Can you guess the average cost of car insurance?

I know it can be a wide range – a 40 year old with a spotless driving record is going to be cheaper than a 20 year old with little history. Someone with a history of fender benders and speeding tickets and an expensive car is going to pay more than someone who has a spotless record and a 10-year old economy car.

But would you guess that the average cost of car insurance is $1,062.23?

How did we get this number? We used data from the National Association of Insurance Commissioners (NAIC) and simply divided the total amount of car insurance paid in a state by the number of drivers. A little simplistic but it works!

While there are so many factors determining how much you’ll pay for your coverage, such as which car insurance company you go with, your premium may look nothing like the average, but it’s still an interesting statistic to know because if you pay more, you want to know why.

We’re going to look at averages in this article, but we’re also going to look at the specific factors that will affect the premium you’ll pay for your policy.

Table of Contents

Car Insurance Coverage “Levels”

Each state imposes a minimum liability level for drivers licensed within their jurisdictions. Liability coverage levels are expressed in a series of three numbers, presented as XX/XX/XX. It may look something like 25/50/15.

Each number represents a specific liability coverage amount in thousands of dollars:

The first number represents the amount of coverage for an at-fault accident in which one person is injured or killed. If that number is “25”, the minimum coverage in your state will be $25,000 for this portion of the liability coverage.

The second number is the amount required to cover injury or death of two or more people in an at-fault accident. If that number is “50”, the minimum coverage in your state will be $50,000 for this portion of the liability coverage.

The third number is the maximum amount of coverage you’ll have for property damage from an at-fault accident. If that number is “15”, your insurance company will pay up to $15,000.

The minimum coverage by state can range from a low of 10/20/10 in Florida, to a high of 50/100/25 in Alaska and Maine.

Of course, the minimum amount of liability coverage may satisfy the legal minimum in your state, but that’s not necessarily the amount of coverage you should have.

For example, if you’re a young driver with few assets, the minimum coverage in your state may be all you need. But if you have significant assets, you’ll be better served by increasing your coverage to, say, 100/300/50. This will provide a greater level of liability coverage if the dollar amount of the claim against you is higher in an at-fault accident. If you have assets that exceed the higher coverage, you may want to consider adding an umbrella provision to your policy. That can add $1 million or more in coverage for an at-fault liability.

The increase in your premium for having a higher level of liability coverage is often less than expected, particularly if you have a good driving record.

Additional Coverage Options

There are other coverage options you may want to add to basic liability. In some states, and under certain circumstances, they may be required – either under state law, or by your lender.

For example, in some states, you’re required to have uninsured/underinsured motorist coverage. This provision will cover expenses from a car accident caused by another driver who either has no car insurance at all or doesn’t have enough to cover the damages. Even if your state doesn’t require this option, it’s highly recommended.

Another type of coverage that may be required in your state is personal injury protection (PIP). This provision is often required in states that have no-fault insurance laws. No-fault basically means that each driver will recover from their own insurance company, regardless of which driver is at fault.

Two other provisions typically required by lenders include collision and comprehensive coverage. Collision is the portion of a policy that will cover damage to your vehicle from an at-fault accident while the vehicle is in motion. You should know that basic liability will not cover damage to your vehicle if you’re the at-fault party in an accident. That’s the purpose of collision insurance.

Comprehensive covers damage to your vehicle while it’s not moving. That can include damage caused by storms, falling trees or tree limbs, or even theft of the vehicle. Lenders will require you to have both collision and comprehensive coverage, since both protect the value of your vehicle, which serves as collateral for your loan or car lease. But you should want to have both coverage options, even if you don’t have a loan or a lease on your vehicle. They’ll be the only protection you’ll have if your vehicle is stolen or damaged while parked or damaged in an accident that’s your fault.

Still another coverage option frequently required by lenders is guaranteed auto protection, commonly referred to as GAP. It’s typically required when you lease a vehicle or take a loan for 100% of the car’s value or something close. Since new cars, in particular, tend to depreciate in value immediately after purchase, it’s possible the insurance reimbursement on your vehicle after total destruction may not be sufficient to pay off the loan or lease on the car. But if you have GAP coverage, the loan or lease shortfall will be covered.

There are many other options you can add to your policy, and exactly which ones are available will depend on the company you are applying to. Examples include rental reimbursement – that pays for the rental of a vehicle while yours is being repaired after an accident – roadside assistance and towing.

However, understand that each of these options will increase the cost of your policy. But the cost of the additional coverage will be well worth the extra premium if you experience any of the situations each option is designed to cover.

For example, having uninsured/under-insured motorist coverage may add $200 or more to your annual premium. But if you’re involved in an accident with someone who has no insurance coverage, you’ll save many thousands of dollars by adding the option.

Your State of Residence

This is one of the single biggest factors affecting the cost of car insurance. Because both laws and driving activity vary by state, how much you’ll pay will be largely determined by where you live.

For example, states with large urban population concentrations tend to have higher car insurance costs. This is because close proximity means more traffic and increased frequency of accidents. Average premiums can even vary significantly from one part of the same state to another. In a large metropolitan area, premiums will be higher than they will be in rural areas within the same state.

The table below shows the average annual premium in each state, as well as the premium for minimum coverage. Each state imposes a minimum amount of coverage that all licensed drivers must meet. However, you can choose a higher level of coverage (typically the liability portion), which will result in a higher premium.

The table shows only the averages. The average annual premium is from data assembled by the National Association of Insurance Commissioners (NAIC), while the premium for minimum coverage figures is drawn from Bankrate.

| State | Average Annual Premium | Premium for Minimum Coverage |

|---|---|---|

| Alabama | $924.64 | $435 |

| Alaska | $1,020.47 | $340 |

| Arizona | $1,022.42 | $502 |

| Arkansas | $950.08 | $452 |

| California | $1,044.29 | $580 |

| Colorado | $1,072.02 | $466 |

| Connecticut | $1,193.05 | $672 |

| Delaware | $1,259.11 | $667 |

| District of Colombia | $1,380.55 | $638 |

| Florida | $1,338.73 | $895 |

| Georgia | $1,129.06 | $654 |

| Hawaii | $890.59 | $333 |

| Idaho | $711.18 | $274 |

| Illinois | $922.21 | $419 |

| Indiana | $789.84 | $354 |

| Iowa | $737.79 | $233 |

| Kansas | $882.88 | $371 |

| Kentucky | $976.97 | $761 |

| Louisiana | $1,496.11 | $757 |

| Maine | $734.03 | $227 |

| Maryland | $1,180.55 | $758 |

| Massachusetts | $1,170.49 | $397 |

| Michigan | $1,407.57 | $995 |

| Minnesota | $900.68 | $522 |

| Mississippi | $1,035.72 | $429 |

| Missouri | $925.68 | $455 |

| Montana | $891.40 | $301 |

| Nebraska | $864.99 | $321 |

| Nevada | $1,147.90 | $709 |

| New Hampshire | $845.32 | $321 |

| New Jersey | $1,424.95 | $727 |

| New Mexico | $963.88 | $337 |

| New York | $1,432.37 | $974 |

| North Carolina | $836.71 | $396 |

| North Dakota | $773.53 | $278 |

| Ohio | $816.92 | $321 |

| Oklahoma | $1,040.32 | $390 |

| Oregon | $957.98 | $579 |

| Pennsylvania | $1,017.17 | $371 |

| Rhode Island | $1,364.56 | $605 |

| South Carolina | $1,046.70 | $529 |

| South Dakota | $807.37 | $278 |

| Tennessee | $898.97 | $369 |

| Texas | $1,194.30 | $496 |

| Utah | $913.63 | $483 |

| Vermont | $790.37 | $256 |

| Virginia | $883.90 | $414 |

| Washington | $1,111.38 | $431 |

| West Virginia | $1,041.67 | $445 |

| Wisconsin | $767.38 | $315 |

| Wyoming | $877.69 | $257 |

| US Average | $1,062.23 | N/A |

Your Age

Age is a significant factor in car insurance rates, but primarily if you are under 25 or over 65.

The following table lists average premiums nationwide by age. The information comes from CarInsurance.com, and reflects premium costs based on a liability policy with coverages of 50/100/50 at each age level.

| Age | Annual Premium |

|---|---|

| 16 | $3,036 |

| 18 | $2,172 |

| 21 | $1,035 |

| 25 | $737 |

| 30 | $670 |

| 35 | $664 |

| 40 | $663 |

| 45 | $636 |

| 50 | $617 |

| 55 | $598 |

| 60 | $598 |

| 65 | $622 |

| 70 | $665 |

| 75 | $758 |

As you can see from the numbers above, car insurance premiums start off in the stratosphere at age 16 through 21. But by 25 they take a big drop, then continue to fall more gradually until reaching a low point at around age 55 or 60.

After 60, average premiums begin to increase, as drivers are judged to have less ability to respond to hazardous driving conditions, and may also be impaired by declining vision, hearing, or reliance on medications that may impair judgment.

Your Driving History

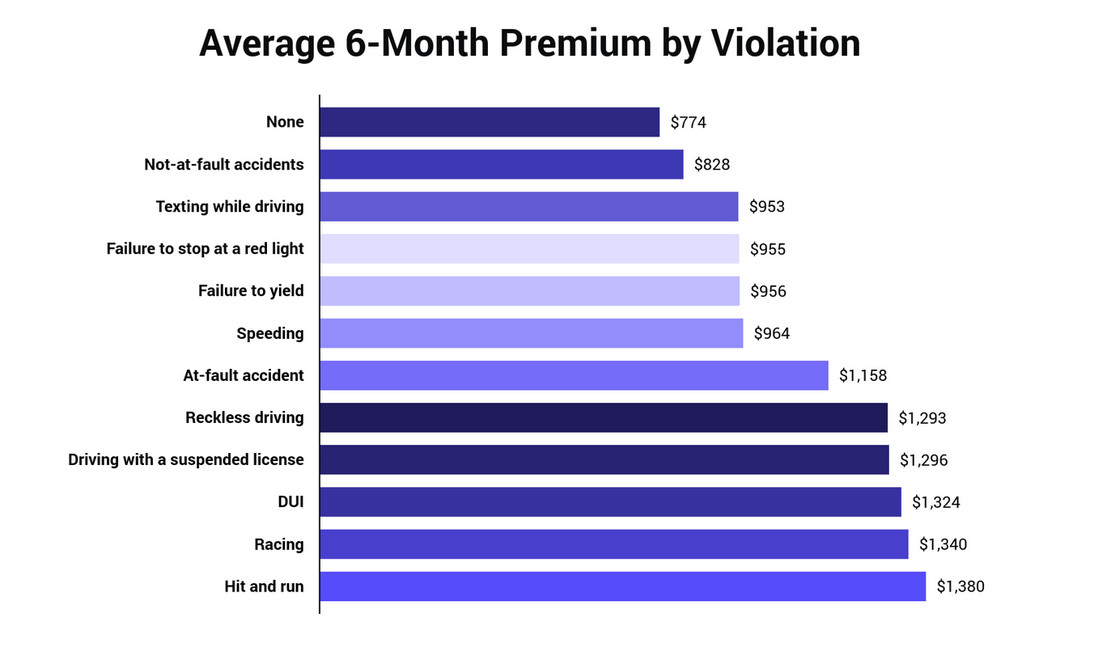

For most drivers, your personal driving history is the single biggest factor affecting your car insurance premium. Some infractions, like driving less than 15 mph over the posted speed limit, or a non-at-fault accident typically result in only a small increase in your premium. But more severe infractions, like an at-fault accident, driving under the influence, or being the perpetrator in a hit-and-run accident can easily cause your premiums to double (or more).

And having no history can be a challenge when getting car insurance – which is why we looked at the best car insurance for new and first-time drivers.

The screenshot below shows the impact of various infractions on your car insurance premiums. It’s taken from The Zebra, and gives a rough idea how much you can expect your premium to increase based on certain common violations.

In most states, moving violations and at-fault accidents will stay on your driving record for a minimum of three years – or as many as five years in some states. As long as the violation or accident is on your record, it will cause your premiums to remain high. It should also go without saying that if you have multiple infractions within that same space of time, your premiums will be considerably higher than what’s posted above. You may even be terminated by your current insurance carrier and moved into an assigned risk pool where you’ll have minimal coverage at a higher premium cost.

There may be certain steps you can take to reduce your car insurance premium after an infraction. Examples include:

- Completing a safe driver course authorized by your insurance company.

- Fighting a moving violation or at-fault accident in court. You may not win, but you may get the severity of the infraction reduced, lowering your premium.

- Increase your deductible. Raising it from, say, $500 to $1000 or more, can make a noticeable difference in your premium.

- Shop for a new carrier. Not all companies treat moving violations and at-fault accidents the same.

To keep premiums down you’ll need to avoid both moving violations and at-fault accidents in the future.

Your Gender

Men generally pay more for car insurance premiums than women. This owes to experience ratings that show men generally tend to demonstrate more high-risk driving patterns than women.

The difference is more pronounced among younger drivers, those under 25. Among drivers between the ages of 16 and 21 the difference can be as much as 15%. But that difference shrinks from about 25 on, at which point it’s generally no more than 5% higher for men than women.

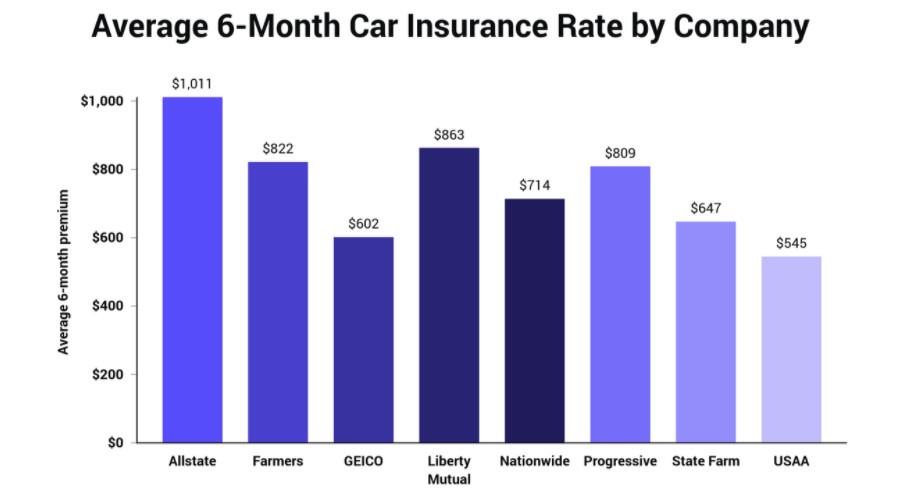

The Company You Purchase Car Insurance Through

Car insurance premiums can vary significantly from one company to another. The screenshot below, from The Zebra, shows the differences in average premiums from eight major car insurance providers:

But remember that these are just averages, based on national statistics. There’s no one car insurance company that has categorically the lowest car insurance premiums nationwide. For example, though Progressive has a higher average premium on a national basis, there are several states where their premiums are generally lower than State Farm.

For this reason, you should check between car insurance companies anytime you’re looking for coverage. Never assume any one company has the lowest premiums, even if they have very convincing advertisements. You owe it to yourself to get premium quotes from at least three or four companies whenever you’re shopping for coverage.

Your Vehicle Type

This is another major factor affecting car insurance premiums that isn’t always well understood by consumers. But it can have a dramatic effect on what you’ll pay for coverage, particularly collision and comprehensive.

At the top of the chart on cost are specialty vehicles, luxury cars, light trucks, and large sport-utility vehicles. The premium differences are high enough that if you plan to purchase such a vehicle, you should get a car insurance quote before doing so. The higher premium may convince you to make another vehicle choice.

Generally speaking, mid-priced sedans tend to have lowest premiums, especially if they have certain safety equipment, like antilock brakes, passenger-side airbags, electronic seatbelts, and other equipment that will either make an accident less likely or provide greater protection for you and your passengers.

Bottom Line

As you can see from the many different factors that affect car insurance premiums, average premiums are no better than ballpark guesses. Exactly how much you’ll pay for your premium will depend on some factors beyond your control, like your state of residence, your age and your gender. But other factors will be well within your control.

At the top of the list is maintaining a good driving history. That’s the single factor that will have the greatest impact on the premium you pay for a car. You can also be careful in selecting the next vehicle you buy. That includes not only the type of vehicle, but also the safety features the vehicle includes.

The major gray zone is the optional coverages. If you have a loan or lease on your vehicle, the lender or lessor will require you to have collision and comprehensive coverage, as well as GAP coverage if there’s a chance you’ll owe more on the vehicle than it’s worth. You may also want to purchase more than the minimum amount of coverage required in your state, as well as add other options, like uninsured/underinsured motorist. Control what you can and make the best of what you can’t.

And finally, always remember to shop around! That doesn’t mean you have to get quotes from every car insurance company in town, but you should get at least a few. You’ll likely find major differences in identical coverage from one company to another.