Since 2014, we've had Southwest's Companion Pass.

And I know I'll have it until the end of the year, 2024, because we re-qualified again last year.

I'm not a “travel hacker” or some guru. I'm a regular person like you.

I have little interest in getting a dozen credit cards, joining half a dozen rewards and loyalty programs, and figure out the most efficient way to convert hotel points into airline points into whatever. I don't want to do a spreadsheet to track it all. I don't want to download any calculators.

To the folks who love that stuff, I salute you. I'm a huge nerd myself and love a good spreadsheet, everyone knows that, but travel hacking isn't one of those things.

That said, I see why it's appealing. Going on nearly free trips, staying at swanky hotels for nearly nothing, and getting the most out of a credit card is fantastic.

Here's step by step how I did it.

Before I got the Southwest Companion Pass, I was looking into the whole travel hacking phenomenon. I learned it wasn't for me, except with one exception — Southwest Companion Pass. We live near BWI airport (Baltimore/Washington International, Thurgood Marshall Airport), which is a big Southwest hub, so this was a perfect fit. From BWI, we could fly to many destinations including international airports like Aruba.

The Best Way to Get Companion Pass in 2024

Very rarely, Chase and Southwest offered Companion Pass and points as a new sign-on bonus.

That offer has since expired and now we are back to the more standard offerings (though this latest offer has a nice little bonus we'll get into below), though the minimum spend is much lower than previously.

Do you run a business? If so, the new Southwest Rapid Rewards Performance Business credit card will give you 80,000 points after you spend $5,000 on purchases in the first 3 months. There's a $199 annual fee but you also get 9,000 bonus points after your Cardmember anniversary.

Here are the best offers on those cards (currently the bonus is all the same):

- Southwest Rapid Rewards Plus Credit Card – Get 50,000 points after you spend $1,000 on purchases in the first 3 months of account opening.

- Southwest Rapid Rewards Premier Credit Card – Get 50,000 points after you spend $1,000 on purchases in the first 3 months of account opening.

- Southwest Rapid Rewards Priority Credit Card – Get 50,000 points after you spend $1,000 on purchases in the first 3 months of account opening.

How I Got My Southwest Companion Pass (2014 – 2024)

📢 The following advice, which explains how to earn Companion Pass through points, is no longer necessary since the current promotion is that you get 50,000 points after you spend $1,000 on purchases in the first 3 months of account opening.

On the personal and business cards, they will frequently run 50,000 Rapid Reward point promotions. I waited for one of those times.

For years, the standard promotion is closer to 30,000 miles for spending $1,000 in the first 3 months. That's not very good. I had to wait until they increased it.

Nowadays, you want to wait for a 60,000 point offer. They come around more often now that CP takes 135k.

Also, anyone with an existing Southwest credit card can refer you to this offer, plus they get 10,000 points too (and those points count towards Companion Pass!).

How to get the Companion Pass for Southwest Airlines (updated with more “traditional” promotional numbers):

- Get the personal consumer credit card, like the Southwest Rapid Rewards Premier Credit Card and you spend the $3,000 for the bonus — that's 63,000 points.

- Stack on a Southwest Rapid Rewards Premier Business Credit Card too, it runs smilar promotions, which right now is 60,000 points after you spend $3,000 on purchases in the first 3 months your account is open. That also has a $99 annual fee. Don't have a business, read our applying for a Business Card section below because you can have a business.

- Otherwise just spend another $72,000 and you're in. I know it's a lot, but creativity can help here.

- With 135,000 points, you'll get SW Companion Pass for rest of the current year AND the next year!

Remember the Chase 5/24 rule! Chase has a rule that if you've been approved for 5 cards in the last 24 months, you will be declined for new cards. You probably can remember when you applied for a card but if you've forgotten, the best way to check is to check your credit reports.

If you don't see the 50,000 or better promotion, be patient and wait. The standard 25,000 point version just isn't as good and the 50,000 comes back all the time. Southwest also offers a Southwest Rapid Rewards Plus card (instead of Premier) which has a lower annual fee ($69) and a few other smaller bonuses (3,000-anniversary points instead of 6,000 for example). There are often 40,000 Rapid Rewards point bonuses too – you can take those if you want but 50k is ideal.

In total, this will cost you the annual fees of the cards you get, which don't count towards the required bonus spending on either card.

Want other ways to earn RR points without the credit card OR flying? My list of Southwest Airlines money-saving hacks explains how their various point-earning programs work, from the Dining program to electricity supplier reward programs.

Common Questions about Companion Pass

If you have questions about Southwest Airline's Companion Pass or the strategy, you're not alone.

Here are the most common ones I've been asked, hopefully, it answers your questions!

What Is Southwest Companion Pass?

Companion Pass lets you name one person who can fly with you for free (you only pay the September 11th fee) anywhere you fly on Southwest. No blackout dates. You fly, they fly free (you still pay fees like the September 11th security fee)

It's an amazing perk and we've saved thousands each year because of it. It's probably one of the best frequent flyer perks out there, and you don't even need to be a frequent flyer. 🙂

To earn a Southwest Companion Pass, you need to earn 135,000 Rapid Reward points in a single calendar year. When you do, you get the Southwest Companion Pass for the rest of the year in which you earned it plus the following year.

If you get it January 1st 2024, you'll have Companion Pass until December 31st, 2025. Nearly two years.

If you get it December 31st, 2023 then you'll only have it until December 31st, 2024. A year and a day.

There's a huge difference. When earning your miles, you want to get it as early in the year as possible to maximize your free flights.

The fastest way to earn miles is by getting the bonuses on their credit card. They often run promotions where you can get 50,000 miles for spending $2,000 in the first three months. More on that shortly.

Best Time to Earn Southwest Companion Pass

You want to get your SW Companion Pass as early in the year as possible since you'll get it for the remainder of the year… plus the next year.

The best time to apply for the cards is near the end of the calendar year. That way you get the cards at the start of the year, hit your spending goals, and earn Companion Pass. If you apply roughly in mid-November, get the cards shortly thereafter, you have three months (December to February) to spend the $2,000 on each card to get the bonus 100,000 miles.

You know your spending habits. Adjust your application date to when you will be able to reach the tiers.

Personally, I applied in December, got the cards in January, and reached the spending limits sometime in February. My Companion Pass congratulations email arrived on March 6th, once all the points posted.

Can I Spend My Points Before I Get Companion Pass?

Yes. You don't need 135,000 Southwest Rapid Reward points in your account, you only need to earn 135,000 Rapid Reward points in a calendar year.

So if you earned 5,000 points in January, that's 5,000 towards that year's Companion Pass eligibility.

You can spend those points on flights, your meter will still have the 5,000 points that you earned.

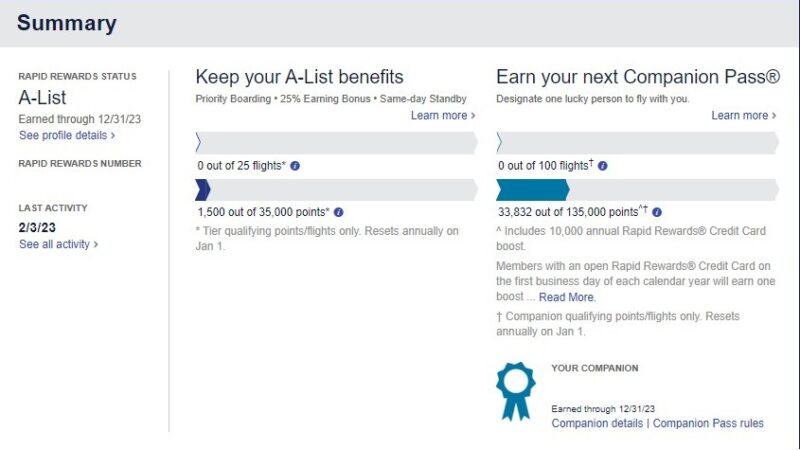

If you log into your account and at the top, it'll show your progress towards A-List and Companion Pass:

We're early in 2023 so my bar is relatively low (we did fly several times which is how it's almost a fourth of the way!).

As you accumulate points, it'll fill up to the 135,000 points you need. (A-List is always a tease though!)

Can I get points for both the Southwest Plus and Premier Cards?

No!

Why can't I get both the Plus and Premier cards? On April 5th, 2018, Chase added new language to the terms of the landing page of the promotions:

This product is not available to either (i) current Cardmembers of this credit card, or (ii) previous Cardmembers of this credit card who received a new Cardmember bonus for this credit card within the last 24 months. To qualify for your bonus points, you must make Purchases totaling $1,000 or more during the first 3 months from account opening. Please allow up to 8 weeks for bonus points to post to your Rapid Rewards® account. (“Purchases” do not include balance transfers, cash advances, travelers checks, foreign currency, money orders, wire transfers or similar cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable.) To be eligible for this bonus offer, account must be open and not in default at the time of fulfillment.

Booo. 🙁

Can an Authorized User Get the Bonus Later?

When we got our first Southwest credit card, I was worried about putting my wife on as an authorized user because I wanted her to be able to apply for the card and get the bonus in the future. It turns out my concerns were not warranted!

I asked Southwest and Chase on Twitter and they told me that…

If the authorized user hasn't gotten bonus points then they are eligible to get it as the primary cardholder!

What if I cancel my card and re-apply, can I get the bonus?

The basic rule governing this is that you cannot get the same bonus on the same card in any 24 month period. If you opened a Chase Southwest card last year, earned the bonus last year, then you won't be eligible until 24 months after you earned that bonus. If the bonus was awarded in January 2017, you have to wait until at least January 2019 before you are eligible to get that same sign up bonus.

Let's say you're beyond the 24 month period but you're still using the card. Can you cancel today and get the card and bonus again?

Yes… but you have to wait 60 days before you apply for the card. It takes that long for their systems to be updated. If you apply earlier than 60 days, you risk being denied because their systems think you still have an activated account.

Other Things to Remember

Before we go into the business card section, some last few thoughts:

- You only need to spend purchase requirements in the first three months to get the bonus point promotions on each card. That's the only time limit. The remaining amount you can spread out over the rest of the year, but it's better to spend it earlier so you'll have Companion Pass for longer.

- The goal is to earn 135,000 Southwest Rapid Reward points in a year, so all the other ways of earning them (like flying, renting cars, hotels, etc.) are all in play. We focused on the credit cards and putting the points in terms of spending because it was easiest to explain. You don't have to spend $6,000 to get the other 6,000 points, you can earn them in more traditional ways.

- You can change your flight Companion up to three times in the validity period.

- Check out these other Southwest Airline hacks to earn miles easily, like Rapid Rewards Dining and joining Rocketmiles if you stay in a lot of hotels.

- The best part is the Southwest credit cards are also Visa Signature cards so you get all the promotions and protections associated with Visa Signature.

Big Change to Southwest Companion Pass qualification RR Points

There was a big change on January 1st, 2017 – the only way to earn Southwest Companion Pass eligible Rapid Reward points:

- paid revenue flights on Southwest Airlines,

- points earned through spending on a Southwest Airlines Rapid Rewards credit card (including the bonuses),

- points earned through transaction with Southwest Rapid Rewards partners.

That means e-Rewards, e-Miles, converted points from hotel and car loyalty partners, Valued Opinions and Diners Club will no longer count towards qualification for Companion Pass. You still get the points, they just don't count towards the 125k you need each year.

Years ago, a popular strategy was to convert Chase Ultimate Rewards points and this change closed that method.

🙁

“Spending” without Spending?

Where do you live?

If it has four walls and a roof, chances are you're paying rent or a mortgage. Most landlords and all banks will not let you pay rent or a mortgage with a credit card. Credit cards charge the merchant fees and landlords aren't a fan of those. 🙂

But if you are getting close to a bonus, or Companion Pass, and just need a little more to get there… using a service to pay your mortgage with a credit card is an option.

They charge fees, because they pay the merchant fee to the credit card, but if you need a few hundred or a few thousand points to get to the bonus and time is running out, it might be worth it.

Applying for the Business Credit Card

If you have a business, awesome! (if you don't, your best option is the Personal Plus card)

Use all the information you have from that.

What if you don't have a business? You're in luck, you might have a business and not even know it. In the United States, if you earn income outside of a job reporting your income on a W-2, then you are operating a sole proprietorship. You don't need to be incorporated, you don't need to have any employees, and you don't even need to make that much money.

In fact, if you've made a profit three out of the last five years, the IRS considers that a business and not a hobby.

Get an Employer Identification Number. It's free, nearly instant, and you never need to use it.

Getting an EIN won't guarantee you'll be approved but it's a step up from using your Social Security Number on the application.

If you want to really improve things, get yourself a website.

Otherwise, fill in the application truthfully.

Here are some more tips on getting a business credit card.

Pending Review???

Once you apply, your application will be approved or “pending review.” Pending review is not always bad but it means they couldn't verify your business or need more information.

Wait a day or two, then call the reconsideration line and ask them that you'd like to check on the status of your application. Be prepared to answer these types of questions about your business:

- What is your business and what do you do?

- How long have you been in business and what were your annual revenues and profits?

- How much do you expect to make this year, revenue and profit?

Whether they approve you will be up to the representative but here are a few tips for a reconsideration call.

When I got the card, I had to call the reconsideration line even though I've had a revenue-generating business for years. They can't verify anything on the application through a third party so the approval process is effectively the same as for the personal card. And remember, when I applied, I told them I was a blogger.

How much have we used it?

ALL THE TIME. (before the pandemic, that is)

I can't even remember the last time we flew an airline other than Southwest. We've since gotten a few flights to New York to visit my parents, Boston to visit my sister and her family, plus vacations to San Juan, PR and soon a flight to Aruba.

The most expensive flight we've gotten for “free” (you pay taxes and fees) will be the one to Aruba. That baby cost me $727.50 and will cost my lovely wife just $70.60. That comes out to be just under $400 per person.

$400 for a direct flight to Aruba? I'll take it.

The 135,000 points we get via promotions are valuable too. They're worth about 1.66 cents on the best Wanna Get Away fares ($108 o/w from BWI to ISP), so that's worth about $2,200+ in and of itself.

All in all, this experience has been a very positive one.

John @ Frugal Rules says

Great breakdown Jim! Both my wife and I got the CP during the first quarter of this year and have loved it. It was relatively simple to earn, especially since it coincided with us adding a deck to our house – thus allowing us to charge a relatively large expense. Given that SW added those Caribbean routes I think it brings even more value to the program. We’re going to Cancun for our 15th next year and will likely take at least 1, if not 2, similar trips with our kiddos over the next year.

We both just redeemed free flights on American recently…we were reminded again why we fly SW as much as we can.

We’ve taken advantage of those international routes too – we went to Puerto Rico (ok ok, technically not international) earlier in the year with it and in a week we’ll be in Aruba. Huge savings so far!

Glen says

Jim,

Is this program still good as of 6-14-16? Someone told me they thought the ability to use the signature visa miles towards the companion pass was not allowed? Since it appears the pass is good for the year in which you apply and the following year, I was confused by the comment above that suggested one wait until November to apply. Thank you very much for the information.

Hi Glen – the program of Companion Pass?

The suggestion to wait until November to apply is driven by this strategy: Apply in November, get the card in late November or December, wait to spend the $2,000 until January. In January, you get 50k points (or 100k if you get two cards), then you get Companion Pass for that year and the following year. If the 110k points hit in Jan or February of 2017, you get Companion Pass for 2017 AND 2018.

If you apply now (June) and get the 110k points in August, you get companion pass for 2016 and 2017.

Waiting maximizes the “current year” part of the equation.

Neema Borji says

Jim,

Awesome article! I only wish that I had seen it before registering and receiving my Southwest card. Womp!

Would it be possible to sign up for the business card now and still receive the 50k points? I read this in the terms…

“Bonus Points

This product is not available to either (i) current cardmembers of this credit card, or (ii) previous cardmembers of this credit card who received a new cardmember bonus for this credit card within the last 24 months.”

Any thoughts?

If you have a business, yes you can still apply. It’s a completely separate card. Good luck!

Dan says

So what happens if you get the 100,000 pts in January (2017) from applying for the cards but then transfer some Hyatt points earned in 2016 to SW in January (2017) to get to the 110,000? Would those points not count because they were earned in 2016 or would they count since they were transferred in 2017?

Earned = when they hit the account, so if you got the 100k points in January then it counts for 2017. Same with the transfers, even if the original points were earned in 2016 in the other program (they have no idea when the original points were earned).

Susan says

Jim, Once you got your card and your business’s card, did you have to do something to combine them?

They’re still separate cards but they are linked to the same (my) Rapid rewards account number.

Kelly koffler says

Looks like those bonus points no longer count toward companion status. According to Southwest: Points purchased for personal use or as a gift, transferred points, points earned from program enrollment, Tier bonus points, flight bonus points, and Partner bonus points (with the exception of the Rapid Rewards Credit Cards from Chase) do not qualify as Companion Pass Qualifying Points.

Which bonus points? The points from the credit card? According to what you pasted, it still applies.

Josh T says

Can anyone verify if the 50,000 points from enrolling in the RRCC from Chase counts toward companion status still?

I can confirm it, it still counts. You can always ask @SouthwestAir on Twitter too, they answer pretty quickly.

Dave says

I am 22,000 miles short of my companion pass with 1 month to go. I just secured a chase marmot rewards card with a 80000 mile signing bonus with intent to transfer them to SW. Although the SW terms say transfer points will not be applied to the companion pass… so I hope like you mentioned they do? Is there any other good ways to make up a shortfall before new years? I’m afraid Im not going to get the 80,000 Marriot points posted and transferred to SW in time. I love my Companion Pass!!!! I’m addicted !

SCOTT NGUYEN says

Hi Jim,

I just applied for SW Premier card and got approved and waiting for approval for business card. If I got both cards, I am still short of 20K Points to get companion card. I called SW credit card department, they said that points from Hotel will not count toward to companion pass (I have 50K points from Chase Sapphire Preferred and plan to transfer to Hyatt and transfer to SW Rapid). Will you please give me some suggestions what to do to get companion pass?

Did you tell them specifically that you were transferring those points to Hyatt and then from Hyatt to RR?

SCOTT NGUYEN says

Hi Jim,

No, I just asked whether Hyatt points can be transferred toward SW Companion Pass and response is ‘No, only points that use for airline bookings can be counted toward Companion Pass’.

Bob says

Hey Jim, My wife has a business and she is going to apply for a card in her name. Is there an issue if we use my SWA mileage account with her card?

It won’t work, Southwest says the names on the account have to match. That said, you can always say you’re an employee of the company and get the card anyway.

Les says

Can you use any of your points while you are accumulating them?

Yes

Trav says

Hey Jim, great article and interesting take on travel hacking not being for you.

As an avid travel hacker, many people would assume that I’d think not travel hacking would be insane, but I can actually see your point of view. Sometimes, the rewards aren’t worth all the effort (even if you are a nerd about spreadsheets!)

I feel this same way with things like taxes – yes, I know there are some things I could nerd out about that would save me money, but I just don’t care enough.

And as long as you pick off the low hanging fruit, of which the Southwest Companion Pass is certainly the easiest and best, then no need to dive deeper if it doesn’t work for you.

Trav – thanks for stopping by! I’m a fan of your blog and love the name too.

I think the rewards are worth the effort, it just happens that the effort can be really high if you want to take full advantage. At it’s core, it’s not really any more complicated than researching and booking a trip, you just add a layer of credit card applications, spending, and coordination. But as you said, we all get excited about different things and I think my energy & attention is better directed towards other things. The benefits of travel hacking are certainly there to reward folks who do put in the effort, that’s for sure.

Jacob Wade says

This is one of the best values in credit card rewards. Period.

I got mine in March of this year, and was able to visit family and take a last-minute trip to Nashville, just because. I was also able to use points to fly my parents a few places as well.

Still have about 70k miles left (WOOHOO Wanna Get Away fares!), and will most likely use it for my trip to San Diego next fall. We’ve saved thousands in travel, and this companion pass is a HUGE reason why 🙂

Maybe you can take a trip to the World Series next year (for free), if the Mets make it back? 😉

Ha so we were in the NY this past weekend visiting my parents on Long Island, I was tempted to go to a game but they’re at 8pm… it would’ve been fun to go to a World Series game but I’d get back home around 2-3am, which wouldn’t have been fun. Plus, I could watch the game with family and my son – no way he would make it to a game now. 🙂

Jacob says

Gotta groom the young ones while you can. Wouldn’t have been as fun to go to a game without him too. There’s always next year.

Hey, maybe the Mariners will live up to LAST YEAR’s hype and get there…..

^ (I almost typed that without laughing out loud….almost…LOL)

We don’t get much news about the Mariners here, being that they’re the AL West, but hype makes sports fun. 🙂

Shauna says

Hi there, we got the 50K points for a new cc earlier this year and since then I’ve accumulated quite a bit for business and personal travel. Would you recommend we still do this late as it’s late in the year? Will we get the companion pass for next year or just this year 2015?

The pass is based on earning 110,000 RR points in a single calendar year, not total points in your account.

If you got the 50K points already, you’ll need to hit 110k before 2015 ends in order to get credit for the 50K you earned earlier this year. On Jan 1, your points earned reset back to zero. You still have the points, but the meter on getting the pass gets reset.

If you hit the 110K, you’ll get the pass for 2015 (this year) and 2016 (the following year).

Lazy Man and Money says

We got found a deal on Kayak and paid $422 from Boston to Aruba on American… no companion pass necessary. I’m definitely going to be looking into this though.

When we looked, we could get individual flights on other airlines for slightly more than our Companion Pass subsidized rate, but they all had layovers in Atlanta or Miami or JFK. These were like multi-hour layovers too, tacking on 2-3 hours to the travel time, which is not something I enjoy. 🙂

Lazy Man and Money says

That’s a good point. My wife made the reservations this year and I just remember the price.

Last year, we went with Southwest and got a Super-Saver (or whatever their biggest discount is) for under $400 I think. The free baggage with Southwest is great. It’s definitely one of our preferred airlines.

Southwest has a lot of stuff going for them and if you get over the whole A/B/C boarding process, which seems to be the only complaint I hear frequently, it’s a great process. I fly it whenever I can.

Chris Peach says

Jim,

In 2011 we cut up all the credit cards and haven’t used them since. We live on a monthly budget and literally account for every dollar that comes into our lives. With that said, I know we could get this Southwest Card and funnel $6k through it in 3 months tim. However, now I feel like I’m the alcoholic that says “its only 1 drink, I’ll be fine…” . What do you think Jim? We travel SW all the time too. Hmmmm…

Well if you feel your use of credit cards is akin to an alcoholic with one drink… No. Don’t do it. 🙂

If it’s more of an exaggeration, I’d say it’s a good chance to see if you can use credit in a way that gives you overwhelming benefits. It’s a clear cut benefit with a goal and a good reason, so it’s a relatively controlled situation.

Plus, you seem like a well disciplined guy so with such clear parameters it shouldn’t be a problem.

Kim says

Very helpful article, Jim!

Say I spend up to $1999/card this year and these purchases post in December 2015. Do you know if these amounts count towards the 110,000 points needed for the pass? Or do I instead need to spend the $4k in 2016 in order for it to count for 4,000 points? I hope to have the 2×50,000 bonus points post early 2016.

Thanks!

The $1999 spend will not count towards the 110,000 points needed if it posts in 2015. You need to spend or have the statement with the spending post in 2016 for that spending to count.

Jeff says

Hi Jim,

I have a small ebay side business. I’m planning to sign up for an EIN and then apply for the business card. But since the EIN will have no history, I’m afraid I will get denied. Would I be better off simply using my social to apply for the business card?

An EIN is better than your social because it’s a sign that at least you have an EIN. 🙂

I don’t know if they consider the age of an EIN. My EIN was many years old (registered in 2006, I applied in 2015) and I still had to call the reconsideration line.

David says

Do I need to keep the cards around after I get the companion pass?

Nope, I have no idea where mine are. 🙂

Chris says

Can the cards be cancelled after receiving the CP and still have the points? I don’t want to pay the annual fees again.

Lisa says

If I don’t get the business card, how much do I need to spend this year to qualify?

You would need another 60,000 points to reach 110,000 after the 50,000 bonus points. So $60,000 or less if some of that is spent on Southwest flights (or you go on flights associated with that account).

Joyce says

If you join e-miles.com, southwest is one of the airlines you can use your points for miles.

Chelsea says

Is this referral link still valid? I want to use it but I’m worried about them accepting my application and only being awarded 25k miles…

When you click through, you’ll go to the card’s website and it’ll have the latest offer. As I write this, it’s valid.

Brandi says

I just tried applying for both personal cards (plus and the premier) at the same time using two different browsers. Last time (3 years ago) getting the business card (based on a rental property) was such a hassle that I was hoping not to have to deal with it. The Plus was submitted first and approved immediately. The premier was a half second later and I got the “We need to review your application a little longer” message. Any suggestions on calling or other tips getting it approved?

They will probably call you, or you can call them, so be prepared to answer questions about your business like the ones listed above. If you have a business, it’s usually not going to be an issue.

Brandi says

But it isn’t a business card. They were both personal cards. Is there an amount of time I need to wait before reapplying for the second personal card, or any suggestions for getting it approved through the reconsideration line?

Oh… that’s trickier then, since you already applied it’s not something you can “take back” — my best advice is to call the reconsideration line, be polite, and ask them what you need to do to be approved. It could be you have too many open cards or total credit with Chase, so they might close one or adjust your limits to the total is lower. Just let them drive and tell you what they need to do, you don’t have to offer to close cards because they might not want or need that (plus it dings your credit a smidge because of age).

One thing to research ahead of time – what do you love about the card and would make it your primary everyday card (don’t mention the bonus). That’s partially what they want so say the magic works, mention a few features you like, and see if they will play ball.

Whatever you do, do not mention the bonus! And it’s OK to say thank you, hang up, and try again with a different rep.

Good luck – I’d love to hear how this turns out.

Brandi says

It worked… I think! Recent advice on Flyertalk suggests not calling reconsideration until you are positive it is declined. So, I just waited it out. I called the automated line to check every couple days, and it always listed the second application as still pending. After 3 weeks, it was suddenly approved! Both appeared in my Chase online account, and my premier card finally arrived in the mail a couple days ago. Now I just have to hope that both will still earn the 50,000 bonus.

I hit the spend on the Plus card already. The regular points posted to my RR account after the first statement closed two days ago, but the 50,000 bonus points haven’t posted yet. When I did this 2 1/2 years ago, the 50,000 posted along with the the first statement points. Have these been posting separately lately?

Nice! That’s awesome, congratulations – if you signed up under a promotion, it should still be active.

I remember mine posting pretty soon after one another, you might want to call and ask?

Pat says

Brandi, did this work out for you? Interesting in trying 2 personal cards but would love to hear if someone had success before I try it.

Cliff Shattuck says

I am interested in knowing if this worked also. When the previous posters talk about getting two cards I wonder how hard it is to “connect” these two sets of points.

I have two cards and pointed both to the same rewards account, you just tell Chase the number.

Tony says

Hi Brandi,

Did you ever end up getting two 50K bonuses for the two personal cards?

Thanks,

Tony

johnny says

Brandi when did you cancel your cards that you did this with 3 years ago? I would like to do the same. Let me know what you did. Thanks!!! 🙂

Johnny says

Hi Jim,

Just wonder if I can change the companion for up to 6 times. Say if I get my companion pass this year and it will be valid till the end of next year, can I change it 3 times in 2016 and then another 3 times in 2017?

Thanks!

I believe it’s 3x for the life of the pass.

Kurt says

I was about to transfer my hyatt points to southwest to go towards the companion pass and just called southwest to confirm. Both a rep and supervisor told me they would not count towards the companion pass. Can anyone confirm that this still works? Thanks

If the reps said it wouldn’t count, they’re probably right? I will ask them.

Kurt — they count, I asked on Twitter and they said yes!

https://twitter.com/wangarific/status/725811283283566592

Kurt says

You are awesome… thank you 🙂

You bet Kurt! 🙂

Tony says

Are the 2 cards automatically linked to the same RR account? Or how does SWA know I have 110K when i technically have 55K on each?

You tell Chase what your Rapid Rewards number is and they will send the points there.

Tracey says

Why do Chase Ultimate Rewards not count? Is there a way around it? I have LOTS of Ultimate Rewards points.

I don’t know why they don’t count when so many other partner transfers will count. I bet a lot of people would love those transfers to count. 🙂

Brandi says

It is possible to ‘launder’ the points through another rewards program which does count, but you will lose significant value. When I did this a couple years ago, Hyatt and Choice points both counted towards the Companion pass. So, UR points could be transferred to one of those, then transferred from there to Southwest. I think I moved around about 12,000 UR points to ultimately get 8000 points counted towards the Southwest companion pass. I think the working partners have changed since then, but you can probably still find common partners.

Yeah, you lose a TON of points in the process but if you’re super close and just need a little to get over the top…

Mallory says

Hi,

I want to make sure I understand this correctly. I currently have the Southwest Premier card. I signed up at the beginning of April and my 50,000 spending bonus just posted today. I called the application line to verify if I could sign up for the Plus card and get another spending bonus and she said no. She said I could sign up for the card, but the bonus is one per customer. Can you confirm that I would be able to get the spending bonus again if I meet the requirements?

Thanks!

Pat says

Jim,

Just found this blog and really dig it! Thanks

Are you positive that your comment below applies all year long?

“Anyone with an existing Southwest card can refer you with this offer, plus they get 5,000 points too.”

These offers seem to pop in the middle of the year (for obvious reasons for SW) and vanish near the end of the year and start of the year. If what you say is true, it could be a good work around….

There doesn’t appear to be an obvious rhyme or reason to when the promotion appears and disappears, but it’s available more often than it is unavailable. Plus, even if you don’t refer, you can always get this 50,000 point offer at the airport from one of the kiosks.

NPK says

May I use my points to purchase a ticket for any family member (or anyone for that matter), or can the points only be used for tickets for the person linked to the SW account?

You can use them for anyone. If they miss the flight, the points go back to you.

NPK says

Can you clarify a timing question for the CP qualification?

If a cardholder makes enough purchases plus the sign-up bonuses by 12/31 for a CP status, some of the threads/comments seem to imply that there is a chance that you still won’t qualify for CP if SW doesn’t manage to “credit” all 110K points to your SW account by 12/31 of that same year merely b/c their systems take some number of weeks to process purchases & bonuses to points.

Here are several scenarios I’m concerned about b/c I am applying for the cards now and will thus only have about 6 months to earn the CP status:

1. You’ve made your last $1K of purchases by 12/31 but SW doesn’t “credit” your SW account with the points until the following January.

2. You’ve made your last $1K of purchases by 12/31 but you haven’t “paid” those amounts back to Chase until January (i.e. do they count your charges or do they count when you’ve paid Chase back for the charges).

It seems that you’ve technically made the purchases in the calendar year, but their systems will prevent you from getting CP status b/c the points aren’t in your SW account until January.

I believe your concerns are real and I believe it works based on when the points are deposited, not when the points are necessarily “earned” through purchases. To be safe, I’d get my spending in earlier rather than later.

Denise says

Two cards? How do the cards/ points connect?

In each credit card account you set your Rapid Rewards account number, that number can be the same.

Dina says

Can it be the Premiere and the Plus cards or does it have to be one personal and one business? I applied for the plus then realized I should have done the premiere. I called to see if I could switch because I just applied but they said no. I will get 60,000 points once I spend what I need but if I can get the premiere also that would put me at 120,000 which would get me the companion pass. do you think this will work?

People have done Premier and Plus cards (both personal), I did the personal card and a business card.

Amy says

what is your plan for when your current cp expires? did you close your cards and do you plan on reopening them-is that possible to get another 2 years of flying?

You can’t do that because you won’t be eligible for the Rapid Rewards points anymore, I plan on referring folks (you can earn up to 50k that way) and put all of my spending on the card. That plus the flying (I fly almost all flights on SW) will hopefully get me CP again!

D. Martello says

HI Jim,

Thanks for sharing this, you are such an expert on this!!! I have a quick question: if I get both business and person cc, can I open them under different names and use the one Repaid reward account number for both business and personal cc ? Or I have to open accounts under one person’s name and then I can link the same person’s rapid reward account number to both accounts? Thanks a lot!

I don’t remember if they matched names but they only asked me for the number on the account, they may try to match names on the back-end — that I’m afraid I don’t know.

Liz says

Can two different people sign up for the 50,000 point southwest cards and use the same RR # to have both bonuses sent to the same account? The business application option does not seem like it will currently work for me.

Southwest, via Twitter, says they have to be different Rapid Reward numbers:

https://twitter.com/SouthwestAir/status/751105410854039552

Steve says

I had a premier card that I earned 50k pts and closed it approximately 3 yrs ago. If I apply for the card again, Am I eligible to earn the 50K pts again? It has been over 24 months. Thx.

Josh says

I applied for the Plus Card today and have never been a rapid rewards member. Application said I would be enrolled upon approval. I was approved! But I didn’t get information on my rapid rewards membership. Is that still coming with the card that will get to me within a couple weeks?

I will ask Southwest and get back to you – thanks!

They said you “will need to enroll in RR at social.southwest.com/8AT and then contact Chase at 1-800-792-0001.”

I hope that helps!

Dave says

Hi Jim,

The 50,000 points from my Southwest Premier card has just posted. My problem is that I got 50,000 points from the Plus card within the last 2 years. Can my spouse apply for a card with my rapid rewards number? Or is there any way to make a rapid rewards number joint?

Thanks,

Dave

I asked Southwest via Twitter and unfortunately they said a different name has to go to a different Rapid Rewards number. 🙁

No joint ones either. 🙁

Jen says

How do people keep earning companion pass status every other year. Do they cancel their cards and then open a new one after a month or two. How does that work?

You can’t get the same bonus within 2 years, so it could be that they get the bonus and then cancel the card. Wait two years, then do it again?

liz says

are points that have been given to me from another account “Qualifying points”?

Nope

Brandi says

Would you recommend applying for the personal card first or the business card first. I’ve run a sole proprietorship for the last 3 years so I use my ssn as my tax id.

FWIW, I did them at the same time (technically, the personal card “first” but by only a few minutes). I have a pretty good credit score so I was confident the personal would be approved and the business card was going to take longer because business cards always do.

David says

If you get a business card, do you have to use that for business expenses or can it be for anything?

If you start using it for personal expenses, you open yourself up for some liability issues when it comes to intermingling personal and business expenses.

John says

How can points from two separate credit card enrollments (and thus two rapid rewards accounts) be combined to work toward the 110,000 points required for the companion pass? Would you have to transfer the points to one account? Isn’t there a huge penalty for that?

They’re two separate credit card enrollments but tied to one Rapid Rewards account, since they are different classes of card (consumer and business), this is possible. The points go directly into the RR account, there’s no transfer.

John Parizek says

Jim, So you’re saying use one rapid rewards account and enroll in two credit cards (one personal, one business)? So you need to be a small business owner in order to make the hack work?

Yes, that’s how to do it!

Chris says

Hi Jim – what sort of credit score would you likely need to get approved for both business and personal cards?

Appreciate all the insight!

Chris says

Also, I was thinking of applying for the Chase Sapphire premiere card, I hear those bonus points may or may not count toward the CP, can you confirm?

If you mean the Ultimate Rewards point transfers, they don’t count towards Companion Pass unfortunately.

You can, however, transfer them to a hotel partner and THEN transfer it to Southwest but you lose a ton of points in the conversion process.

No one knows for certain but some places collect self-reported data and they say you will generally need in the high 600s for the card.

Christina says

I saw this asked elsewhere upthread but I didn’t see your response – forgive me if I missed it!

I applied for and got 50,000 SW bonus points on a personal card (and possibly, a business card too, but I can’t remember for certain), in 2012.

I am still eligible to receive the 50,000 points for both cards, correct? Since it was more than 2 years ago? I think I will wait until November/December to apply for these bad boys and get 2 years of the CP out of it!

There are a few things you have to contend with:

1. If that personal card is still open, you can’t get it because you are an active cardholder and you can’t get a second one in the same rewards program.

2. You have to make sure you’re outside the 24 month window.

3. Since this is a Chase card, Chase has a 5/24 rule (not confirmed or seen written anywhere but cardholders swear by it) that says you can’t open 5 Chase cards within 24 months or they will deny the 6th and beyond. There are examples of people who have gotten a 6th and 7th card as well as those who get denied. It may be subjective but it’s a real thing.

I hope that helps!

Christina says

Thanks Jim! The card is not still open. I believe it has been closed for at least 2 years.

Re: #2 – do you know if it has to have been closed for 2 years?

#3 – may be problematic. I have a lot of Chase cards…all 0 balances and not all open still, but I may want to look into it.

Thanks so much!

Nick says

Hey Jim,

Just wanted to give an update. I just checked with Southwest about whether the points from the credit card enrollment bonus count towards companion pass and sadly they no longer do via Twitter message.

“Hey Nick – While your monthly spending points will count towards companion status, bonus points do not. Hope this helps! We look forward to having you onboard again soon. – Kayla”

Nick – This would change everything — can you post a link to the Tweet?

UPDATE: I reached out to Southwest and they told me the 50,000 points count towards Companion Pass – https://twitter.com/SouthwestAir/status/767372491035594753

Nick says

Jim, that’s GREAT news! Whoever responded to me must have had the wrong information.

Thanks for clarifying!

Thankfully!

Richard Codell says

Nick:

I read a paragraph from the SW website and it seems to be pretty clear that points from joining the program (40,000 or 50,000) don’t count for companion passes:

“Purchased points and points earned from Rapid Rewards program enrollment, tier bonuses, flight bonuses, and partner bonuses (excluding points bonuses earned on the Rapid Rewards Credit Cards from Chase) do not count toward Companion Pass.”

This doesn’t jive with your twitter response from SW. I noted in your question that you just asked about 50,000 points, and didn’t note that this was an enrollment bonus. Can you please confirm this?

The 40,000 or 50,000 points aren’t from joining the program, it’s from the credit card — “excluding points bonuses earned on the Rapid Rewards Credit Cards from Chase.”

Richard Codell says

Thanks. The wording is tricky and ambiguous to the uninitiated.

I am rapidly trying to spend money to reach the 110,000 goal by the end of my billing period, Dec 8. I was planning to pay state and federal income taxes through the credit card. 1.87% fee. Do you know if this is considered a purchase for the companion pass? It seems like it would be.

It’s tricky and ambiguous to everyone! That’s why I ask Southwest on Twitter. 🙂

It seems like it would be but you’re paying a heck of a premium for those points!

Stephanie says

Hi Jim, I opened the Pemier card and also the Plus card, both were offering the 50,000 bonus points after the 2,000 spend. I used my rapid rewards number for both cards. Can you confirm that this will get me to the companion pass once I hit 110,000 including these two bonuses? I opened one card in June and he other in July so neither of my bonuses have posted yet. Thank you!

Stephanie – I’d confirm with a Southwest representative but I don’t think you can get both bonuses on the cards? If you get the points, I don’t see why it wouldn’t count…

Jennifer says

Hi Stephanie,

I’m curious to see what happened? Did the points from both cards end up counting towards the CP?

Thanks!

Obaid says

Hi Jim, can I have a parent who owns a business apply for the Business Card and Premier Card, and eventually (once approved), purchase Southwest tickets through him for me?

Yes, you can book flights for anyone using your points.

Dianne says

Jim,

I am just learning about the potential of earning a companion pass – I stumbled across your article – thank you! We’ve used the SW Plus cards for years and have earned many points for free flights. In November 2015 we got the Premier cards and the 50,000 points each. We currently have 85,000 towards the 110,000 for the Companion Pass on the card we use for all purchases. The business card is not an option and each of our names are on the 4 open accounts we still have. Other than earning points by spending ($2500-$4500 per month, paid off each month), can you think of a way for us to make it to the 110,000 points by the end of the year? I’m sad that I’ve never paid attention to the Companion Pass potential before – we have always just loved SWA and have appreciated the free flights we have already gotten! Thank you for any help you can offer!

There’s no way to get a big slug of points but there are a few smaller ways, like signing up for Energy Plus and other promotions. Most of those I list here – https://wallethacks.com/8-money-saving-hacks-for-southwest-airline-flyers/

Dianne says

Thank you – I am checking these out now! I’ve signed up for the dining and Rocketmiles so far. Also came across an offer of 80,000 bonus points to open a Marriott Rewards card. Am I correct in thinking I can do this (spend $3000 in first 3 months) to get the bonus and then convert them to SW RR points? I am thinking I will need 70,000 to get 25,000 RR points?

Thank you!

I believe that you can convert them to SW RR and have it count towards Companion Pass, the conversion is very expensive though (it’s the rate you listed).

UPDATE: I asked Southwest on Twitter and they confirmed it counts! https://twitter.com/SouthwestAir/status/768175691762245632

Dianne says

Thank you so much for checking – very excited at the prospect of getting a Companion Pass for next year!!!

Scarlet says

Hi Jim,

If I have the Rapids Rewards business card and my husband has the personal card, can we transfer the bonus points from one card to another to get the companion pass?

Thank you!

Scarlet

No because your card is linked to your Rapid Rewards and his is linked to his RR Number, if you opened a personal card and received the 50,000 then it would count towards your pursuit of the Companion Pass.

Matthew says

I have done the trick once and received the companion pass-best deal ever!!!! We got one card in my name and another in my wife’s name (business card). We used her name for the RR #. Our companion pass is about to expire :(. Can we do the opposite now, (business card in my name and a personal card in my wife’s name) and put them under my name for a RR #? Any help would be much appreciated. Your article was fantastic, very clear and concise! Thanks.

If it worked the first time, I imagine it’ll work again?

Matthew says

I’m hopeful, just concerned because I read a comment above where you mentioned that the RR# and the CC name have to match. In that case, we may have just gotten lucky the first time…

Mimi says

Hi, just started to understand what I missed on. I believe 3 years ago I got CP but totally forgot about it until today. Do you think there is anything I could do about it now?

Thanks

Mimi

I doubt it, check your account maybe you still have it based on travel?

Bob says

I currently have the premier card. I got it about a year ago and got my 50k promotion points after I spent the required $2000 within the first 3 months

It was rather simple since I used it to pay my college tuition.

I am a current landlord and own rental property. I thought about applying for the business card and use it towards my rental property expenses.

Do you know if this would be feasible? Only downside is that the rental property expenses have been flat since the property is in much better condition

than when I first got it. Expenses on the property have been regular maintenance and upkeep and nothing major.

Therefore, I dont see thousands of dollars in expenses on the property within the next 3-6 months. Now if i were to use the BUSINESS card to pay for college expenses then yeah that $2000 minimum would be met. Do you know if that would be possible?

Anything is possible but you run a risk when you co-mingle business and personal expenses. I don’t recommend you do it but if you did, the risk is that a lawyer could pierce the “corporate veil” from your real estate to your personal finances. Is that a risk worth taking? It’s unlikely to happen but it’s still a risk. Up to you.

Tony says

Hi Jim,

A couple of comments here regarding liability. I’m not a lawyer but I’m thinking if the business is a sole proprietorship there would be no corporate veil to pierce (so the liability risk is there already due to the sole proprietorship structure).

Also, I’m not sure the method of payment would increase the risk for an LLC or corporate structure. I haven’t read the T&C in detail of the business card but I don’t think there is any legal obligation to only put business expenses on a business card. Claiming the (non-business) expenses charged to a business card on your tax return as business expenses would be where you would get in trouble and open yourself up (regardless of business structure) I believe.

I’m not sure any co-mingling occurs when you charge something, (paying personal expenses out of a business account when you pay off the business card charges). I could see paying those personal expenses out of a business checking account without reimbursing the business is where the co-mingling angle could be exploited. So I would think to avoid any appearance of co-mingling, you could write a check from a personal account to the business for the value of any personal expenses that were charged to a business account, especially if it were an infrequent occurrence.

Again, I’m not a lawyer so I’m curious if you know of anyone who’s gotten tripped up by this (not for this promotion per se, but just mixing business and personal expenses in general).

Thanks,

Tony

I think the cases where this comes into play (the comingling) are so rare that you don’t see it covered. You are right on the Sole Prop part, everything passes through so no veil to pierce.

I don’t think a “business credit card” is where you’d get caught up, it’s if you start paying off personal expenses with the business – that’s where the comingling occurs.

And I’m not a lawyer either, which is why I keep everything separate. Probably too rigid but I’m fine with it. 🙂

kristyn says

Can you use the miles you earned that are going toward the companion pass, or will it deduct toward qualifying from it?

Hi Krystn, I’m not clear on what your question is asking? I’ll take a stab at it anyway!

Miles that you earn, either points through the credit card or flying, all go towards Companion Pass but you don’t “spend” points to “buy” a Companion Pass. So if you earned the 110,000 points in a year, you’ll have 110,000 Rapid Reward points in your account that you can use towards flights AND you’ll have Companion Pass for the year you earned it and the following year.

kristyn says

I’ll ask a different way 🙂

I have 55,000 points. So half way to earning a companion pass. I want to purchase a flight. My question is, if I use points to purchase a flight will that deduct from the points I am earning to qualify for the companion pass.

For example 2 rt tickets will cost 50,000 points. If i use the points will it mean that now I only have 5,000 points towards my companion pass?

Aqeel says

Hi,

I have southwest Premier card, for past 3 months now.

I was interested in applying for both premier and plus card to make my way to 110K; however, i feel since I own one card for a few months I will not be get the BONUS offer on the next approval.

The terms & conditions of the card application say that the members who have a card in the same rapid reward program will not qualify for the bonus.

I haven’t applied for the card yet, I am bummed to read that; anyone else who had one card for 2-3 months and applied for the other one and got bonus for both?

It looks like the T&Cs say you can’t get it. 🙁

Aqeel says

I got approved for the card 🙂 lets see how it goes with bonus

Neema Borji says

Aqeel,

Let me know if this works for you! I am in the same situation.

aqeel says

it seemed initially they may not even approve you for the card based on what i read in T&C, but that did not happen

Keep us in the loop on what happens 🙂

Stephanie says

I currently received the bonus points for the premier card and my plus card should post in the next couple of days, I have called several times and they assured me I was going to received the bonus points for the plus card so I will also keep you all updated.

That’s awesome!

Aqeel says

just wanted to update; I Got 50K from both personal cards almost there will probably have my pass in 2-3 weeks 🙂

Fantastic!

John says

Great article, Jim – thanks! My fiance and I both applied for and received SW Premier cards with the intent of just using one to maximize points since the two accounts’ points can’t be combined. But after I read your comment of applying for a business card in my name, the light went on in my head since I do a lot of side work as an independent contractor! I just applied for an EIN per your instruction and will be applying for a business account card next month. Many thanks for the great information.

DING DING DING – way to go winner! 🙂

Wolfgang says

If I have the premier card with my wife is the authorized user, and then she has the business card and has me as the authorized user, can the points be combined?

Not for companion pass point accumulation purposes.

Stephanie says

I wanted to confirm that I did just receive the bonus posits for the Premier card and also the Plus card and I hit the 110,000 points and received the companion pass! Thanks so much!

Aqeel says

great!! 🙂 I am more hopeful now, I have both cards and I am expecting to get there soon now! cheers

Neema says

Stephanie and Aqeel,

Just checking to see if we are all in the same boat. We applied for our first personal card and received the bonus. We then waited several months and decided to sign up for the business card as well but were worried that we would not get the bonus for the second card due to the terms and conditions. Is this correct?

You should still get the points because it’s a different card.

Yay!

Travis L says

Hey Jim – thank you for the incredible article! Is it possible (to your knowledge) to apply for spouses to each apply for a credit card within the same account and have the 110k points amass that way as opposed to applying for both a personal and business credit card? Thinking this would also be a wonderful way to get there. Happy travels.

Travis L says

Nevermind; just read previous commentary… will apply for personal and Biz!

I don’t think that’ll work because the names have to match the RR account. 🙁

Lori says

My mortgage provided gives me the option to pay my mortgage with a credit card in exchange for small processing fee. If I use my southwest card to pay my mortgage loan will southwest consider that a cash advance or will it be charged like a regular credit card payment?

Check with how your mortgage servicer treats the transaction, how they do it is how Chase will recognize it.

My guess — and you should confirm this with your mortgage — the fee is probably going to be around 3% and that’s how much a credit card company charges a merchant on most transactions. I suspect it’s going to be treated as a regular purchase but you must confirm this with your mortgage to be 100% sure.

LoAn says

Hi Jim-

Just rec’d both my premier & plus cards today. What are your thoughts on how to plan accordingly for my 110k towards the cp? Start spending to get it by December or wait until December to spend and see if my charges and bonus reward will get posted in January 2017?

You want them to post in January so you get the Companion Pass for 2017 and 2018. I’d call to confirm the exact dates because December is getting close to the 3 month time limit.

LoAn says

They said I can only change my payment due date and not my statement ending date. So should I change my due date to the 1st or the ending of the month? The guy on the phone sounds pretty green about the promo so I’m not sure I can trust his answer of the 28th payment date so my statement period would be 3rd-28th of the month.

To be 100% honest, I don’t know and I’m afraid to give you bad advice. I’d call back until you get someone who knows what the heck they’re talking about. They must have your account opening date and know the promotional deadline, you don’t want to miss that.

LoAn says

Just did exactly that. The CSR was more experienced this time and she broke down that I need to charge my $2,000 worth from 12/4-12/27 to get the 52k miles on 2017. whew… so refreshing to talk someone that’s experienced (which I still consider you are so thank you for your honesty and advice). Looking forward to reading more useful articles!

Jo Marie says

Hi Jim,

I guess I am confused. My husband opened his account in Sept. of 2016. Earned the 50,000pts and proceeded to also earn a total of 100,333 points in the 3 months that he has had the card. I was racking my brain on how to earn the additional 10,000 points needed for the companion pass. I called Southwest and they told me I only had till my closing date of Dec. 11 to qualify with a 110,000 pts. It is now Dec. 30 so I have no chance of getting to the 110,000 points this year. The woman told me I would have to earn another 110,000 points in 2017 to qualify. She said the points reset Jan. 1 back to 0 towards companion pass status. From what you are saying it doesn’t sound that way. Can you please clarify this? Thanks

Jo Marie

John says

Hey Jim, great post!

I already have a Premier card, and have had it for about 2 years now. I’m at 80k miles now. It probably makes sense to try and get the card now, even though it’s almost the end of the year, rather than starting fresh next year but losing my 80k CP qualifying points, right?

If so… If I apply for a Plus card, do you know how quickly you get the bonus points, if you hit the 3k spend in the first month? Do you still need to wait 3 months for the points to be credited? Thanks in advance!

If my memory serves me, I got my bonus points pretty quickly after hitting the spend. I also wasn’t trying to get it before year end so I didn’t pay super close attention.

JC says

Lots of good information from this post. My question is should I apply for the plus card in early December that way I can hit minimum spend and receive 52k points in January? Then apply for the premier card in January and do the additonal spending?

I would aim to get the points in January so you get Companion Pass for that year and the following year.

Salman Vishal says

Hi Jim –

Apologies if this has already been answered. I opened my RR premier card on Sep 19th. Unfortunately, I didn’t wait until later. So the promotional period is from Sep 19th – Dec 19th, meaning the charges must hit my account during that time. It takes 6-8 weeks for points to post to my account. So, if I were to wait until Nov 27th, 6 weeks later would be Jan 1. For those 50,000 bonus points that would count towards the 110,000 needed for companion pass, does the language — WHICH IS GOOD FOR THE CURRENT YEAR AND FOLLOWING YEAR — apply for when they points post to my account (from Jan 1-Jan 15) – OR – when the charges were made?

I submitted my application for the RR premier business card today. I would like to know though whether to spend it all now or to wait until late November / early December because if “current year and following year” is the latter situation (2016 and 2017), instead of the former situation (2017 and 2018), then I would at least like to benefit from some Christmas and New Year’s Trips if I can. Like Merry Christmas, right? 🙂

Hi Salman – it’s based on when the points post to your account –

https://twitter.com/SouthwestAir/status/786148002926768128?cn=cmVwbHk%3D&refsrc=email

Ben says

Jim – have you heard that Hyatt Gold passport transfers do not count toward companion pass? Thanks!

Where did you see that?

Bob says

I currently have the Premier card and got my 50k bonus points when I signed up last year. I a about 30k points away from a companion pass.

I don’t have a business so I doubt applying for the SW Rapid Rewards Business card would work. Can I sign up for the plus card? Current promo looks to be earn 40k points by spending 1,000 bucks within the first 3 months.

Jennifer says

Plus and Premier are only offering 40k points right now. Any advise about what to do/when they might be offering 50k again?

It’s hard to say, it comes and goes though usually it moves between 25k and 50k — not 40k and 50k.

Aaron says

Hi Jim,

Can I sign up for two personal (Plus card and Premier card) and two business (Plus card and Premier card) cards–and have all of them under the same rewards account? Or can I only do one personal and one business. Thanks!

You can definitely do one of each but I doubt you can do two, I’d ask Southwest.

Lo-An says

I did 2 personal, 1 premier and 1 plus. I can see SW approving 3 (personal premier, personal plus and business). Genius!

Aaron says

Jim,

Also, can you “buy” points from SW and have those points count towards the 110,000 for the companion pass? Thank you!

Buying does not count towards companion pass.

John B says

Hi Jim,

Do RR points toward a Companion Pass expire or reset at the end of the calendar year? I obtained a personal Premier card in August and my 50k points were awarded in Sept (bringing my current total to 72k pts). I’m now prepared to apply for a Business Card and to get 40k more pts. You mentioned the 110k CP term is based on when the points are credited to your RR acct, but if my 40k signup points aren’t credited until January ’17, will I still have my 72k pts in my acct to combine with the 40k to get to 110k needed for CP? Or will the 72k pts no longer count toward CP total?

The points don’t reset, you keep the points as long as you’re active (your account goes inactive if nothing happens for 2 years).

The points going towards Companion Pass reset to zero after each year, so your 72k count for 2016 and would not count in 2017.

Hunter says

Alright … I apologize if this question was already asked but I was just approved for the card on Oct 18. From my understanding I have 3 months to spend $2,000. In order to make sure the 50k points are posted the first part of 2017 …..when should I spend the $2,000? If I wait to spend the money in Jan I’m worried it will not post until Feb which is outside the 3 month window.

You have to spend within 3 months, the time is not related to the posting of the points.

miranda says

Question- I am an authorized user on my mothers card. Will I be able to take her points as well as her companion pass status? i.e. I will be the main owner of the companion status and will be able to add my husband as my companion? Or does my moms name have to be on the ticket?

No, the CP is associated with the RR account and not the credit card account.

miranda says

I’m not understanding. Would she be able to transfer her points to my RR account to allow me to qualify for CPS?

No

Corey says

Do you know who to contact at Southwest or Chase to confirm this information? I own both the Southwest Premier Business and Southwest Premier card that I got accepted for the first week of October 2016. Ideally I’d like to complete all the necessary “hoop jumping” in the first week of January 2017 (three months after getting accepted) so that I’m qualified to receive the pass for all of 2017 and 2018. Does that sound like a possibility? Any advice you can give me to make sure I complete the process appropriately?

You can call and they can look up your information to give you exact dates but otherwise I’ve had success asking Southwest on Twitter.

helen says

Hi, If I apply in November 2016 for both the SW Premier and the SW Business card and receive both in December 2016 will the purchases I make in December 2016 count towards fulfilling the additional points required to obtain the 110,000 points for the companion pass for 2017/18? Or do I need to wait to charge things until Jan 1, 2017 for it to count for the 2017 calendar year. Thanks so much for your help.

That’s an excellent question, I believe the points are awarded when the statement closes and not when you the charges are made. I’d confirm this with Southwest.

Lyn says

Jim,

I am 76% from qualifying for a Companion Pass under the Rapid Rewards VISA. Other than applying for the Business Card, do you have any suggestions on how to achieve the remaining points quickly so that I qualify for the CP by December 31, 2016? Also, please advise on timing of when to complete these suggested actions and when does Southwest typically post the points earned to a Rapid Rewards account following qualifying activities/purchases?

Since the timing is so tight, I recommend asking Southwest if you can get the card fast enough to get the points – I suspect it’s too late given how long it takes for you to get the card, spend the money, and then have it post. I’d double check it.

Laura says

I’ve read some horror stories about the points being applied in 2 different calendar years. My question is this. If I fufill the $2000 spending limit on 12/15/16 and they apply the 50,000 points on 1/15/16, will the points apply to 2015 or 2016 when it comes to accruing the 110,000 total?

I believe it’s 1/15/16 but you should confirm with SW.

Lo-An says

I’m in the same boat Laura. December is the final month that I have to complete the $2K purchase and when I contacted SW, they confirmed that the 50,000 miles will hit my account in January or later so definitely 2017. Fingers crossed!

Perfect!

Jenna says

So just to confirm… If you’re traveling solo, this doesn’t actually benefit you, right? Only if you’re traveling with someone?

It’s most effective if you have someone you travel with regularly because you tell Southwest who you want as your companion. They fly for free when you fly (you pay the September 11th fee).

Zoey says

Thank you for all this wealth of information. I don’t need the companion pass until June 2017. 1) When should I “purchase” the companion pass to maximum its benefits? I figured I can accumulate $4k for Christmas shopping so I already applied for the SW Plus card. 2) Guessing I should not finish the $2k balance until January? 3) When should apply for SW Premiere?

If you need it next year, wait until January to accumulate the points.

Nina says

You have to use the signed up credit cards to earn the 6k points? You can’t say use a corporate card to fly and apply the points (using your RR#) to get the CP right?

You can use any card that awards Rapid Reward points to earn the 110,000 points you need for CP. It can be business or personal, it just needs to link to your account.

The cards listed give you bonus points when you sign up (at the time of writing, 50,000) – which gives you a head start towards 110,000.

Bob says

I currently have the Premier credit card. I dont own a business, so a business card is out of the question. I am 28,703 points away from a Companion Pass. Is it possible for me to apply for the Plus card and try to get the current promo?

It’s 40k bonus points after spending 1,000 bucks within the first 3 months.

It’s possible but the timing gets to be a little tight – I’d call to find out.

kathy g says

Hi Jim, I need about 8,000 points by my Dec. 13th posting date to qualify for companion pass. I was going to pay my tax bills which will be a couple hundred in fees, but wanted to make sure every charge on SW Rapid Rewards qualifies toward companion pass. Would this qualify? (property taxes) Thanks!

I’d call to confirm since so much is on the line.

But, my gut says it’ll count since it’s a regular charge vs. a cash advance.

kathy g says

Thanks, Jim, I asked on SW Twitter and they said Yea. So Yay!

Shelley says

Hi,

I’m torn. My husband and I love the points and companion pass option BUT we won’t be planning on doing any major flying for two years (he’s currently a student). In two years we will be flying all the time. Is there much benefit in getting the card now?

We already have another credit card with good rewards, and no fees. We also don’t put a ton on the credit cards, so is there a point in switching?

The benefit is in the points you can still use today but getting CP wouldn’t be much of a benefit for you.

As for switching, it doesn’t sound like it makes sense given your spending and your flying habits right now.

Heather Hansen says

Jim, Can I apply for a card and then My husband apply for the business card? Would the points be able to transfer to one or the other and be able to get the companion pass after we both hit our spend and then accrue the 6,000 extra maybe splitting it $3000 on each of our cards. Or do the two Southwest cards have to be opened under the same person? Thanks

I don’t think that’ll work because the cards have to be in the name of the linked account.

Connie says

I see the business card is currently offering the 50k bonus but the personal card is offering a 40k bonus. Do you suggest I wait? Thanks for the details here, this is really awesome!!

It’s hard to say because in the past the personal card switched between 25k and 50k (biiig difference), I don’t know if the 40k is the new 50k (so 50k will never happen again) or if 40k is just a test.

Tom says

What’s the best way to get the companion pass after already having it for 2015 2016? It was in my wife’s name so can she sign up again or should I.

I think there are rules to how often you can get the bonus points for a credit card. You should confirm but if you received it in the last 2 years, you can’t get it again. (if you have the card too)

Candice says

I just applied for the business card, although my sole proprietorship only rakes in 5,000 annually. Should I wait for the approval before applying for the personal card? Or is it better to have them both under way at once for the reconsideration aspect?

I had both under way at once, I don’t think one will affect the other from Chase’s perspective.

Dave says

Would it be possible to just apply for both the Southwest Premier Card and also the Southwest Plus Card? If you have them both in your name and do the required spend($1,000 in the first 3 months each) so for $2,000 you’d have 80k points racking in 40k for each of the personal cards? Is there an issue with this or can you get the bonus for both since they are technically different cards? If so.. I’m applying for them today and starting spending in January 🙂 Let me know!

After that you get the business card for the 50k bonus pulling in 130k points after the required spend there($2,000 in the first 3 months). Should this work?

Randy says

There are 50,000 point referral links. You just need to look for them

Nina says

Hi Jim, I got the Plus card this month and have reached the $2k required to get the 50k bonus points. The statement will come by the end of December bill due January . I won’t pay it until January 2017. Will that 50k point count towards 2016 or 2017 since I spent it in November 2016 but paying bill in January.

Nina says

I have 50k bonus referral links if anyone needs them, email me at [email protected]. Happy holidays!

Jay says

Hello Jim: It is a very helpful post. I appreciate it.

I need about 2,000 miles to earn the companion pass, and as you see we do not have much time till the end of the year (Currently I have 108,000 miles earned in 2016). I am going to purchase 2,000 miles from Southwest to make 110,000 miles. Do you think it will work? (Will the purchased mile qualify?) If you know the answer, please let me know. Thank you.

No it won’t unfortunately, purchased points don’t count towards Companion Pass.

Lynde says

Thanks, Jim. This is an excellent write-up!! I don’t have a business. Is it possible to do this applying for both personal (Premier and Plus) cards?

I’ve never tried it myself and I think the Terms and Conditions prohibit it, you won’t be able to get the bonus on the second one. 🙁

Lynde says

I just read more thoroughly through the post and see Brandi back in April said she got the bonus on both Plus and Premier personal cards. I wonder if terms and conditions have changed since then…or just a fluke it worked for her but usually doesn’t??

I asked Southwest via Twitter and they told me if you are approved for both cards, the bonus points count! (I updated the post to reflect this)

Lynde says