Sometimes we make bad bets.

Make a bad bet in a casino, you might leave with a drink. Make a bad bet in the stock market, you can leave with an income tax deduction.

If that made you say “huh? what?” — perk up.

It's called tax loss harvesting and it's what successful investors use to help juice up returns on their investment.

You can think about your public market investment portfolio as a business. When you sell a winner, you have profit (capital gains). When you sell a loser, you have loss (capital loss). Capital gain is offset by capital loss and you are taxed on the difference between the two.

For example, if I bought $10,000 worth of Wallet Hacks stock in January and sell it for $20,000 in March, that's a $10,000 short term capital gain. If I also bought $10,000 worth of Get Rich Slowly stock in January but sold it for just $5,000 in December, that's a $5,000 short term capital loss (sorry buddy!).

$10,000 of gain minus $5,000 of loss means I will be taxed on $5,000 of gain at the short term capital gains rate.

I cash out my winner because I want to lock in the paper gains, but I want to lower my tax burden so I need to find a loser I can sell to help offset those gains. Boom, found a good candidate and I sell it to lock in the losses.

The IRS and Treasury Department know people do this. So they create a rule, you can't use the loss to offset gains unless you follow specific guidelines. Those guidelines are referred to as the “wash-sale rule.”

The wash-sale rule says that if you buy the same or “substantially identical asset” within 30 days, you won't be able to use the loss. The loss gets added to the tax basis of the new holding, so it in effect just gets delayed until you sell the stock again. The loss doesn't disappear. (funny enough, your new holding is actually an extension of your old holding, which you sold at a loss, so it could be eligible for long term capital gains rates)

After I sell Get Rich Slowly stock, I can't buy back in for 31 days if I want to offset my gains with that loss. I can buy another asset, maybe pick up shares of The Penny Hoarder or Wise Bread (I hear those two blogs are going places!), but I can't buy Get Rich Slowly. (the same rule applies for 30 days before the loss sale, so I can't buy Get Rich Slowly 30 days before I sell my losing position)

One final rule to remember – if you have more losses than gains, you can use up to $3,000 of those losses to offset ordinary income. Any extra losses above $3,000 get carried over to the next year.

How the rich use this strategy

It all comes down to the term “substantially identical.” There are plenty of mutual funds that, if you asked a regular human being, are pretty much the same.

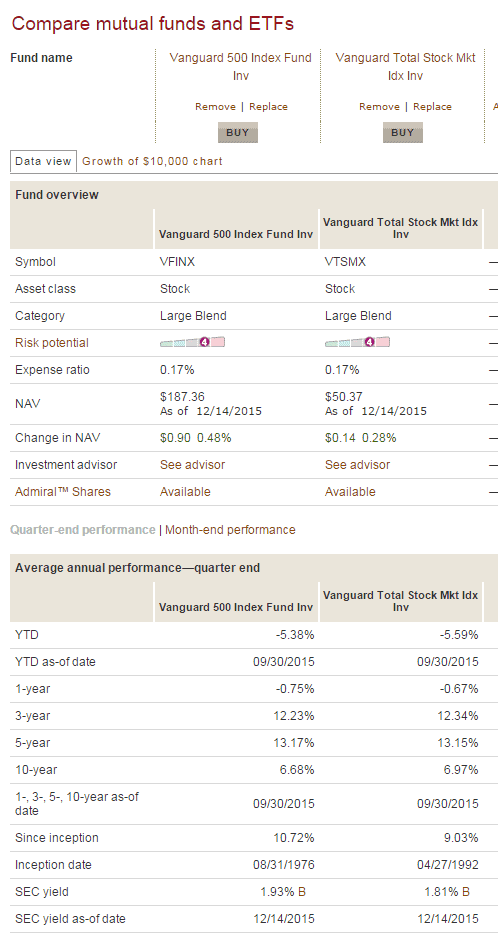

To IRS regulations, they are not. Take a look at these two funds:

Vanguard 500 Index Fund and the Vanguard Total Stock Market Index fund are two different funds but they're very close. The S&P500 makes up around 75% of the market so we have a lot of good overlap. If you were looking at a loss this year in the S&P500 fund, you could harvest those tax losses and put them into the Total Market fund. Wait 31 days, then go back to the S&P 500 fund.

Another prime example are in two foreign large cap ETFs, VXUS and VEU. They are funds that hold similar companies, with similar performance, but they are not substantially identical.

(Michael Kitces has a good discussion of the substantially identical rule as it relates to the intent of the rule, pooled investment vehicles, and loss harvesting — read it)

When the market took a nosedive in 2008 and 2009, I know a lot of folks who harvested losses. Tens of thousands of dollars, if not into the hundreds of thousands, of losses. But they participated in the upside when the market recovered because they purchased something similar, albeit not “substantially identical.”

Now before the pitchforks come out, remember that the losses suffered are very real. This isn't some crazy loophole that makes the rich richer (look up carried interest for that). It just makes them a little bit more richer because you get a small tax benefit in the interim.

All of the tax benefits, very little risk you'll miss some upside move by the S&P500 that isn't captured by the Total Market fund.

Realizing paper losses may hurt psychologically but it's a boon financially. If your $10,000 investment is only worth $5,000, selling it doesn't mean you lost $5,000 right now. You lost it a long time ago, you're just now able to reap some of the silver lining in that loss. $3,000 can go towards offsetting ordinary income and the rest can be used to offset any capital gains you've already realized.

If you read Kitces' article, tax-loss harvesting has a lot of murkiness around “substantially identical” but it's a powerful tool many folks are using and you should be using too.

✨Related: Year-End Tax Moves You Must Be Doing

Another strategy for the not-so-rich

Before you go, I want to share with you a strategy that is available to those who make very little money.

There's a way you can have gains and still pay ZERO on the capital gains.

Long term capital gains are taxed at either 0%, 15%, or 20% depending on your marginal tax rate for ordinary income. If you are in the 22%, 24%, or 32% brackets then you pay 15%. If you are in the 35% or 37% bracket, you pay 20% (there's a bit of weird overlap in the brackets there, but not the point of this).

If you're in the 10% or 12% tax brackets – you pay ZERO PERCENT in capital gains.

Where's the top end of the 12% bracket? $41,775 for single filers and $83,550 for married filers for 2022.

Add back in the standard deduction of $12,950 for single filers and $25,900 for married filers and your ceiling on the 12% bracket drops considerably.

When you go to sell investments, whatever gains you would get that remain under that ceiling after adding in your income would be tax-free.

As we near the end of the year, check to see what your tax rate on long term capital gains might be. If it's 0%, it might be a good time to harvest some of those gains tax-free.

That's how you avoid paying capital gains on long term investments. And you don't have to be wealthy to do it!

(as with all tax suggestions, make sure you check with an accountant to know for sure)

Thias @It Pays Dividends says

This is a really easy to follow write-up of a difficult topic. Thanks for putting it together Jim. As part of the wash sale rules, I have read that you can’t re-purchase the security you sold for 31 days even if it is in a different account (ex. your Roth IRA).. Is this correct? If so, you need to also be aware of any auto contribution investments you might have so you don’t accidentally contribute in the quiet period.

I don’t know for certain but the spirit of the rule is that you don’t buy shares within that quiet period.

Now if you were to buy it in a Roth IRA where you aren’t keeping track of capital gains and thus not reporting when you buy and sell stock, I’m don’t know how this would be detected and enforced. I would not do it.

Good point on auto-contribution (especially reinvested dividends), could make for a messy filing.

Mike Piper says

Thias, I know this is a late reply, but in case you are still reading, yes, a wash sale will occur if a substantially identical security is purchased in a Roth IRA within the specified time window.

See IRS Rev. Rul. 2008-5:

https://www.irs.gov/irb/2008-03_IRB/ar08.html

I suspected as much, it is within the spirit of the rule after all.

Mr. Groovy says

Hey, Jim. Nice synopsis of the strategy. I’ve been reading general articles about tax-loss harvesting for about six months now. I’m still a little fuzzy about it, but decided to give it a go recently. In late October I sold a chunk of an energy index fund. Needless to say it’s been getting clobbered this year, so I was able to offset a lot of my dividend income with that one sale. Last week I put the proceeds from the October sale back into that fund and avoided the wash sale. I also got more shares because energy is still getting clobbered. (If energy every comes back I’ll look like a genius.) Thanks for the specific examples. They certainly made things clearer. And thanks for the Kitces lead. I feel a little more confident now.

Kitces is really good at what he does, I like his explanations and his tone, you won’t go wrong reading his stuff.

Stinks to lose money on an investment but you might as well help your tax situation out in the short term. 🙂

Devin says

Clean and easy to understand summary, the wash sale rule was one of my main reasons I stopped dripping or auto-reinvesting dividends. Thanks for the write up.

I did it because all those transactions are a pain to keep straight! 🙂

Stockbeard says

Yup. I sold all of my $BABA this year as I’m not seeing it going anywhere, and it was bought in my “bad” period when I thought investing in stock meant picking individual stocks.

So, I sold at a loss, which sucks, but I am now where I want to be in terms of international stock, I had too much before, so I consider it a win-win: rebalanced my portfolio AND got to do a bit of loss harvesting.

Definitely a win win!

Holly Johnson says

Nice analysis! I know that some of the online financial advisors – I think Wealthfront and Betterment? – take care of tax loss harvesting for the clients.

Yep — the robo-advisors are integrating this into their offerings but your regular broker won’t (they can’t).

Ted says

Nice article. I have a question. I use Wealthfront, which use a small percentage of my portfolio in Real Estate. I was considering to invest in Fundrise in order to diversify my portfolio even more but I am not sure if there could be a potential wash sale between the two. Any advice?

Fundrise runs their own funds so there wouldn’t be any worries of wash sale rules.