Own Adventure Calculator

Adam created what is easily the coolest early retirement calculator on this list with his blend of calculator + choose your own adventure style guide. The other calculators on the list are just calculators, this one is a guide with a slew of calculators built into the guide. If you are new to the early retirement movement, unfamiliar with some of the vocabulary being thrown around, this is a great guide to help you learn everything.

There are several calculators built into the guide and none will satisfy the hardcore math and spreadsheet heads out there. The first one is a straightforward savings rate calculation (savings divided by income) which will seem fairly basic, as in why do I need a calculator, but it powers a chart later on and is more of a tutorial on how the guide is laid out.

Overall, the calculators in the guide are standard but the layout and organization are great to help walk you through the steps of financial independence.

Vanguard Retirement Next Egg

Vanguard offers a very easy to use Nest Egg Calculator that takes a handful of inputs and gives you an answer based on a Monte Carlo simulation:

You put in how many years you want the savings to last (5-50 year range), your current balance ($10,000 – $10,000,000), how much you spend each year ($1,000 – $250,000), as well as your asset allocation.

Hit “Run Simulation” and you’ll get a probability your savings will last your retirement. The chart you see above is run with their default entries.

I’m a big fan of Vanguard and their super cheap mutual funds.

Ultimate Retirement Calculator

My friend Todd Tressider, who writes the great blog Financial Mentor, has built his own custom retirement calculator he calls the Ultimate Retirement Calculator.

Is it the ultimate? It’s pretty close. It’s my favorite calculator of the ones that aren’t perfunctory mini-calculators that have just a handful of inputs.

It takes about twenty inputs (all necessary pieces like age, inflation expectations, portfolio size, growth, etc) and tells you how much you need to save when you hit retirement, how much you’re ahead or behind, and exactly what you need to save. It will calculate and create that schedule for you based on the information you include.

It’s a comprehensive tool that will give you great data if you spend the time to enter in the data points. It only asks for stuff that’s necessary and doesn’t hassle you with anything extra.

cFIREsim

If you think the tools up until now seemed a little too simple, cFIREsim is going to add a little complexity to your life.

cFIREsim is a calculator that uses historical data to figure out how your portfolio would have performed throughout history. It will take your simulation period and run it for every given period, from 1871 until today, and give you an idea of whether your portfolio would’ve failed (gone to $0 at any point). It’s a way to help you understand how you’d have done in the past.

The minimum data it needs to work is your retirement year (the year you retire), the retirement end year (when your retirement ends – probably with death), plus your portfolio amount and yearly spending. It is all typical data you’d need to know to use a calculator.

Enter that in, click Run Simulation, and see how your portfolio would’ve fared.

You can improve the analysis by adding more detail about your portfolio and your spending and it can get pretty complicated if you want it to be. 🙂

FIRECalc

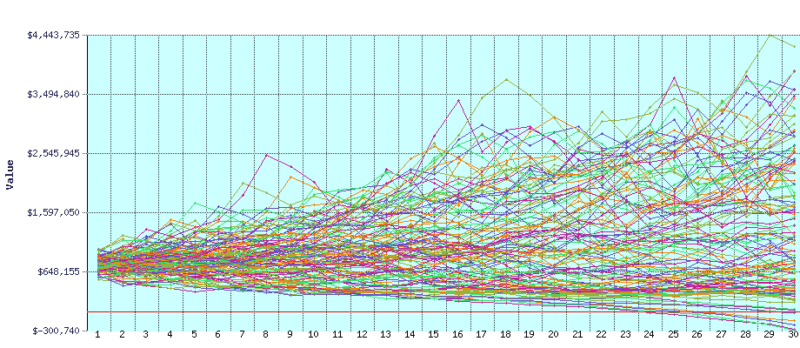

FIRECalc is another tool that is similar to cFIREsim in that it takes your inputs and calculates how your portfolio would’ve performed in that period throughout history. It’s a light version of cFIREsim. It takes just three inputs (spending, portfolio value, and years for retirement) and charts out the performance.

I put in the default data of $30,000 a year spending, $750,000 portfolio, and 30 years:

It’s a good visual look at how your portfolio would’ve performed.

Quick Comparison of Calculators

Here’s a quick look at all the tools:

- Personal Capital Retirement Calculator – This calculator will take the data you enter into Personal Capital, include your assumptions, and give you an idea of whether you’ll hit your number along with what you need to get there. It’s powerful because it takes your existing data without you having to enter it each time.

- Vanguard Retirement Next Egg – Very few inputs, very quick simulation, and you get an answer in a few seconds. The simplest calculator and powered by the folks at Vanguard.

- Ultimate Retirement Calculator – Financial Mentor has created the best data driven calculator that does not require you to log in or link up any accounts. It will tell you if you’ll hit your number as well as what you need to change to hit it if you aren’t on track.

- cFIREsim – More simulator than a planner, this is a comprehensive calculator that takes your plan and runs it through history to see how it would’ve performed in the past.

- FIRECalc – Similar to cFIREsim but with just three inputs, the simplest calculator of the bunch.

Personally, I’m sticking with the Personal Capital Retirement calculator because it takes my own data (which is already in Personal Capital) and because I feel safe with my data in Personal Capital.

If you are wary of sharing data, the most comprehensive calculator is on Financial Mentor because it takes all the data you could need and gives you a light plan to work with. The others are good for snapshots (especially if you like comparing with history) if you’re in a pinch.

Happy early retirement planning!

Jim @ Route To Retire says

Nice rundown, Jim! I’m loving the Personal Capital planner as well for the reason you mentioned – it knows your current numbers so it’s easy to jump back in it at any time.

Another one that I found pretty good is NewRetirement (https://www.newretirement.com/) and I keep going back and toying with that one as well.

— Jim

GYM says

Loved your about page, Jim, you have a beautiful family!

I would love to use Personal Capital but it’s not in Canada right now.

I have tried the FIRECalc and thought it was good.

Will take a look at the other ones you mentioned, they look great.

Thanks GYM!

Budget On A Stick says

Wow! I hadn’t heard of a lot of those. Time to go play with some numbers!

Most of my fuzzy math projections are done in Google Spreadsheets 😀

Jon says

FIRECalc is much more than 3 inputs, look near the top of the screen, those are actually tabs for quite detailed input (optional on all) for income, expenses, asset allocation, and calculation options. I rank it number one on my list. Donate to projects like these if you utilize them and find value in them. Think of how much you might pay a CFP or CPA to do this calculation for you. I hope my calculations will work for me, early retired for health related reasons and to escape the normal job/work no balance B.S. Remember 72t if you get caught in a situation as well. Thanks for your website and trying to educate people.

Financial Freedom Countdown says

Jim,

Is there any calculator which besides just an input of stocks and bonds actually lets me enter details such as 30% emerging; 5% small cap value etc of my portfolio to run various simulations based on historical data?

You can use Portfolio Visualizer – https://www.portfoliovisualizer.com/backtest-asset-class-allocation