In life, products come and go. New products make old products obsolete.

When Apple came out with an iPod, it became really hard to keep making Walkmans and Discmans. And good luck trying to find a VCR!

When it comes to financial products, obsolescence is much slower. Money market accounts still exist and I have no idea why (for consumers) – anyone can usually find higher rates at an online bank.

But, much like how there are still over a million people paying for AOL, human behavior often defies understanding. 🤷

Which brings us to the topic at hand – certificates of deposit.

This post gets updated every few months as we react to where interest rates are.

When I first wrote it, back in 2022, interest rates were low. Now that rates have gone up, we must ask ourselves, are certificates of deposit worth saving into right now?

Table of Contents

The Use Case for Certificates of Deposit

Before we get into whether they are worth it, which is a question about rates and alternatives, we have to think about the use case for CDs.

The reason people use CDs is because they are looking for absolutely safe investments that offer a return greater than their savings accounts. To get a higher return, they are willing to lock up the funds for the specified term. The longer the term, the higher the yield. You can access your funds early but that typically comes with a penalty.

When we first did this exercise back in May of 2022, we saw that at Ally Bank, the online savings account and the 6-month CD offer the same yield, except you can access your funds in a savings account at any time. This rate set up is common, Discover® Bank has something similar (though Discover Bank has a $150/$200 new account bonus).

Today, we see this rate spread:

| Deposit Product | Yield |

|---|---|

| Online Savings Account | 4.25% APY |

| High Yield CD – 3 months | 3.00% APY |

| High Yield CD – 6 months | 4.40% APY |

| High Yield CD – 9 months | 4.45% APY |

| High Yield CD – 18 months | 4.45% APY |

| High Yield CD – 36 months | 4.00% APY |

| High Yield CD – 60 months | 3.90% APY |

This highlights why laddering your emergency fund into CDs is so appealing. You needed that money to be safe because we never know when an emergency will strike, but getting a little extra in yield was a fair tradeoff. This isn’t money that can go anywhere else – so the move from a savings account to a CD makes sense.

This trade of your liquidity (ability to access your funds) for yield (interest) is a common trade in finance. It’s how loans work. You lend out your money to a friend, they pay it back by a set date and give you a little extra (interest).

With CDs, there’s no fear that the bank will default because of FDIC insurance and so your yields are quite low. Low risk, low yield.

If you want liquidity but also the safety of CDs, you can consider no penalty CDs. These are certificates of deposit that do not penalize you for early withdrawal. Some CDs will let you withdraw part of the CD without having to liquidate the whole thing. No penalty CD rates are very competitive right now, with many banks offering flexibility in ways they didn’t previously consider.

For slightly better yields, another option to considered are Brokered CDs – which are simply CDs you get through your brokerage. You hold them in your brokerage account and the broker works with the banks. There are certain rules you have to follow but they’re basically the same product.

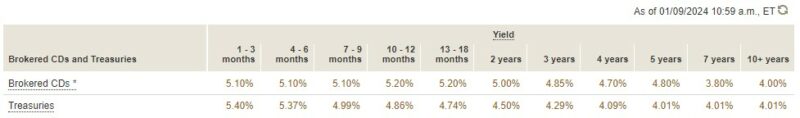

Here are Vanguard’s rates as of January 9th, 2024:

Brokered CDs can be traded on a secondary market so their market values can fluctuate but if you hold to maturity, you receive the full value of the CD plus interest.

Now that we know how CDs work, we have to ask – are they worth it?

Are CDs Worth It?

This question comes down to two factors:

- Are yields attractive enough?

- Are there better alternatives right now?

1. Are CD Yields Attractive Enough?

CD yields are decent right now. And in a rising interest rate environment, with the Fed signaling they will move the target interest rate higher, there’s a sense that CD yields will continue to go up. That’s a tough psychological pill to take.

| Bank | Min. Deposit | 12-Month APY | 36-Month APY | 60-Month APY | |

|---|---|---|---|---|---|

| Western Alliance Bank | $1 Member FDIC | 5.05% APY | 👉 Learn More | ||

Barclays Online CD | $0 Member FDIC | 5.00% APY | 3.50% APY | 3.75% APY | 👉 Learn More at Barclays |

| $500 Member FDIC | 4.75% APY | 2.85% APY (18 Month) | 👉 Learn More at Nationwide | |

| $0 Member FDIC | 4.50% APY | 4.00% APY | 3.90% APY | 👉 Learn More at Ally Bank |

| $2,500 Member FDIC | 4.70% APY | 3.75% APY | 3.75% APY | 👉 Learn More at Discover Bank |

| $1,000 Member FDIC | 0.30% APY | 0.40% APY | 0.50% APY | 👉 Learn More at CIT Bank |

| $1,000 Member FDIC | 0.20% APY | 0.20% APY | 0.20% APY | 👉 Learn More at Axos Bank |

But let’s look at the rates on their own, rather than how they may change over time.

Are you OK with the liquidity terms?

This is the biggest question to answer with CDs – does it make sense for you to lock in at these rates? That’s a personal question and for some, the convenience is worth it.

They don’t want to think about it so they just put it in a CD and move on with their lives.

If you’re putting $1,000 into a CD at 5% APY, that’s like $50 after a year. If you left it in a 4.50% APY savings account, that’s only $45. You might even say that putting it in a CD isn’t worth the time.

What about the stock market?

Ahh, the siren call of the stock market.

This is the biggest question – when the stock market promises historic annual returns in the high single digits, where do low single digit CD yields?

First, remember the two are NOT substitutes for one another. CDs are 100% safe. The stock market is very volatile. We saw this most recently at the start of 2022 and during the pandemic. The market will go up and down, CDs only go up (slowly and surely).

Second, they serve different roles in your financial ecosystem. Everyone loves seeing high returns but we forget that to get those returns, we have to weather the rocky storms – this is only possible if our time horizon is long enough. The point of CDs is to offer better than savings account yield for a short period of time. These aren’t dollars that can sit there for years to weather a downturn.

You should have some of your money in the stock market, such as your retirement assets, but not money you need in the short term.

2. Are Better Alternatives Available?

OK the stock market is not an alternative to a CD – so what else should we consider?

There are very few perfect substitutes to a CD (higher than savings account yield, 100% safe) but here’s one that is very attractive right now.

If you want 100% safe and have a longer time frame, Series I bonds can offer high yields especially in times of higher inflation. They are issued by the Treasury so they are backed by the full faith and credit of the United States.

The Series I bond’s rate is set twice a year (May and November) and has a fixed rate for the life of the bond and a semiannual inflation rate that changes twice a year. When inflation is high, the rate on the bond goes up.

Right now, that rate is 5.27% APY – it’s very high but that’s because inflation is high.

Our post Series I Bonds explains all the intricacies but the notable ones for this discussion is that:

- You cannot redeem your bonds within a year no matter what

- If you redeem within five years, you surrender the last three months of interest

There aren’t any other 100% safe alternatives (unless you’re considering other Treasury bonds) but there are a few that are close:

- Earning bank bonuses – This is where you open accounts at new banks for their new account bonuses. This requires more time, as they often ask you to move your direct deposits, but some will give you cash for large deposits.

- High yield savings accounts – These are always around and some accounts are better than others, usually you can get high rates on low balances. As of May 2022, Current offers 4.00% APY with their savings pods (you can have three pods, up to $2,000 in each, for $6,000 total), so that’s pretty good for an FDIC insured account.

- Reward checking accounts – These are accounts that offer a higher interest rate if you agree to use their debit card numerous times each month. They use the transaction fees from the card usage to pay higher interest.

- Brokered CDs – This is where you go through a brokerage to buy CDs. It can get you access to obscure banks with higher rates but it’s still a CD.

Conclusion

“So Jim, are CDs worth it right now?”

Short answer is maybe because:

- Rates are attractive, but high yield savings account rates are too

- Alternatives may be better

Longer answer is that this is a personal decision that depends a lot on your personal situation, the value of your time, comfort, and the rate environment.

In January 2024, with inflation slowing down and the Fed putting a pause on rate hikes, CDs may be worth saving into today because rates may go down.

It depends on your plans for the money, the time it takes to move the money into a CD, and your time frame.

I will say that rates are likely to be around the highest you’ll see in the near future. Unless something drastic happens, we probably won’t see them going up much more. You may see some banks offering high rates, like 6% CD rates, to get more depositors but that’s a business and marketing decision.

Richard says

Hi Jim,

I have $10,000 in an I-Bond that I purchased last month.

I have purchased a 6 month T-Bill through Vanguard last month paying 1.35%. It seems this is better than a CD. I am planning on purchasing another one this month. Maybe 1.40%?

What do you think?

Richard

If it fits your financial situation, I don’t see why a T-Bill isn’t a good fit. 6-month CD rates right now are less than half that.

chris says

Series I bonds only allow a purchase of $10,000 per year per individual. Your example is won’t work as written.

Which aspect of the example doesn’t work?

Fran Campbell says

My thoughts on CD’s. Interest rates will have to rise and you can be locked in for 5 years at a very low rate. If you leave early or need some of the interest–the penalties are harsh. I lived through these contortions in the 50’s, 60’s and 70’s when mortgages rose to 12% and that was if you had great credit and a good job. When my Husband and I wished to build our dream home on the lot we had purchased 8 years prior and the Viet Nam war was ending and copper and lumber started going up and the S&L President was dragging his heels on a fixed 25year mortgage–I threatened to take our money out and leave. I got a 5.25% mortgage and afterwards rates just zoomed upward but we were locked in. I still like my tax free muni’s. I just purchased one for 4.2% insured. I am having a number of calls even the 3% ers are going out and I am re-investing at a higher rate