Atom Finance

Strengths

- Professional grade tools and research

- Offers brokerage firm integration

- Chat features allows you to discuss investment ideas and strategies with other investors using the service

Weaknesses

- There are third-party ads on the platform

- Does not operate as a brokerage provider

- Currently missing real-time coverage of stocks trading on foreign exchanges

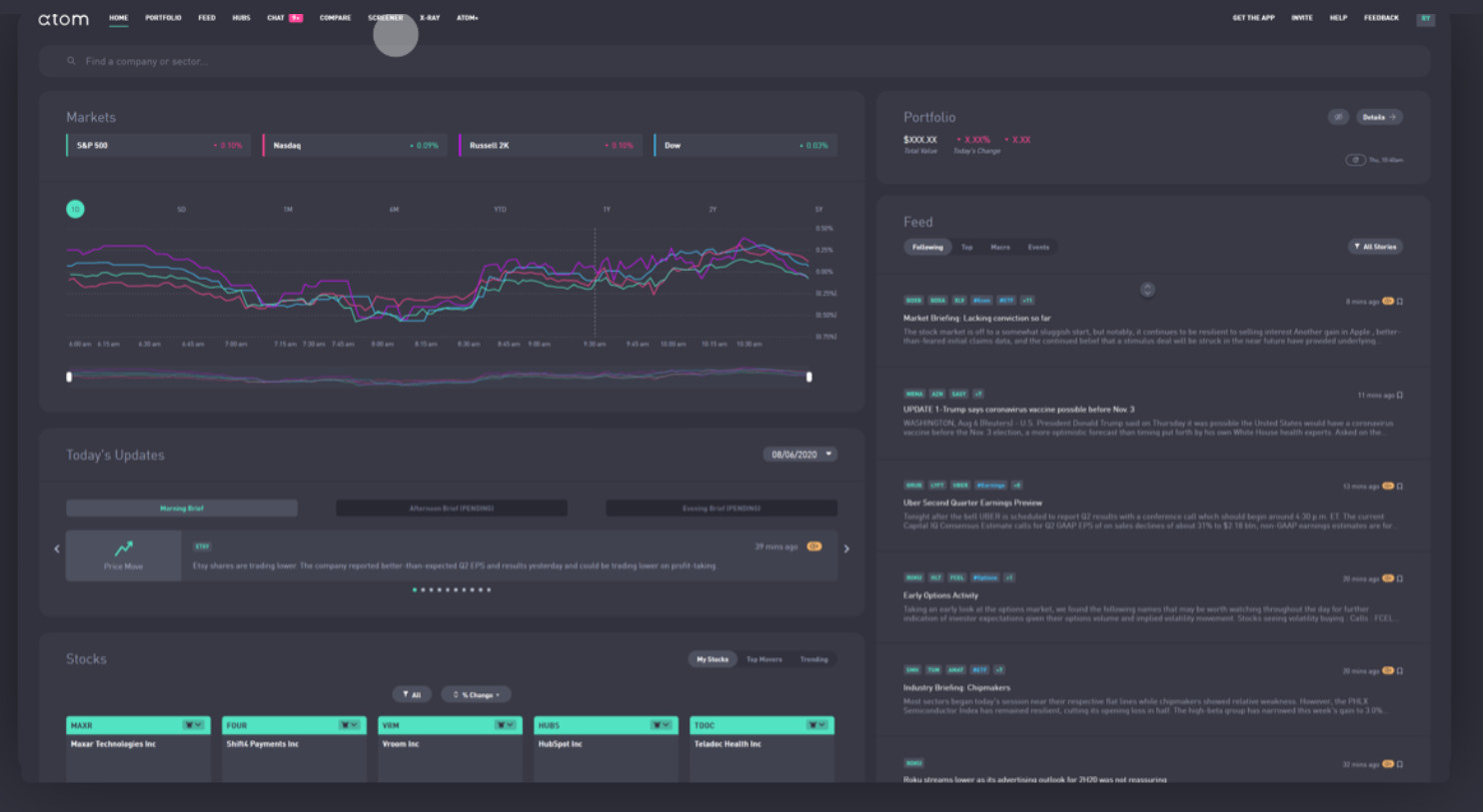

Atom Finance provides research tools that can integrate with the brokerage platform you are already using. You can even aggregate multiple brokerage accounts within the Atom Finance platform, giving you high-altitude view of your entire investment universe in one place.

This is perfect if you like your brokerage service but their research and analysis tools aren’t satisfactory.

Atom Finance offers a premium version with a 7-day trial. You can start with a free trial and if you like what you see, you can continue on the premium version and have access to many more tools and information sources.

Table of Contents

What is Atom Finance?

Atom Finance is an investment research platform, giving users greater ability to make informed investment decisions. It does this by providing institutional-quality tools and resources, as well as real-time tracking of US stocks (share counts and non-US stocks are updated daily).

Right now, Atom Finance offers real-time coverage of stocks traded only on US stock exchanges. However, they plan to add coverage of international markets, as well as other asset classes going forward.

The company does not offer brokerage services but you can integrate Atom Finance with popular brokerage trading platforms. This is done through synchronization of your Atom Finance account with your brokerage firm using Plaid. Once you create your Atom Finance account, you’ll have a link on the platform to integrate your broker into the service. The service will then begin analyzing your brokerage account(s), giving you a comprehensive picture of your holdings, even if they are held in multiple accounts.

Based in New York City, Atom Finance began operations in 2018. It currently has ratings of 4.1 stars out of five among both Android and iOS users.

How Atom Finance Works

Atom Finance offers four core features:

Hubs

Hubs are watchlists that provide powerful company comparison tools. For example, you can track your favorite stocks, compare metrics from the dozens available to instantly compare stocks, as well as aggregate data automatically. Metrics include valuation multiples, growth rates, and margins.

You can also use Hubs to create visual comparisons, instantly creating stock charts for analysis. You can even give your specific hub a unique name, and share it with others to follow and discuss.

Portfolio

This tool enables you to track all your investments on the Atom Finance platform. Using one simple dashboard, you can monitor all your investment information, including active positions, trades, and profits and losses across multiple accounts.

The tool also provides portfolio stats and sector diversification measures, so you’ll know exactly how your funds are allocated across multiple accounts. It also provides custom portfolio alerts, event notifications, and shareholder badges. The portfolio tool also allows you to compare your own performance against major indices, as well as to manage diversification and analyze portfolio statistics.

And through the Chat feature, you can connect with other shareholders using the service to discuss company outcomes and other details.

If a portfolio tracker is the main thing you are interested in, here are our favorite portfolio trackers.

Screener

What’s an investment research platform without a screener, right? With Atom Finance’s Screener tool, you can customize your criteria to screen for dozens of metrics, then see live results populate in real time. From there, you can make live adjustments and create a hub to save your screen results.

Here’s our list of favorite stock screeners.

Modeling

Create customized financial models to test different investing scenarios. You’ll also get automatic updates with the latest analyst estimates, and the ability to export the financial data directly into Excel, where the data can be more easily manipulated.

X-Ray

This tool enables you to search specific terms across multiple documents. You can even search those documents simultaneously and instantly find references to keywords across SEC filings, transcripts, presentations, and news.

All the information will be presented on your Atom Finance platform, enabling you to move to relevant sections quickly. You’ll also be notified when new documents referencing your search terms become available.

Atom Finance Features

Available platforms: Web and iOS (11.0 or later) and Android (7.0 and up) devices

Account security: Since the service doesn’t take custody of your investment funds, there’s no risk of loss due to broker failure. Unfortunately, the service does not provide many details on specific security measures they may employ to protect your information, other than the use of a password and encryption of data on its servers. The Privacy page mostly discusses strategies you should use to protect your password, as well as to limit access to your computer or mobile device.

Chat feature: Discuss investment ideas and breaking news with other investors in live group chats.

Customer service: Available by email only – no phone or live chat with Atom Finance personnel are indicated.

Atom Finance Pricing

Atom Finance offers just one plan – Premium, which is $6.99 per month after a 7-day free trial.

Atom Finance offers the following features:

- Breaking institutional-grade news and mobile alerts.

- Daily market briefings, three times each day.

- Real-time streaming stock quotes for all public US companies.

- Detailed historical financial statements for all public US companies.

- Account aggregation – connect your investment accounts and track all your positions in one place.

- Stock screener, offering real-time screening using dozens of metrics.

- Hubs – track and compare companies by creating custom watch lists.

- Chat with fellow investors in live group chats.

- Analyst consensus estimates for all major line items, growth rates, and margins – limit three per month.

- Investor documents aggregated in one place, including SEC filings, event transcripts and presentations – limit three per month.

- Comprehensive institutional investor holdings data – limited to top five holdings only.

- Comprehensive ETF and mutual fund holdings data – limited to top five holdings only.

- X-Ray document search and alerts from keywords across multiple documents – limited to three per month.

- Sandbox, to create financial models that automatically refresh with the latest analyst estimates or your own inputs (no saving or exporting on this plan).

- Price change explanations of notable price changes in major stocks during market hours.

- Analyst commentary on all major macro updates and business updates.

- Equity research summaries and highlights of equity research reports from major banks and research firms.

- Comprehensive price target updates from all major banks and research firms.

- Analysts forecast and estimates for all major line items, growth rates, and margins – unlimited.

- Investor documents aggregated in one place, including SEC filings, event transcripts, and presentations – unlimited.

- Comprehensive institutional investor holdings data – unlimited.

ETF and mutual fund holdings data – unlimited. - Premium non-GAAP company metrics and operating key performance indicators (KPIs) from presentations and filings.

- Fund look-through providing access to all underlying holdings of ETFs and mutual funds.

- X-Ray document search and alerts from keywords across multiple documents – unlimited.

- Sandbox, to create financial models that automatically refresh with the latest analyst estimates or your own inputs (includes saving or exporting on this plan).

- Excel report, downloading Atom Finance company data directly into Excel for easy financial manipulation.

Atom Financing Pros & Cons

Pros:

- Provides the type of tools and research more typically reserved for investment professionals and institutions.

- Offers brokerage firm integration that’s not available with free stock screener services, or even with many premium screeners.

- The Premium plan offers a 7-day free trial, giving you an opportunity to see if you feel the service is worth the price you’ll pay for it.

- Atom Finance includes a social sharing capability that enables you to discuss investment ideas and strategies with other investors using the service.

Cons:

- Atom Financing does disclose that they permit third-party ads on their platform.

- The service does not operate as a brokerage provider.

- The company provides little information on security protocols beyond use of passwords and encryption of stored data.

- Does not offer any type of investment management service.

- Currently missing real-time coverage of stocks trading on foreign exchanges, though the company promises this capability is in the pipeline.

Should You Sign Up with Atom Finance?

The real value of Atom Finance is for active traders. The institutional grade tools and research provided by the Premium plan are a must if you choose your own investments and are a frequent trader. For less than $10 per month, you’ll have access to information typically available only to institutional investment insiders.

Still another group of investors who may benefit from Atom Finance are those who trade on low/no-cost investment apps, like Robinhood and Webull, that offer very little in the way of investment information, research, or screening and analysis tools. Atom Finance will provide you with all the features of the major stock brokerage platforms, with the convenience and ease of use of apps like Robinhood and Webull.

If you’ve been at all interested in improving your investment performance and returns, you can try their service for free for 7-days. If you like what you see, and it’s delivering the results you are hoping to get, stick around and it’s less than $120 per year.