When I was in high school, my high school quarterly report card always told me which decile I was in with respect to grades.

Every quarter – top 10%, 2nd half.

There were 495 students in my grade so that meant I was somewhere between 25th and 50th.

Every quarter – same result. Top 10%, 2nd half.

Was that good? Compared to 90%, yes. Compared to 5%, no.

Now that I’m easing into my late-30’s, I realize that the rankings have largely disappeared but the comparisons remain.

🗓️ I updated this post with the latest U.S. Census data from 2022, reported in June 2023, so all the tables have the most currently available data. The visual charts still need to be updated, they are using older 2011 data, but the general trends are still correct.

I use median and average interchangeably. I recognize the two are not the same but for most people, they want to know the median even if they ask for the average. We always, technically, use median even when we use the word average.

Much like your GPA in high school, if you were to point to one figure in your life that summed up how you were doing – it’s probably your net worth.

It’s really easy to see the people around you with new clothes, fancy cars, and enormous houses and think they’re wealthy.

It’s just as easy to overlook the janitor who drove a 2007 Toyota Yaris, kept his clothes together with safety pins and foraged for firewood. He’s definitely poor… right?

But that ex-janitor donated six million to a local library and hospital.

Most of us are somewhere in-between.

Fortunately, the U.S. Census Bureau collects valuable data that can help give us guidance. With hard data.

Table of Contents

- Understanding Average Net Worth Data Sources

- ⭐Median Net Worth of All Americans⭐

- Median Value of Assets by Generation

- Median Value of Assets by Education

- Median Value of Assets for Households by Age and Type

- Median Income by Age

- Ratio of Median Net Worth to Income by Age

- Net Worth with and without Home Equity

- Number of Accredited Investors

- My Personal Takeaways

- How do the rich get richer?

- How You Can Increase Your Net Worth

Understanding Average Net Worth Data Sources

The U.S. Census does more than count the number of people in the U.S. – they collect a lot of other data too.

We know the net worth of householders based on a variety of factors – including age. The data shown below was taken from the U.S. Census Bureau, Survey of Income and Program Participation (SIPP), Survey Year 2022 – released 6/27/2023. That’s a lot of dates but the data is solid and the most up to date as of March 2024.

If you go to the 2022 SIPP website page, they state “The 2022 SIPP continued to face data collection complications because of increasing costs and a general lower-than-average unit response rate nationally.” It’s unclear when we’ll get more up to date data.

Figures of net worth include home equity (it’s not clear how home equity is determined though).

⭐Median Net Worth of All Americans⭐

The median net worth for all Americans across all demographic categories is $166,900.

If you exclude home equity, the average net worth is $57,890.

As for average net worth with and without equity, broken down by age:

| Age of Householder | Median Net Worth | Median Net Worth excluding Home Equity |

|---|---|---|

| Under 35: | $30,500 | $18,270 |

| 35 – 44 | $126,900 | $49,000 |

| 45 – 54: | $186,000 | $70,910 |

| 55 – 64: | $276,000 | $106,900 |

| 65 – 69: | $341,400 | $138,100 |

| 70 – 74: | $373,900 | $146,900 |

| 65+: | $336,000 | $117,700 |

| 75+: | $315,900 | $92,300 |

| All: | $166,900 | $57,890 |

But that’s the high level number – we can dig deeper and learn more.

| Age of Householder | Median Net Worth |

|---|---|

| Under 35 years old: | $22,000 |

| 35 to 44 years old: | $97,740 |

| 45 to 54 years old: | $166,600 |

| 55 to 64 years old: | $230,900 |

| 65 to 69 years old: | $285,100 |

| 70 to 74 years old: | $326,700 |

| 65+ years old: | $300,000 |

| 75+ years old: | $292,800 |

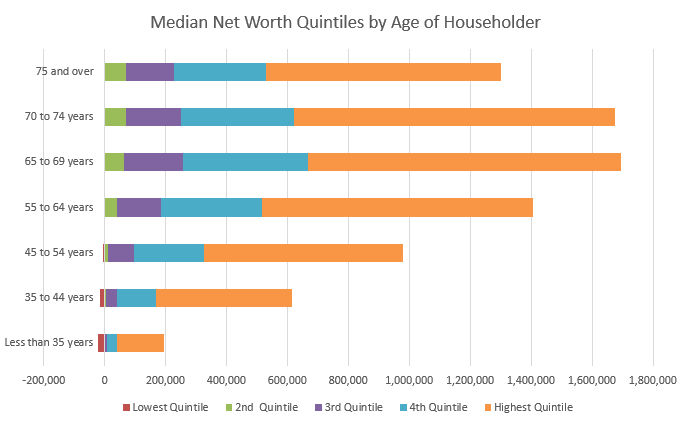

Here it is in chart form with quintiles (this is with older 2011 data but still close enough visually):

The highest quintile, which represents the top 20%, is often the biggest jump in median net worth for a quintile. Remember, these are median values so the top 10% are literally off the charts.

Without running a regression analysis, I suspect the biggest impact on net worth is going to be age. The older you are, the longer you’ve been earning and thus accumulating assets. That said, it’s still educational to look at comparisons across different factors like education.

Median Value of Assets by Generation

Want to start a fight? Here’s how the net worths compare by generation:

- Generation Z – $8,870 ($7,500 when excluding net worth)

- Millennial – $58,430 ($28,760 when excluding net worth)

- Generation X – $180,600 ($69,140 when excluding net worth)

- Baby Boomer – $321,000 ($127,300 when excluding net worth)

- Silent Generation – $308,600 ($86,300 when excluding net worth)

Median Value of Assets by Education

As for net worth based on the highest level of educational attainment, it follows the trends you may expect:

- No high school diploma – $8,460 ($3,120 when excluding net worth)

- High school graduate only – $55,030 ($16,140 when excluding net worth)

- Some college, no degree – $90,810 ($30,140 when excluding net worth)

- Associate’s degree – $139,000 ($44,800 when excluding net worth)

- Bachelor’s degree – $266,600 ($121,700 when excluding net worth)

- Graduate or professional degree – $555,900 ($321,700 when excluding net worth)

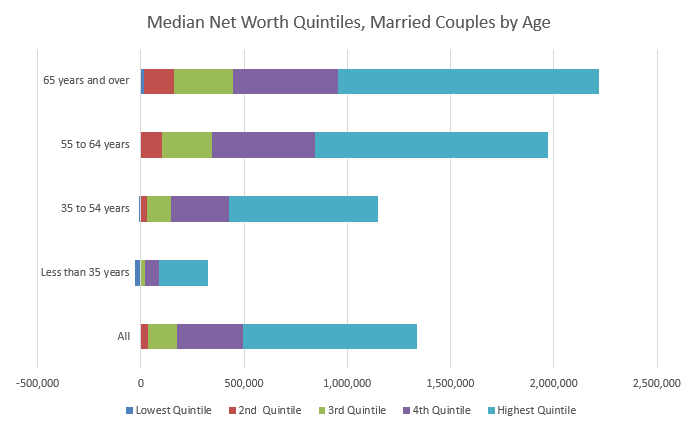

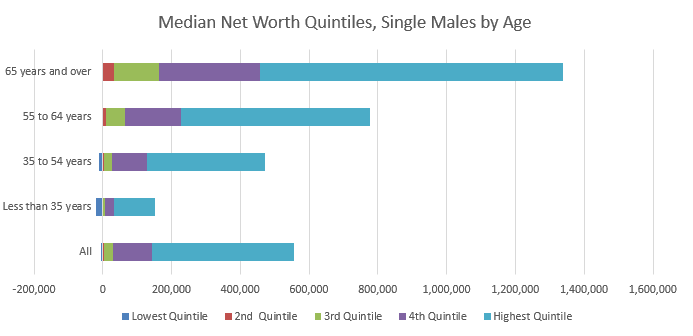

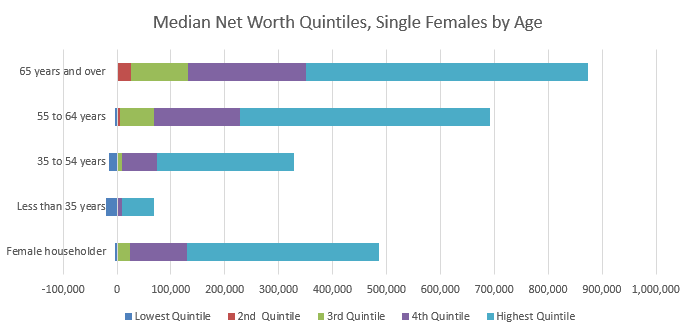

Median Value of Assets for Households by Age and Type

| Age of Householder | Married-couple | Male householder | Female householder |

|---|---|---|---|

| Under 35: | $86,430 | $27,620 | $9,390 |

| 35 – 54 | $304,600 | $81,240 | $28,600 |

| 55 – 64: | $571,900 | $103,000 | $98,300 |

| 65+: | $600,000 | $197,900 | $184,000 |

| All: | $370,000 | $69,400 | $58,240 |

Here these are in chart form (note: the X-axis scales are different!):

Overall, independent of age, the median net worth by average household income quintile was:

- Lowest quintile – $12,000

- Second quintile – $61,260

- Third quintile – $145,200

- Fourth quintile – $269,100

- Highest quintile – $805,400

Median Income by Age

Before we start looking at the numbers and drawing conclusions, net worth is as much as inputs (income) as it is about outputs (expenses).

For income, there are several data sources but I’m going to go with the Federal Reserve (BLS has great data too) and their Survey of Consumer Finances report for 2022 (released in 2023):

| Age of Householder | Median Income (estimate) |

|---|---|

| Less than 35 | $60,500 |

| 35 – 44 | $85,900 |

| 45 – 54 | $91,900 |

| 55 – 64 | $81,900 |

| 65 – 74 | $60,900 |

| 75+ | $49,100 |

Ratio of Median Net Worth to Income by Age

The SCF also has net worth data so we can calculate the ratio of net worth to income:

| Age of Householder | Ratio (Net Worth / Income) |

|---|---|

| Less than 35: | 0.645 |

| 35 – 44 | 1.579 |

| 45 – 54: | 2,690 |

| 55 – 64: | 4.451 |

| 65 – 74 | 6.731 |

| 75+: | 6.835 |

Interesting huh?

Net Worth with and without Home Equity

Here’s something very eye-opening from the Census data:

| Age of Householder | Median Net Worth | Median Net Worth excluding Home Equity |

|---|---|---|

| Under 35: | $30,500 | $18,270 |

| 35 – 44 | $126,900 | $49,000 |

| 45 – 54: | $186,000 | $70,910 |

| 55 – 64: | $276,000 | $106,900 |

| 65 – 69: | $341,400 | $138,100 |

| 70 – 74: | $373,900 | $146,900 |

| 65+: | $336,000 | $117,700 |

| 75+: | $315,900 | $92,300 |

| All: | $166,900 | $57,890 |

Ponder the differences in those columns, especially as you reach higher ages. One caveat is that they’re both median figures, so the person with a net worth of $30,500 isn’t the same person as the one with a median net worth excluding home equity of $18,270 – but this is good enough for our purposes of identifying trends.

As a percentage of total net worth, here’s how home equity stacks up in each age group:

| Age of Householder | Home Equity | % of Total |

|---|---|---|

| Under 35: | $12,230 | 40% |

| 35 – 44 | $77,900 | 61% |

| 45 – 54: | $115,090 | 62% |

| 55 – 64: | $169,100 | 61% |

| 65 – 69: | $203,300 | 60% |

| 70 – 74: | $227,000 | 61% |

| 65+: | $218,300 | 65% |

| 75+: | $223,600 | 71% |

| All | $109,010 | 65% |

The median net worth of all Americans is $166,900. The median net worth excluding equity is $57,890 – which means home equity (of $109,010) accounts for 65% of total net worth.

I have only one thing to say about that – that’s incredible!

When they say that real estate is a way to build wealth, this isn’t what they mean!

My guess is that home equity is essentially “forced savings,” which may not be mathematically optimal but it is effective.

Number of Accredited Investors

An accredited investor is someone who has a net worth greater than $1,000,000 or has income greater than $200,000 a year for each of the last two years ($300,000 of combined income for those who are married) and expects to make that much this year.

In 2014, at the Forum on Small Business Capital Formation, the SEC held a discussion about the rules for accredited investors. In this presentation, they showed that there were over 9 million households that would qualify based on net worth alone. If you include income rules, that number increases to over 12 million households.

This is important because accredited investors can take advantage of private placements, angel investments and some crowfunded real estate platforms.

My Personal Takeaways

We only looked at median net worth, income, and a few other demographic factors. We skipped a lot of factors, like geography, education, and many many more. You cannot look at these numbers and feel good or bad about where you are specifically.

These groupings are huge – 10 year periods – and net worth doesn’t even start until 35. The lowest income range starts at 15! I made nothing (reported to the IRS!) when I was 15 and was working a full-time job when I was 23. That age range is hardly homogenous.

I recognize this is imperfect but so is making decisions based on what everyone else is doing. Remember that this data is a view of American’s net worth, their income, etc. It’s not meant to paint the picture of an ideal financial situation. The average credit card debt is still five figures and no one is arguing that’s a good thing!

With that out of the way, is there anything interesting to tease out of this?

- We tend to reach “peak net worth” in our early 70’s, otherwise known as the first few years after our typical retirement age. Then we draw upon those assets because we stop working full-time. It’s also when Social Security starts paying and that’s an income stream not represented in your net worth.

- We are woefully unprepared for retirement. If you have a net worth of $336,000 when you hit 65 and expect to spend only 4% a year, that gives you $13,400 a year or less than $1116 a month (and that’s based on net worth, not cash in the bank). Even with the average monthly Social Security benefit at $1341 (2016 data), that’s a little over $2,400 a month in retirement income. That’s the median. Half get more, half get less.

- In the past I’ve talked about financial gravity, you escape it when your passive income exceeds your expenses so it becomes an ever-growing balance. When you’re young with low-income relative to expenses, it’s hard to save. It’s why the net worth ratio for those under 35 is so low – you’ve had neither the time nor the income to accumulate assets. Compare that to 55+, when the ratio is 2-4x.

- If you save money, invest it wisely, then you will surely beat the average. In fact, the average is going to be too low. It will be misleadingly low. In fact, just investing at all will put you ahead of most Americans because very few of them own stock at all!

- Lastly, net worth is a valuable financial benchmark, but remember it’s not everything.

How do the rich get richer?

One of the striking stats is how uneven wealth is in America. It’s shocking how low the median net worth is but also how high the top end of the range is.

For more insight on the distribution of wealth, and how we got to where we are today, I posed a few questions to Professor Rishabh Kumar, Assistant Professor of Economics at California State University, San Bernardino – he has been studying this for many years:

Q. When we look at the distribution of wealth in America, what are the biggest drivers of wealth accumulation?

The main reason appears to be slower national income growth in the US along with a long upswing in asset prices. With low growth, even a small asset price appreciation can increase the size of wealth relative to national income.

If asset prices increase by 2% in real terms while income grows at 2%, the effect is larger than (say) 4-5% national income growth (USA 1945-70). The implication is that asset owners become richer as GDP and national income slow down.

Q. What do the top 1% do differently than the rest of Americans?

One of the key differences is that the top 1% is a much more unequal growth than (say) the top 10-1%. At the level of the top 0.1%, the size of wealth is enormous, nearly 3 times the average wealth in the top 1%. This means returns to wealth are exceptionally large for the richest 0.1%.

Compared to their wealth and capital gains, their spending is almost too small to be noticed. For most Americans, savings are closer to 0-2% of their income while for the richest the saving rate is as high as 60%.

Not only are the rich holding sizeable wealth but they save more of their income too.

Q. What are some common misconceptions of how the wealth get where they are?

The most common misconception is the fraction of meritocratic rich in the US. While many such as Gates and Zuckerberg have made outstanding gains due to their entrepreneurship, the average wealthy family tends to inherit their position. There is very little chance of downward social mobility once an American is in the top 0.5-0.1%.

With access to better schooling, influential networks, and a sizeable inheritance, kids from these families are able to dedicate themselves to increasing their dynastic wealth as opposed to building it up from scratch.

To sum up: the core driver of wealth accumulation in USA is the difference between the growth of asset prices vs income; those who already own wealth grow it faster than those who build new wealth from wages and salaries.

This makes intuitive sense but it’s one thing to think it and another to see it in the data.

How You Can Increase Your Net Worth

I started tracking my net worth when I started working – the perils of being a spreadsheet junkie!

There’s also a trend, especially among personal finance bloggers, of sharing net worth reports with your audience. I’m never going to do that but sometimes I think those net worth reports can lead people to the wrong conclusions. It’s about the journey and the trendline, not the headline number.

Peter Drucker, the famed management consultant, once said that “What gets measured gets improved.” While the simple act of tracking your net worth won’t automatically raise it, it will start impacting your behavior. If you check in on your money every month, you’ll start caring if things go up or down.

john says

does that include all assets including your house? Seems low

It does include the equity in your house, the figures excluding it are even lower.

There’s been a lot of talk about how older generations are “being screwed” because younger generations aren’t buying homes. So the folks who relied on their house as a retirement vehicle are now finding it hard to cash out, or cash out at levels they expected. It’s quite a conundrum.

Larry says

Alternatively, I see a shift where there is insufficient inventory of existing homes for younger folks to buy as the mid-range to older millennials are in their 30s. Regarding retirees, we in fact may be witnessing more of a “choice” versus a “screwing” as many boomers plan to stay put in their homes in retirement.

http://money.cnn.com/2014/10/30/real_estate/baby-boomers-homes/index.html

Builders are just now starting to build more affordable first homes, but they are typically in the metro outer belts, far from where the younger crowd wants to live.

The difference between choice and screwing is all about perspective and emotional involvement. 🙂

But your point is well taken and I agree, the data does show that. The financial crisis and subsequent recession delayed a lot of activities across the board, which is something that needs to be managed. If people are working longer, staying in their homes longer, then the younger generation has to wait until that process works itself out sometimes.

Ted Mittelstaedt says

Both of you are kind of wrong on the housing haven’t you ever watched the movie “It’s a wonderful life”?. The problem in housing is that historically the “starter homes” were the large, expensive-to-heat, drafty old places that Grandma had lived in for 40 years and died in and not put a dime into, and had rotting roofs, rusted out plumbing, and electrical that was 2 sparks away from burning the place to the ground. The youngsters would buy them cheap and put 3-4 years of hard work sweat equity into and get them fixed up. (as the movie detailed) then once they were fixed up they would live in them.

But today the youngsters were raised on video games and they would rather RENT a place that is move-in-ready with the big screen TV for more money than buy a place that they own for cheap and then spend every evening fixing for the next 3 years.

As a result the housing industry has become infested with “flippers” who buy a home, fix it up, then sell it for inflated prices. We have TV shows like “extreme home makeover” that were very popular during their run and we have tons of home fix up shows even today where the first thing they do is gut the place out and rebuild it to look like a Better Homes and Gardens place.

Builders have found that building cheap homes is just not as profitable as long as there’s sucker…I mean people willing to go in debt for 600 years to buy a Street of Screams I mean Dreams place.

I live in one of the hottest real estate markets in the country and all they can build is half million dollar places the local government had to bribe…I mean pass a subsidized housing bond to get ’em to build some ratty small “low income” apartments. BUT- any place in the property listings that is NOT move-in-ready just sits even though the move-in-ready stuff usually lasts a week on the listings then has 2 offers on it.

Non move-in-ready places just do not sell no matter how cheap, they are hard to get rid of. When I go to Home Depot and look at the aisles with building stuff (paint, electrical, piping, lumber) all I see are contractors buying for jobs and Latinos (THEY “get it”) buying for fixing up their places. But the only others I see are maybe on occasion a housewife buying a can of paint to paint a birdhouse or something.

When the young late 20s candidates for first time home buyers are willing to buy a place that looks like its 40 years out of date and has lead paint, asbestos popcorn ceilings, radon in the unfinished basement, ugly linoleum in the dining room, a broken furnace and a big old woodstove in the living room that doubled as a heater and a trash incinerator, THEN you may see average home prices drop and younger people start buying into the housing market. But until then, those homes are flipper fodder and within a year will be priced out of reach of the millennials.

Jay says

Doesn’t seem low to me. This says the median income of a 40 year old is 71,000. I know exactly two people that age who make over 71,000. I know dozens who make between 16,000 and 40,000. I wonder what the distribution looks like. It’s hard for me to believe. At my lab company there is a manager who makes like 50k. And a boss above him who makes like 170k. But then there are like 60 people at the bottom actually doing the microscope work of diagnosing cancers who make like 27k-40k. I am betting there is a huge distribution. I find it hard to believe a health median of 71k at age 40.

Cynthia says

I think that most educated individuals with a strong work ethic and goals can meet 70k by midlife. You may have to get another degree or work for yourself. Everyone I know has achieved that number already, in their 30’s.

Carol says

I just turned 58. Not educated, have been a Word Processor for 30 years at consulting companies. I worked hard, and started my retirement savings at 38. My net worth between my 401k and the equity in my home is about $450,000 after taxes. I purchased my home for $119,000 in 2000. It’s just a matter of set it and forget it!

Start the 401k before 40; contribute 15% of salary, and forget about it for 20 years, and buy a home, any home before you are 40, stay in it awhile – you’ll get some decent equity in it so you can retire somewhat early. I have about 300,000 equity in my house now; and that was even after the big housing market crash. It bounced back. I live in Sacramento, CA now. Planning to sell house, retire from my current job this year. Buying a smaller home soon to get rid of most of my mortgage.

Mr. Freaky Frugal says

Thanks for the really useful data and analysis!

We’re in the Top Quintile for 55 to 64 year old married couples which feels pretty good. I retired at 52 by being frugal and investing well.

Unfortunately, I agree with you – most people are woefully unprepared for retirement. I have family that have saved nothing, zero, nada, zip for retirement. I’m worried what is going to happen to them.

I know others that save, but pay so little attention into investing, it will take them much longer to become financially independent than necessary. They will be alright in the long-run, but it’s hard to watch.

Unfortunately, there’s nothing you can do – people have to come to those realizations for themselves or they’ll get defensive if you bring it up (as I’m sure you know).

It’s definitely hard to watch.

Larry says

The sad thing is that the realization will come too late. So many continue to consume excessively, often supported by debt, through their 50s and into their 60s, living an unsustainable lifestyle. Many are about to face a retirement reckoning that is unfathomable as their standard of living unravels as their ability to generate income diminishes. Throngs of people working well beyond normal retirement age may also tend to “constipate” the job markets, stagnating opportunities for following generations.

Kudos to Mr. Freaky and others who had the wisdom to save and live within their means. I’m nearly 52 and plan to be financially independent at 55, maintaining my current lifestyle. The markets are a big question as they are so overvalued (my opinion).

It will be interesting to see what happens with the older generation and those who are unable to maintain the unsustainable lifestyle. After a certain point, the loans won’t come because it’s too close to EOL and there are no assets to claim from the estate to repay the loans. In theory (at least explicitely), your age is not a factor in your credit score (it is in the sense that you have a longer history, but is too long a history a bad thing?).

I haven’t studied this extensively but my feeling is that credit cards haven’t been around long enough for this to have been a broader issue. Diners’ Club, considered the first credit card, started in 1950. It’ll be interesting…

Tom says

Siblings with similar education and careers may have quite different retirement incomes, depending on their respective financial decisions. This can cause a lot of friction in families.

Every financial institution has guidelines for investing; it’s hard to imagine not being prepared. But what blind-sided me was the envy that surfaced in my family as we entered middle age.

I really enjoyed this analysis (and the “third person” joke that I’m going to steal) but I do wish financial advisors talked more about the results of creating a large net-worth.

Anytime you add 40 years, a lot of things can happen even if the inputs are largely the same. 🙂

Barnaby @ Personal Finance King says

Thank goodness the economy continues to slowly improve, because it looks like a lot of people will have to work long into their golden years. Or starve. But working seems like a better option, haha.

Thanks for the great data and graphs!

Working is better. 🙂

Matt Warnert says

Has it always been this way? I feel like understanding where were 10, 20, or 30 years ago would really help put this into context. It’s hard to know if this is a looming problem that is about to blow up in our faces or just the way things are? Jim, have you ever stumbled across any historical data similar to this that has been inflation adjusted?

Mr. Freaky Frugal says

I have a feeling that 20 or 30 years ago, retirees had more Defined Benefit Plans aka pensions.

Matt Warnert says

Good point, those don’t show up on people’s balance sheets. I still wonder if they were accounted for in any way.

My gut says that’s the case too because the 401(k) was made possible in 1978 when Congress passed the Revenue Act of 1978. They’d become more popular a little later but before that you had only defined benefit plans. If you have a pension, much like Social Security, then you have a stream of income coming that isn’t tied to an asset you own. You could go through the act of valuing the cash flow (like net present value, estimating your lifespan) but that’s not something an individual will likely do (and thus likely report to the Census when asked).

The farthest back the Census goes on this (online) is 1991, from their 1993 report. Median net worth in 1991, adjusted for 2017 dollars, is $48,870.50. Our 2011 median net worth of $68,828 expressed in 2017 dollars is a more impressive $76,422.98. So median net worth has improved slightly each year.

(The report gives the median net worth in 1991 but expressed in 1993 dollars. I used the BLS Inflation calculator and turned those January 1993 dollars into April 2017 dollars.)

Patrick Maher says

The roughly $28K increase (in 2017 dollars) includes a wider use of 401(K) investments, which are included in net worth, versus the higher use of pensions in 1993, which are not part of one’s net worth.

So the increase of the net worth number may not show any evidence of behavioral change relative to preparing for retirement during the 20 years period in question. The numbers provided can not show whether people are better financially positioned in 2011or in 1991.

Josh says

W00t! Top quintile for Under 35, despite my negative equity in my home! Or course I’m also at the top end of that age range, so I will be in the 35-44 group by EOY.

GET TO WORK THEN! 🙂

Susan Lowell says

We have a huge and growing wealth gap in the US, with 1% of the population owning 43% of the wealth in 2011 (Wikipedia).

So, what happens if we take the uber-wealthy top 3 -8 % out of the average for these numbers? We have a nation of broke people thinking they’re wealthy because of their shiny new cars and other debt shackles.

That’s where financial education and awareness come in-thanks for the great work you do in this, Jim!

Well, that’s why we use median rather than average. If there are ten people in the room and one of them is Bill Gates, the average person is a billionaire. 🙂

With median, it’s at least closer to the “middle.”

That said, there is still a wealth gap but the concentration is accounted for when using median.

Financial education is crucial because the ying to its yang, marketing, churns out new graduates by the tens, if not hundreds, of thousands each year!

fbgcai says

Pray tell then why do you use “average” in one of your paragraph headings :

“Understanding Average Net Worth

The U.S. Census does more than count the number of people in the U.S. – they collect a lot of other data too.” (above)

when the tables following are median numbers which are the ‘correct’ ones to use. Adding to the confusion of these two very different numbers is not helpful.

Fair question – the two terms are very different but oftentimes when someone is looking for average, they mean median. They assume some kind of binomial distribution of income, even though there’s no reason, and I’m assuming that bias and using the term average.

Ed says

Median is a form of average. You two are using the word average to only mean mean.

RobH says

I am starting to see more and more age descrimination of people in their 50s. This will make it harder and harder to catch up. Especially in the technology space.

Also, more 500k+ houses are being built near me. Some are over 650k. Talk about a waste of money. But they are selling.

Matthieu Dalant says

The data for Under 35s (my age group) seems particularly depressing. The rising cost of living combined with wage stagnation makes me very wary of the future. I feel like the middle class is slowly being eroded.

J Spen says

What you are doing is great if that’s all you can do. One quick thought, my wife and I amassed 70% of our retirement savings after turning 50/47. Our kids were starting to get established, thus freeing needed cash flow to channel to tax deferred 401Ks and after-tax savings. I note this because what you are currently doing is ahead of most. In turn, you’ll hopefully have more money and options for savings as you progress towards your retirement.

Erik @ The Mastermind Within says

While a good portion of my net worth is tied up in my house, I’m currently growing my investment and business accounts month by month. Depending on the valuation, my house equity makes up 25-60k of my net worth, while my investments total about 30k.

At 25, I’m doing alright, but am excited to keep the ball rolling! Onwards and upwards

Tom says

@Eric

I’m 62, closing in on retirement. I have no advice for you as you seem to be doing things right. But I just wanted to say that when I was your age (oh how I hate those words…), I was suspicious of the math that showed I could retire wealthy, early. Even with the numbers in front of me, I just wasn’t convinced that someone with a moderate salary could become wealthy.

I’m here to tell you that it works! Nobody is as suprised as me, but it does work and you’ll get there. Just keep going!

Damn Millennial says

Shows how much people are relying on their homes for retirement. As you mentioned the liquid assets of many are small while home equity is rather large. This is why the reverse mortgage industry continues to make money, people can use their home as an ATM. Pretty sobering numbers but life goes on for the majority of people in the lower quintile. I feel like finance blogs are always on another level while the reality is many people either don’t care or feel helpless and would rather enjoy today. If you start early and focus you can become very wealthy in America but for many people it is a never ending hamster wheel.

Tom says

Damn, I agree.

If you combine a natural tendency to procrastinate with a poor understanding of compounded interest, I think you end up with a lot of apathy and financial fatalism, so people just stop trying. And since they’re in good company, they figure “somebody will fix this”.

What scares me is when those people are in your family. So prepare yourself – If you save and do everything right, you’ll retire wealthy. But you may find siblings and friends are very envious.

Damn Millennial says

Tom,

Good point on the family and friends observation. I think this makes people wonder why they are working/saving in the first place if it will ultimately make them an outsider to those they care about the most…makes the case for stealth wealth which I am a big fan of.

Larry says

I’m concerned by the possibility/probability that all of that “good company” will vote for someone to “fix this”…someone akin to Bernie. Whether because of apathy, poor choices in life or bad luck, so many seem to adopt the perspective of the victim these days. And, in their minds, to be a victim, there must be an oppressor; oppressors may be family members or people they perceive to have wealth. And DM, I as well am a big fan of stealth wealth…under the radar!

Damn Millennial says

Larry no control over what government policy is so I don’t even focus on that piece. I do agree with you on a large victim mentality. Only one way to get what you want and that’s to rise up and get it with your own hard work and dedication. I have never seen anyone get rewarded for complaining no one else will listen or care.

JRSmithz says

I don’t understand why this is so low. I’m 36 and my net worth including ALL my assets (home, car, 401k) minus liabilities (mortgage, car loan, ccards) is $417k which I think is very low.

Remember that there are a lot of people in the United States and they live in situations very different from you. There are a LOT of people. 🙂

Dividend Daze says

Those are some interesting numbers. I bet the FIRE movement within the past few years will boost the numbers in the younger demographics. This at least gives a good benchmark. I like seeing the home equity vs non home owners. Thanks for sharing.

The FIRE movement may seem “large” in frequency terms but remember that there are a LOT of people out there. I doubt you’ll see much of a change in overall numbers (sadly).

Tim says

My wife and I are late 40s and are in the 98th percentile for net worth with very little of it in home equity. No inheritance or business, just working for a salary. I’m not even a manager; too much hassle. My advice:

1.) Chase the money when you’re young and you can. Keep yourself light and portable.

2.) Save prodigiously but don’t go overboard. Go on trips, go to the movies and out to eat…but keep socking away the money. Too many of the financial blogs over-emphasize frugality.

3.) Rent apartments, at least until you have kids if not longer. Houses have lots of costs, lack of liquidity, and are a barrier to opportunity. That 20% down? You’d likely be better off investing it elsewhere. And don’t get me started on all the crap you have to buy.

4.) Avoid buying “stuff”….”stuff” does not make you happy, experiences do. We spend maybe $12k/year on vacations but both drive 10 year old cars.

5.) If you’re all fired up to retire in your 30s something is wrong with your career choice. Fix that problem and you won’t mind working. Only now as I approach 50 am I kinda sorta thinking about calling it…..but even then I’ll probably just try some other job for fun.

Tom says

Tim – well said. I’m 62 and although I was financially able to retire a few years ago, I continue to work. As a result, when I do retire, I’ll be quite wealthy.

I have to comment on your view of home-ownership. What you say is dead-nuts true if you view your home as a financial vehicle. However, my wife and I have always seen our home as our reward. This is what we were working for.

For us anyway, home ownership, and the maintenence that goes along with it, are enjoyable; much like having a dog or children to other people. It’s our vacation!

Oh, and what you said about “stuff” should be in bold, caps and posted on everyone’s forehead!

Ted Mittelstaedt says

In most Western markets renting even a modest apartment is 1.5 times a monthly mortgage for a decent single family home and in some it’s 2 times or more. And 12k a year for vacations is nuts. We did Disneyland for less than $4k a couple years ago with both kids. $12k is what we spent on completely furnishing our last home purchase including all new paint and leather furniture, 1 king and 2 queen beds, etc etc. You diss houses when what you should be dissing is how the average person overspends on furnishing their house.

Paul says

My question: Why do different authors have different data? All of this feeling better at others expense is rubbish. The markets have been favorable; it is not because of individual skills. And when the markets tumble, the tone of new articles will be how brilliant people with no stock exposure are, and what fools investors are.

Ellie says

Having invested before, during and after the recession, I can say from experience that the stock market is always a good option in the long run (not short, unless you are good at trading or get lucky). I held onto my portfolio when the markets dropped and kept buying more, now a few years later it is doing brilliantly. Those who panicked and sold out lost money, those of us who didn’t and instead bought even more have done very well. The market is cyclical. It will rise and crash at different times. When it crashes, you buy in, then you are rewarded when it goes up again.

Shymala says

I’ve been looking for this data a while. Thanks for gathering it together and presenting it in a precise way (i.e. where it came from, what dates…)

Angela @ Tread Lightly Retire Early says

It’s a little crazy that the standard savings advice isn’t usually enough to fund retirement even at traditional retirement age! So glad there is better information out there to follow.

John Q says

Yeah. I’m above the highest quintile for my age range.

john jay says

a lot of people have so many loans to get through school only to not find jobs. its like a new scam. if you have a net worth 200k and your under 35 you are doing extremely well. This data seems pretty accurate there are a lot of people out there struggling in this current economy.

OMGF says

Considering the percentage of wealth attributed to home equity it is unsurprising that on average those who are not homeowners have much less wealth than those who are. This shows how housing policy directly correlates to wealth and determines who has it and who doesn’t. Thanks for putting the info out there.

SANTO says

Considering the percentage of wealth attributed to home equity it is unsurprising that on average those who are not homeowners have much less wealth than those who are. This shows how housing policy directly correlates to wealth and determines who has it and who doesn’t. Thanks for putting the info out there.

JT says

My wife and I are in the higher end of the top of the 65 age range. This happened by avoiding and eliminating debt and getting into a position to power save by the time we were in our early 50’s. We only earned over a $100,000 combined a few times in 35 years of marriage. Frugality and avoiding depreciating assets allowed us to invest and retire by 60…. my 2 working class Union pensions didn’t hurt the cause for sure. My advice…..save your money and live within your means!!

Sage advice – saving money and living within your means always works.

JT says

One more thing….I recently read about a way to formulate your pensions into a dollar amount towards your net worth. Sorry I don’t remember where I saw it. I see this isn’t included in these statistics but it would be nice to know since I have spent a lot of time trying to build pension, annuity, and Social Security income most of which is COLA adjusted. I think its the foundation of building wealth if you are a conservative investor. The formula I read about was take each $100 of pension income per month and multiply it by $18,000 and this gives you a dollar amount to add to your net worth total. An example would be a pension paying you $3000 per month (30 ) X $18,000 = $540,000. I use this formula to add to my net worth total and it seems reasonable to me. Please comment if you think this is a fair or unfair formula.

Hmmm, that’s one way to do it. It really comes down to what you’ll use the number for. $36,000 divided by $540,000 is 7% – essentially you’re getting a 7% dividend (the pension) – and so you value the pension at that figure. You could also use 4%, which is the safe withdrawal rate, or some other figure. You could use the immediate cash value if the pension offers that. In the end, you want the net worth to be a useful number and that $540,000 isn’t immediately accessible so it may cause more confusion than you need.

Don AuBuchon says

Great article & useful information Jim Wang!

I think your pension should absolutely be considered in your net worth & JT’s formula closely matches what an annuity would cost. So $36,000 per year would be about $540,000 in net worth. I suppose Social Security shows up in the chart “Medium Income by Age” but probably shouldn’t be used in this article for comparing net worth since nearly everyone receives it & it’s not included in the charts, but for contemplation the average SS payment of $1,500 per month ($18,000 per year) would be $270,000 of net worth.

As long as you know how much of your “net worth” consists of a pension, I think it’s fine to put in there. You just don’t want any surprises if you ever need to tap into it!

Daniel says

I call this the validation post… When you look at the numbers and realize you are above the top quintile for your age group. And that doesn’t even factor in my pension (maybe pensions….).

Bill Chestnut says

Your figures and charts for net worth show MEDIAN values as less than $300k for all Americans. Median doesn’t mean average; it means MIDDLE. That means that if is just ONE American with a net worth of 1 Billion and 1 with a net wirth of 1 dollar the Median is 500 MILLION. Your numbers don’t work

What you’re thinking of is average, median means the middle and average means you add up all the net worths and divide by the number of people. I use the terms interchangeably knowing full well it means median the whole time because that’s how people think about it generally.

steven schrift says

Theese calculations assume a person will live in the same place they have been living and spend almost as much as they did while younger. You will find that many retirees will move to a cheaper location like overseas or a cheaper area in the USA. I stopped working at 47 and moved to Thailand for 6 years than I moved to my current location in Ecuador my expenses here are miniscule compared to the USA and my standard of living here could’nt be better. I live in a small modern house with a stove/oven washing machine large one bedroom large kitchen and bathroom on 1 hectare of land with a river flowing at the back of my property only 300 a month. I live in a 24 hour gated private community I have access to high quality mineralized organic fruits and vegetables 12 months of the year as I live right on the equator with perfect weather all year long. I used to live in SanDiego California and let me tell you the weather here blows it away. My house keeper charges me 10 dollars to clean my house and gardners here charge about 20 a day to clean your yard. Doctors like a specialist charge 30 dollars a visit including a free return visit after you have taken your medicine or done your tests. My electric has averaged 12 dollars a month and my water bill haha is under 5 dollars internet has been a little high but we are getting fibre optics soon for the same price and 5 times the speed. Most retirees could live like me on thier social security alone. So yeah if push comes to shove people will find a way to make it work and moving overseas is a great way to keep your standard of living high without being gouged to death in the good old USA.

Ted Mittelstaedt says

For those who have no children and a spouse who feels the same way it sounds great. For those who want to be involved with the grandkids not so great.

Richard says

You really don’t want to confound median and mean just because you want to gloss over the difficulty (“for our purposes it’s the same thing”). It isn’t.

Median asset is what assets does the typical person own.

Mean asset is whose pocket does the typical dollar live in.

Two very different things

Paul says

How depressing. Now why aren’t you writing for the New York Times? I thought there was something suspicious about the financial industry’s desperate attempts to persuade all retirees to wait till seventy to apply for SS. They fear these people will become burdens and of course we know after seventy many will begin dropping.

Average Joe says

The US is fast becoming a 2 class society.

There is and has been a concerted effort to keep wages low and boost executive pay and increase costs and further strip away the remainder of wealth held by the working classes.

Wages have far been exceeded by the CPI, housing, energy and education costs so the average worker has continuously lost ground over the last few decades and a dollar today doesn’t buy anywhere near what it did then.

Workers have just got back to 1999 levels so its obvious who is winning and who is really losing.

30 is the new 20 financially and that’s only the beginning of whats wrong.

https://www.cbsnews.com/news/30-is-the-new-20-and-thats-the-economys-fault/

Its all over for the working classes but the crying.

The paradigm shift in wealth has allowed for our government and policies to be bought and paid for to favor the wealthy and nothing will or can change that, period.

JC says

How much does it take to be in the top 10% overall? 1% percent?

Great analysis

L.J. Seams. says

I feel like a misfit. I am one year from owning my home outright, 6 years from owning my professional building outright. All said and done, 2K to 3K revenue from the building. Not a lot of retirement $$ 100K. So am I OK? I think so, but what do I know? SS=2K, plus 2-3K building revenue. No home mortgage after a year.. Single female.

D-nice says

Are people really this broke? If this is accurate then my god.

willie says

i live in a retirement community – i was astounded when i learned that nearly half of the retirees here past the age of 65 have mortgages on their retirement homes – truly sad

Alex says

Good discussions here, nice to see everyone provide their input without being smashed for their opine.

Thanks!

Chuck says

Bottom Line:

•Get married and stay married.

•Buy a house and maintain it properly and pay off the mortgage in 20 years and don’t borrow on it ever.

•Don’t hold any Credit card debt.

•Save enough for retirement to provide an income of $3000. Per month or higher in 2020 dollars.

•Don’t become disabled.

Kathy says

For the under-30 population who cannot fathom becoming financially independent/secure whilst raising children, managing a mortgage, living through several major economic downturns (crises), major health issues, etc., I am here to tell you to take heart. I graduated with college debt and literally $35 in the bank. Married at age 23, our folks couldn’t give financial support (but lots of moral support!) With a frugal lifestyle (seemingly extreme by today’s standards), particularly until our 3 (college educated) children were on their own, and seeking consult from a financial advisor early on, paying close attention to our earnings/spending, we are financially secure (age 57), mortgage free, healthy and 3 years from retirement (by choice-any time would suffice). Sacrifice, goal-setting, a good marriage partnership, good financial planning advice, then move on when financial mistakes are made (we made plenty!). You CAN do it. Eyes on the prize. And enjoy the journey. Peace.

JC says

Start putting money away in retirement accounts when you’re young. I started when I wasn’t making much at all in 1986, still finishing under-grad as I had to pay for my own school by working full-time. I was only able to put aside $25/week. No bar nights, no Starbucks, no latest and greatest gizmos. As I earned raises, I increased my contributions a bit. My wife, who I wouldn’t meet for another 15 years, did the same. We bought a new home in a new sub, but outside the “metro” area. Paid it off, along with cottage (both home and cottage modest at $200,000 total purchase price). Fast forward to were both mid-50s, and we have seven figure net worth with at least $850k in retirement. Save early, time is your friend. Don’t worry about keeping up with the Jones’s (I’m driving a 18 year old Tahoe with 450k miles). You just have to make the touch choices. Don’t Scrooge away all your money. Enjoy life modestly, give back to the community and live for memories instead of stuff.

Save early and often is a strategy that has worked since the beginning of time, good to hear of another situation where it has worked out.

450K miles! Wow!

Mitch says

Great discussion! Keep in mind when using 401K as a savings vehicle to use about 4 to 5 % as a realistic return. There are always financial blogs and family that will tell you that a return of 10% is to be expected but that is not typical over the long term!

I think it’s important to use ranges – best case, worst case, and expected. 10% is likely high for an “expected” rate of return but as long as your plan can handle the worst case, you’re OK.

JM says

Hi Jim,

Cool article, and thank you for taking the time to do it.

Folks need to realize they can save $$ without being a financial genius. It all starts by living within your means and making savings an expense in your budget. For whatever reason people will not make savings a real item.

My wife and I are basically 55 years old and have tried and worked hard to always live within our means and save $$ consistently.

Neither of us has ever made more than $55k in a year and we have 5 kids between us.(major expense)

Yet our Net Worth with equity is right at $800k and our Net Worth minus equity is at $600k.

This is not a lot of $$ in the real world, but we will continue to forge ahead.

I hope others will see it can be done.

You’re welcome JM – You can even say that most people who are able to save money and live a comfortable retirement are not a financial genius whatsoever. It’s like weight, the basics are simple but they’re not easy. Living within your means when you have marketing all around you is not easy. Having your neighbors buying fancy [insert product here] and you feeling like you need to match up – fighting that urge is very hard.

Kudos to you for being able to save while raising a large family – it’s not easy and you have to make tradeoffs. But it’s definitely possible.

Thank you for sharing your experience!

barb says

yes, a lot can be done if you focus. I am a 71 year old retired teacher. mostly haven been a single parent for the majority of my disabled 30 year old son’s life. With dedicated I have a net worth a net worth of approx $2,300,000 excluding equity in my home valued at about $350,000 with no mortgage. I’ve traveled the world but economically. Again a lot can be done

That’s amazing!

Robert Gardner says

Sorry man, even my fifth grade students know there is a purpose for discriminating between mean and median. People who try to use them indiscriminately usually have an agenda. Facts matter.

My agenda is only to have more people read this article.

Tim says

I’m simply comes down to the financially illiterate American public. It’s my feeling that personal finance classes should be a mandatory part of every high school curriculum. Simple classes in interest, debt control, time value of money. I talk to people all the time who are getting ready to retire and have $250,000 saved and think they are going to be fine. It all depends on the realization of the definition of “fine”. Maybe I was a anomaly but at 27 I thought to myself there was not going to be Social Security when I retire so that’s how I saved. 15% a year in a 401K and never missed it. I had no pension to count on either so I saved accordingly. I will be 62 next month and even after going through a divorce 9 years ago and giving away half, I can say I am in the top 10% of net worth for my age group. I didn’t start to make a six figure income until my late 40’s so it wasn’t like I made a ton of income. I made some very good investments mainly in high tech stocks that returned more than I could of imagined but I did my homework and stuck with them. People have to be taught how to manage their finances. Only then will they be able to control their own destiny.

Ashish says

There are some very good comments, some specifics:

* start saving early: compounding is your friend, prioritize tax-free savings & deferred taxes.

* get rid of credit card debt and interest. The 15+% interest on credit card debt is something I find simply borderline criminal.

* If you are single, get a room-mate if you can, rent is one of the biggest expense.

* reduce recurring expense: cable/phone-plan/car-insurance/eating out/gym membership (run on the road/get some weights for home)

* don’t buy stuff you don’t need. The time spent contemplating a purchase should increase with corresponding cost. Lot of stuff you can buy at discount or even at good-will stores.

* shop around to reduce cost of expensive items

* buy used cars, you will save on price & insurance

* expenses add up very quickly, plan for surprise expenses (car breakdown/medical payments)

* increase your skills, try and get a job that helps increase pay. Just look around and you will know which jobs pay well and have room for growth with experience and continued learning.

* Be frugal, but enjoy.

* use free public resources: libraries: books/movies, public transport. (I haven’t seen a movie in a theater in years, partly I am very busy also)

Like some one said what is tracked can be improved, track your expenses & savings rates.

There are low paying jobs which can make the above very challenging, so try and get out of the low paying job by increasing your skills.

Building wealth needs: Increasing your earnings/reducing your expenses, fairly easy to understand.

Good luck!

Great suggestions, especially the “Be frugal, but enjoy” – all too often we sacrifice 100% to save money and lose sight of enjoying a bit of life in the meantime.

Charles Nunn says

Enjoyed your comments, spot on. My spouse and I are simple people who have always lived a simple life. No new cars, no big vacations, modest home, etc but we have always been savers (not hoarders). We were and are most comfortable living frugally. By the way, our siblings also live in a like manner.

We both came from families that lived on the brink of poverty.

We are retired and we are always amazed at our net worth. It’s nice to know that our children will be pleasantly surprised by the amount of their inheritance when we pass.

It’s always nice to be pleasantly surprised!

I think that comfortable yet frugal is a good way to live. It allows you to enjoy what you enjoy out of life without feeling like you’re being extravagant. It also makes it more likely you won’t outlive your savings. Kudos to you and your family Charles!

JJ says

Excellent article. You are the only one I have seen who examines the role of home equity on the net worth scenario. On a personal note, had a lot of Asian friends when younger, almost feel like a kid again reading your articles :); great years and felt like I got somewhere with the comradery. It is amazing what you mention though about savings and net worth. I know the Asian mind set is one of hard work, frugality and always saving for the rainy day. My net worth personally is above 3 million as of now at 52, and we have more than 1.6 million in self-directed IRAs but we always lived like mices. But I am so grateful that were as frugal as we were, cant take money for granted like the supposed good old days of working 40 years having pension and a gold watch. Once again thanks for your articles, they are very germane and insightful. . .

I don’t think the mentality is uniquely Asian but, at least in the United States, probably stronger the closer you were to the first generation to immigrated to the United States. If you’re the first in your family here, your support and social structure is small (or non-existent). And so you have to save money because your money is your safety net, you can’t rely on friends or family since they’re in another country. Technology has made it a lot better than decades ago, you can talk to someone from home and they can send you money easily, but it’s still a big challenge and saving money is the best way to protect yourself.